RNP: 8.5% Dividend Backed With Robust Fundamentals

Summary

- RNP asset allocation strategy focuses on a diversified set of high quality, investment grade equity REITs and sound preferred securities.

- The offered yield of 8.5% is significantly above what other similar broad indices provide. The key explanations lies in RNP's external leverage, which accounts for 32% of the total AuM.

- The additional leverage is considered safe and well structured, where ~80% of the financing is locked in at 1.9% yield until 2027.

- The 8.5% dividend is safe and underpinned by conservative leverage and investment grade securities. Investors may expect stability in both current income and RNP's price level.

SDI Productions

Cohen & Steers REIT & Preferred Income Fund (NYSE:RNP) carries 291 holdings with a primary intent to capture high streams of current income stemming from investments in real estate and diversified set of preferred securities. The secondary objective is to extract value from capital appreciation.

As of now, RNP provides ~8.5% dividend yield (distributed on a monthly basis), which is significantly above the level of what the broader REIT market such as Vanguard Real Estate Index Fund (NYSEARCA:VNQ) offers. The current dividend yield of VNQ is ~4.2%, which from the historical perspective is attractive, but still nowhere near the RNP's yield.

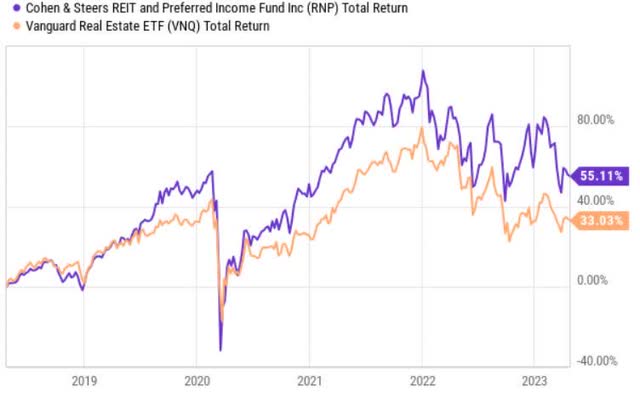

At the same time, if we look on a total return basis (i.e., dividends plus price appreciation), since the outbreak of COVID-19 RNP has proven to be a much more resilient investment.

Below I will articulate why I think that given the current macroeconomic and industry specific backdrop, RNP will continue to deliver superior results relative to the overall REIT market.

Exposure to preferred securities

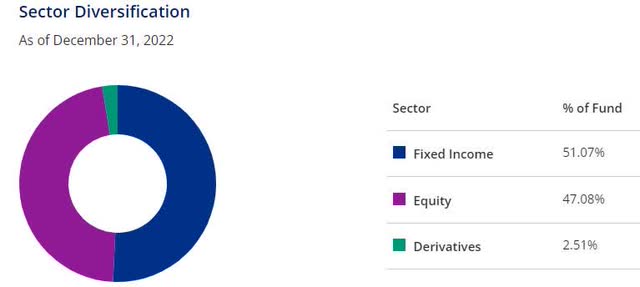

RNP has roughly 50% of its total holdings invested in preferred securities, which to a large extent explains the consistency and stability in the dividend payments.

The general concept of preferred instruments is that these securities provide more safety relative to equities as the pre-stipulated distribution amounts of preferred instruments have to be serviced first before equity holders can start accessing the profits (dividends). A company has to first service the ongoing liabilities related to internal stakeholders and debt holders, and only then preferred stockholders have the right to benefit from cash extraction.

This dynamic introduces an additional layer of safety for preferred stockholders as essentially the only moment when the preferred stockholders do not receive payments is when there is insufficient amount of remaining cash after servicing debt holders.

In a nutshell, there are two major advantages for having an exposure towards preferred instruments, and two disadvantages, which are notable, but in the context of RNP are well managed that ultimately reduces the potential negative impact.

First, the preferred shares are less volatile compared to equities, which helps maintain a stable value of investments.

Second, the dividends are inherently more predictable as the payable amounts are stipulated in the prospectus rather than based on discretionary dividend policies, which tend to correlate with the changing dynamics of underlying business performance.

This aspect comes in extremely handy in the prevailing macroeconomic environment, when the overall margins are gradually becoming more compressed due to inflationary forces and surging interest costs. REITs especially are extremely exposed to the rate of change movements in interest rates as typically buy and hold strategies are heavily accommodated by significant leverage to widen the delta between cap rates and cost of funding. Also looking at the REIT industry level, there are many pockets of distress, which are facing serious headwinds on their FFO levels - e.g., offices, hotels, retail etc. Namely, at the current moment there is a value of holding securities, which offer relatively high yield, but at the same time provide predictability in the income streams.

On the negative side, there are two clear aspects, which have to be considered.

First, preferred securities embody risk and return characteristics that are more similar to fixed income than to common equities. Since the distributed cash flows are fixed and long-dated, even small changes in interest rates result in notable fluctuations in the instrument's price (i.e., duration risk). Usually, equities tend to absorb better the negative effects from rising interest rates as there are avenues through which additional cost factors can be passed through (e.g., rent escalations, leasing spreads, inflation indexation etc.).

While this is a material risk factor, which can materialize if interest rates continue to climb up higher, the underlying cash distribution levels should not be hurt. The pain will manifest itself through a more pronounced price drop, which is not that crucial for investors, who:

- seek stable streams of current income

- believe that the FED will start to loosen its policy in the foreseeable future

Second, preferred securities, per definition, yield less than common equities. This goes hand in hand with the notion of higher (lower) risk requiring higher (lower) returns.

One might wonder, how that is possible if the current yield level of RNP is around 8.5%. A reasonable guess would be that the portfolio constituencies entail very high credit risk, which in turn implies juicer yields. However, that is not the case as articulated below - i.e., significant concentration in the high IG segment. The explanation lies in the additional leverage factor that the RNP's management employs to magnify the safe and stable returns of preferred income and high quality REIT returns.

Exposure to investment grade and large cap factors

Whenever a leverage is applied to magnify the return factor stemming from pure play equity or preferred / fixed income allocations, it is of utmost importance to have a strong and healthy base of underlying assets. Otherwise, if the assets are volatile and of a high beta nature, the fluctuations in investment's market value and potentially distributed dividend levels might not fit relatively risk averse and prudent investor profile.

When assessing RNP's exposures, two separate categories should be taken into account - equity REITs and preferred securities.

Looking at the equity REIT component, the chosen allocations reflect best of breed and strong quality picks. Top 10 list in terms of % of managed assets has only investment grade, large cap equity REITs for which the likelihood of cutting dividends is extremely low. In fact, all of the REITs in the Top 10 list have managed to consistently grow their dividends, even in the current macroeconomic conditions. By scrolling down the list, the picture remains unchanged - i.e., dominance of IG and large cap REITs, which coincides with the RNP's capital allocation strategy.

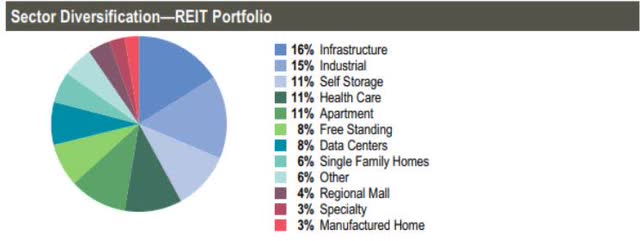

An additional factor of safety can be identified by looking at the allocations on a sector level. RNP has managed to avoid high risk and distressed REIT sectors such as office, retail and hotels (lodging). There is, for instance, a tiny allocation to regional malls, but the largest constituent by far is Simon Property Group's (NYSE:SPG), which has a strong investment grade credit rating and an ultra safe dividend underpinned by conservative FFO payout ratio and growing FFO.

The preferred security component is comprised of a diversified set of sectors where the lion's share or roughly 80% is comprised of banks and insurance companies. As articulated in the RNP's annual report 2022, these preferred security allocations are also subject to rigorous credit analysis so that the risky bets are filtered out from final selections. In other words, the preferred securities entail a solid degree of safety not only from the fact that these securities provide a better safety from the capital structure's perspective, but also from the investment grade credit rating and large capitalization levels.

Well structured leverage profile

In the previous section, it was mentioned that the inherently lower yields, which are associated with sound preferred securities are offset with an external leverage. RNP sources 30% of leverage to enhance the yields offered by high quality equity REITs and preferred securities.

The current leverage ratio is 32% (represented as a percentage from the total AuM). These additional proceeds are linked to both variable and fixed rates - 19% and 81%, respectively. The fact that 81% of financing is stipulated on a fixed rate largely protects RNP from additional rate hikes up until 2027 as the weighted average term of fixed financing is ~3.5 years. Granted, there is still 19% of the financing that is linked to variable rate, but the overall impact from further expansion in interest rates should be relatively muted.

An important thing to mention is that the fixed portion's cost of debt level is only 1.9%, which provides very favourable ground to capture positive spread from the cost of debt associated with 30% leverage factor and the incremental yield of allocations into equity REITs and preferred securities. The only moment, when this can come back to haunt RNP is when the FED's fund rate suddenly gets cut by more than half in the next 3 - 4 year period. In my opinion, this is an unlikely scenario.

The bottom line

The current dividend yield of 8.5% that is offered by RNP is secure due to prudent asset allocation tactics and conservatively structured external leverage. In my opinion, RNP is a solid pick for any investor, who wishes to enjoy a predictable, stable and abnormal streams of current income and at the same time avoid a notable decline of price level that could stem from duration risk and REIT idiosyncratic risks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.