ARKF: Is Cathie Wood's FinTech ETF Set To Soar?

Summary

- ARKF typically selects 35-55 global FinTech stocks based on their potential to disrupt the Financial Services sector. Its expense ratio is 0.75%, and the ETF has $775 million in assets.

- ARKF was down 50% YTD at my August 2022 review. It's declined another 10% since but is up 23% YTD. It has some legs, and my analysis suggests it's justified.

- Seeking Alpha data confirms Wall Street analysts are increasing earnings estimates at a faster rate than traditional growth stocks held in ETFs like QQQ, IWY, SCHG, and VBK.

- Three-quarters of the fund will report earnings over the next few weeks, and positive earnings surprises can be a major catalyst for these speculative stocks.

- I don't support Cathie Wood's strategy for markets and recommend growth investors take a long-term view with high-quality stocks. However, the short-term benefits outweigh the risks, and I can see ARKF surging through this earnings season.

- Looking for more investing ideas like this one? Get them exclusively at Hoya Capital Income Builder. Learn More »

Marco Bello

Investment Thesis

The ARK Fintech Innovation ETF (NYSEARCA:ARKF) is for investors seeking exposure to companies involved in transaction innovations, blockchain technology, risk transformation, frictionless funding platforms, customer-facing platforms, and new intermediaries. These areas, described on ARKF's fund page, are exciting opportunities, and in its four-year history, ARKF has shown itself capable of both huge returns and losses. The ETF is actively managed by Cathie Wood and her team at ARK Investment Management, has a 0.75% expense ratio, and manages $775 million in assets.

I previously concluded suggesting ARKF likely won't outperform broad-based growth ETFs if held for more than one year since it primarily selects low- or non-profitable companies. That perspective has stayed the same. However, there is a short-term opportunity today because of positive Wall Street sentiment for these unique companies. Using Seeking Alpha Factor Grades as my guide, ARKF is now an anomaly for the right reasons, and it's a speculative fund worth holding onto through the upcoming earnings season. I look forward to discussing why in more detail below.

ARKF Overview

Strategy Discussion and Top Holdings

ARKF typically holds 35-55 companies at a time, but it's more concentrated than usual today, with just 27. Shopify (SHOP), Block (SQ), and Coinbase Global (COIN) total 30% of the portfolio. With few exceptions, these companies have low profitability scores. To illustrate, only five holdings (16% of the weight) have an "A-" or better Seeking Alpha Profitability Grade. Therefore, it's primarily speculative.

Ark Invest

ARK Performance History

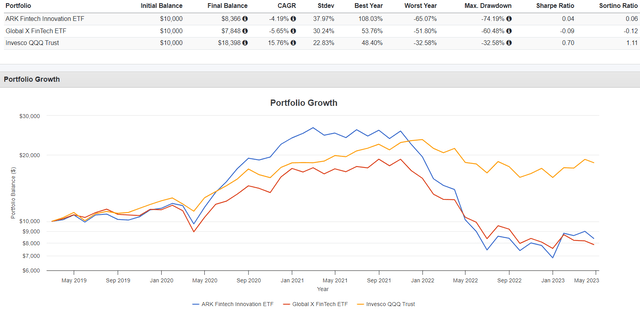

ARKF declined by an annualized 4.19% since February 2019, slightly outperforming the Global X FinTech Thematic ETF (FINX) but substantially lagging the Invesco QQQ ETF (QQQ). I used a logarithmic scale to highlight the substantial swings better. QQQ was more steady, while ARKF experienced a meteoric rise post-pandemic, only to crash one year later. As a result, risk-adjusted returns (Sharpe and Sortino Ratios) disappoint.

Portfolio Visualizer

ARKF Analysis: Strong Earnings Momentum

In August 2022, I recommended readers avoid ARKF. Its track record was one reason, but ARKF also had poor Seeking Alpha Factor Grades. These grades, which I've normalized and weighted on a ten-point scale, were as follows:

- Value Score: 2.82/10

- Growth Score: 5.61/10

- Momentum Score: 4.08/10

- Profitability Score: 4.79/10

- EPS Revision Score: 4.37/10

- Quant Score: 4.97/10

Here are the latest scores as of April 25, 2023:

- Value Score: 2.32/10

- Growth Score: 7.78/10

- Momentum Score: 6.89/10

- Profitability Score: 4.12/10

- EPS Revision Score: 7.06/10

- Quant Score: 6.68/10

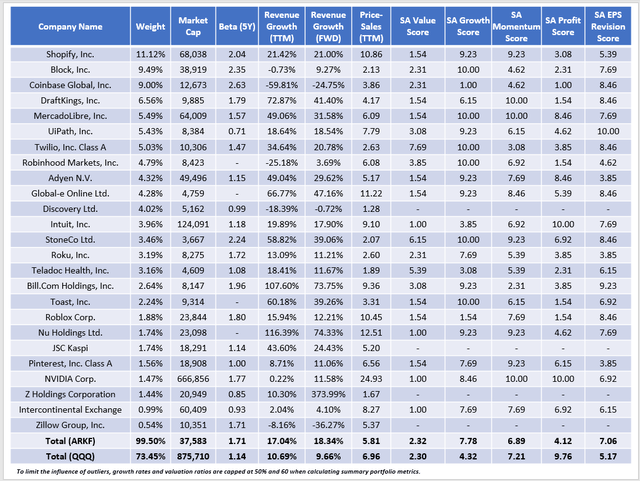

All scores improved except for value and profitability, which is less concerning when market sentiment is positive. A key contributor to ARKF's higher Quant score is its 18.34% estimated one-year sales growth rate, an impressive figure nearly double the Invesco QQQ ETF growth rate. Here's how the two ETFs compare on other metrics.

The Sunday Investor

ARKF holds smaller companies with high growth potential, indicated by its weighted average $38 billion market capitalization figure. ARKF's 1.71 five-year beta illustrates its high volatility, and the ETF trades at a relatively cheap 5.81x trailing sales, down from 7.04x in August 2022. Unfortunately, I couldn't calculate any other valuation metrics because approximately 75% of the fund's holdings by weighted reported a net income loss over the last year.

ARKF's 7.06/10 EPS Revision Score is what I want to highlight most. QQQ's 5.17/10 is close to what other diversified growth ETFs like IWY and SCHG offer. Even leading small-cap growth ETFs like VBK score around 5.50/10, so Wall Street clearly favors these more speculative stocks. Some of the most significant changes since August 2022 include:

- Coinbase Global (COIN): F to A-

- Global-e Online (GLBE): F to A-

- StoneCo (STNE): C- to A-

- Roblox (RBLX): C to A-

All have led ARKF year to date, too, with Coinbase standing out with a 66.83% return vs. ARKF's 22.87%.

Seeking Alpha

Many other constituents performed well, too. However, the weakest performers still have relatively poor EPS Revision Grades. They include Robinhood Markets (HOOD), Adyen (OTCPK:ADYEY), Pinterest (PINS), and JD.com (JD). Roku (ROKU) is the exception and is up 42% YTD.

Seeking Alpha

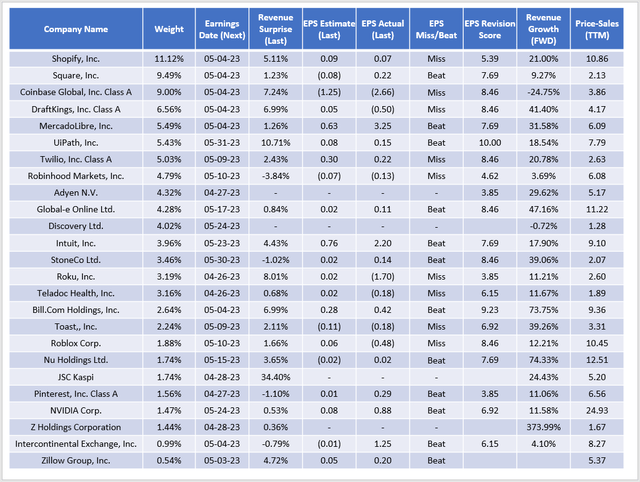

The following table is an earnings season guide for ARKF. It includes each company's earnings date, performance against consensus estimates last quarter, and Q1 2023's consensus estimate. Approximately three-quarters of the holdings will report by the middle of May.

The Sunday Investor

Nearly all constituents beat consensus sales estimates last quarter but were mixed on earnings per share. For example, Shopify missed $0.02 on a $0.09 estimate. However, sales were up 25% over the prior year's quarter, and management expects growth in the high teens with improved gross margins, according to Seeking Alpha's earnings summary. Block topped EPS expectations by $0.22. Cathie Wood bought the dip last month when shares slumped 15%. Like her or not, she and other active managers are paid to do that. Rules-based ETFs can't take advantage of these opportunities, and arguably, an active manager is needed with highly volatile stocks.

Again, Wood's track record isn't great, but she's hit it big a few times before. ARKF outperformed QQQ by 28% from May 2020 to July 2020 and 14% from December 2020 to February 2021. Not coincidentally, aggregate S&P 500 earnings surprises reached record highs during that period. So far this quarter, the aggregate earnings surprise is 8%, with one-third of companies reporting, which is the best start in about a year.

Yardeni Research

This chart is another reason why I'm optimistic despite frequent recession discussions. The Estrella and Mishkin model calculates one-year recession odds at 57% with short- and long-term U.S. Treasury rates as inputs. It's something to consider, but there may be one bull market left. A small and speculative position in ARKF is one way to take advantage.

Investment Recommendation

I don't own ARKF and don't intend to buy it. However, ETFs like ARKF are helpful to me because they can serve as proxies for market sentiment. ARKF is up 23% YTD, and upon review, it's justified because Wall Street analysts have increased earnings estimates faster than traditional growth ETFs like QQQ. Furthermore, preliminary earnings surprise figures provided by Yardeni Research are positive. Declining market sentiment was why I recommended investors avoid QQQ last year, and it's exciting to finally see some good news again after a painful year.

Three-quarters of ARKF's constituents report earnings over the next few weeks, and current shareholders should hold on until the earnings season concludes. Refrain from betting the farm on this unproven strategy, but the short-term benefits outweigh the risks. Still, I urge readers to take a longer-term view on growth investing. Use your time horizon to your advantage and accept the evidence that holding high-quality stocks is more rewarding. Thank you for reading, and I look forward to the comments section below.

The Sunday Investor Joins Income Builder

The Sunday Investor has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I perform independent fundamental analysis for over 850 U.S. Equity ETFs and aim to provide you with the most comprehensive ETF coverage on Seeking Alpha. My insights into how ETFs are constructed at the industry level are unique rather than surface-level reviews that’s standard on other investment platforms. My deep-dive articles always include a set of alternative funds, and I am active in the comments section and ready to answer your questions about the ETFs you own or are considering.

My qualifications include a Certificate in Advanced Investment Advice from the Canadian Securities Institute, the completion of all educational requirements for the Chartered Investment Manager (CIM) designation, and a Bachelor of Commerce degree with a major in Accounting. In addition, I passed the CFA Level 1 Exam and am on track to become licensed to advise on options and derivatives in 2023. In November 2021, I became a contributor for the Hoya Capital Income Builder Marketplace Service and manage the "Active Equity ETF Model Portfolio", which as a total return objective. Sign up for a free trial today! Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.