The Trade Desk: A Promising Stock With A 'Hold' Rating

Summary

- The Trade Desk has become the leading third-party programmatic advertising platform, offering an attractive alternative for advertisers who aren’t comfortable with conflicts of interest.

- The company has been profitable since 2013 and reported a retention rate of at least 95% in every quarter for nine years.

- The Trade Desk has a strong balance sheet with no outstanding debt and a cash balance of over $1 billion.

- I am personally looking to add more to my position, but I recognize that the current price may not be the best entry point.

stockforliving/iStock via Getty Images

The Trade Desk's (NASDAQ:TTD) share price has surged this year, fueled by the company's impressive business performance in the midst of a slump in the overall digital advertising market. Its cloud-based self-serve ad platform has proven to be a hit with customers, and the company has reported a retention rate of at least 95% in every quarter for the past nine years. However, despite its promising growth prospects and stellar balance sheet, the current price presents more downside risk than upside potential for new investors. While current investors like myself may hold on to their shares, potential investors may want to wait for a more attractive entry point.

The Advertising Business

The global advertising industry is expected to grow to $835 billion by 2028, with companies in the United States alone projected to spend $347.78 billion in 2023. The Trade Desk is at the forefront of helping advertisers navigate this massive market, using its self-service platform to algorithmically select the best location to display their message across various media channels. Its clients, which include advertising agencies, brands, and other intermediaries, rely on The Trade Desk to efficiently place ads and maximize their return on investment.

In addition to its impressive financial growth, The Trade Desk is also leading the charge in preparing for the industry's transition away from online cookies. With privacy concerns on the rise, The Trade Desk helped create the Unified ID 2.0 (UID2) framework, a unique identifier that enables targeted ads while protecting user privacy. This innovative solution has already won over major players in the industry, including Amazon Web Services and The Washington Post.

I believe the Trade Desk's success can also be attributed to its focus on connected TV, which is rapidly gaining traction among consumers. With 120 million connected TV devices and 90 million households already reached, The Trade Desk's CTV unit is its fastest-growing channel, accounting for 45% of its total revenue. As linear TV continues to shift towards CTV, The Trade Desk is well-positioned to support its clients through this transition.

Further highlighting why advertisers are so keen to shift to CTV, Walt Disney (DIS) reported that once it began using the company's UID2 framework, it saw a 12-fold improvement in effectively reaching its target audience. This could be an early indicator of success for what appears to be a necessary upgrade from privacy-intrusive third-party cookies.

A Strong Balance Sheet

Despite the global advertising market growing by only 11% in 2022, The Trade Desk delivered exceptional sales growth of 32% year-over-year, generating $1.6 billion in revenue and gaining valuable market share within its industry. This impressive growth is even more notable considering that many companies are experiencing declines in ad sales.

The Trade Desk's success can be attributed in part to its focus on building a strong balance sheet. With $1.45 billion in cash and short-term investments, the company is well-positioned to weather any potential recession. Moreover, its lack of outstanding debt leaves the door open for potential acquisitions, as many smaller advertising companies may face turbulence in a recession environment.

In addition to its strong financial position, The Trade Desk boasts an impressive 95% customer retention rate for the ninth year in a row, indicating the company's ability to provide value to its clients and maintain long-term relationships.

Leadership

The Trade Desk's success can largely be attributed to the leadership of founder and CEO Jeff Green, who has a strong background in the online advertising industry. During the dot-com boom of the late 1990s, Green worked for an ad agency and witnessed the reliance of thousands of internet start-ups on ad revenue to make their business models work. This experience gave him valuable insights into the industry and inspired him to create his own successful ventures.

After building his AdECN online ad exchange and selling it to Microsoft (MSFT), Green founded The Trade Desk, which has become his most successful venture to date. Green has what I like to see in a CEO, skin in the game. With a stake in the company worth roughly $2.5 billion at recent prices, Green has a significant financial interest in the success of the company. He also has nearly 50% voting power through his Class B shares, which means that investors can be confident that he will lead the company into the future with their financial interests in mind.

Risks & Challenges

Despite its recent success, The Trade Desk faces several risks and challenges that could impact its growth and stock price in the future. One major concern is the possibility of economic downturns leading to a decrease in advertising budgets, which could affect The Trade Desk's revenue and profitability. Additionally, the company has a high beta of 1.79, indicating that its stock price is significantly more volatile than the broader market.

Another significant risk is concentration risk, as a few clients account for a significant portion of The Trade Desk's revenue. While this concentration has increased over time, the company's strong balance sheet should allow it to avoid liquidity problems that could affect less financially secure companies. However, any significant loss of clients could have a significant impact on the company's financial performance.

Privacy concerns are also a potential challenge for The Trade Desk, particularly as regulators continue to scrutinize the online advertising industry. The company will need to stay on top of changing trends and regulations around privacy to avoid potential regulatory action or public backlash.

Moreover, The Trade Desk must compete against larger players like Alphabet (GOOG) (GOOGL) and Meta (META), which have their proprietary ecosystems. To maintain its market share and growth, The Trade Desk will need to continue innovating and expanding its offerings.

Valuation

The Trade Desk has seen tremendous growth in recent years, thanks to its cloud-based self-serve ad platform. The stock price is up nearly 2,000% over the last decade as digital advertising has boomed, and more companies have embraced Trade Desk's platform, which allows brands and agencies to manage ad campaigns and adjust them using real-time data. Customers have been overwhelmingly happy with its product as it has reported a retention rate of at least 95% in every quarter for nine years. The sales are booming, and the company has been profitable since 2013, however, it has been maximizing revenue in pursuit of earnings. Based on that, the company is currently in the growth stage of its life cycle.

Product Life Cycle (Lumen Introduction to Business + Author)

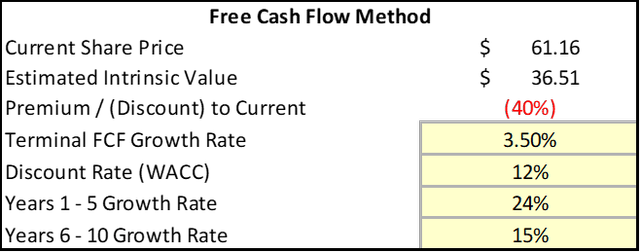

Overall, I believe that The Trade Desk is in the growth stage, meaning the earnings per share are not being maximized as the company is aiming to increase revenue. Therefore, I don't think the price-to-earnings ratio can be used to value the stock. In this case, I prefer to use the price-to-earnings-to-growth, price-to-sales or a discounted cash flow model. The stock is pricey, trading at a 19x price to sales. Using the discounted cash flow model, I use two different growth rates, as I don't believe the stock will have the same growth rate for the next 10 years. The DCF gives me an implied share price of about $36.51, which implies a discount of around 40%. Using the DCF, in order to justify the share price of around $61, the implied growth rate needs to be around 24% for the next 10 years, which I don't believe the company will be able to maintain.

Here's a table that shows a comparison of some key financial metrics for TTD and its peers:

Company Name | Market Cap | EPS | PEG | Price to Operating Cash Flow | P/B | ROIC |

30.35 B | 0.11 | 23.5 | 56.05 | 14.19 | 2.97% | |

18.72 B | 6.36 | 5.48 | 20.4 | 6.02 | 14.27% | |

546.14 B | 8.59 | 5.77 | 11.31 | 4.36 | 18.03% | |

1,340 B | 4.56 | 1.42 | 15.25 | 5.30 | 22.46% |

As shown in the table, the stock is not the cheapest, but quality comes at a price. Among these four companies, TTD has the highest PEG ratio of 23.5x, the highest price-to-book value (P/B) ratio of 14.19x, and the highest price-to-operating cash flow ratio of 56x, which may seem unattractive to value investors. However, these high ratios reflect the company's quality.

Conclusion

Looking to the future of the digital advertising industry, it's clear that ads are here to stay, and we will continue to pay for them. We've seen this with the recent release of cheaper subscription plans from Netflix (NFLX) and Disney that still include ads. The Trade Desk is well-positioned to take advantage of this trend and continue its success. The company has a stellar balance sheet and is still in a hyper-growth phase, making it a strong contender in the market. However, as a current shareholder, I must acknowledge that the current stock price may pose more downside risk than upside potential for new investors. While I am personally looking to add more to my position, I recognize that the current price may not be the best entry point for now.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TTD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.