Dow Inc. Q1 Earnings: Still Struggling

Summary

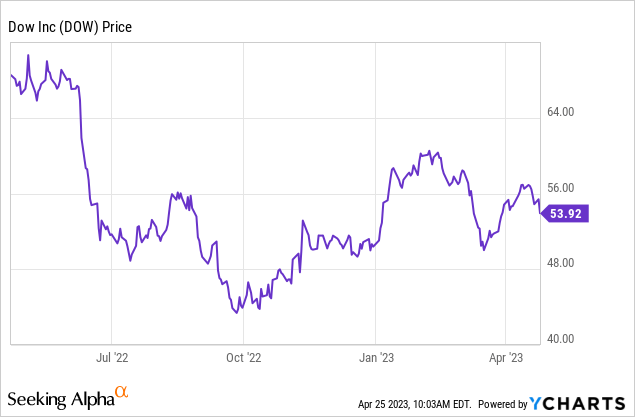

- Dow Inc. has rebounded nearly 27% from its 52-week low.

- The recent economic indicators are suggesting an acceleration in slowdown which should continue to weigh on the company.

- The latest earnings remain very weak as volume and pricing both showed a meaningful decline.

- The current valuation and EPS estimates seem way too optimistic considering the macro backdrop.

- I rate the company as a sell.

Bill Pugliano

Investment Thesis

Dow Inc. (NYSE:DOW) is down roughly 4% since my last coverage in February, but still up over 27% from its 52-week low. I remain pessimistic about the company for the near term and do not feel comfortable owning it with so much optimism already being priced in. I believe we are still in the early phase of the downturn as economic indicators are just starting to demonstrate an acceleration in decline. The company's latest earnings continue to be weak with a broad-based decline across multiple segments, driven by both lower pricing and volume. The current valuation is also discounting a potential recession and could present an unprecedented downside. Therefore I reiterate my sell rating on the company.

Macro Headwinds

As mentioned in the previous article, Dow is very cyclical and sensitive to the macroeconomy due to its business nature. The weakening economy will impact demand meaningfully while the ongoing decline in inflation should continue to put pressure on pricing. The rebound of the share price in the past few months is largely attributed to the ongoing hope of a potential soft landing, but the chances are looking increasingly unlikely.

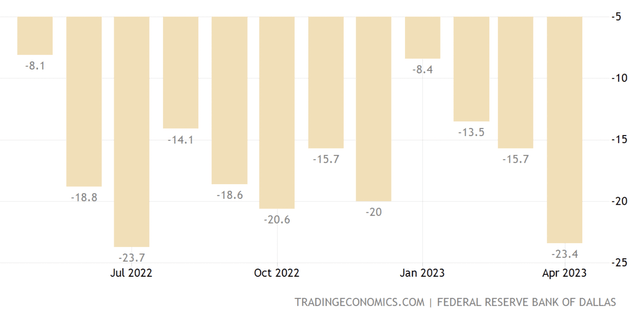

The recent economic indicators have been signaling an acceleration in a slowdown as the impact of rising rates is starting to show. On the consumer end, the retail sales number for March came in at a negative (1)% MoM (month over month), well below the expectation of negative (0.4),% as the willingness to spend continues to decline. On the business side, the Dallas Fed manufacturing index reported this week came in at negative (23.4), also much worse compared to the consensus of negative (14.6), mostly driven by the slowdown in production. The figure is now back to levels not seen since July 2022, as shown in the chart below.

Inflation has also been declining as the CPI (consumer price index) continues to trend down. However, this is not particularly positive for businesses as the decline is largely driven by the drop in demand, as shown above in the retail sales figure. This will also be a headwind for Dow, as lower inflation will put pressure on the company's pricing. For instance, pricing in the recent quarter dropped 5% compared to the prior year and 6% sequentially. The recent deterioration of the economic indicators all points to a potential recession and the ongoing slowdown will likely impact the company's financials massively.

Trading Economics

Weak Q1 Earnings

Dow Inc. recently announced its first-quarter earnings and the results remain extremely soft, as macro headwinds continue to weigh heavily. The company reported net sales of $11.9 billion, down 22% YoY (year over year) compared to $15.3 billion. Volume is down 11% due to softer demand while pricing also declined 10% due to disinflation pressure.

The numbers across all three segments were very weak. Packaging & specialty plastics revenue was down 20% from $7.63 billion to $6.11 billion, driven by lower polyethylene and olefin prices. Industrial intermediates & infrastructure revenue was down 25% from $4.52 billion to $3.38 billion, largely due to the slowdown in industrial and construction activities. Performance materials & coatings revenue was also down 25% from $3.05 billion to $2.28 billion, driven by lower prices of siloxanes.

The bottom line was even worse due to the large amount of fixed costs. While sales were down 22%, costs of sales only dropped 14.5%. On the expense side, R&D (research and development) expenses were roughly flat and SG&A (selling, general and administrative) expenses only declined 14.1%. The elevated spending resulted in the company flipping from a net income of $1.55 billion to a net loss of $(73) million. On an adjusted non-GAAP basis net income was $415 million, or 3.5% of revenue. Operating cash flow also plummeted 66.6% YoY from $1.6 billion to $535 million. The non-GAAP EPS was $0.58 compared to $2.34, down 75.2% YoY.

Valuation

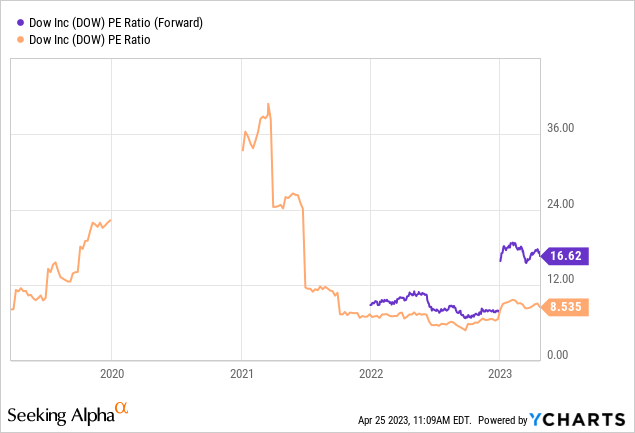

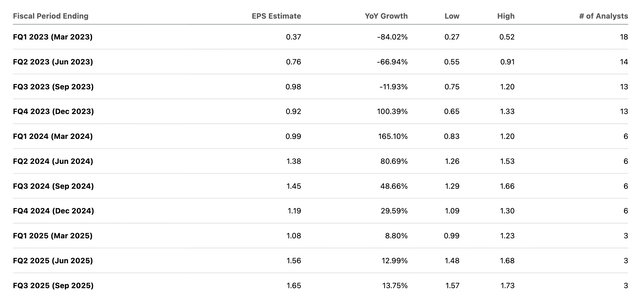

Dow's valuation remains pretty high considering the current macro backdrop. As shown in the chart below, the company is currently trading at an fwd PE ratio of 16.6x, which is not particularly cheap compared to its 5-year average of 16.9x. The PE ratio for FY24 is expected to drop back to 11.4x but the EPS estimates for the next two years seem way too high in my opinion. According to Seeking Alpha, the current consensus estimates that the quarterly EPS will bottom this quarter and starts to rebound throughout the year. However, this seems highly unlikely as the economic indicators are just starting see a meaningful drop, not to mention the potential impact if a recession does happen. I believe the current valuation is way too optimistic and a downward revision in the EPS estimates will likely present meaningful downside potential.

Seeking Alpha

Investors Takeaway

Dow Inc. is a solid company but its cyclical nature makes it very tough to own during downturns. I do not believe now is the time to start buying as the recent economic indicators suggest there will likely be further deterioration. The impact continues to be reflected in the earnings as every segment showed a significant decline in sales. However, the current valuation and EPS estimates are discounting the macro impact and expect financials to improve starting next quarter, which is highly unlikely. With so much optimism being priced in, we might see meaningful downside potential if the company falls short of the elevated expectation. I do not like the current risk-to-reward ratio and I am reiterating my sell rating.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.