TIP: De-Dollarization Should Help Drive Real Yields Lower

Summary

- While the 1.6% real yield on the iShares TIPS Bond ETF may not seem like a great annual return, from a risk-reward perspective, the TIP fund remains highly attractive.

- The rising trend of global de-dollarization is likely to put downside pressure on US growth while putting upside pressure on inflation, pushing real yields lower.

- I expect to see US real 10-year bond yields move back below zero over the coming quarters, which would result in around 10% capital gains for the TIP.

- The relatively low duration of the TIP limits volatility and downside risks relative to longer-dated instruments.

Torsten Asmus

Inflation-linked bonds benefit when interest rate expectations fall faster than inflation expectations or inflation expectations rise faster than interest rate expectations. Ultimately, the level of real interest rates reflects the outlook for real GDP growth and monetary policy. Both of these factors suggest real yields will head lower over the coming years, in part due to the ongoing de-dollarization of the global economy. While the 1.6% real yield on the iShares TIPS Bond ETF (NYSEARCA:TIP) may not seem like a great annual return, from a risk-reward perspective, the TIP remains highly attractive. I strongly believe that the US real bond yields will head back below zero over the next 12 months, which would provide strong capital gains for the ETF. The main risk in the short term is that the Fed maintains its tightening focus to combat still-elevated headline inflation, although this would further improve the long-term outlook.

As I noted in my previous article on February 17 (see 'TIP: Don't Be Put Off By Falling CPI'), while disinflationary pressures are typically negative for inflation-linked bond indices such as the TIP, long-term inflation expectations as measured by breakevens markets are already factoring in a huge drop in inflation over the coming years, which may not be sustainable. Despite the continued decline in headline CPI over the past few months, the TIP appears to be embarking on an uptrend as long-term interest rate expectations decline relative to inflation expectations.

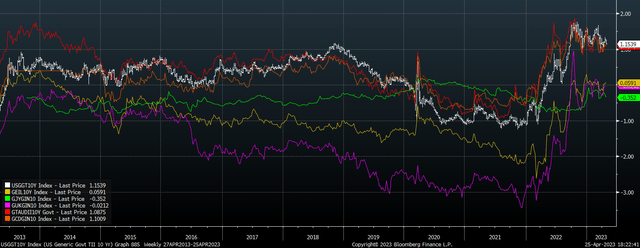

TIP ETF Vs 10-Year Inflation-Linked Bond Yield (Bloomberg)

The TIP ETF

The TIP tracks the performance of US Treasury inflation-protected securities, with a weighted average maturity of 7.3 years and an effective duration of 6.8 years. This makes the fund significantly less volatile when compared to the longer-dated PIMCO 15+ Year U.S. TIPS ETF (LTPZ) (see 'LTPZ: Real Yields May Need To Move Back Below Zero To Prevent A Fiscal Meltdown') so should be favored by those with less tolerance for risk. The current real yield on the TIP is 1.6.%, which is what investors should expect to receive per year over the long term after inflation, less the fund's expense fee of 0.19%. The TIP is the largest inflation-linked bond ETF, with USD22.6bn in assets under management, but the combination of outflows and price declines have seen the fund lose 42% of its assets market cap since the January 2022 peak.

US High Real Yields Unlikely To Remain Above Their Peers

The following chart shows 10-year inflation-linked bond yields in the US alongside those of its developed market peers; Germany, Japan, the UK, Australia, and Canada. US real yields are around 0.8% above the average of its peers, which reflects expectations of real GDP growth outperformance in the US and expectations that real interest rates will therefore average significantly higher.

10-Year Inflation-Linked Bond Yields (Bloomberg)

While US real GDP has historically been slightly higher than its peers, the de-dollarization occurring in the developing world poses a significant risk to this long-term trend. The US has benefitted from the 'exorbitant privilege' of having the global reserve currency, which has allowed the country to run persistent current account deficits in every single quarter since 1991. This has allowed the US to gain access to imports at artificially low prices and invest in excess of its savings for decades, supporting real GDP growth.

The increased weaponization of the dollar over the recent years has resulted in a backlash across emerging markets, which are looking to reduce their reliance on the dollar in international trade, which threatens to diminish this long-standing privilege to the detriment of real GDP growth. Many analysts have argued that such a trend is bearish for US bonds as it means fewer dollars will be recycled into US Treasuries, putting upside pressure on yields. However, this is unlikely to be the case in my view as the impact of weaker growth dominates. Furthermore, the reduction in global dollar demand is likely to have long-term inflationary consequences for the US economy as the dollar declines.

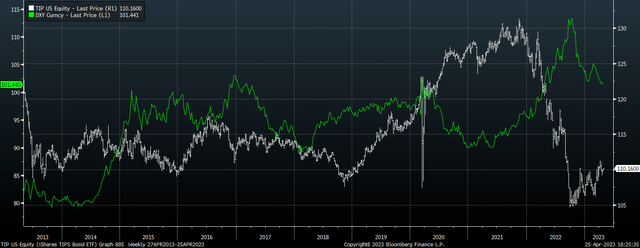

US Dollar Index Vs TIP (Bloomberg)

The TIP has historically been closely inversely correlated with the US dollar index, with a weaker dollar coinciding with lower real yields. Typically, real yields, at least relative to its peers, drive the value of the dollar, but if we see the US dollar's weakness accelerate, this could set in motion a vicious cycle of rising inflation, deteriorating growth, and a plunge lower in real yields. I fully expect to see US real 10-year bond yields move back below zero over the coming quarters, which would result in around 10% capital gains for the TIP.

Low Duration Limits Downside Risk

The main risk to this view comes from the potential for the Fed to keep monetary policy tight in order to prioritize inflation over growth. Interest rate futures markets are pricing in a 25bps Fed funds cut by December this year, which would likely rely on headline CPI coming down sharply, as I expect. However, if the Fed keeps rates at current levels, we could see real yields continue to move higher temporarily as bond yields resume their uptrend and inflation expectations decline under the weight of tight monetary policy. For this reason, the TIP, with a duration of just 6.8 years, is preferable to longer-dated inflation-linked bond funds such as the LTPZ for investors looking to limit near-term risks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TIP, LTPZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.