If You're Bullish On Bullfrog AI, Consider The Warrants For A Superior Risk To Return Profile

Summary

- Bullfrog AI is a two-month-old IPO that has gotten caught up in the recent AI hype.

- With less than 6 million shares outstanding and less than a 2 million float, the stock has the potential for massive runs as a trading vehicle.

- There are warrants on the stock with a strike price of $7.80 with five years to expiry trading under the symbol BFRGW.

- BFRG is a pre-revenue microcap stock, which makes it inherently risky and hard to derive fundamental value in which to compose a long-term price target.

- Considering the relative price between the warrants and stock as well as the strike price, bulls should consider buying the warrants for a superior risk-to-reward profile.

Shutthiphong Chandaeng

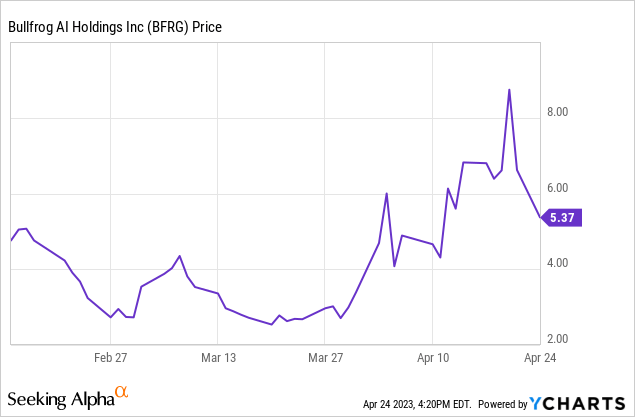

Bullfrog AI Holdings, Inc. (NASDAQ:BFRG) began trading on the NASDAQ in mid-February after its IPO, raising $9 million at $6.50. Along with the IPO came two sets of warrants, a non-tradeable warrant with a strike price of $8.125 and a tradeable warrant (NASDAQ:BFRGW) with a strike price of $7.80. Since it has started trading, it has gotten caught up in the ChatGPT-led artificial intelligence hype that is making waves in the small cap and speculative technology sectors. The stock has been on a wild ride with two unsustained runs to about $9.00 since it started trading. BFRG has continued to show its volatility, having dropped 38% to $5.43 on Monday from last Thursday's close of $8.74.

Excluding any potential dilution from the exercising of warrants, there are only 5.7 million shares outstanding while the float is 1.7 million, so I expect the wild price swings to continue. With the stock being as risky as it is, I will propose a strategy to traders and bullish speculative investors that should both reduce risk and maintain upside potential through the purchase of the tradeable warrants instead of the stock.

BFRG is a risky startup with no current revenue, but has a business model with speculative upside

Bullfrog AI is an emerging digital biopharma company with a mission to use its proprietary artificial intelligence and machine learning analytics platform to improve drug development and clinical trial design. Its goal is to improve clinical outcomes for patients and reduce trial-and-error treatment strategies through its bfLEAP™ technology, an AI/ML analytics platform derived from technology developed at Johns Hopkins University Applied Physics Laboratory. The platform is disease agnostic and the company intends to use it throughout the drug development cycle during the discovery phase, with pre-clinical data and throughout clinical development.

The business model and target market are as follows, taken from the company's S-1 filing:

The process for our drug asset enhancement program is to:

● acquire the rights to a drug from a biopharmaceutical industry company or academia; ● use the proprietary bfLEAP™ AI/ML platform to determine a multi-factorial profile for a patient that would best respond to the drug; ● rapidly conduct a clinical trial to validate the drug's use for the defined "high-responder" population; and ● divest/sell the rescued drug asset with the new information back to a large player in the pharma industry, following positive results of the clinical trial.

Basically the company wants to take failed or stalled drug candidates, data mine the heck out of them, redo any clinical trials for the new, focused indications, then sell the drugs at higher valuations for a profit after any success. The company also intends to contract out its services and collaborate with biotech or pharma companies to help design trials for drug candidates in development - data mining before actual data mining of double blind studies - as well as trying to recover value from past failed trials.

I like the service fee and collaboration model best for Bullfrog, given that it's a pre-revenue small cap with very limited resources after the small IPO. I think this focus would provide the most positive impact in the biotech industry, particularly in assisting with trial design. Any experienced biotech investor can think of an example of a company that had a trial fail to meet its endpoint, but a small cohort within the study saw material benefit. The problem is the market is so critical of this data mining that it doesn't lead anywhere. If bfLEAP™ can help biotech companies determine those cohorts beforehand and design the double-blind studies specifically for those favorable outcomes, the data might be seen as having a lot more credibility.

The company only has a $2.5 million annual burn rate, but that would rise substantially if it were to undertake its own clinical trials. Prudent growth is quite possible here if it contracts out its services or primarily relies on success fee or milestone-based revenues. But what I want to see and what the company does are two different things. If management takes the aggressive growth by trial route, more dilution will be in the future. However, unlike other junior health care companies, more dilution isn't necessarily a foregone conclusion for this stock.

In the going concern section of the S-1, BFRG mentioned the need to raise further equity or debt capital in the future, though it foresees that with the IPO raise it has sufficient capital to sustain its operations for at least the next 15 months. The risk of a capital raise happening within the next six months is slim unless the stock price moves substantially higher and dilution at those stronger valuations actually makes sense. An equity raise below the $6.50 IPO price is not something I see happening in 2023.

How buying the warrants can reduce the risk and improve the upside for an investment in Bullfrog AI

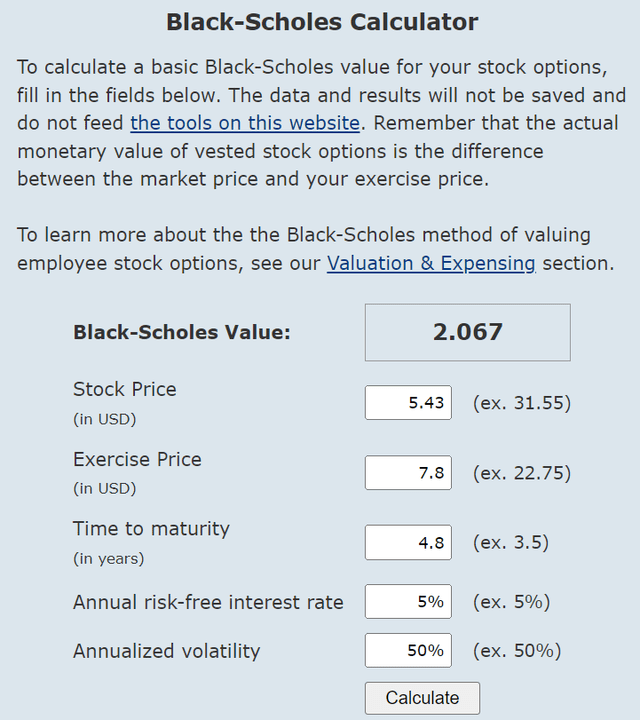

Warrants function as long term call options on the stock with a strike price of $7.80 and five years to expiry. The implied volatility on the warrants is extremely low right now, likely due to the market speculating that BFRG's hot trading will eventually die down. While the stock closed at $5.43 on Monday, the warrants closed at $0.98. This option pricing calculator demonstrates the value of the warrants given the volatility of the stock:

Assuming a base case of 50% volatility - which in my opinion is quite low given the already demonstrated volatility of the stock - the warrants should be worth over $2.00, not less than $1.00. The implied volatility of the warrants is around only 25% right now. This type of low IV is common for de-SPAC warrants, but those usually come with early redemption clauses that are extremely disadvantageous to warrant holders. BFRGW doesn't have any unfavorable clauses that would hurt the value of the warrants.

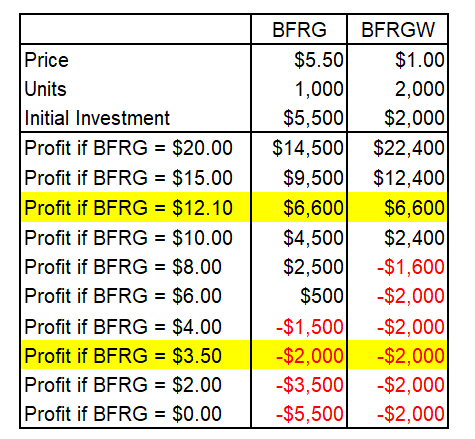

Given how cheap the warrants are relative to the stock, investors can obtain a better upside by buying more warrants than stock while spending substantially less cash to do so. Below is a chart where I outline two scenarios and their profit potential at a variety of stock prices. A purchase of 1,000 shares of BFRG at $5.50 for a $5,500 cash outlay versus the purchase of 2,000 warrants of BFRGW at $1.00 for a $2,000 cash outlay:

Self-created chart

In a bullish scenario where BFRG rises to $20, 1,000 shares would be worth $20,000. Subtracting the initial outlay and the investor is left with $14,500 in profits. However, if the same investor had instead purchased 2,000 warrants, those warrants could be exercised for 2,000 shares at $7.80 or $15,600. Those shares could then immediately be sold for $40,000, leaving the investor with $22,400 ($40,000-$2,000-$15,600) in profits. On the flip side, if BFRG were to go to zero, the max loss would be the entire initial outlay. For the stock that would be $5,500. For the warrants that would be $2,000.

The two lines highlighted in yellow would be the point where profit on the stock and the warrants would be the exact same. If the stock was to drop 36% from $5.50 to $3.50 in five years, the first scenario would cause a $2,000 loss to the investor. In the second scenario, the warrants are worthless so the loss is 100%, but the dollar figure loss is capped at $2,000. The investor could then buy 1,000 shares for $3.50 or less and be no worse off than had they initially purchased stock instead of warrants. If the investor decided to cut their losses in less than five years, the warrants could be sold for something tangible as they would still have time value.

The upper band breakeven point would be at $12.10, where selling the stock and exercising the warrants would result in a net profit of $6,600. So if investors expect the stock to be higher than $12.10 or lower than $3.50 in five years, the warrants provide both higher upside and lesser downside in this scenario. Where the superiority of the warrants breaks down is within the range of $3.50 to $12.10, particularly in the $6.00 to $8.00 range where shareholders would see a small profit while warrant holders would see a wipeout. But this goes back to the philosophy of speculative small cap trading. Investors aren't buying this stock in hopes that it will be $7.00 in five years. It was over $7.00 a few days ago. They either expect returns well in excess of 100% or that BFRG turns into a dog and is trading at less than $1.00. This is why the warrants make much more sense for most investors at these relative prices.

If the warrants traded at $2.00 instead of $1.00 as the option calculator implies they should, it would take a $4,000 cash outlay for the warrant scenario rather than a $2,000 cash outlay. The range for which the 1,000 shares would lead to superior returns would widen from $3.50-$12.10 to $1.50-$14.10, a much less enticing situation for the 2,000 warrants. If you do similar scenario analysis on stocks with call options, you get ranges more like the latter. That's why going long call options is generally considered a method of increasing risk exposure while I'm trying to demonstrate that going long on BFRGW actually represents a risk reduction strategy.

You don't necessarily need to be bullish on the stock to be bullish on the warrants either. This could be a short term bet that the implied volatility of the warrants goes up. As in other words, the warrants increase in price simply because they offer a good deal on a volatile ticker, even if that ticker stagnates in price. This is my bet as I think BFRG could go either way right now, but the warrants offer such a good deal that I can't pass it up. Sort of like how I never eat at fast food burger joints at full price, but if a coupon came in the mail, I would consider it. If the stock does explode to $15 or higher, I am profiting more than 500% on the warrants. But if BFRG slides down to $3 in the next several months, chances are that I will still be able to sell the warrants for $0.75 to $1.00 if I am patient and wait for my ask to get filled. This is the type of risk-to-reward trade-off I love. If the market ends up liking BFRG's tech and business model or the company can sign some deals that result in substantial contract backlog, that would be a bonus.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BFRGW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.