Cognyte Software's Outlook Stalls Out

Summary

- Cognyte Software Ltd. provides security analytics and related software to organizations and governments worldwide.

- The company's revenue has dropped and operating losses have worsened.

- Forward revenue guidance is tepid at best, while operating losses will likely continue due to the need to fulfill Cognyte Software's revenue performance obligations.

- I'm Neutral [Hold] on Cognyte Software Ltd. for the near term.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

Urupong

A Quick Take On Cognyte Software

Cognyte Software Ltd. (NASDAQ:CGNT) provides investigative analytics software for security threat environments.

The firm has seen a sharp drop in revenue while operating losses remain heavy.

Due to its high revenue performance obligations, management isn’t planning on any meaningful headcount reductions and revenue growth appears stalled, so its financial results appear stalled.

I’m Neutral [Hold] on Cognyte Software Ltd. for the near term.

Cognyte Software Overview

Herzliya, Israel-based Cognyte Software Ltd. was founded in 2020 to develop an open software platform to assist governments and enterprises in conducting security investigations.

The firm is headed by Chief Executive Officer Elad Sharon, who was previously president at Verint Systems.

The company’s primary offerings include an analytics platform covering networks, blockchains, the internet, cyber threats and situation intelligence environments.

The firm acquires customers through its direct sales and marketing efforts as well as through partner relationships.

Cognyte also counts a number of national-level agencies as significant customers, such as the U.S. NSA and various law enforcement agencies.

Cognyte’s Market & Competition

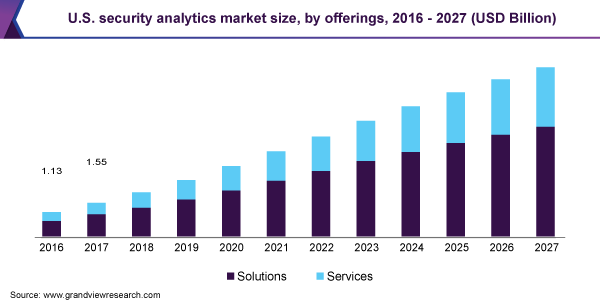

According to a 2020 market research report by Grand View Research, the global market for security analytics was an estimated $7 billion in 2019 and is forecast to reach $20.8 billion by 2027.

This represents a forecast CAGR of a very strong 14.6% from 2020 to 2027.

The main drivers for this expected growth are an increasing threat environment in terms of the number of attacks and the complexity and sophistication of security breaches.

Also, companies have a greater need for modern systems to assist them in the prevention of repeat attacks as well as maintaining regulatory compliance.

The rise in machine learning/artificial intelligence-enhanced systems will also continue due to demand for greater automation in monitoring and response activities.

The chart below shows the historical and projected future growth trajectory for the security analytics market in the U.S., through 2027 by offering type:

U.S. Security Analysis Market (Grand View Research)

Major competitive or other industry participants include:

IBM

Cisco

Broadcom

Splunk

RSA Security

FireEye

LogRhythm

Securonix

Hillstone Networks

Exabeam

Rapid7

Alert Logic

Snowflake

Others.

Cognyte’s Recent Financial Trends

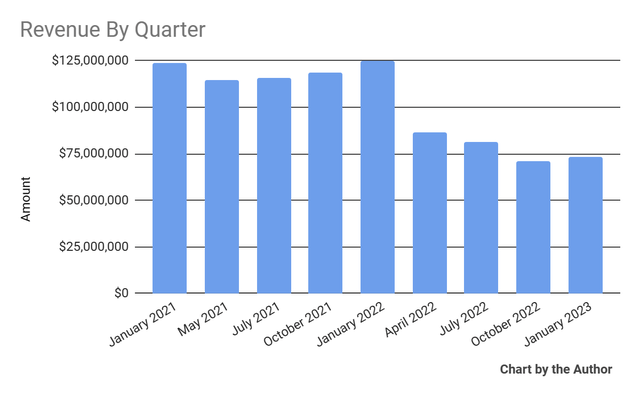

Total revenue by quarter has continued to drop, as the chart shows here:

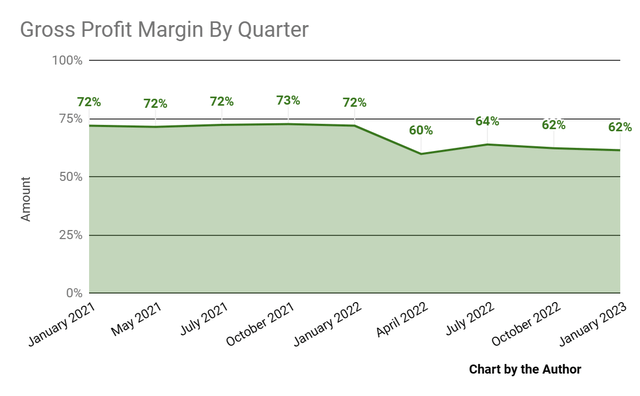

Gross profit margin by quarter has also fallen materially:

Gross Profit Margin (Seeking Alpha)

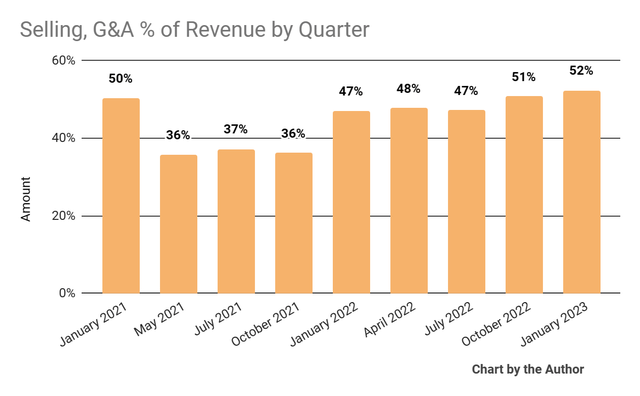

Selling, G&A expenses as a percentage of total revenue by quarter have risen, a negative signal indicating the firm is spending more for each dollar of revenue:

Selling, G&A % Of Revenue (Seeking Alpha)

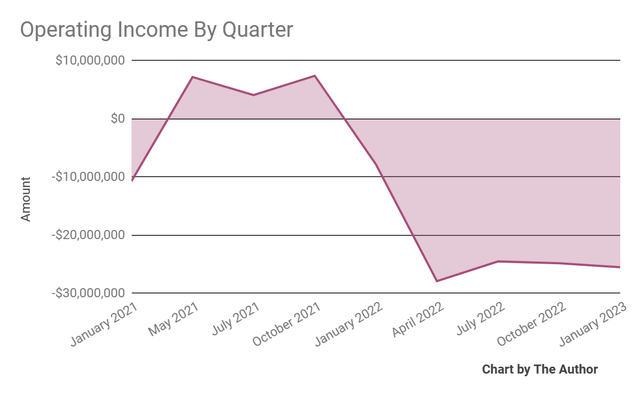

Operating losses by quarter have worsened in recent quarters:

Operating Income (Seeking Alpha)

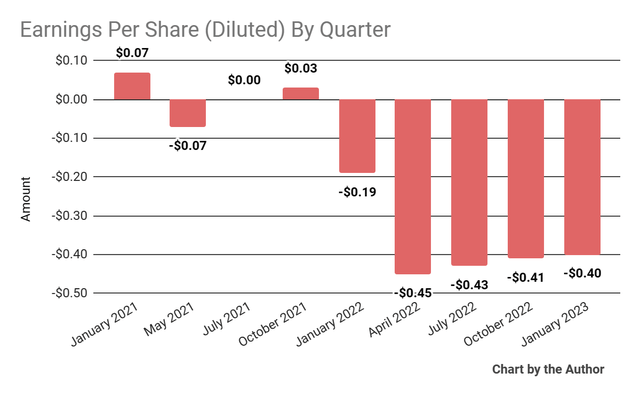

Earnings per share (Diluted) have also remained heavily negative recently:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP.)

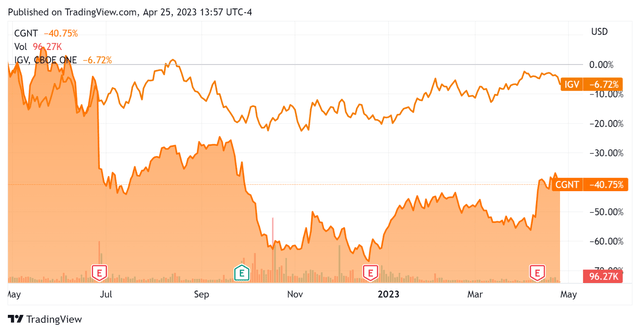

In the past 12 months, Cognyte Software Ltd.’s stock price has fallen 40.75% vs. that of the iShares Expanded Tech-Software Sector ETF’s (IGV) drop of 6.72%, as the chart indicates below:

52-Week Stock Price Comparison (Seeking Alpha)

For the balance sheet, the firm ended the quarter with $52.1 million in cash, equivalents and short-term investments and no debt.

Over the trailing twelve months, free cash used was $45.3 million, of which capital expenditures accounted for $8.3 million. The company paid $25.2 million in stock-based compensation in the last four quarters.

Valuation And Other Metrics For Cognyte

Below is a table of relevant capitalization and valuation figures for the company:

Measure [TTM] | Amount |

Enterprise Value / Sales | 0.9 |

Enterprise Value / EBITDA | NM |

Price / Sales | 0.9 |

Revenue Growth Rate | -34.2% |

Net Income Margin | -36.6% |

GAAP EBITDA % | -28.8% |

Market Capitalization | $297,400,000 |

Enterprise Value | $277,930,000 |

Operating Cash Flow | -$36,990,000 |

Earnings Per Share (Fully Diluted) | -$1.69 |

(Source - Seeking Alpha.)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

CGNT’s most recent GAAP Rule of 40 calculation was negative (63.0%) as of FQ4 2023’s results, so the firm has performed poorly in this regard, per the table below:

Rule of 40 - GAAP | Calculation |

Recent Rev. Growth % | -34.2% |

GAAP EBITDA % | -28.8% |

Total | -63.0% |

(Source - Seeking Alpha.)

Commentary On Cognyte Software

In its last earnings call (Source - Seeking Alpha), covering FQ4 2023’s results, management highlighted the stabilization of its revenue and providing fiscal 2024 revenue guidance due to greater forward visibility.

The company has made strides in recent quarters with cost reductions, but SG&A as a percentage of revenue has still risen and operating losses have not improved.

Management doesn’t provide net retention rate metrics as it believes the metrics are ‘less relevant’ to its business.

Looking ahead, management expects fiscal 2024 revenue to be at $300 million, which, if achieved, would represent a drop of around 3.9% versus fiscal 2023’s results.

Due to its large revenue performance obligation [RPO], leadership has decided to keep its existing headcount in order to be able to execute on its requirements.

The company's financial position is bordering on the problematic, as the firm has about 1.25 years' worth of cash and equivalents based on its trailing twelve-month free cash burn.

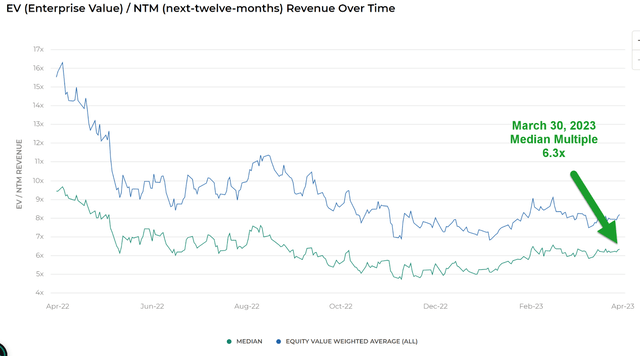

Regarding valuation, the market is valuing CGNT at an EV/Sales multiple of around 0.9x.

The Meritech Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.3x on March 30, 2023, as the chart shows here:

EV/Next 12 Months Revenue Multiple Index (Meritech Capital)

So, by comparison, CGNT is currently valued by the market at a substantial discount to the broader Meritech Capital SaaS Index, at least as of March 30, 2023.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown which may accelerate new customer discounting, produce slower sales cycles and reduce its revenue trajectory.

With flat revenue and continued expected high operating losses, I see no upside catalyst to the stock, so I’m Neutral [Hold] for Cognyte Software Ltd. in the near term.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.