Brandywine Realty Trust: Unfairly Punished By The Market

Summary

- Since my last article on BDN, the stock has taken a beating, dropping by 40% as the market sentiment for office space reached an all-time low.

- I interpret the Q1 2023 earnings, highlighting the fact that from an operational standpoint, the REIT is stable.

- I present my outlook for the company and why I'm doubling down on this 19% dividend yield.

Marc Dufresne

Dear reader/followers,

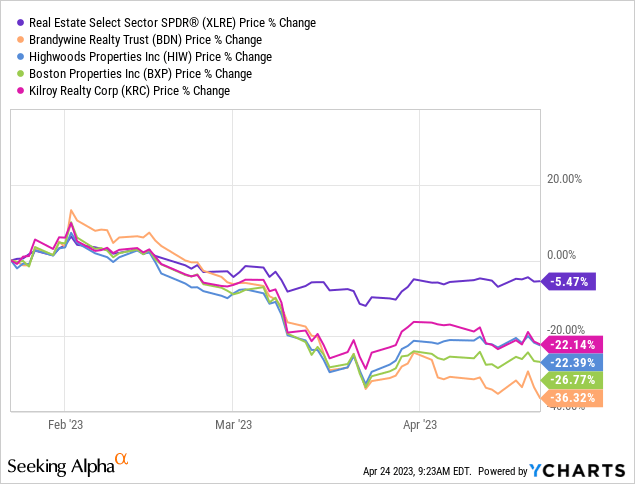

I started coverage on Brandywine Realty Trust (NYSE:BDN) in early February with a STRONG BUY rating as the company was vastly undervalued at the time and offered a very enticing and well covered 11% dividend yield. Despite good Q1 2023 result (which I'll discuss below) and no indication of a dividend cut, the share price has collapsed by 40% since then. This drop was almost entirely caused by market sentiment as Mr. Market absolutely hates any kind of office exposure at the moment. While the Real Estate Index has fallen by "only" 5% since then, office REIT have declined by 20-40%.

I think there's a lesson to be learn from the chart below and that is that if one is buying stock in a speculative sector (which office certainly is at the moment), especially during a bear market, it's best to stick with the best of breed to limit the downside. Boston Properties (BXP), Highwoods Properties (HIW) and Kilroy Realty Corporation (KRC) are arguably some of the best quality office REITs with the youngest and highest quality real estate and their price fell significantly less than Brandywine's. These are the companies I have focused on since buying BDN. The second lesson is to be learnt is that, one should average into these stocks slowly, rather than buying a full position right away as timing the bottom is impossible.

I intend to be fully transparent with my analysis and have no intention of trying to cover up my losses. In fact, I continue to hold my position with a break-even at $6.14 per share. The position was initially worth about 0.5% of my portfolio and I haven't added to it since publishing my last article. Following such a steep decline in price, it's time for an update. This time I intend to be quite skeptical and conservative when going through the numbers as I try to determine whether my buy thesis is still valid and whether I will add to my position here to lower my basis.

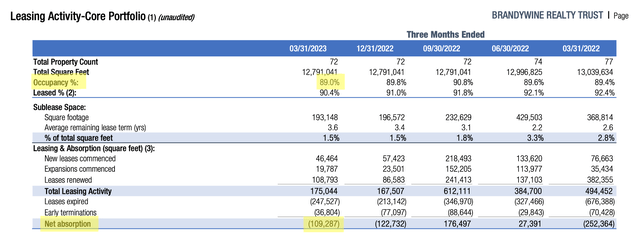

I will focus on three key areas that will be essential for the REITs long term success (and survival). These are leasing, dividend coverage and debt. Let's start with leasing. In Q1 2023 total occupancy fell from 89.8% to 89.0% as the lease expirations exceeded new leases (incl. renewals and expansions) by 110,000 sqm. That's obviously not a great result and was mainly caused by the Washington, D.C. portfolio which continues to underperform with occupancy of just 75%. On the bright side, the core portfolio which comprises of assets in Philadelphia CBD, University City, Pennsylvania suburbs and Austin and covers 94% of NOI has a solid occupancy of 92%.

Future occupancy will depend on their ability to offset lease expirations with new leases. Over the next four years, they will face relatively low average expirations of 225,000 sft every quarter which is reasonable considering that they executed 225,000 sft and 357,000 sft of leases in Q4 2022 and Q1 2023, respectively. So really to keep occupancy stable, they just need to continue doing what they have been doing over the last year.

Management reported that Q1 physical tours exceeded the 2022 quarterly average by 40%, signalling that more tenants are looking for space and more importantly tenant expansions continued to outweigh tenant contractions in the quarter. For year-end management targets occupancy of 90-91%. While full occupancy is a long way away, their core portfolio is performing well, and a large drop in occupancy seems unlikely. I will continue to watch their net absorption closely, but don't see any major red flags yet.

Secondly, I want to discuss their dividend coverage. The Q1 dividend has been confirmed at $0.19 per share ($0.76 annually). That's a 19% dividend yield ladies and gentlemen and what's crazy is that it's actually well covered by their Q1 2023 FFO which came in at $0.29 per share. That's a very reasonable payout ratio of 65% with an FFO that was down 13% QoQ. Though this drop doesn't worry me as it was primarily caused by the fact that Q4 2022 had large net gains on the disposal of real estate which somewhat skewed the data on a quarterly basis.

Going forward management guides towards a 2023 FFO of $1.12 - $1.20 per share which even at low point translates into a payout ratio of under 70%. And although management said that going forward when deciding on the dividend they will "closely monitor capital market conditions, overall liquidity, sale activity progress and our payout levels", they gave no indication that a dividend cut may be on the horizon. Having gone through the numbers, I really feel that the dividend is sustainable, even though the yield is getting insane. Normally I'd argue that they should cut the dividend to preserve liquidity, after all a 10% would still be pretty good, but REITs by law have to payout 90% of taxable income to shareholders so as long as the business runs the way it has, don't expect a dividend cut.

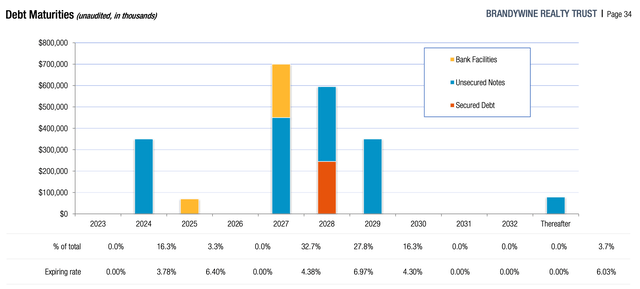

Finally, to get the full picture of the company, let's have a look at their balance sheet. To be fair, it's BBB- rated, which isn't great. BUT... they've successfully refinanced $315 Million of debt that was due this year. Of this $245 Million was raised in January via a 5-year secured loan with a reasonable interest rate of 5.875%. The remaining $70 Million was raised in February via an unsecured term loan with a floating interest rate (effective rate today of 6.4%). Combined the company has a weighted average interest rate of 5.1% and 93% of debt is fixed rate. They also have no further debt maturities until October, 2024. They also continue to have full availability on their $600 Million unsecured line of credit and $97 Million in cash on hand. This really should give them plenty of liquidity to survive the next few difficult years.

As you can see, from an operational stand point, the company remains pretty solid. They should be able to maintain occupancy around 90%, generate plenty of cash to cover the dividend, and have a solid balance sheet with no near-term maturities. As such I see no imminent threat to the dividend or the business. Long-term they should also do fairly well because of their life-sciences focus. Remember from my original article - Philly is the place to be for life sciences. All of this makes me want to double down on my position. But first let's look at the valuation.

We know that BDN is going to be cheap. But let's see just how cheap it has become. With a market cap of $700 Million and $2.1 Billion debt, enterprise value stands at $2.8 Billion. For that you get an NOI of $268 Million. That means an implied cap rate of 9.6%.

Put differently, with 13.5 Million sft of space, we're buying their offices at $207 per sft (ignoring the value of their 205 acres of land for development). Ask anyone in construction and they will tell you that there is absolutely no way to build comparable real estate for $200/sft anywhere in the US, much less in a major city. Replacement costs would be at least double and on top of that you have the land! So the real estate is absolutely trading below replacement costs, as one would expect from a stock trading at 3x FFO.

I don't want to sound too excited but from a fundamental standpoint, there really isn't much that this company is doing wrong and we are getting a huge bargain today. That's why I reiterate by "STRONG BUY" rating for BDN here at $4.0 per share and will double down on my position to bring the breakeven to around $5 dollars. That will bring the position to around 1% of my portfolio.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BDN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.