Olympic Steel Q1 Preview: Earnings Could Disappoint, So What?

Summary

- I believe that after the very strong rally in ZEUS stock, investors' expectations near term could be primed for disappointment as we head to Q1 results.

- Here I explain what Olympic Steel does and how its growth strategy relies on a strong balance sheet.

- Olympic Steel is cheaply valued, with alluring medium- and long-term prospects.

- Looking for more investing ideas like this one? Get them exclusively at Deep Value Returns. Learn More »

aydinmutlu

Investment Thesis

Olympic Steel (NASDAQ:ZEUS) is one of the leading US metals service centers focused on the processing of processed carbon steel, coated, aluminum, and plate steel products.

While I don't believe Olympic Steel's Q1 2023 results next week will leave much room to dazzle investors, given how much Olympic Steel has already rallied in the past several months, I am nonetheless impressed with Olympic Steel's prospects.

Furthermore, given that the stock is evidently far from being expensive at approximately 5x EBITDA, I urge readers to see the big picture and stick with this name.

Why Olympic Steel?

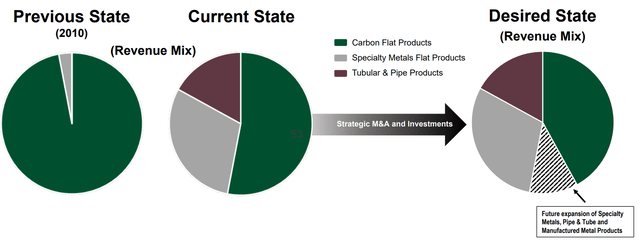

In recent years, Olympic Steel has grown its value-added processing products to include carbon flat products, particularly through its acquisition of Metal-Fab. In fact, the Metal-Fab acquisition was a significant move, back in January of this year, costing approximately 30% of Olympic Steel's market cap.

Further, I believe that one distinguishing feature of Olympic Steel is that they do not appear to embrace acquisitions for the sake of acquisitions, but instead, describe their specific operating objectives to include managing inventory turnover and cash turnover rates and end-market diversification, see below.

That being said, if I were to highlight one negative consideration towards this investment thesis, it would be that despite working hard to free up its working capital in 2022 and be highly free cash flow generative and all the while paying down nearly 50% of its debt in 2022, Olympic Steel still carries a fair amount of debt on its balance sheet.

Moreover, while I don't have the latest figures for Q1 2023, I believe that on the back of its Metal-Fab acquisition subsequent to Q4 2022, Olympic Steel's net debt profile will probably be higher than $200 million or about a third of its market cap.

Q1 2023 Preview

Olympic Steel is a steel processing company focused on the value-added processing of steel. This means that when steel prices go higher, its working capital requirements go up and its free cash flow goes down.

And when steel prices trend lower, this alleviates its tied-up working capital, which delivers strong free cash flows.

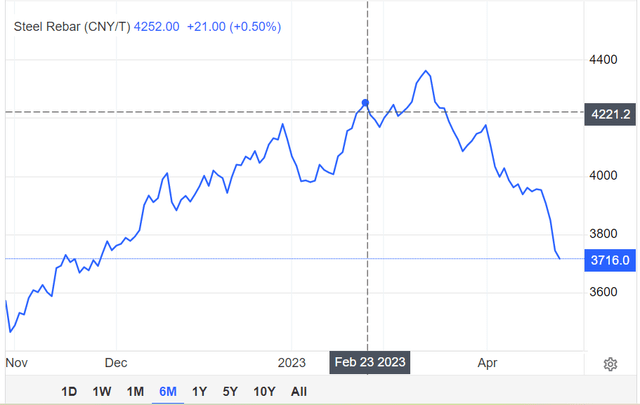

Moving on, at the time of the earnings call, back in February, steel prices were trending higher.

However, in recent weeks, steel prices have noticeably tumbled. This will mean that Q1 2023 earnings and probably Q2 2023 too, will not be very strong, but Olympic Steel's free cash flows will optically look impressive.

The Medium-Term Prospects for Steel

The infrastructure of today is constructed with steel. Without steel, it is impossible to produce electric vehicles, bridges, modern homes, and the semiconductor industry.

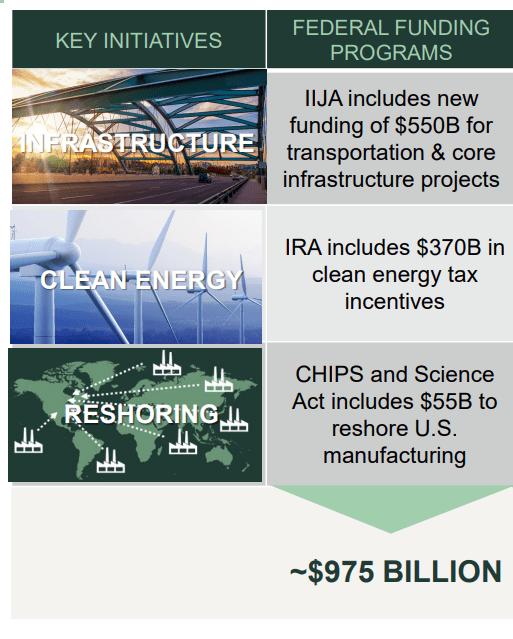

The way to best understand the importance of steel to rebuilding the US is to consider that the Biden administration has no less than 3 different federal funding programs to incentivize the use of steel.

Nucor Presentation 2023

This is my key contention, the world can't embrace Future Energy without steel. Every aspect of Future Energy has steel at its core, from wind turbines to solar panels to EVs to the reshoring of semiconductor fabs plants.

Altogether with ZEUS priced at very approximately 5x EBITDA, a multiple that I don't believe is expensive for what's on offer.

Particularly given that Olympic Steel has demonstrated a tendency to astutely deploy capital towards both capital returns, by increasing its dividend payout by 39% y/y as of Q1 2023, as well as being savvy business acquirers.

What's more, unlike other steel manufacturers, Olympic Steel is a processor and distributor, which means its capex requirements are only about 10% to 12% of its EBITDA, which means this business oozes free cash flows.

The Bottom Line

Olympic Steel is a cheaply valued steel stock with solid medium-term prospects, even if the very near term may be bumpy.

The more nuanced summary remarks how given that Olympic Steel's growth has been so reliant on acquisitions to continue diversifying and growing its operations, with its balance sheet carrying a fair amount of debt, it will take some time before Olympic Steel will be able to make further needle-moving acquisitions. Tune back in for its Q1 results next week.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.