Risks And Uncertainties Undermine Viad's Promising Progress

Summary

- Viad's business model has been demonstrated to be effective in a post-COVID era.

- Proven by its struggles during the Covid lockdown, Viad's strategy and performance anchor to the cycle.

- High debt levels and interest charges during a time of rising rates pose major threats to Viad's cost structure, profitability, cash generation, and financial flexibility.

- Viad's preferred stock issuance is a double-edged sword.

- In my view, Viad is currently overvalued.

deimagine/E+ via Getty Images

Investment Thesis

The travel industry experienced a surge in demand following the lifting of COVID-19 restrictions. However, as inflation continues to rise leading to economic slowdown concerns, the momentum behind the travel boom could fade. This is especially true if middle-income consumers pivot their spending towards necessities and mortgage payments over international vacations.

One company to consider in this industry is Viad Corp (NYSE:VVI), which operates three main lines of business: Pursuit, GES, and Spiro. Pursuit, their travel experiences arm, may be particularly vulnerable to a decline in revenue due to its significant contribution of 69% to the company's bottom line. If the travel industry experiences a downturn, it could have a detrimental impact on VVI profitability.

It's also important to note that VVI has a high interest payment for its debt and relies on loans to fund growth. In a high interest rate environment, the company may face significant challenges in maintaining its financial stability and continuing to invest in its business.

What Does VVI Do

VVI has three main lines of business. The first is Pursuit, which focuses on acquiring unique travel experiences and providing hospitality services around those experiences. This arm of the company could be particularly vulnerable to changes in the travel industry, as it relies heavily on people's willingness to travel and spend money on experiences.

The second line of business, GES, is a global exhibition services company that partners with leading exhibition and conference organizers as a full-service provider of strategic and logistics solutions to manage the complexity of their shows. This arm of the company has the potential to be more stable due to recurring revenue from long-term relationships with clients.

Finally, Spiro is a spin-off from GES that was established in 2022. This experiential marketing agency partners with leading brands to create unique and engaging marketing campaigns. This arm of the company has the potential to be highly profitable, as experiential marketing is an increasingly important part of many businesses' overall marketing strategies.

Why VVI Might Appeal To Investors

After analyzing VVI's businesses, investors must understand the substantial revenue growth in FY2022 stem from the reopening of the U.S. borders as of November 2021 to visitors, following COVID-19 lockdowns.

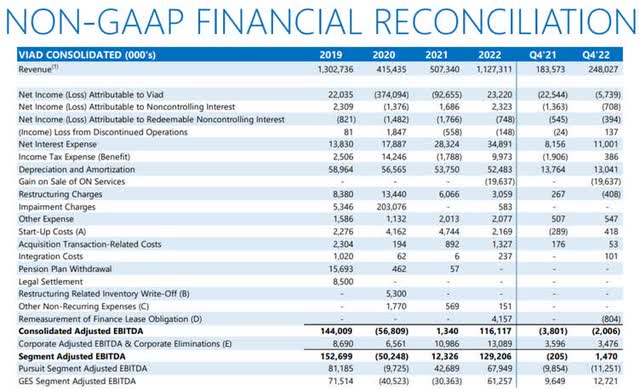

Viad Income Statement Breakdown (VVI FY2022 Presentation Slides)

Pursuit acquires and manages travel experiences such as Banff Jasper Collection, Glacier Park Collection, Alaska Collection, FlyOver Attraction, and Sky Lagoon. It also acquires, renovates, and operates hotels and lounges. Pursuit significantly expanded its portfolio through acquisitions and new experiences during 2020 to 2021, resulting in a boom in revenue in 2022 as lockdowns eased. Additionally, when more countries reopened borders and allowed travel, Pursuit's experiences witnessed strong demand.

Pursuit New Opening and Acquisitions from 2019 to 2021 (VVI FY2022 Presentation Slides)

On the other hand, GES underwent a successful restructuring in FY2022, lowering operating costs substantially. It also reorganized the business, repositioning Spiro as an experiential marketing agency. GES's customers include plastics recycling conferences and the Global Pet Expo, relationships that generate recurring revenue annually. However, these conferences halted during COVID, plunging revenue, before rebounding powerfully in FY2022, driving significant income growth. Restructuring also expanded margins.

Spiro's customers include Cisco, the Houston Super Bowl, and Aveada, providing a channel for traditional companies to rebrand themselves for today's age through differential marketing to attract post-COVID crowds. Spiro also benefited from increased demand for such services following lockdowns.

VVI's model has proven itself and is well-poised to capitalize on the post-COVID era. Revenue surged in 2022 on easing lockdowns and restructuring's benefits while relationships and services with potential for ongoing growth and higher profitability were secured across its pursuits.

What Investors Might Be Missing

Extreme Dependence On Economic & Market Swings

While VVI has established a compelling business model that thrived following lockdowns, it remains fundamentally flawed. The company's identity and marketing rest solely on the promise of "unique experiences," realities that fade into irrelevance during economic downturns. What matters most for consumers in a recession is affording basic necessities like food and shelter by any means necessary, not experiences.

VVI's model prospered in FY2022, but suffered tremendously in the depths of the financial crisis between FY2020 to FY2021, demonstrating its susceptibility to economic cycles.

Moreover, in FY2022, Pursuit, VVI's travel experiences arm, generated only 26% of total revenue but contributed a substantial 69% to net income through high profit margins. However, travel ceases to be a necessity during recessions, exposing Pursuit's revenue and VVI's bottom line to severe jeopardy. Any significant drop in Pursuit's sales would devastate profits.

In essence, VVI's reliance on discretionary spending and disproportionate dependence on Pursuit render it profoundly vulnerable to the unpredictable vicissitudes of the economic environment. Its success rests upon consistent momentum in the travel industry, an unlikely permanence.

Weak Financials

Other than the fundamental flaw in their business model, the company also has a weak income statement and balance sheet.

As a % of Revenue (Seeking Alpha)

For the income statement, two key items that stand out are the company's low gross margin and high interest payments.

VVI business model lacks pricing power since its gross margin remain consistently low at less than 8% since 2013. This leaves the company vulnerable to any economic mishaps, as a decline in revenue could cause the gross margin to turn negative.

In addition, its high interest payments are a concern. The company incurs significant capital expenditures in acquiring and remodeling lodging around travel experiences, resulting in a need for borrowing. In a high interest rate environment, this can be particularly problematic. According to the company's 10K,

The weighted-average interest rate on total debt (including unamortized debt issuance costs and commitment fees) was 9.3% for 2022, 6.4% for 2021 and 4.6% for 2020.

Looking at the balance sheet, VVI high level of indebtedness and low current and quick ratios are also concerning. In the event of a recession and additional losses, the company's weak balance sheet may not be able to sustain the extra losses, potentially leading to bankruptcy.

Balance Sheet Ratio (Seeking Alpha)

A Ticking Time Bomb: Convertible Series A Preferred Stock

In FY2020, VVI took on Convertible Series A Preferred Stock to manage its finances. As per 10k:

The Convertible Series A Preferred Stock carries a 5.5% cumulative quarterly dividend, which is payable in cash or in-kind at Viad's option and is convertible at the option of the holders into shares of our common stock at a conversion price of $21.25 per share. Dividends paid-in-kind increase the redemption value of the preferred stock. The redemption value of the preferred stock was $141.8 million as of December 31, 2022 and 2021. Upon the occurrence of a change in control event, the holders have a right to require Viad to repurchase such preferred stock. During the year ended December 31, 2022, $7.8 million of dividends were declared, all of which were paid in cash. We intend to pay preferred stock dividends in cash for the foreseeable future.

However, the preferred stock's dividend can be paid in cash, or be converted with shares at $21.25 per share, or be accumulated into the redemption value. At VVI current share price being below $21.25, holders will not convert to common stock. If VVI continues losing money, the share price could drop further, limiting options to cash payments and higher redemption value.

Paying mostly cash during a recession may be unjustified. Management's choice may default to a higher redemption value, potentially far surpassing VVI market capitalization if the share price keeps falling. Currently, the preferred stock's redemption value is 34% of market cap already.

VVI's preferred stock issuance is a double-edged sword. It provided a lifeline during financial struggles but now poses substantial risks to capital structure and shareholder confidence if circumstances deteriorate. The potential for a destabilizing increase in liabilities and dilution of ownership looms.

Potential Solutions For VVI

In my view, VVI management should sell GES and Spiro, redeem the preferred shares, and concentrate solely on operating Pursuit profitably before pursuing any new acquisitions within Pursuit.

VVI recently divested its non-core ON Services business for $30 million, demonstrating a willingness to streamline operations. Exiting GES, a subsidiary generating weak returns, would further strengthen VVI financials by boosting income statement performance and balance sheet health while reducing complexity.

Redeeming or restructuring the preferred shares would eliminate an overhang threatening shareholder interests and capital structure stability. This could reassure long-term investors by diminishing risks and concerns over VVI ability to prudently manage its liabilities and prioritize key strategies.

Focusing efforts on Pursuit, its most profitable subsidiary and growth engine represents the most judicious path forward from both business and investment standpoints. Optimizing Pursuit's operations and potential should be the top priority.

In short, a simplified, de-risked, and concentrated approach centering on Pursuit is the strategy most likely to deliver sustainable progress and prosperity for VVI and its shareholders. However, this would involve major overhauls and is unlikely to happen, at least in the near future. This can be a cause for concern, especially given the coming economic recession

Upside Risk

No Recession

The key upside potential I identify is that the economy avoids a recession. If economic growth persists, income levels hold steady or increase, and consumer demand stays strong in the face of central bank tightening and cost pressures, tourism expenditures will probably continue gaining momentum.

Canada's Removal Of COVID-19 Entry Restrictions

A more immediate upside opportunity is Canada dropped its COVID-19 entry restrictions in October 2022. VVI has a substantial presence in Canada through attractions such as the Banff Gondola, Columbia Icefield Skywalk, Maligne Lake Cruise, FlyOver Canada, as well as hotels within Jasper National Park, including the newly constructed Forest Park Alpine Hotel in 2022. This resumption of cross-border travel from Canada also introduces a nearer-term boost to its revenue, an upside risk.

Valuation

For valuation, as explains in the Movado article, I preferred to look at EV/EBITDA to make comparisons against industry peers, and P/E for comparisons across time.

EV/EBITDA Across The Industry

VVI EV/EBITDA of 10.85x is slightly below the diversified support services industry average of 11.74x, suggesting moderate under-valuation. However, this industry average more closely aligns with GES, a weak-performing subsidiary, than Pursuit, VVI's primary profitability driver.

The hotels, resorts and cruise lines industry, a better proxy for Pursuit, averages 9.72x EV/EBITDA. Averaging the two industry benchmarks yields 10.73x, indicating VVI trades near fair value when compared with its peers.

P/E Across Time

In contrast, I will utilize data from ROIC.ai to compare VVI's P/E ratios between 2007 and 2022, encompassing both bear and bull markets. Over this 15-year period, the median P/E provides the most objective view of the market's overall assessment of VVI's fair value.

A P/E ratio below the median indicates that the company is undervalued relative to its historical performance. Conversely, a P/E ratio exceeding the median suggests that the stock is overvalued.

While market conditions evolve over time, a long-term perspective helps identify valuation dislocations and opportunities. The median P/E is the benchmark I use to determine whether VVI represents an attractive buying or selling opportunity based on its current share price. Fundamentals drive value, so a below-median P/E particularly intrigues me as a potential buying opportunity for the patient, long-term investor.

VVI PE Ratio from 2007 to 2022 (Roic.ai Website)

The median P/E ratio for VVI between 2007 and 2022 stands at 19.25x. As previously mentioned in the section on "potential solutions for VVI," the company recently sold its non-core ON Services business for $30 million. If we base the P/E ratio solely on VVI's EPS from continuing operations (US$0.53/share), the ratio is 34.3x.

Using the median P/E ratio of 19.25x and EPS of US$0.53/share, we arrive at a fair value of US$10.20, which represents a significant overvaluation of 78%.

In summary, while valuations based on EV/EBITDA may provide justification for upside potential if VVI experiences substantial growth and profitability expansion, the risk of overvaluation and eventual price correction remains significant based on the fair value calculated using the median P/E ratio.

Conclusion

VVI model and momentum are appealing in a strong economy, meaningful risks and uncertainties suggest a strategy still only nascently transformed and far from resilient. VVI must prove the financial and strategic discipline to navigate uneven cycles and complex challenges before its shares can be considered a stable, compelling long-term investment relative to alternatives. Progress is apparent, but hurdles remain, and it remains far from certain that VVI can ultimately overcome them.

What Will I Do

Since I judge VVI to be overvalued, rather than short selling outright, I will implement a bear put spread to contain risk. Moreover, I do not intend to maintain these options positions for an extended period. Given my view that the prospect of recession looms nigh, I will deploy this strategy in the near term, implying the options will likely expire by June 2023 or September 2023.

This approach involves purchasing one put option with a higher strike price of US$17.50 and selling one put option with a lower strike price of US$12.5. Using options will limits my cash output and allow me to close the position if necessary.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in VVI over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.