The Fed Is Set For A Massive Showdown With The Market

Summary

- The Fed has made its intentions clear – inflation is far too high and there will be no interest rate cuts in 2023.

- The bond market is screaming for an imminent recession and pricing in four Fed interest rate cuts by January.

- The equity market seems oblivious to both the Fed and the bond market, as well as the coming debt ceiling showdown in Congress.

- Each of these three groups is telling a distinctly different story about the economy over the next 1-2 years.

- Who do you trust here? Fed economists, the bond market, or stock speculators?

traveler1116

The equity market has been calm in recent weeks, but underneath the surface, the bond market is going haywire. Traders are placing increasingly bold bets on an imminent recession and a Fed pivot, squaring off against a Fed that has been battered by the highest inflation in 50 years. Specifically, the bond market is calling for four interest rate cuts by January, with more to follow. The Fed sees zero. Additionally, the bond market is surprisingly sanguine about inflation, only pricing 2.3% annual inflation over the next 10 years. Stocks, for their part, have been locked in a futile tug-of-war over the past nine months between bulls and bears.

What The Bond Market Says

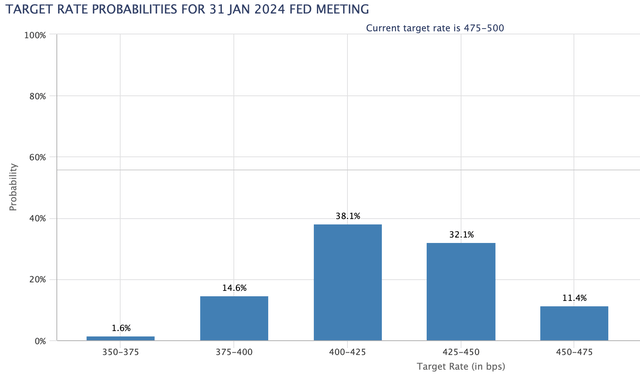

The CME FedWatch Tool is showing a market-implied Fed funds rate of 4.00% to 4.25% in January 2024, which would be four cuts from the expected range of 5.00% to 5.25% in early May. CME FedWatch is based on market prices for interest rate futures, so if you think these numbers are wrong then you can bet on them for many millions of dollars, and profit if you're right.

January 2024 Implied Fed Funds Rate (CME FedWatch)

I cropped the far right of the graph, but the market is only pricing a 2% chance that the Fed will keep rates where they indicated they would in their most recent dot plot. Put another way, the market thinks there's a 98% chance the Fed is bluffing and will soon pivot and start sharply cutting rates.

This screams recession. History shows that inflation does not go away on its own without a severe recession. On average, it has taken about 10 years for core inflation to return to 2% annually after going above 5%. Core inflation didn't even decrease last month, instead edging up from 5.5% to 5.6% year-over-year. The market is betting on inflation to decrease faster than it virtually ever has, and for that, you need unemployment to increase dramatically. Even with First Republic (FRC) now teetering on the brink of collapse, there would likely need to be many more bank failures to approach the level of economic pain that would fully suppress inflation. While it's possible policymakers will give "modern monetary theory" another go and accept permanent double-digit annual inflation in the United States, this would have severe consequences and would destroy much of the country's accumulated wealth over time.

What The Fed Says

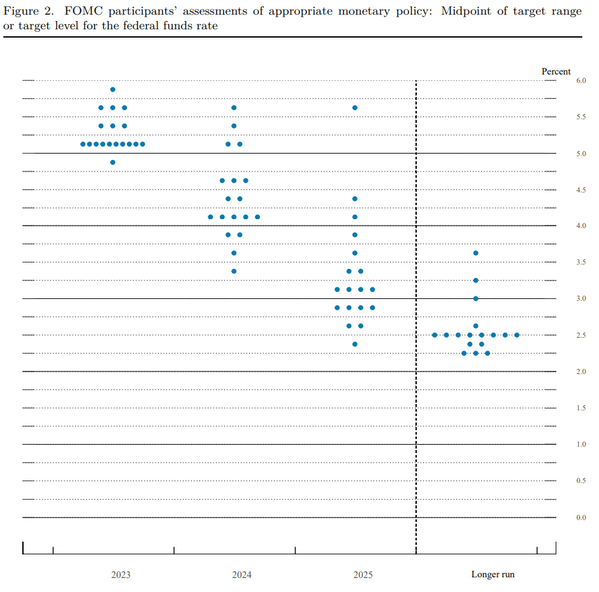

The Fed releases a "summary of economic projections" each quarter, which is colloquially known by traders as the "dot plot." Their most recent release was in March, and there are some interesting nuggets in it.

The first is that the Fed tacitly admits that they expect a recession. This actually isn't a new response to the banking stress that emerged in the system in March but was in the projections previously in December. Specifically, they expect unemployment to rise to a range of 4.3% to 4.9% in 2024.

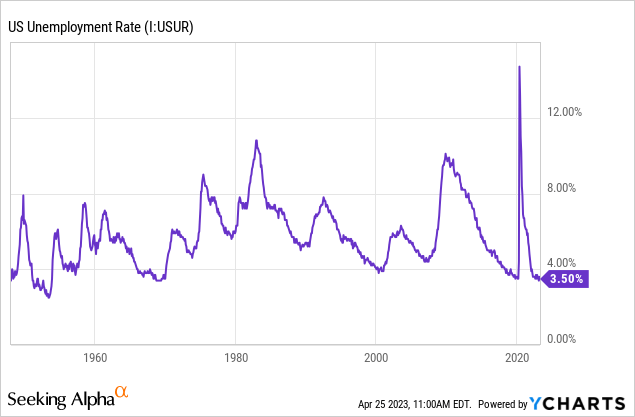

Just for fun, I'll pull up the unemployment rate in post-war America. Over the past 70 years, there hasn't been a single time that unemployment has risen 1% and then promptly stopped. The Fed has a political responsibility to sugarcoat things a little, which they are here. However, if they think unemployment is going to rise to 4.7% or whatever, that's their way of saying it's going to hit 6% to 8%. The business cycle is not dead, and Congress or the Fed cannot eliminate the effect of unproductive investments being made and then washed out of the economy.

The other thing that the Fed says here is that they're keeping rates at 5.25% until year-end 2023 and 4.25% at year-end 2024. In other words, the Fed will not be cutting at all through January, and then slowly intends to cut rates to keep a positive real interest rate. This is intended to put continual downward pressure on inflation and make sure it doesn't come surging back. Note that the dot plot is for year-end rates.

Fed Dot Plot (Federal Reserve)

The market, on the other hand, seems to anticipate that the Fed will try to monetize the debt by keeping nominal rates below inflation, or that inflation will go away on its own. However, cutting rates too much would likely lead to a second surge in inflation, or at least it has in emerging markets that have tried these kinds of dubious economic policies.

The Fed has continually surprised the market since the start of the rate hike cycle with how far they've been willing to hike rates. After all, the bond market barely anticipated the current Fed hikes, and then piled in betting on rate cuts in 2022 until Powell slapped their ambitions down at Jackson Hole.

What The Stock Market Says (And Might Be Missing)

The stock market seems blissfully unaware of the economic concerns raised by Fed economists and the bond market. Analysts expect earnings to be roughly flat this year for S&P 500 components. Stock speculators have piled into meme stocks, FAANG, and now some banks. "Easy come, easy go" has always been the stock market mantra, while money market yields are now pushing over 5%, risk free.

But higher interest rates have powerful direct and indirect impact on the stock market. The direct effect that speculators aren't watching out for is the steady refinancing of corporate debt that will occur over the next few years. Unless interest rates are promptly cut to zero, interest costs will be higher for companies. And in the off chance rates are cut back to zero, their interest costs will simply be the same as they were during the pandemic. There's no way companies are winning the margin battle in a sustained inflationary environment.

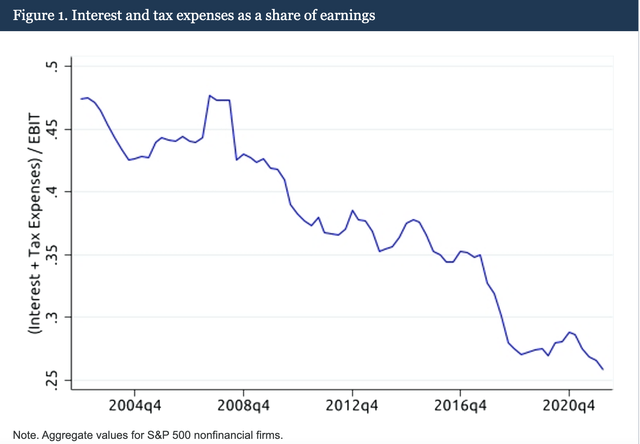

A Fed study has shown that corporate tax + interest costs ate up a little under 50% of EBIT in the early 2000s, but by 2021 this had fallen to a little above 25%. Of course, this made companies look super "profitable" and caused earnings multiples to rise. Companies aren't inherently more profitable now than before, however, and this will revert to the mean with the US government in deep debt trouble and inflation pushing up interest rates.

Corporate Taxes and Interest Share of EBIT (Federal Reserve)

The fact that Corporate America feasted off of 0% interest rates and tax cuts is a structural problem with the stock market, and it virtually guarantees that returns will be low over the next 5-10 years. Stocks simply can't get any more support than they were, and going forward they're going to get hit with tax increases and higher interest rates. This does not support paying 20x earnings for the S&P 500 (SPY)!

The Wildcard: The Debt Ceiling Battle

Something highly technical has been going on over the past few months, and it relates to the debt ceiling fight between the Biden administration and Republicans in Congress. I believe it largely explains the discrepancy between the Fed, the bond market, and the stock market. It also explains the wacky yield curve where one-month Treasuries are being panic bought to the exclusion of longer-dated bills.

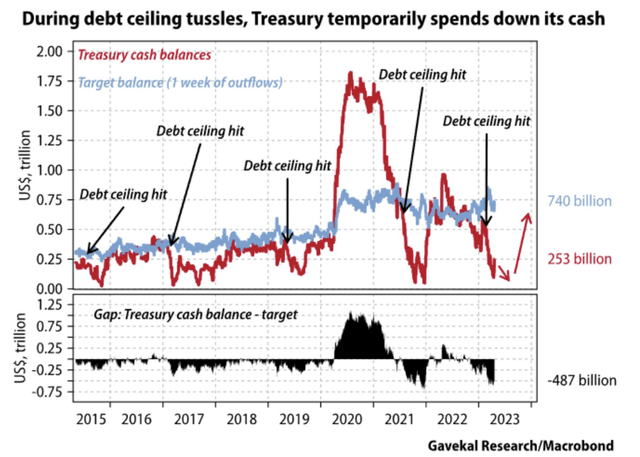

Specifically, the US Treasury has been blowing its cash pile to stay under the debt ceiling.

US Treasury Cash Balance (Gavekal Research/Macrobond via Bloomberg)

The US government finances much of its spending by selling bonds. But suppose for a second that instead of selling bonds, they simply spent all the cash they had for six months. This does a few things.

- First, it would push down interest rates. Removing hundreds of billions worth of supply of bonds from the market would mean that rates would be lower than they would be otherwise. This has happened.

- Second, this would support the stock market as it temporarily keeps the system flush with liquidity. This also has happened.

- Third, the fiscal hole would need to be corrected in the future, leading to a sustained tightening in interest rates and a contraction in asset prices when it's dealt with, like a giant Amex bill after the holidays. This may be some of what the bond market is seeing here.

Additional stuff I find interesting about this-

- In 2011, the debt ceiling crisis sent stocks down about 15% in a few months.

- Most of this decline came after the debt ceiling was raised, as traders were forced to grapple with $900 billion in spending cuts and a need for huge Treasury auctions. Republicans were surprisingly successful in 2011 at getting spending cuts from the Obama administration. My back-of-the-envelope analysis shows they were able to cut government outlays by a bit less than 1% of GDP.

- This time could be bigger, with student loan cancellation likely to be blocked as well as the spending cuts on the line. A fair way to think about this current debt ceiling is that the spending cuts would 2x as meaningful for the economy.

- Worst-case scenarios: Bookies are currently giving a 10%-15% chance that the US will technically default on its debt (for at least a short period of time), a 60% chance that the government will shut down for at least one day, and a roughly 40% chance that the shutdown will last more than a week. Missing paychecks for millions of government employees would be a surefire way to kick off a recession, and bookies aren't totally discounting the possibility.

Bottom Line

Markets are relatively calm now, but the stage is set for some huge political and economic showdowns in the next few months. Cash is paying 5%, while markets are anticipating a recession, government shutdown, or both. Meanwhile, stocks are trading near bubble levels, fueled by the US Treasury spending the last of its cash balance before the debt ceiling showdown. The Fed, for its part, has indicated that they'll keep rates higher for longer to get inflation under control. Who's bluffing and who has the cards? We'll soon find out.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.