SGDM: Sprott Gold Miners ETF Could Soar On Debt-Ceiling Drama

Summary

- Since gold is generally priced in U.S. dollars the world over, the Sprott Gold Miners ETF could significantly increase on any potential U.S. debt-ceiling drama.

- That's because any potential default on America's debt obligations would likely lead to a debt rating downgrade and a significant drop in the value of the U.S. dollar.

- For investors who don't have exposure to gold or other hard assets priced in U.S. dollars (like oil), now is the time to get prepared for potential U.S. debt-ceiling drama.

Diy1The

The Sprott Gold Miners ETF (NYSEARCA:SGDM) has a relatively poor long-term performance track record. However, considering what appears to be an on-coming political train-wreck over raising the U.S. debt-ceiling, investors that don't have adequate exposure to hard assets that are globally priced in U.S. dollars - like gold - should consider a short-term investment in the SGDM ETF as a safe-haven insurance policy should raising the U.S. debt-ceiling become a significant issue over the coming weeks. While my followers know that I advise all investors to allocate some capital to gold and silver coins as part of a well-diversified portfolio, for those who don't own gold or are not knowledgeable and/or comfortable with buying gold coins, the SGDM ETF might be just the ticket.

Investment Thesis

As most of you know, there has been a political battle brewing over increasing the U.S. debt-ceiling. Despite raising the debt-ceiling three times during the Trump administration while running near $1 trillion annual deficits (during the supposed "best economy of all time"...), and partly as a result of the large tax-breaks given mostly to the super-rich and corporations, the Republican Party under new Speaker Kevin McCarthy now apparently want to use the debt-ceiling limit as leverage to force President Biden into negotiations to cut spending - something the President has said he will not do. As a result, there is a dangerous standoff as the U.S. moves toward a debt default.

Meantime, nearly all responsible government officials seem to think this is a very dangerous and unnecessary game to be playing. Indeed, U.S. Secretary of the Treasury Janet Yellen sent a letter to Kevin McCarthy in January which said in part:

...the period of time that extraordinary measures may last is subject to considerable uncertainty, including the challenges of forecasting the payments and receipts of the U.S. Government months into the future. I respectfully urge Congress to act promptly to protect the full faith and credit of the United States.

There is near unanimous consensus that a U.S. default would have catastrophic consequences for the U.S. economy as well as the global financial system that is largely based on the U.S. dollar. Indeed, as the Financial Post reported in February, Moody's Analytics predicts: a "U.S. debt ceiling default would cost 3 million jobs and wipe out $15 trillion in household wealth." Much of that loss of wealth would likely be due to a fall in the U.S. dollar, a fall in the U.S. stock markets, and a severe economic recession (or worse).

That being the case, and as part of a well-diversified portfolio built for the long-term, American and global investors need to have exposure to gold. Gold would most likely rise significantly in the event of a dramatic fall in the value of the U.S. dollar.

With that as background, today I'll take a look at the Sprott Gold Miners ETF to see if it may be worthy of an allocation within your portfolio.

Top-10 Holdings

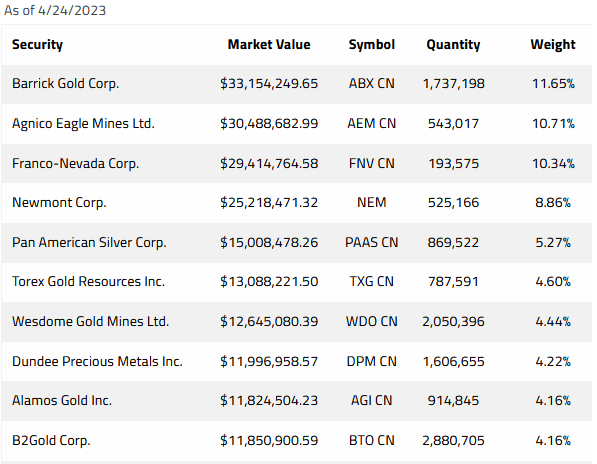

The top-10 holdings in the SGDM ETF are shown below and were taken directly from the Sprott Gold Miners ETF webpage where you can find more detailed information on the fund.

Sprott

As can be seen in the graphic, the SGDM ETF is relatively top-heavy with more than 41% of the entire portfolio allocated to the top-4 holdings. However, for investors looking for exposure to the price of gold, these four companies are arguably a very good way to achieve it.

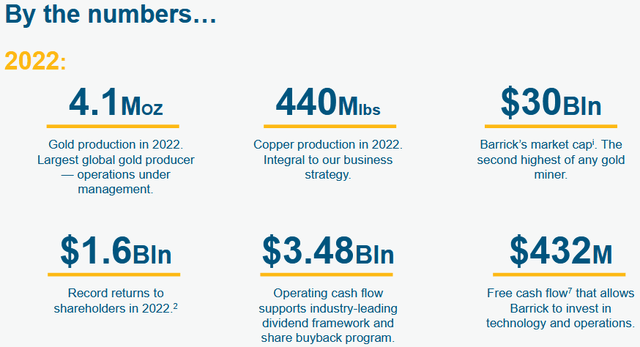

The top holding with an 11.7% weight is Barrick Gold (GOLD). The slide below summarizes Barrick's 2022 performance and was taken from the company's most recent Investor Presentation:

Since the merger with Randgold in 2019, Barrick says it is now the largest global gold producer with 4.1 million ounces mined last year. As you can see, the company is also a large producer of copper and generated $432 million of free-cash-flow last year. Barrick current trades with a forward P/E = 22.5x, pays a $0.40 annual dividend, and yields 2.1%.

Canada-based Agnico Eagle Mines (AEM) is the #2 holding with a 10.7% weight. Agnico owns mines in Canada, Australia, Mexico and Finland. In addition to gold, AEM also produces silver, zinc, and copper. The stock is down 2.3% over the past year and yields 2.85%.

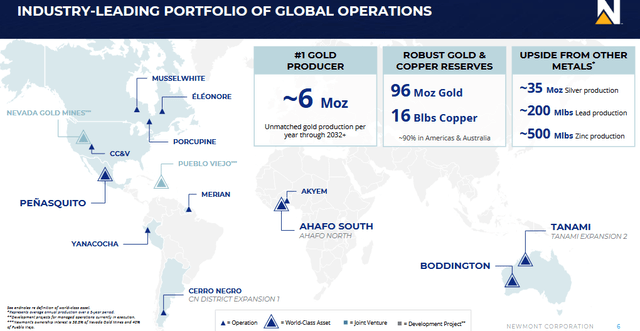

Newmont Mining (NEM) is the #4 holding with a 8.9% weight. Newmont also claims to be the world's largest gold producer (based on gold production estimates through 2032). NEM's global portfolio is shown below and it is notable that the company also has significant silver, lead, and zinc production:

Newmont stock is down 33% over the past year even as gold has gone from $1900 to $2000 per oz (+5.3%). NEM currently trades with a forward P/E of 21.1x and yields 3.33%.

Alamos Gold (AGI) is the #9 holding and has a 4.2% weight in the portfolio. AGI is also based in Canada and has mines in Canada and Mexico. The company primarily produces gold and silver. AGI is up a whopping 64% over the past year. In February, the company announced it will buy the rest of Manitou Gold (OTCPK:MNTUF) for C$14 million. Manitou shareholders will receive 0.003525 of Alamos common stock for each Manitou share. The deal will more than triple AGI's regional land package around Ontario's Island Gold Deposit.

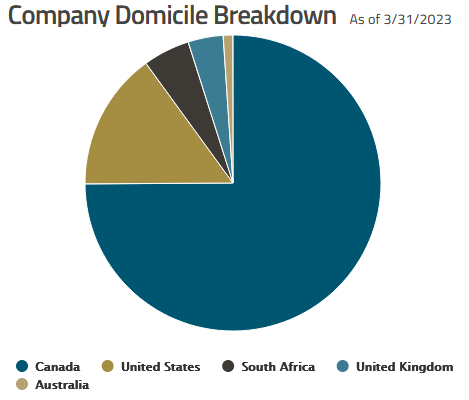

As a whole, the SGDM ETF's portfolio is greatly oriented toward Canadian producers:

Sprott

Sprott says the ETF's industry weightings are 93.6% gold and 3.9% silver. That's just what investors should be looking for: excellent and leveraged exposure to gold production.

Performance

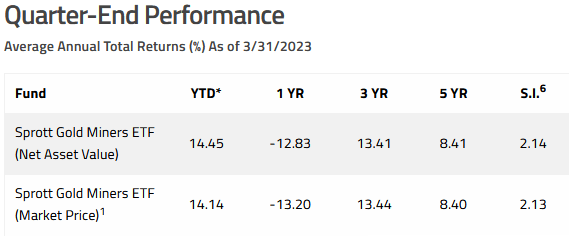

As mentioned earlier, the SGDM has a relatively poor long-term performance track record:

Sprott

S.I. stands for "Since Inception" and (7/15/2014).

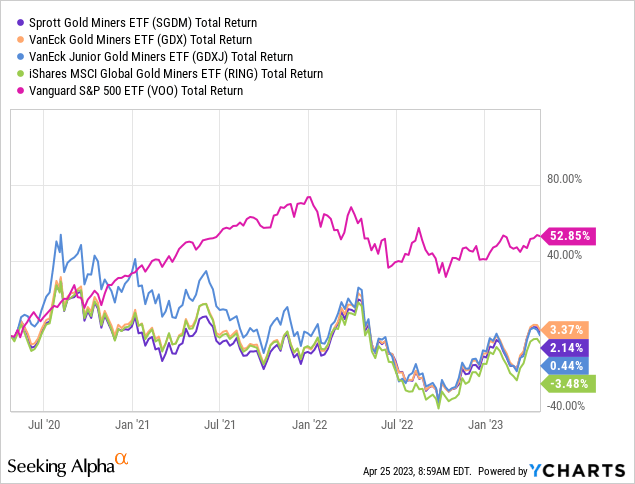

The graphic below compares the 3-year total returns of the SDGM ETF versus the VanEck Gold Miners ETF (GDX), the VanEck Junior Gold Miners ETF (GDXJ), the iShares Global Gold Miners ETF (RING), and the Vanguard S&P500 ETF (VOO):

As can be clearly seen in the graphic, all of these gold funds have been horrible investments as compared to the S&P500. This is why I recommend investors hold much (much...) more of the VOO ETF as compared to any allocation to gold.

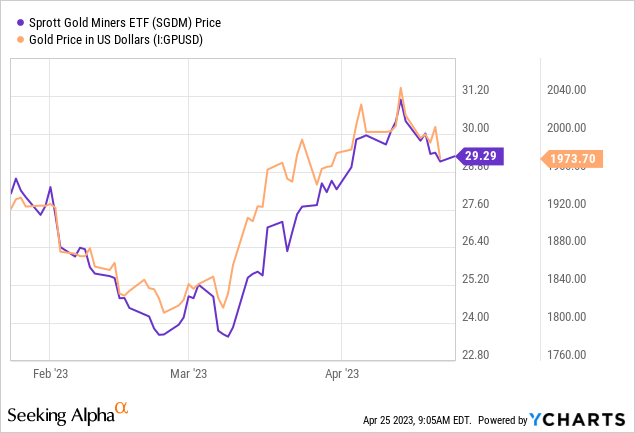

However, note how both gold and the SGDM ETF jumped since the Silicon Valley Bank drama unfolded (SVB was closed by regulators on March 10th):

In my opinion, this is a direct indication of the value of gold as a safe-haven in times of financial stress. In addition, note that the failure of SVB would pale in comparison to a U.S. debt default, so the rise in the price of gold and the SGDM ETF would likely be much, much greater.

Summary & Conclusion

As shown in this article, the SGDM ETF has a poor long-term performance track record. However, in my opinion, and as we head into a political and potential financial crisis over raising the debt-ceiling, investors need exposure to gold as a safe-haven insurance policy. As my followers know, I think holding gold and silver coins is the best way to protect wealth against a financial crisis in which the U.S. Dollar could drop precipitously. However, owning coins is tricky for many investors and they do present storage issues. That being the case, many investors would be better off holding a gold miners oriented ETF like the SGDM fund. For those investors, SGDM is a BUY. Yet once the U.S. debt-ceiling issue is resolved (if it is resolved...), I would then sell the ETF and put the proceeds into the S&P500 or simply buy some U.S. minted gold coins in preparation of the next financial crisis. And, unfortunately, there always seems to be a "next" crisis. Which is why - in my opinion - all well-diversified portfolios should have an allocation to gold and silver.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am an electronics engineer, not a CFA. The information and data presented in this article were obtained from company documents and/or sources believed to be reliable, but have not been independently verified. Therefore, the author cannot guarantee their accuracy. Please do your own research and contact a qualified investment advisor. I am not responsible for the investment decisions you make.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.