Estee Lauder: A Luxury Company In Temporary Trouble

Summary

- Sales declined sharply due to COVID restrictions in China.

- However, their ROC and ROE are very good, and as returns follow ROC in the long term, they are a good bet.

- The price you pay for this company is expensive, but quality comes at a price, and on a normalized basis the valuation is better, but still not cheap.

BalkansCat

7Thesis

Estee Lauder (NYSE:EL) is one of my long-term holdings, which I bought years ago despite the high valuation it has always had. And I am quite happy with that decision as it has outperformed the market over that period and I have added to it when it has fallen. Now is another of those times when the share price has come down quite a lot from its highs because the environment is not the easiest at the moment.

However, I have confidence in the company's management that these are temporary difficulties and that EL will return to normalized earnings and outperform the market over the next 5 to 10 years.

Analysis

Part of the problem is that earnings have fallen sharply in recent months and investors are unsure whether this is a temporary phenomenon or whether dependence on Chinese earnings is a threat to future earnings. But the fact is that 35% of the global beauty market is in North Asia. So, all beauty companies have this problem because China with its more than 1.4 billion people is such a big market for almost all companies in the world.

North America and Europe account for only 26% and 22% of the market respectively. So, the most populous countries, such as China and India, which together have almost 3 billion people, will be important for future growth rates in the beauty market and every other market in the world.

And I think EL will be able to resume its growth in China now that almost all of the COVID-related restrictions have been lifted. So, I think this drop in sales is only temporary.

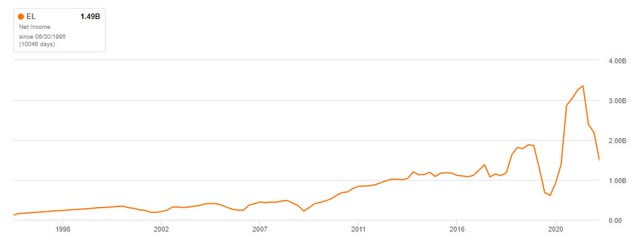

As a result of the decline in sales, net income also decreased. However, the decline was more dramatic as net profit margins also fell.

If we look at gross profit margins, we see a poor development over the last few years. Gross profit margins have fallen from over 80% to 73%. Not exactly what you want to see from one of your holdings.

But if we look at net income margins, there is another side to the story. Despite declining gross margins, net income margins remained almost the same, and in 2021 and 2022 even reached record levels. So just looking at gross margins gives a false picture.

The decline in profit margins over the last year is mainly COVID related and due to lower shipments of replenishment orders, according to their latest earnings call. These temporary difficulties should be overcome in the next few months, and EL should then return to growth.

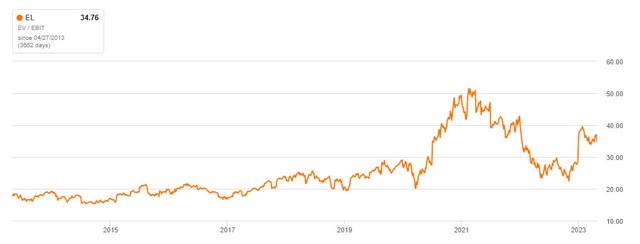

The long-term EV / EBIT chart suggests that EL is massively overvalued at the moment, as the long-term average is more in the ~20x range and is now at 34x. And even a 20x multiple is an expensive company. However, a normalized EBIT with recovered sales in China would bring the multiple to a more reasonable range close to the long-term average.

The global cosmetics market is expected to grow at a CAGR of 5% over the next 5 years, and skin care dominates the market as it is something that many people use on a daily basis. And while the beauty market has historically been targeted at women who want to look good or young, the men's market is growing faster as more and more men want to look and feel good.

EL has positioned itself in this market as a luxury brand for women, and its marketing and advertising campaigns try to make them buy emotionally. And I think a lot of male investors don't look at companies like EL because they're not the target audience, but women are a big buying group and it really pays off in the long run to look at what your spouse is buying. Otherwise, you might miss out on some fantastic companies.

How They Return Money To Shareholders

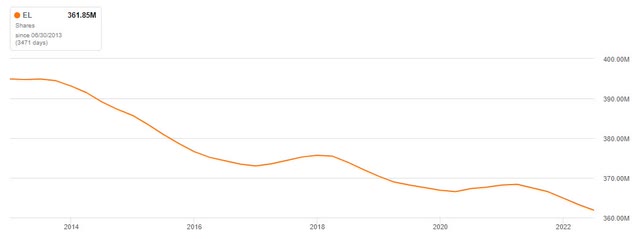

Over the last 10 years, the number of shares outstanding has declined and EL has used some of its cash flow to buy back shares. This has benefited shareholders over this period and is likely to continue.

EL has also increased its dividend almost every year despite the COVID year 2020 and its FCF is currently in a position to do so again in the coming years. The 10-year annual dividend growth rate is ~10%, which is quite nice.

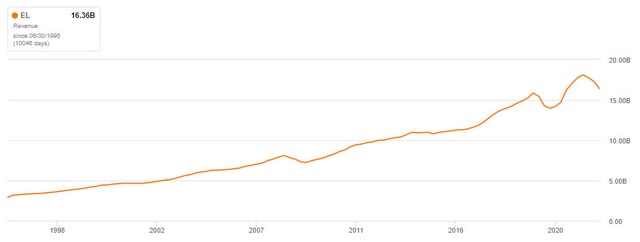

Shareholders have also benefited from rising sales, with a 10-year annual growth rate of 6%, and multiple expansions.

Return On Capital And Equity

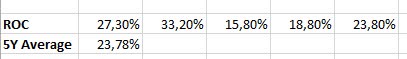

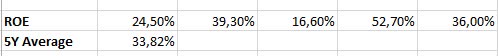

I am one of those people who believe that return on capital is the most important driver of long-term results. So, I like to look at that and see if they can maintain that return in the future.

Author Author

And both figures look exactly as I want them to look for long-term investments. Both are over 20% per annum over the last 5 years and therefore show that EL is a high quality company that can use its capital efficiently.

Because EL is a family controlled business with a long-term strategy and really strong brands like Estee Lauder and Clinique, I can see them achieving similar numbers over the next 5 to 10 years. They have a competitive advantage because of their brands and their ability to grow remains because they can grow organically or through acquisitions.

Their balance sheet also looks relatively fine, as they have total debt of $7,627m and cash and equivalents of $3,725m, but their EBIT/Interest Expense ratio is 14x, which is good compared to the S&P 500 average of ~10x.

Reverse DCF

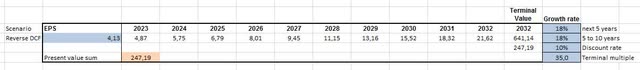

Looking at the reverse DCF to see what is priced into the current share price, we can see that with a depressed EPS of $4.13, the company would have to grow by 18% per annum over the next 10 years to justify this share price if you want a 10% annual return.

However, as EPS is only temporarily depressed, we can argue that normalized EPS should be higher and therefore the required growth rate should be lower.

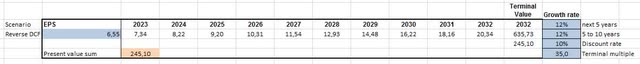

If instead of the diluted EPS TTM of $3.14 we take the 2022 figure, which is $6.55 and could be closer to normalized earnings, we get a different picture. This time, EPS only needs to grow by 12% over the next 10 years to justify the share price.

But, as always with projections into the future, we have to be cautious. I think the better way is to look at the business and its return on capital and whether they have a competitive advantage that protects them.

Conclusion

So, I would argue that the difficulties are temporary and that sales in China will increase in the future. This, combined with the extraordinary return on capital and equity and their competitive advantage, should lead to market-beating returns over a 10-year period. I would not expect annual returns in the 20%+ range, but 15% is achievable for such a high quality company as I would argue that the long-term return is similar to the return on capital and they should achieve 15%+ annual ROC over the next 10 years.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.