The market continued to trade higher for the second consecutive session on April 25, driven by select banking & financial services, oil & gas, FMCG and metal stocks.

The BSE Sensex rose 75 points to 60,131, while the Nifty50 climbed 26 points to 17,769 and formed a Doji kind of pattern on the daily charts with above-average volumes. The index has been making higher highs and higher lows for two days in a row.

“The index remains comfortably above the critical moving averages, suggesting a positive trend. The upside resistance is visible at 17,800, where the bulls may find an immediate resistance. Above 17,800, the Nifty may move higher towards 18,000,” Rupak De, Senior Technical Analyst at LKP Securities said.

On the lower end, support remains intact at 17,700, he feels.

The broader markets had a mixed trend with breadth slightly favouring bulls. The Nifty Midcap 100 index was down 0.1 percent, while the Nifty Smallcap 100 index gained half a percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

Pivot charts indicate that the Nifty may get support at 17,730, followed by 17,708 and 17,674. If the index advances, 17,799 is the initial key resistance level to watch out for, followed by 17,820 and 17,855.

The Bank Nifty also traded in line with benchmarks, rising 43 points to 42,679. The index has formed small bodied bearish candlestick pattern on the daily scale but continued making higher highs and higher lows for the second straight day.

“The index remains in a strong buy mode with support at 41,500-41,400 levels which will act as a cushion for the bulls,” Kunal Shah, Senior Technical & Derivatives Analyst at LKP Securities said.

He feels the upside resistance is visible at 43,000 where the highest open interest is built up on the Call side and once surpassed will see further short covering.

As per the pivot point calculator, the Bank Nifty may take support at 42,614, followed by 42,552 and 42,451. Key resistance levels are expected to be 42,816, along with 42,878 and 42,979.

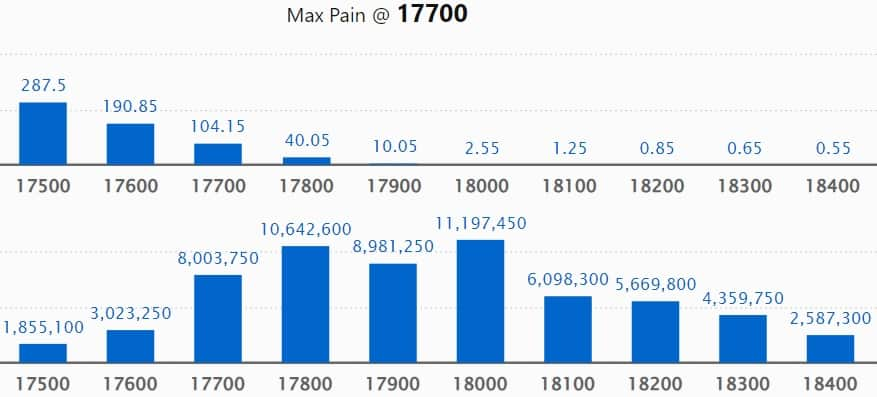

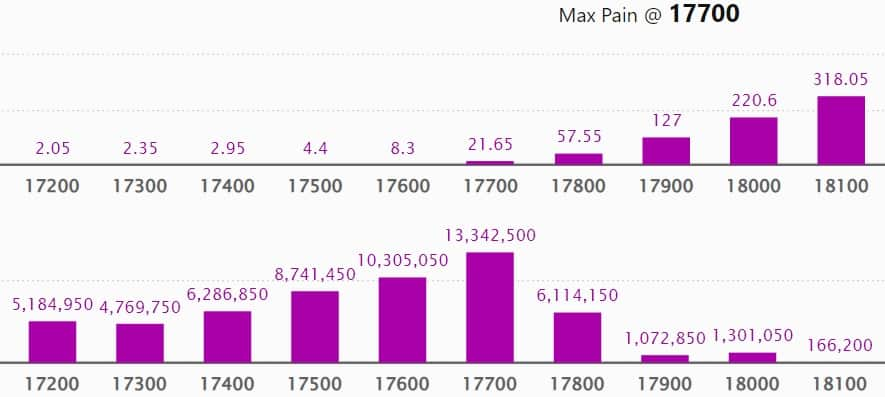

On the monthly options front, the maximum Call open interest (OI) was at 18,000 strike, with 1.11 crore contracts, which is expected to be a crucial resistance level for the Nifty in the coming sessions.

This was followed by 17,800 strike, comprising 1.06 crore contracts, and 17,900 strike, with more than 89.81 lakh contracts.

Call writing was seen at 17,800 strike, which added 27.07 lakh contracts, followed by 18,000 strike, which accumulated 13.74 lakh contracts, and 17,900 strike which added 9.72 lakh contracts.

Call unwinding was at 17,700 strike, which shed 26.38 lakh contracts, followed by 18,500 strike which shed 23.12 lakh contracts, and 17,600 strike, which shed 18.24 lakh contracts.

The maximum Put open interest was at 17,700 strike with 1.33 crore contracts, which is expected to act as a crucial support level in the coming sessions.

This was followed by the 17,600 strike, comprising 1.03 crore contracts, and the 17,000 strike where there were 99.57 lakh contracts.

Put writing was seen at 17,800 strike, which added 23.18 lakh contracts, followed by 17,500 strike, which added 10.43 lakh contracts, and 17,400 strike, which added 5.01 lakh contracts.

We have seen Put unwinding at 17,100 strike, which shed 10.14 lakh contracts, followed by 17,600 strike, which shed 10.13 lakh contracts, and 17,200 strike, which shed 6.86 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. The highest delivery was seen in Maruti Suzuki India, Hindustan Unilever, Bharti Airtel, NTPC and Torrent Pharma, among others.

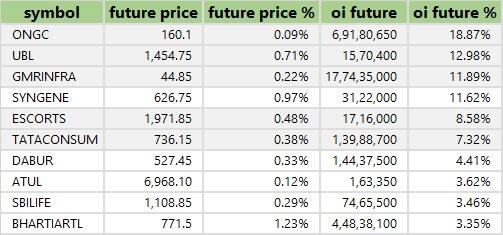

An increase in open interest (OI) and price typically indicates a build-up of long positions. Based on the OI percentage, 40 stocks, including ONGC, United Breweries, GMR Airports Infrastructure, Syngene International and Escorts saw long build-ups.

A decline in OI and price generally indicates a long unwinding. Based on the OI percentage, 51 stocks, including Honeywell Automation, Ramco Cements, Navin Fluorine International, AU Small Finance Bank, and Dixon Technologies saw a long unwinding.

32 stocks see a short build-up

An increase in OI along with a price decrease indicates a build-up of short positions. Based on the OI percentage, 32 stocks, including Crompton Greaves Consumer Electricals, Ipca Laboratories, M&M Financial Services, LTIMindtree and Bharat Electronics saw a short buildup.

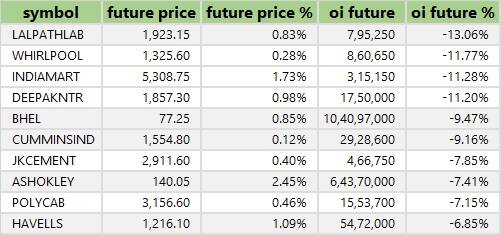

A decrease in OI along with a price increase is an indication of short-covering. Based on the OI percentage, 67 stocks were on the short-covering list. These included Dr Lal PathLabs, Whirlpool, IndiaMART, InterMESH, Deepak Nitrite and BHEL.

Stove Kraft: Emerging Business Fund has bought 3.03 lakh shares or 0.91 percent stake in the cooking appliances manufacturer via open market transactions at an average price of Rs 373 per share.

CMS Info Systems: Foreign portfolio investor WF Asian Reconnaissance Fund has offloaded 14.84 lakh equity shares in the company via open market transactions at an average price of Rs 280.02 per share, and 14.82 lakh shares at an average price of Rs 280.01 per share, amounting to Rs 83 crore. Total stake sale was 1.92 percent against 5.73 percent stake held as of March 2023. However, ICICI Prudential Mutual Fund bought additional 7.81 lakh shares in CMS at an average price of Rs 280 per share.

(For more bulk deals, click here)

Maruti Suzuki India, Bajaj Finance, HDFC Life Insurance Company, Indus Towers, SBI Life Insurance Company, L&T Technology Services, KPIT Technologies, Can Fin Homes, IIFL Finance, Oracle Financial Services Software, Poonawalla Fincorp, Shoppers Stop, Supreme Petrochem, Syngene International, Tanla Platforms, UTI Asset Management Company, and Voltas will be in focus ahead of quarterly earnings on April 26.

Stocks in the news

Bajaj Auto: The two-and-three-wheeler company has recorded a 2.5 percent year-on-year decline in standalone profit at Rs 1,433 crore for the quarter ended March FY23 despite a healthy topline and operating performance, impacted by a high base. Revenue for the quarter at Rs 8,905 crore grew by 11.66 percent over a year-ago period despite a 12.5 percent fall in sales volumes.

Tata Consumer Products: The FMCG company reported better-than-expected numbers on all counts in Q4FY23. Profit during the quarter grew by 21 percent YoY to Rs 289.6 crore, while revenue from operations increased by 14 percent to Rs 3,618.7 crore compared to the year-ago period, mainly driven by underlying growth of 15 percent in India business, 6 percent in international business and 9 percent in non-branded business.

Mahindra Lifespace Developers: The real estate developer has recorded a profit of Rs 0.54 crore for the quarter ended March FY23, down sharply compared to Rs 137.7 crore in the same period last year due to a high base. The company reported an exceptional gain of Rs 96.8 crore in Q4FY22. Revenue from operations at Rs 255.4 crore for the quarter increased by 57.8 percent over a year-ago period.

Cipla: Madison Pharmaceuticals Inc, a wholly owned step-down subsidiary of Cipla, in Delaware, USA, will be dissolved with effect from April 28, 2023. Madison is a dormant entity, and this dissolution will not affect the performance or revenue of the company.

Dalmia Bharat: The company has reported a massive 121.4 percent year-on-year growth in Q4FY23 consolidated profit at Rs 589 crore despite a lower margin, boosted by profit from joint ventures of Rs 529 crore in Q4FY23 against nil in the same period last year. Revenue from operations increased by 15.7 percent YoY to Rs 3,912 crore.

AU Small Finance Bank: The small finance bank has recorded a 23 percent year-on-year growth in profit at Rs 425 crore for quarter ended March FY23, with provisions and contingencies falling 56 percent YoY. Net interest income grew by 29.5 percent YoY to Rs 1,213 crore for the quarter. Asset quality improved for Q4FY23 with gross non-performing assets (NPA) as a percentage of gross advances falling 15 bps QoQ to 1.66 percent and net NPA declining 9 bps QoQ to 0.42 percent.

Mahindra CIE Automotive: The auto ancillary company has recorded a 73 percent year-on-year growth in profit at Rs 279.1 crore for the March FY23 quarter, partly driven by strong operating performance and topline. Revenue from operations in Q1CY23 at Rs 2,440.2 crore grew by 18.4 percent over a year-ago period.

Fund Flow

Foreign institutional investors (FII) sold shares worth Rs 407.35 crore, whereas domestic institutional investors (DII) bought shares worth Rs 563.61 crore on April 25, according to provisional data from National Stock Exchange.

Stocks under F&O ban on NSE

The National Stock Exchange has added Zee Entertainment Enterprises to its F&O ban list for April 26. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.