Billionaire Investor: U.S. Going Through 'Textbook' Financial Crisis - SPY Implications

Summary

- Billionaire investor Leon Cooperman recently said that the US is going through a "textbook" financial crisis.

- He sounded a warning that the S&P 500's returns will be very weak for a long time.

- We share our analysis of SPY's current valuation and our approach in the current environment.

- Looking for a portfolio of ideas like this one? Members of High Yield Investor get exclusive access to our subscriber-only portfolios. Learn More »

Leonid Sorokin

Billionaire investor Leon Cooperman recently said that the US is going through a "textbook" financial crisis and went on to warn that the S&P 500's (NYSEARCA:SPY) returns will be very weak for a long time to come. In this article, we will share our updated analysis of SPY in light of Mr. Cooperman's warning and how we are investing in light of that perspective.

Leon Cooperman's Warning About SPY

Billionaire investor Leon Cooperman recently warned that the recent market volatility, including the failure of Silicon Valley Bank, has shaken confidence in the US banking sector and will likely lead to sluggish returns for the S&P 500 for a long time. Specifically, he stated:

It's kind of like textbook. We have a self-induced crisis by irresponsible fiscal and monetary policy [over] the last decade. I did not forecast the [SVB] issue, but I did have a view that we were heading into a crisis of some kind, and we're seeing it... I think the 4,800 on the S&P will be a high that will stand for quite some time. I expect returns in the S&P to be very pedestrian.

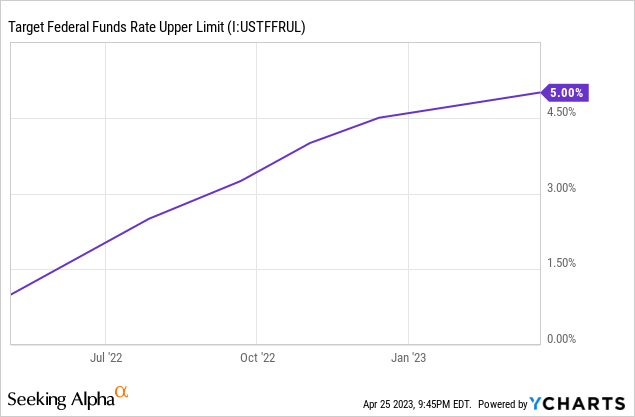

The recent market turmoil is largely due to the Federal Reserve's aggressive approach to interest rates, increasing them dramatically over the past year to combat inflation:

This brought a sudden end to the previous decade-long streak of ultra-low interest rates, with the dramatic change in the interest rate environment leaving casualties like Silicon Valley Bank (OTC:SIVBQ). Moreover, elevated debt levels - which have grown faster than the broader economy - are likely not finished causing problems in the US economy. As corporate debt matures, the higher refinancing costs will lead to headwinds to profits and in some cases bankruptcies. This in turn will lead to job losses and the beginning of a vicious cycle for the economy.

In fact, Mr. Cooperman warned that these conditions will lead to sluggish returns for stocks after he previously predicted a recession and a potential 22% fall in the S&P 500.

SPY Implications

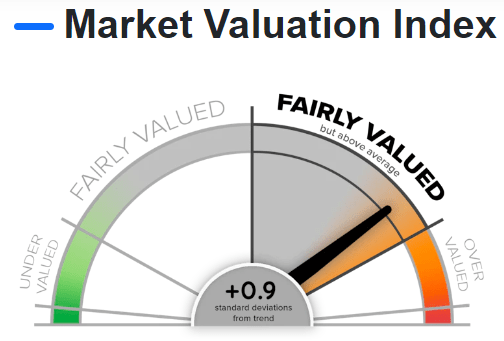

What does all of this mean for SPY? Well, at a bare minimum it means that we should expect subpar growth from its subcomponents for the next few years and therefore should not pay a premium for it. This is even more important when taking into account that interest rates have risen so rapidly, thereby increasing the discount rate used to value it.

Unfortunately, based on an aggregation of popular valuation models (such as the Buffett Indicator Model, the Price/Earnings Model, the Interest Rate Model, and the S&P 500 Mean Reversion Model), SPY appears much closer to being overvalued than fairly valued at the moment:

Market Valuation Index (currentmarketvaluation.com)

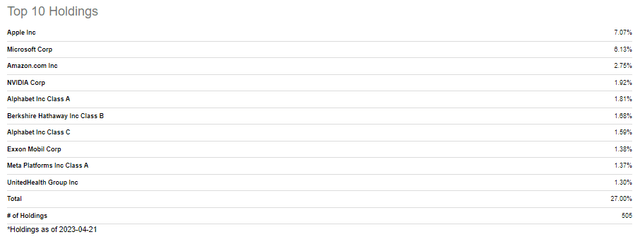

When we look at SPY's top holdings we see this overvaluation on display as well:

SPY Top Holdings (Seeking Alpha)

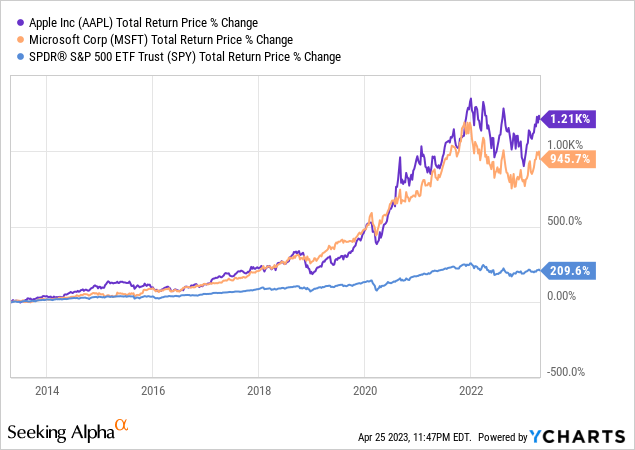

Its top two holdings - by far - Apple (AAPL) and Microsoft (MSFT) - have been on an absolute tear over the past decade, leaving the rest of the index in the dust:

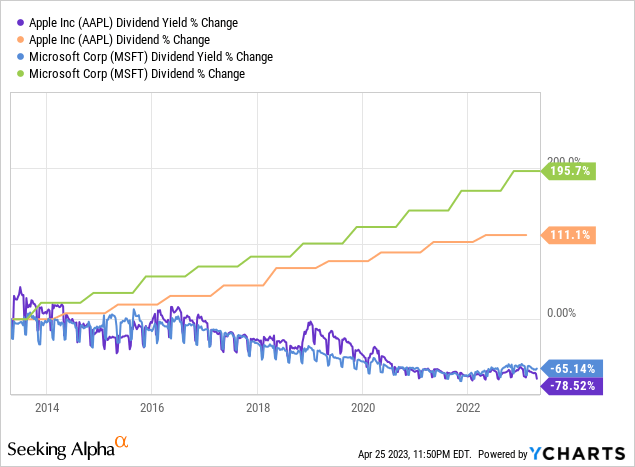

While much of this stellar stock performance has been driven by strong fundamental performance, we believe a lot of this has also been driven by the market assigning an exaggerated appraisal to these businesses' intrinsic values. Yes, Berkshire Hathaway (BRK.A)(BRK.B) - itself a substantial constituent of SPY - has a very large stake in AAPL and investing greats Warren Buffett and Charlie Munger have offered ringing endorsements of the business. However, it appears to us that both AAPL and MSFT have outrun even their fundamental greatness. The first symptom of this is their rapidly falling dividend yields despite both being stellar dividend growth stocks:

Second is the fact that their valuation multiples are at or near all-time highs despite interest rates also being on the higher end of where they have been during these companies' histories.

AAPL's current price to normalized earnings ratio is 26.52x vs. its historical average of 18.01x and its EV/EBITDA ratio is 20.24x vs. its historical average of 10.87x.

Meanwhile, MSFT's current price to normalized earnings ratio is 26.93x vs. its historical average of 19.29x and its EV/EBITDA ratio is 18.41x vs. its historical average of 11.89x.

Do they deserve to trade at a premium to their historical averages? Without a doubt. However, EV/EBITDA premiums of between 55% and 86% with interest rates at elevated levels (and still rising) along with being on the verge of a serious recession seem to be quite stretched.

AAPL is particularly at risk given its outsized dependence on and exposure to China. After all, over 95% of its iPhones, AirPods, Macs and iPads are manufactured in China and it also relies on Chinese consumers to purchase a sizable portion of its products. If current geopolitical tensions lead to war or at the very least sanctions between the United States and China, AAPL will undoubtedly suffer immensely, and by extension, SPY.

It is also important to keep in mind that SPY has even more exposure to SPY than the 7.07% currently listed in its holdings. This is because Berkshire Hathaway - SPY's fifth largest holding - has ~40% of its stock portfolio invested in AAPL stock.

Thus, we conclude that the broader market valuation models likely are accurately assessing the current overvalued stated of SPY, and investors should realize that when they invest in SPY, they are in effect buying large positions in significantly overvalued companies like AAPL and MSFT.

Investor Takeaway

Mr. Cooperman may very well be correct that the United States is facing a 'textbook' financial crisis. The ingredients are all there and the wheels are already beginning to move. Of course, things could calm down and none of this may come to fruition. Perhaps the resilience of the U.S. consumer and job market and the re-emergence of the Chinese consumer can enable the Federal Reserve to achieve a soft landing for the economy by keeping interest rates elevated just long enough to slow inflation down meaningfully without wiping out a lot of businesses and jobs in the process. We will know soon enough, but time is running out.

In the meantime, SPY - led by its overweight positions in heavily overvalued AAPL and MSFT - looks like an unappealing risk-adjusted place to allocate capital at the moment, and Mr. Cooperman's predictions for very pedestrian returns from the fund for the foreseeable future will likely prove to be accurate in our view. As a result, we are focused on picking unique, underfollowed opportunities in niche, inefficient areas of the market while also maintaining significant diversification by emphasizing assets like precious metals, energy, and a few others with relatively low correlation to SPY.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you would please click "like", comment below, and "follow" me that would mean a lot as it helps me to continue producing quality content.

SAVE 50% BY SIGNING UP TODAY!

You can join Seeking Alpha’s #1 community of high-yield investors at just $199 for your first year!

Try it Free for 2-Weeks. If you don’t like it, we won’t charge you a penny! We have over 150 five-star reviews and we spend 1000s of hours and over $100,000 per year researching the market and share the results with you at a tiny fraction of the cost.

(Limited to only 50 spots!)

This article was written by

Samuel Smith is Vice President at Leonberg Capital and manages the High Yield Investor Seeking Alpha Marketplace Service.

Samuel is a Professional Engineer and Project Management Professional by training and holds a B.S. in Civil Engineering and Mathematics from the United States Military Academy at West Point. He is a former Army officer, land development project engineer, and lead investment analyst at Sure Dividend.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.