Bakkt: Despite Apex, Major Hurdles Remain

Summary

- Bakkt recently completed its acquisition of Apex Crypto, a custodial business that provides crypto services to fintech platforms like Webull.

- Bakkt is still hemorrhaging money and plans to reduce headcount by 40% by the end of 2023.

- Without a global footprint, Bakkt's short-term growth is limited by an antagonistic regulatory environment.

- I do much more than just articles at BlockChain Reaction: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

24K-Production

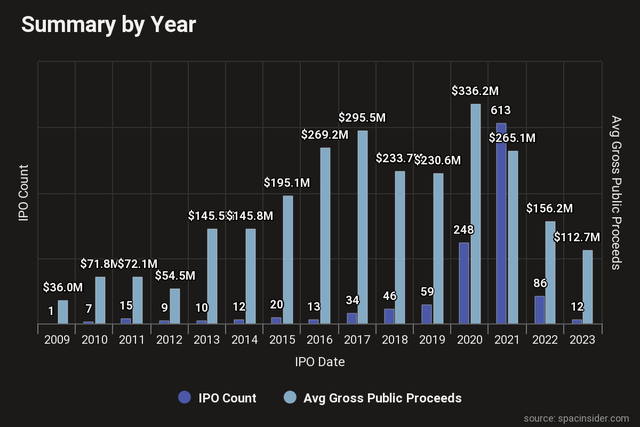

One of the biproducts of the liquidity-fueled speculative frenzy following COVID lockdowns was the proliferation of companies going public via SPAC merger. Companies that go public via SPAC tend to be on the riskier side and it could be argued many of these companies shouldn't go public at all. The average public proceeds and the raw number of companies that went public through SPAC dwarfed the figures from previous years:

Annual SPAC Stats (SPACInsider)

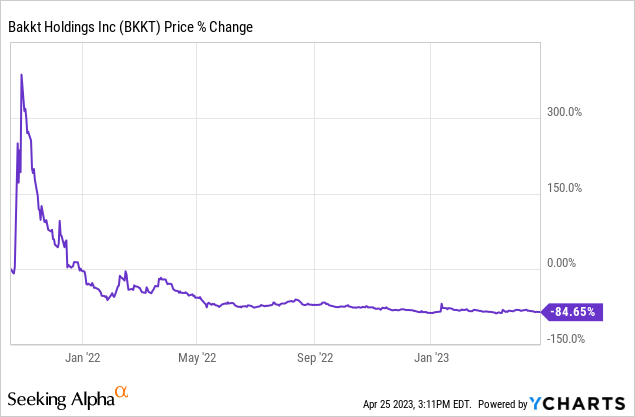

The number of SPAC mergers exploded from 59 in 2019 to over 600 in 2021. One of those 2021 SPACs was Bakkt Holdings (NYSE:BKKT). Longer term BKKT shareholders have been on quite the ride as the stock went from $10 in September 2021 to over $42 the following month.

Just three months later, BKKT shares were under $4 and it has mostly been a slow bleed down below $2 ever since.

Revenue Model

From an operations standpoint, Bakkt is trying to be a crypto business that operates a B2B2C model. The company previously had a direct to consumer application that allowed individual users to buy and sell crypto but that app has since been sunset. On the last conference call, Bakkt CEO Gavin Michael insinuated this was to avoid competing directly with Bakkt's active business clients during the Q&A:

...it became apparent with the app that it really was detracting from the focus that we had around being that platform that scalable company that is really providing market level infrastructure without any channel conflict or brand conflict to our partners.

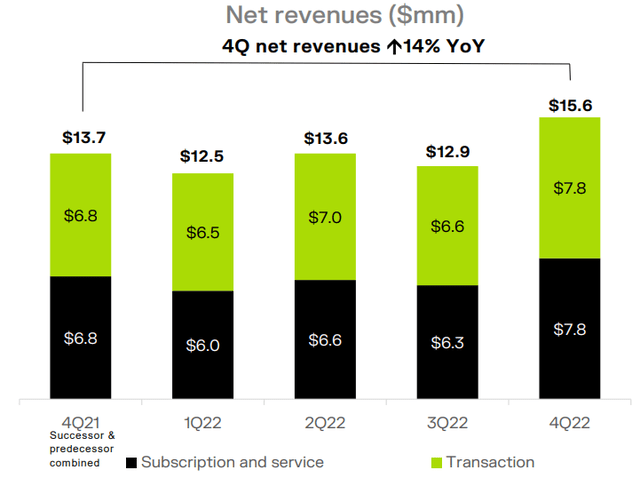

While there is probably some truth to that assertion, I'd say the decision to end the app was probably more influenced by the underwhelming revenue figures from that segment in previous reports. Going forward, the company operates a crypto rewards platform that breaks revenue out between two segments; crypto transactions and subscription and service revenue:

FY22 Presentation (Bakkt)

While each of these segments grew both sequentially and year over year, the company is still very unprofitable and managed just $54.6 million in revenue for 2022. Gross profit for the year was -$113 million - and this was actually an improvement over 2021.

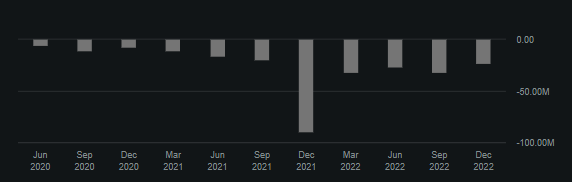

Gross Profit (Seeking Alpha)

It should be noted, these losses aren't even factoring in the $64 million in opex or the enormous $1.8 billion impairment hit the company took last year. Simply put, the company losses a lot of money. To address these obvious expense issues, Bakkt is guiding for a 40% headcount reduction by the end of the year. That restructuring is projected to result in $29 million in free cash flow savings this year according to the company.

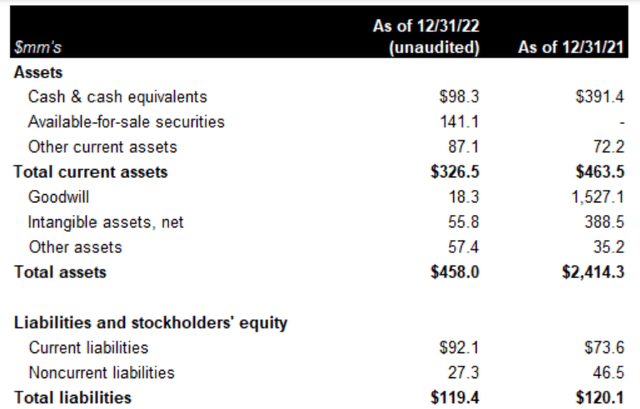

Balance Sheet and Apex Crypto

Despite the underwhelming performance of the business over the last couple years, Bakkt had a half decent balance sheet entering 2023. At the end of 2022, the company had $239 million in cash and short term investments against just $119 million in total liabilities - most of which are current.

Balance Sheet (Bakkt)

However, $55 million of that cash is already spoken for through the company's recently completed Apex Crypto acquisition. The total acquisition cost could end up being $164 million in cash and stock if Apex hits future financial targets. $100 million is dependent on future milestones through 2025. On the surface, this is an acquisition that makes some sense. Apex Crypto is a custodial crypto business that works with third party investment services like Public.com and Webull for client-facing cryptocurrency offerings. According to Gavin Michael, Apex Crypto brings 33 signed partners into Bakkt's existing client base.

The original deal included $45 million in stock rewards if Apex Crypto hit certain milestones in Q4 2022. In the last report, Bakkt disclosed just $9 million of that $45 million stock reward payment was achieved. There are two ways to look at this; on one hand, Bakkt isn't paying as much for Apex Crypto as it could have. On the other hand, Bakkt's growth through acquisition strategy with Apex Crypto may not generate the long term returns shareholders might be expecting.

In any case, the deal brings in a business that should result in a revenue boost right away as Apex has generated $12.5 billion in lifetime crypto transaction volume since 2018. By comparison, Bakkt did just $832 million in crypto volume last year. This is less than a company like Coinbase (COIN) does in a typical day. Of course, the major headwind that all of these US crypto custodians are now facing is a regulatory environment that has become highly combative to the industry since FTX collapsed.

Regulatory Headwinds

On the conference call in March, company leadership talked about potential growth possibilities within its B2B2C segment and specifically mentioned stablecoins and crypto yield products:

The ability for us to be able to support an increased range of tokens and protocols including things like stablecoin and yield generating offerings as well. In consideration for things like Staking, we see custody as a growth area. There are more and more of our partners are looking to work with custodial operations like ours.

The issue I find with this guidance is the legality of third party staking services domestically was already a point of contention from Gary Gensler's SEC. In February, the SEC reached a settlement with centralized crypto exchange Kraken over its staking as a service products. The point is, this is likely not a viable growth opportunity for US-based crypto companies until there is better regulatory clarity from the US government regarding centralized staking services.

And that really gets to the heart of what companies like Bakkt are up against with this regulatory regime. The SEC has insinuated repeatedly that Ethereum (ETH-USD), the market's second largest asset by market cap, is an unregistered security. The CFTC disagrees. This jurisdiction war between regulators is a significant risk because both entities are trying to regulate by enforcement actions to justify oversight. We've seen iTrustCapital recently suspend Algorand (ALGO-USD) purchases through its investment platform in response to the SEC's claim that ALGO is an unregistered security. Bakkt won't be immune from these problems and acknowledges such in the risk factor summary from the company's 10-K:

A cryptoasset’s status as a “security” in any relevant jurisdiction is subject to a high degree of uncertainty, and if cryptoassets on our platform are later determined to be securities, we may be subject to regulatory scrutiny, investigations, fines, and other penalties, which may adversely affect our business, operating results, and financial condition.

This problem wouldn't be as significant if Bakkt had a global footprint. But per the company's 10-K, Bakkt is a US-only business. Apex Crypto appears to be as well. If Bakkt had a history with even a single profitable quarter these regulatory problems would still be a major problem for the company's immediate growth prospects. The fact that the company wasn't even profitable when the SEC was being more lenient on the industry doesn't give much confidence in going long this stock.

Summary

Maybe the biggest fundamental problem for Bakkt is the company just bought a custodian service in an industry that doesn't require custodians. Even if the regulatory environment in the United States was a welcoming one, Bakkt's model still has problems. The rewards platform is admittedly interesting, but because it's a crypto business it's impacted by the same regulatory environment that the custodial business is impacted by.

Given these problems, I can't recommend going long BKKT shares unless you're a seasoned contrarian investor with a high tolerance for pain. Even then, I'd keep positioning small. Without the central bank liquidity spigot, the retail investor demand for cryptos will likely be limited. Furthermore, without clearly defined regulatory parameters from the US government, institutional demand will likely be limited as well. I certainly wouldn't be shorting BKKT at $1.35 given the cash pile and the possibility of a more efficient operation with cost cuts this year. But if you're bullish crypto, just buy crypto. BKKT is a hold.

Decode the digital asset space with BlockChain Reaction. Forget about the dog money. With over 20,000 coins, malinvestment was begging to be purged. But not every coin is disaster. In BCR I'll help you find the ones that have staying power. Service features include:

Decode the digital asset space with BlockChain Reaction. Forget about the dog money. With over 20,000 coins, malinvestment was begging to be purged. But not every coin is disaster. In BCR I'll help you find the ones that have staying power. Service features include:

- My Top Token Ideas

- Trade Alerts

- Portfolio Updates

- A Weekly Newsletter

- Full Podcast Archive

- Live Chat

Crypto Winter can be cold and brutal. But there is value in public blockchain and distributed ledger technology. Sign up today and position your portfolio for the future!

This article was written by

5 years as a media research analyst. Mainly covering crypto, metal, and media equities. I share deep dives on under the radar digital assets through my Seeking Alpha investor group BlockChain Reaction - my approach to crypto coverage leans far more fundamental than technical. I believe the overwhelming majority of crypto coins will go to zero. However, I think there are many that will actually perform very well long term. Those are the assets I aim to help other investors find.

Outside of Seeking Alpha, I write the Heretic Speculator newsletter where I share additional thoughts on finance with more of a social backdrop.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ALGO-USD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm not an investment advisor.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.