PSI: A Possible Recession Means That There May Be More Downside

Summary

- PSI invests in 30 large-cap semiconductor stocks in the U.S. market.

- The global semiconductor industry is expected to grow at a CAGR of 12.2% through 2029.

- Semiconductor inventory correction may be near the end, but a possible recession will further weaken the demand.

jiefeng jiang

Introduction

The semiconductor industry has enjoyed very strong growth during the pandemic due to strong demand for technology devices as people attempt to work and study remotely. However, the strong demand has quickly shifted towards high inventory level. Will this inventory correction trend continue in the near-term? Should investors be taking advantage of this opportunity to invest now? In this article, we will analyze Invesco Dynamic Semiconductors ETF (NYSEARCA:PSI) and provide our insights and suggestions. Last I analysed this ETF was in 2020.

ETF Overview

PSI owns a portfolio of 30 large-cap semiconductor stocks in the United States. Stocks in PSI's portfolio should continue to enjoy strong industry fundamental as the semiconductor industry is set to grow at a rate of 12.2% annually through 2029. However, the semiconductor industry is going through a period of inventory correction and a possible recession in the second half of 2023 may further weaken the demand. Therefore, downside risk appears to be quite high. Hence, we think it is better for investors to wait on the sidelines.

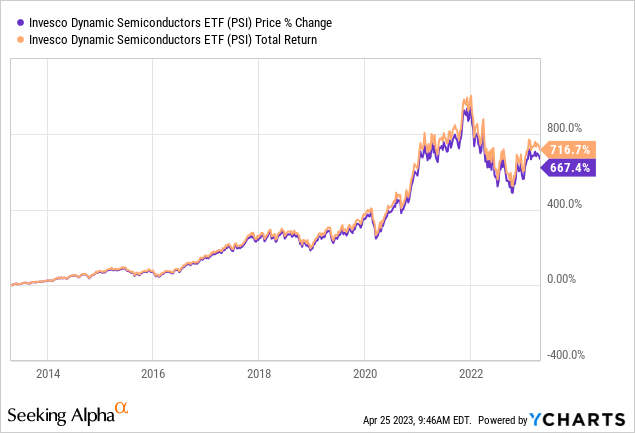

YCharts

Fund Analysis

Semiconductor industry is still going through inventory correction

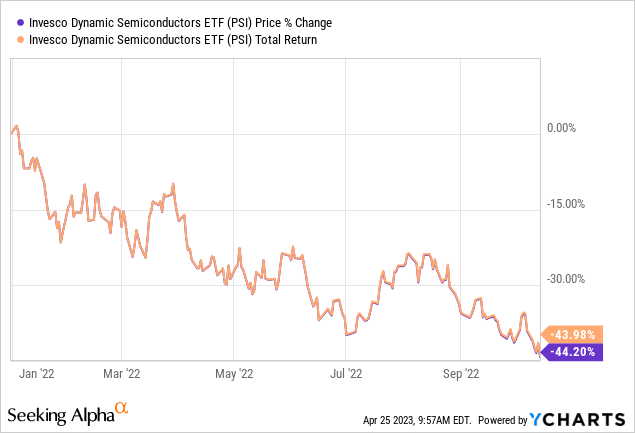

PSI has not done well in 2022 as it delivered a total loss of nearly 44% from the peak in the beginning of 2022 to the trough in October 2022. It appears that a combination of the Federal Reserve’s aggressive rate hike and the inventory correction in the semiconductor industry are the primary reasons behind this significant decline. Fortunately, PSI’s fund price has since rebounded with a gain of about 36% since the trough in October 2022.

YCharts

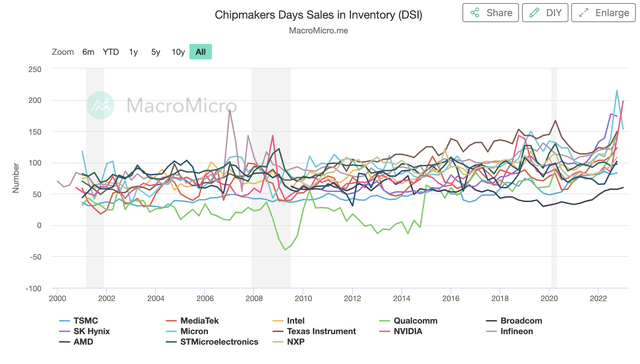

The question we need to ask is that whether this inventory correction is near the end or not. Below is a chart that shows the major global chipmakers’ days sales in inventory since 2000. As can be seen from the chart, inventory levels of many of these large semiconductor companies are still quite elevated. There are still no signs of easing yet. From a macroeconomic perspective, the persistent high inflation in the past one year has also eroded consumer’s purchasing power and resulted in a weak demand for consumer electronic products. In addition, a possible economic recession that might show up in the second half of 2023 may further weaken the demand. Hence, it is possible that this inventory correction cycle will be a lengthy one.

However, the semiconductor industry should deliver strong growth in the long run

Despite the weak sales in the semiconductor industry right now, the entire industry should benefit from several long term secular growth trends such as artificial intelligence, electric vehicles, Internet of Things, industrial automation, cloud computing, etc. In fact, the global semiconductor market is expected to expand at a compound annual growth rate of 12.2% between 2021 and 2029. As a result, the global semiconductor market is expected to reach $1.38 trillion by 2029. This is significantly higher than the semiconductor market of $527.9 billion in 2021.

Should you own PSI now?

PSI has delivered a total return of 36% since reaching the trough in October 2022. As a result, its valuation does not look cheap now, especially considering the fact that the industry is still going through a period of inventory correction. As CEO C.C. Wei of Taiwan Semiconductor Manufacturing (TSM) stated in its latest conference call in April, this inventory adjustment will continue through the second quarter of 2023 and TSM is expecting a recovery in the second half of 2023. However, we actually think that the bottom will likely not be in the second quarter but in the third quarter of 2023. The reason is that persistent inflation and a worsening global economy due to tightening monetary policy will result in weaker than expected demand throughout the year. Therefore, we think it is better for investors to have a conservative view. As such, we think investors should not rush to buy PSI right now.

Investor Takeaway

PSI is poised to benefit from long-term secular growth trends and we have confidence that it will be a good long term holding. However, given macroeconomic uncertainties (e.g. a possible recession) that might continue to weaken semiconductor demand, near-term downside risk appears to be quite high. Hence, we think investors should continue to wait on the sidelines.

Additional Disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.