Five Below Has Run Its Course

Summary

- Five Below has proven itself to be an amazing business that has captured tremendous growth on its top and bottom lines.

- Long term, I fully expect this trend to continue as the company reaches its goal of 3,500 locations.

- The stock does look a bit too lofty to warrant much optimism at this point in time.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

jetcityimage

For the most part, I do not consider myself a fan of retail. This is especially outside of grocery retail. But every so often, I will find a special company that I believe offers attractive upside. One of the players that fits this description is extreme discount retailer Five Below (NASDAQ:FIVE). Fueled by low store startup costs, as well as robust demand for cheap goods, the company has done incredibly well for itself and its investors in recent years. So far, there has been no evidence that the firm's growth will slow materially before it reaches its goal of hitting at least 3,500 stores by 2030. That's up from the 1,340 that it ended its fourth quarter at. But of course, growth does not come cheap. Investors gravitate toward high quality companies that can continue to grow for the foreseeable future. And this results in the share prices of the firms in question trading at rather lofty levels. Although I wouldn't go so far as to say that the company is overvalued, I would make the case that the stock is more or less fairly valued and, as a result, should achieve upside that is more or less in line with the broader market for now. Because of this, I've decided to downgrade the company from a 'buy' to a 'hold'.

A hefty price tag

For some time now, I have been bullish about Five Below. In an article published in early September of last year, for instance, I rated the company a 'buy' because I was drawn to the rapid growth that the company was experiencing, even though the firm had posted a bit of weakness on both its top and bottom lines, and even though it was trading at rather lofty multiples. Since then, the stock has generated upside for investors of 55.5%. That's significantly higher than the 5% increase seen by the S&P 500 over the same window of time.

This move higher has not been without cause. Rather, it has been driven by strong demand for the company's offerings, combined with management's ability and willingness to invest heavily in expanding the company's physical footprint. Take financial results for the fourth quarter of the 2022 fiscal year. Revenue during this time came in at $1.12 billion. That represents an increase of 12.7% over the $996.3 million reported one year earlier. Some of this growth was driven by a 1.9% rise in comparable store sales. But the larger factor, by far, was an increase in the number of stores in operation from 1,190 to 1,340.

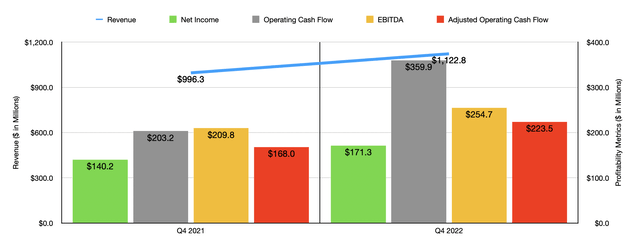

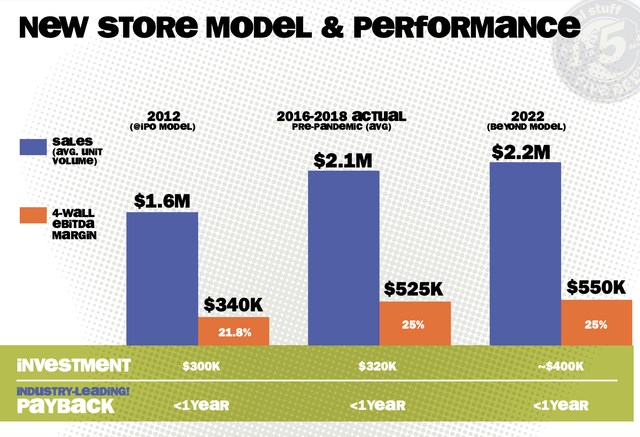

Management is able to grow the company's physical footprint so rapidly because of the low cost of producing a store. With the newest generation of store that the company launched in 2022, the average cost of construction for a location came out to $400,000. That same store, once launched and stabilized, would generate about $2.2 million in revenue and $550,000 in EBITDA per year. These same dynamics are also responsible for the surge in profits the company has experienced. During the final quarter of 2022, for instance, net profits totaled $171.3 million. That was up from the $140.2 million generated one year earlier. Operating cash flow nearly doubled from $203.2 million to $359.9 million, while the adjusted figure for this expanded from $168 million to $223.5 million. And finally, EBITDA for the enterprise grew from $209.8 million to $254.7 million.

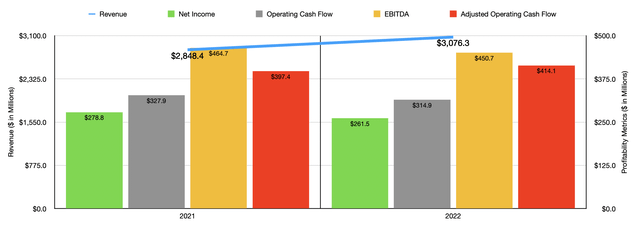

For the most part, the results experienced during the final quarter of 2022 were similar to what the company saw for 2022 as a whole. This much can be seen in the chart above. Although it is also true that the company experienced some weakness on its bottom line as a result of inflationary pressures and other causes. But as the fourth quarter data reveals, the picture on that front seems to be clearing up. As for the future, I already mentioned that the company wants to continue to expand its footprint at a rather rapid pace. For 2023, the goal is to add 200 new stores why are benefiting from comparable sales growth of between 1% and 4%. Achieving the midpoint for revenue guidance of between $3.49 billion and $3.59 billion would result in overall year over year revenue growth of 15.1%. It is worth noting that around $40 million of this revenue will come from the 53rd week that the company will enjoy this year.

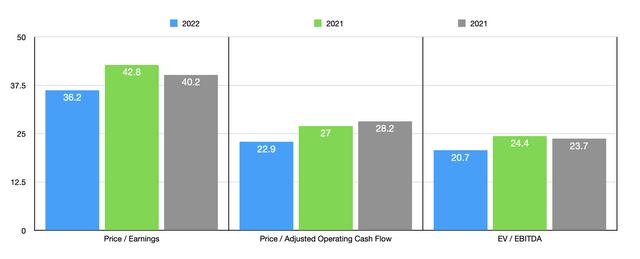

If this all comes to fruition, management believes that net income for the year will be between $295 million and $323 million. No guidance was given when it came to other profitability metrics. But if we assume that they will increase at the same rate that net profits should, we should anticipate adjusted operating cash flow of $489.3 million and EBITDA of $532.6 million. Based on these figures, shares of the company still do look to be trading at rather lofty multiples as the chart below illustrates.

As you can see here, on a forward basis, Five Below is trading at a price to earnings multiple of 36.2. The price to adjusted operating cash flow multiple should be 22.9, while the forward EV to EBITDA Multiple should be a bit lower at 20.7. If you compare these numbers to the results experienced in 2021 or 2022, you will notice a sizable improvement from a valuation perspective. But no matter how you stack it, shares of the company do look rather pricey on an absolute basis. To see how the company fares against other players, I decided to put up its trading multiple against the two major players in the extreme discount retail space. These companies are Dollar General (DG) and Dollar Tree (DLTR). As you can see in the table below, Five Below is more expensive than either of these companies using any of the three valuation metrics that I looked at.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Five Below | 42.8 | 27.0 | 24.4 |

| Dollar General | 20.4 | 24.9 | 13.4 |

| Dollar Tree | 20.9 | 21.0 | 12.0 |

Takeaway

At this moment in time, I am unhappy having to downgrade Five Below from a 'buy' to a 'hold'. The company has a winning recipe for growth and it has been able to use this recipe to generate strong upside, both from an operational perspective and a shareholder return perspective. But this doesn't mean that strength will last forever. I have no doubt in my mind that the stock will continue to climb in the long run. But given how lofty shares have become, I do think there might be better prospects on the market to be had at this time.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.