Despite Q1 Slowdown, Taiwan Semiconductor's Tech Capabilities Secure Its Dominance

Summary

- Taiwan Semiconductor delivered mixed results with a revenue decrease of 4% and a net profit increase of 2.1%.

- Management has provided guidance of a further slowdown in revenues during the second quarter.

- Despite a difficult first half of the year, industry analysts believe there will be a rebound during the second half of the year as a result of inventory corrections.

- TSM expects its 3nm technology to be fully utilized with demand exceeding its ability to supply.

Sundry Photography

Business Description and Investment Thesis

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) is the world's largest and most pivotal player in the semiconductor industry, the company operates the world's largest silicon wafer factories and produces some of the most advanced microchips used in everything from smartphones to fighter jets. TSM supplies 90% of the most advanced chips all across the globe making it of paramount importance for the technological growth of major industries. Despite a weaker financial performance during the first quarter of 2023, it remains with robust fundamentals achieving industry-leading margins with operating income and net profit margins during the first quarter of 45.5% and 40.7%, respectively. Furthermore, TSM is well-positioned for continued growth alongside the industry. As such I continue with my rating for the company of a buy. Let's take a look at the quarterly financials.

1Q-23 Financial Results

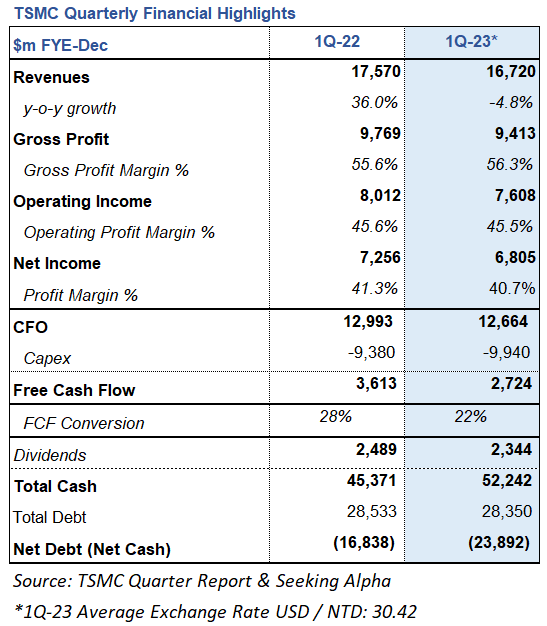

TSM Quarterly Financial Highlights (TSM Quarterly Report)

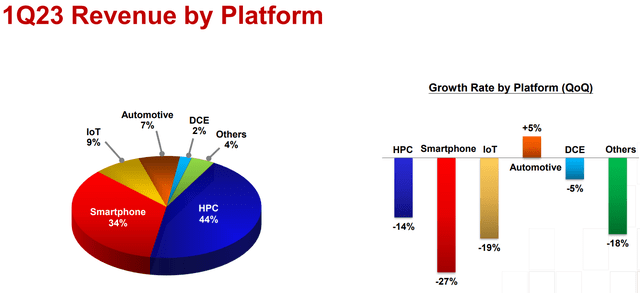

During the first quarter of FYE 2023, TSM saw a decrease in revenues of 4.8% to $16.7 billion. Revenues were impacted by weakening macroeconomic conditions and softening end-market demand. Platform decreases in revenue were seen in HPC, Smartphone, IoT, DCE, and Others which decreased by 14%, 27%, 19%, 5%, and 18% respectively. These decreases were slightly offset by a 5% increase in Automotive.

1Q-23 Revenue by Platform (TSM First Quarter Report)

Despite this slowdown, TSM continues to have unrivaled margins in the semiconductor industry with operating margin and net income margin standing at 45.5% and 40.7%. Total operating expenses accounted for 10.8% of revenue, which is lower than the 12% implied in the first quarter guidance. This improvement was achieved thanks to stringent expense control and lower employee profit sharing. Thanks to the lower operating expenses TSM was able to generate robust operating income and net income of $7.6 billion and $6.8 billion for the quarter.

TSM reported a strong cash flow from operations totaling $12.7 billion during the first quarter which management used to cover capital expenditures of $9.9 billion. As such the company reported a free cash flow for the quarter of $2.7 billion. Management used part of this cash to return value to its shareholders through dividends of $2.3 billion.

Key Takeaways

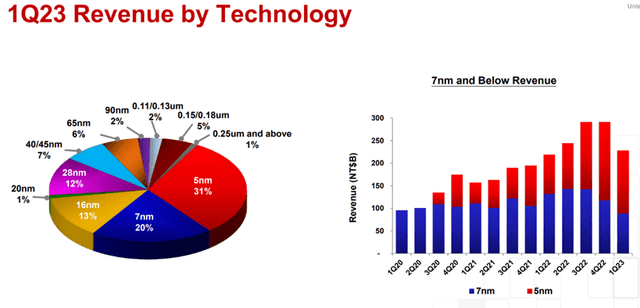

- TSM continues to derive most of its revenues from its most advanced technology consisting of 5nm with 31% of total revenues and 7nm with 20% of total revenues.

1Q23 Revenue by Technology (TSM First Quarter Report)

- TSM continues to invest in its wafer capacity with a major production push across all geographies. The company is tripling US investments to $40 billion, with its fourth fab in Arizona scheduled to begin production of 4nm processing technology in late 2024. In Japan, TSM is building a specialty technology fab with volume production scheduled for late 2024. In Europe, the company is evaluating the possibility of building a specialty fab focusing on automotive-specific technologies based on the demand from customers and the level of government support. In China, TSM is expanding its 28-nanometer in Nanjing as planned to support our customers in China. Finally, the company continues to invest domestically and expand its capacity to support customers' growth with investments in 4 cities across the country.

- TSM continues to develop strong technological advances. In 2023, TSM is the first company in the semiconductor industry capable to produce high-volume with good yield for 3-nanometer technology. Currently, the company's demand for 3nm exceeds its ability to supply, with management expectations that 3nn will be fully utilized in 2023 supported by both HPC and smartphone applications. TSM expects to generate significant revenue from its 3nn technology at the start of the third quarter contributing a mid-single-digit percentage of total wafer revenue in 2023. Finally, management mentioned during the investor call that TSM is on track of developing and being able to produce 2nm semiconductors by 2025. This technology will again be the most advanced semiconductor technology in the industry in density and energy efficiency. These technological advancements will help TSM stay ahead of its competition for the next years.

Guidance Provided

Management gave the following guidance for the second quarter during the investor call:

- Revenue is expected to be between US$15.2 billion and US$16.0 billion.

- The gross profit margin is expected to be between 52% and 54%.

- The operating profit margin is expected to be between 39.5% and 41.5%.

With this guidance provided we can already generate estimates for the company's operating profit for the period. With the lower end of operating profit being in the range of $6 billion and $6.3 billion. As such TSM would be able to generate an operating profit for the first half of the year of approx. $13.7 billion. This is a decline compared to the same period last year nonetheless these are not bad results amidst a slowdown in the industry. Let's not forget that analysts expect a rebound in the second half of the year.

Bottom Line

In conclusion, TSM is experiencing a slowdown in revenues however thanks to its strong operating expenses controls, management is holding up the company's profits to some extent. Further to this, TSM continues to be in a good position to maintain its leadership as the world's largest chip manufacturer. The company continues to invest in its manufacturing capabilities and will be the only company to offer 3nm technology to customers around the globe. Due to TSM being the only company to provide this technology, demand exceeds its ability to supply. This provides TSM with a favorable growth outlook. With the expectation that the industry will rebound during the second half of the year, we could see better numbers in the 3rd and 4th quarters. Taking these factors into consideration, I believe TSM remains a compelling long-term investment opportunity.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.