SQM And Albemarle: Betting On The Inevitable Electrification

Summary

- Despite Chile's attempts to nationalize or bring the lithium industry under-state control, congressional approval has yet to be obtained, suggesting minimal impacts in the intermediate term.

- The decarbonization cadence through 2050 may provide further tailwinds for energy storage and EVs, suggesting the importance of lithium miners such as SQM and ALB.

- ALB's aggressive FY2027 guidance suggests stellar top and bottom CAGRs of 21.4% and 19.34%, triggering a potential doubling in its adjusted EPS to over $40.

- SQM is a robust lithium play with stellar profit margins as well, while offering rich forward dividend yields of 16.55%, after the drastic correction.

- Therefore, investors may want to diversify and add both stocks to balance their commodity portfolio, especially made more attractive by the Chilean discount.

peepo

The Electrification & Geopolitical Investment Thesis

Lithium spot prices have been decimated recently, plunging by -70.2% from the previous peak in November 2022. Part of this was attributed to the peak recessionary fears, in part driving lower sales for EVs in 2023 YTD.

The uncertain macroeconomic events had also triggered Tesla's (TSLA) price war, with CATL similarly cutting battery prices since early 2023. The situation was significantly worsened by the supposed oversupply of lithium coming online through 2024.

Chile had also attempted to nationalize or bring the lithium industry under state control, naturally impacting lithium miner stocks, such as Sociedad Química y Minera de Chile (NYSE:SQM) and Albemarle Corporation (NYSE:ALB).

Given the decline in lithium prices and deceleration in EV sales, it seems unsurprising that Mr. Market has turned pessimistic toward the electrification cadence.

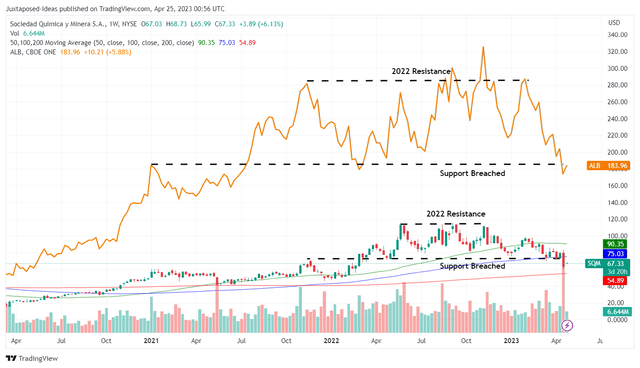

SQM & ALB 2Y Stock Price

Naturally, the SQM and ALB stocks had not been spared, given the potential normalization in their top and bottom lines, further made uncertain by the recent move by the Chilean government. Both stocks had drastically declined in recent days, breaching their support levels.

However, we reckon this pessimism is only attributed to the volatile macro and geopolitical events thus far, since the EIA continues to project 672M of EVs by 2050, comprising 31% of the global light vehicles then. The number indicates a consistent expansion at a CAGR of 15.97% from 2022 levels of 16.5M, implying that lithium-based batteries will remain highly relevant in the electrification process.

Much of the market share may still be retained by SQM and ALB moving forward, attributed to their guidance of 265K MT (+47.2% from 2022's level of 180K MT) of lithium production by 2025 and 600K MT (+200% from 2022's level of 200K MT) by 2030, respectively.

Furthermore, the tailwinds to their long-term profitability remain robust, given that BloombergNEF estimates the prices for lithium may further expand by seven-fold from today's market value in 2050.

For now, SQM recorded impressive revenue growth of +274.4% and EPS growth of +567.3% YoY in FY2022, attributed to the higher lithium realization prices. The same had been experienced by ALB at +119.8% and +443.5% YoY, respectively.

Therefore, while 2023 may bring a surplus of lithium, we reckon it is only temporary, with the global demand for the commodity projected to more than double to 1.5M MT by 2026, from 690K MT in 2022.

While it may not be of direct consequence, the WTI crude oil prices have also been well supported at the mid-$70s since Q3'22, significantly aided by the recent OPEC+ cuts, against the pre-pandemic normal of $60. This has triggered the higher US retail gas prices at an average of $3.76 per gallon at the time of writing, compared to the pre-pandemic levels of $2.7, potentially making the transition from ICE vehicles to EVs easier.

Therefore, since batteries typically comprise up to 20% of EV costs (based on an MSRP of $50K), the declining lithium prices may also translate to more attractively priced EVs, significantly aided by the Inflation Reduction Act's $7.5K EV tax credits. Perhaps this is why automakers have offered discounts on their EVs, since some of their lithium supply contracts may be based on spot prices.

The tailwinds for EV adoption may also be boosted by the proposed performance-based auto emission standards from 2027 onwards, attributed to the US' determination in meeting its 2030 decarbonization goals. The combination of the US President's ambition of 50% EV sales by 2030 and the EU's ban on ICE vehicles by 2035, implies that there is no going back from the ongoing electrification progress.

While it remains to be seen if EVs are actually better for the Earth and the electrical charging network/ power grids can be reliable enough, we reckon the global appetite for lithium will not abate in the long-term, only temporarily impacted by the peak recessionary fears in our view.

So, Are SQM & ALB Stocks Buy, Sell, or Hold?

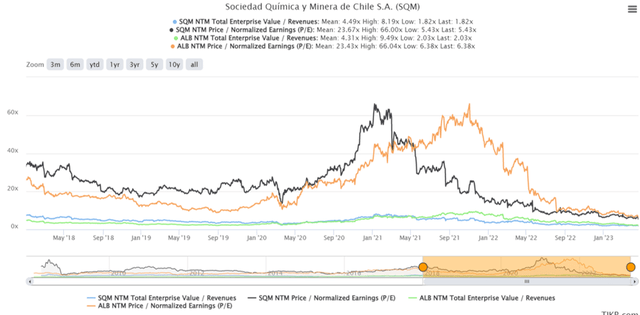

SQM & ALB 5Y EV/Revenue and P/E Valuations

Due to their mixed intermediate-term prospects, it is unsurprising to see both SQM and ALB trading pessimistically at EV/NTM Revenue ratios of 1.82x and 2.03x, respectively, against their 3Y pre-pandemic means of 5.10x/ 3.55x and 1Y means of 2.60x/ 3.71x.

However, we reckon the sell-off is overdone, due to the market analysts' projected improvement in their FY2024 toplines to $9.73B (normalized CAGR of 38%) and $11.93B (27.2%) compared to FY2019 levels of $1.94B and $3.58B, respectively.

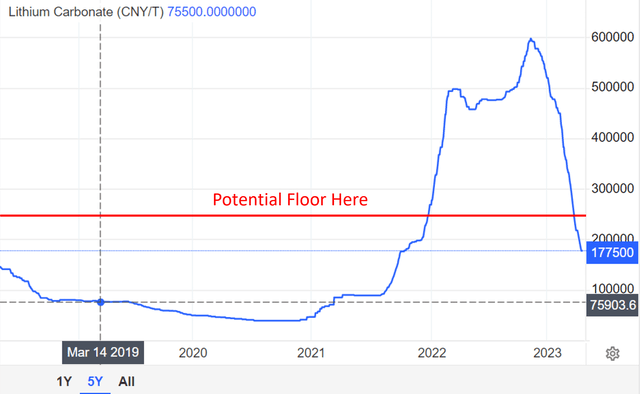

Lithium Spot Prices In China

The market concerns on the lower lithium realization prices are also overly gloomy in our opinion, since the commodity is still trading higher than pre-pandemic levels by +133% at 177.5K Yuan/T (or the equivalent of $25.75K/T), at the time of writing.

This points to SQM and ALB's overly pessimistic NTM P/E valuations of 5.43x and 6.38x, respectively, against their 3Y pre-pandemic mean of 25.17x/ 18.55x and 1Y mean of 8.54x/ 12.30x.

We believe this is especially true since SQM has been expanding its net income/ Free Cash Flow margins from 14.3%/ 5.4% in FY2019 to 36.5%/ 29.6% in FY2022, with market analysts projecting a sustained cadence of 36.2%/ 33.5% in FY2024. The same was observed for ALB at 17.9%/ -3.7% in FY2019, 35.3%/ 8.8% in FY2022, and 30.9%/12.3% in FY2024.

Furthermore, there are market rumors of a lithium carbonate coalition in China, to support a floor price of 250K Yuan/T ($36.39K/T) ahead. Assuming so, we may see an upwards re-rating in SQM and ALB's top and bottom-line growth, triggering potential recoveries in their stock prices ahead.

Based on their price actions, we reckon that the SQM and ALB stocks may have over-corrected, especially given the critical role lithium will most likely play in the electrification cadence through 2050. Naturally, it is tough to choose only one stock to recommend in this article, since it is between rich dividends and high growth.

SQM may be the better income choice, due to its higher forward dividend yield of roughly 16.55% compared to ALB at 0.83%, and its improved balance sheet with net debts of -$1.21B (-856% YoY) compared to ALB at $1.65B (+10.7% YoY) by the latest quarter.

On the other hand, ALB has aggressively guided for FY2027 net sales of $19.3B and adj. EBITDA of $8.4B, suggesting stellar CAGRs of 21.4% and 19.34%, respectively. This also suggests a potential doubling in its adjusted EPS to over $40, compared to FY2022 levels of $21.96. Naturally, this is assuming a stable share count and sustained lithium prices.

Then again, given the developing situation in Chile, both stocks are only suitable for investors with higher risk tolerance, with ALB likely being the safer choice with the 2043 contract renewal in Chile, as compared to SQM by 2030. However, we generally share the same sentiments as Joseph L. Shaefer here, in that the "nationalization risks" are probably overblown by the media.

As a result, we reckon that it may be more prudent for investors to diversify and add both stocks to balance their commodity portfolio, according to individual investor's risk tolerance and style of investing. Combined with the fact that SQM is trading at its 1Y lows and ALB at its 2Y lows, we are rating both stocks as excellent Buys here.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.