Leidos Holdings: Potentially A Buy Down The Road

Summary

- Ledios Holdings has managed to increase revenues on a yearly basis despite the margins throughout the whole business taking a hit.

- The company is very much affected by the activity in the economy and how willing companies are to spend money getting their margins higher through cost-cutting solutions.

- I think for now the company is a hold until there is a more clear recovery for our economy which should help boost revenues significantly for Leidos.

Hero Images Inc

Investment Summary

Leidos Holdings Inc (NYSE:LDOS) is a company that acts as a service and solutions provider in a number of different industries, all from defense, and intelligence to health markets. They primarily operate in the United States but also maintain an international presence too. Within the company, there are three different segments and the defense solutions is by far the largest one, generating $8.2 billion in revenues during 2022. In the last earnings report, the company did manage to see an increase in revenues, even though the operating margins took a dip across all the segments on a year-over-year basis. The company does predict they will continue seeing growth in the top and bottom line, but in my opinion, the growth isn't necessarily large enough to make a strong buy case right now though. However, looking at the long-term picture, holding shares does seem quite favorable.

Creating Shareholder Value

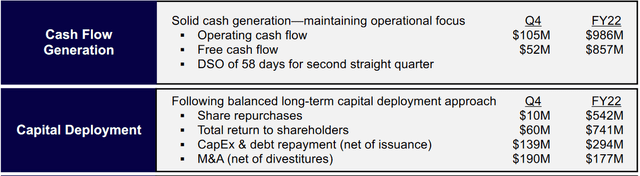

It seems Leidos has reached a point now where they begin to more aggressively deploy capital to create shareholder value through dividends and buybacks.

Company Goals (Investor Presentation)

In the last report the company highlighted some of the measures they have taken to create value for shareholders. Looking back over the last 5 years, the company has bought back around 2% of the outstanding shares and I think the trend will continue. But what does worry me slightly about 2023 is that the free cash flows are expected to be lower by a fair bit. The expectations around at or around $700 million. Much of the reason for that is a $300 million charge the company will have to pay in 2023 related to cash taxes that weren't paid in 2022. This will have an effect on the shears that would be bought back in the year for sure and possibly the dividend too.

I don't doubt however that the company will be able to pick up once again as the economy hopefully comes back to a less worrisome environment and a more active economy can be had in 2024 and beyond.

Besides this, I think the future does look optimistic for Leidos as the global consultant market is expected to have some rapid growth until 2031 at a CAGR of 10.2% from 2022 according to a report by alliedmarketresearch. With diversified exposure, I don't think it's impossible or unrealistic to expect similar growth for Leidos. The reason I still have them as a hold is that up until now, I haven't seen that growth rate yet, which makes me a little uncertain. Much of the reason for the market growth is that companies constantly aim to reduce operating costs which is something that consultants help with. The demand for their services will continue, especially now that AI can be leveraged to make a company run more smoothly.

Risks

I think one of the major risks to the market and industry that Leidos operates in is that we don't experience the recovery that experts are predicting. Delays will cause there to be less capital circulating and in general be a slower tempo. Consulting firms like Leidos thrive when there is a lot of demand and growth in an economy and their services can be offered for a high price tag because of this.

Looking at Leidos as a company I think the decrease in margin is quite worrisome. There didn't seem to be any stronghold within the company that didn't experience a YoY decrease. Perhaps much because 2022 is a more difficult environment to operate in also. Their margins thus far aren't exactly impressive either, their gross margins sit at 14.48% for the last 12 months, leaving little room for mistakes or headwinds to come up.

Financials

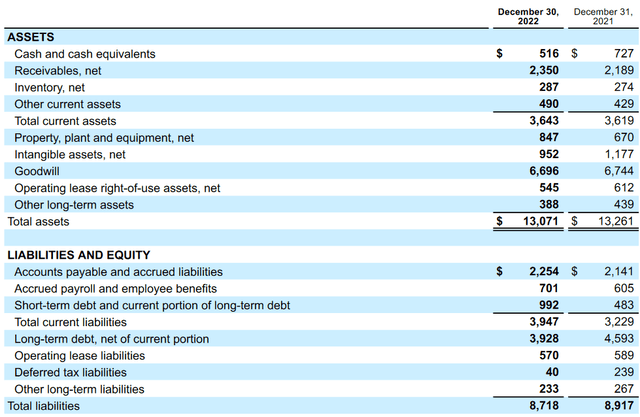

Looking at the financials of the company there is one worrying move that I notice first. The cash position decreasing YoY. I think that even though 2022 was a tough year, a continued priority to not decrease a cash position is important. As of the end of 2022, it sat at $516 million a decrease of over $200 million.

Besides that, the current assets are less than the current liabilities which makes share dilution come into question. However, I think that the cash flows are enough to help fill up this around $300 million discrepancy between current assets and liabilities. But I also think it will make an impact on buybacks in 2023 as the company is already predicted to have less free cash flow than in 2022.

Balance Sheet (Earnings Report)

Moving over to the debt the company has made moves to pay it back significantly. From 2021 to 2022 it decreased by almost $600 million, a decrease of around 16%. I think this is great to see as it highlights some of the stability the company has financially.

All in all, I think the balance sheet for Leidos has some improvements that are needed to bolster a potential buy case. Building up an even stronger cash position would help and keeping current liabilities lower than current assets is also important in my opinion. The net debt/EBITDA does sit quite high though at 3.47, which has been caused by the margins taking a hit. If you believe in a recovery in the margins eventually, which I do, then that number shouldn't be given too much attention.

Valuation & Wrap Up

Right now the forward p/e for Leidos sits at around 13 which is a fair bit below the sector's average of 16. I think there is clearly more upside potential than downside risk right now as the company has a good runway if you believe they can capture the same growth the industry is expected to have. But I don't think it's bad to rate the company a hold either. The cash flows taking a hit in 2023 because of tax charges has pushed the multiple to 17 which I think is quite high.

The company does have a strong history of buying back shares and providing investors with a dividend, but I think that might be under pressure in 2023. If margins take another hit because the economy is still quite turbulent and difficult to maneuver in then I can understand the low multiple the company currently has. Too much risk is present which isn't worth paying a high premium for.

I will be keeping a close eye on the way the margins are developing and when I see a clear uptrend and stability then I think the company will have a buy rating from me. But until then I don't see any issue with holding shares and collecting a dividend in the meantime.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.