Planet 13 Offers Big Upside And Low Risk For Cannabis Investors

Summary

- I have followed Planet 13 Holdings closely for years, and I include it on my Focus List of 28 cannabis stocks.

- I just added it to my Beat the Global Cannabis Stock Index model portfolio.

- The stock doesn't look cheap using projected 2023 estimates, but it is one of the best American cannabis operator stocks.

- Looking for more investing ideas like this one? Get them exclusively at 420 Investor. Learn More »

Lemon_tm

The cannabis market is getting crushed, but Planet 13 Holdings (OTCQX:PLNHF) is up in 2023. It's down, though, since I wrote it up here in December. In that piece, I said that I didn't own it at the time in my model portfolios at 420 Investor but wanted to buy it potentially. I closed the 420 Investor service at Benzinga at year-end, and I am reopening it to the public on May 15th. At year-end, I launched a new model portfolio, and I included a position in Planet 13 at what has been, coincidentally, it's 52-week closing low price of $0.61. I ended up exiting it after it rallied sharply early in the year, but I added it back in March and wrote about it near the end of the month. It's at the lowest price since early January now.

I exited the name again earlier this month, but I added it back this past week. I really like it right here, right now! I explain why below.

The stock is up in a down market

The New Cannabis Ventures Global Cannabis Stock Index has set a new all-time low this year. While it has rallied slightly very recently, it is still down 16.6% year-to-date.

Planet 13 Holdings, which was at $1.15 when I wrote it up in early December, ended the year neat an all-time closing low and was down 53.8% during December. PLNHF stock ended the year at $0.61, so it's up more than 10% year-to-date.

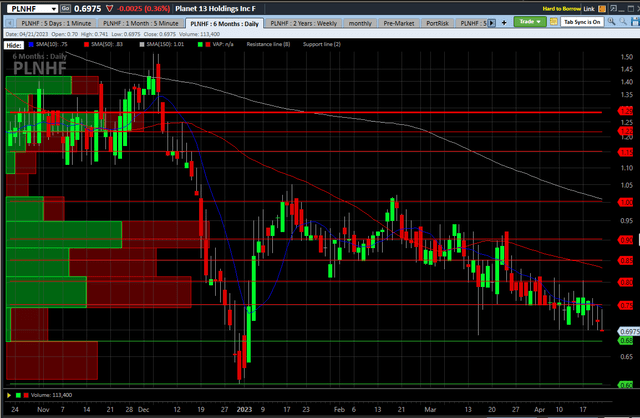

Charles Schwab StreetSmart edge

The stock is still very down

While Planet 13 Holdings is up in 2023, which may discourage some from buying it, it's down a lot from the past. At $.6975, it's down 39.4% since I wrote about it in December. Looking at it since the peak, the stock has collapsed over 90% since February 2021:

Charles Schwab StreetSmart edge

What makes Planet 13 different

Unlike all of the major multi-state operators, Planet 13 has very little debt (less than $1 million). In fact, it had cash as of year-end of $52.4 million. In the olden days, investors would pay up for this, but now they don't seem to do so as much.

I didn't really address management in that first piece in December, but this is one of the few publicly traded cannabis operators in North America that is run by real operators and not lawyers or financial folks. I don't think that the co-CEOs are necessarily the best business people out there, but they do have a big leg up on the alternatives in my view. Bob Groesbeck and Larry Scheffler are big owners here, but, more importantly, they run the company with a long-term vision and to build it.

The company started out focused solely on the Nevada market, where it has very strong share, but it has expanded into a real multi-state operator position. In California, bit started with a single dispensary and then added through M&A another company, Next Green Wave. The company hasn't yet generated any revenue in Florida, but it bought the Harvest license when that company merged with Trulieve (OTCQX:TCNNF), and it will soon open its medical dispensaries. If that state were to legalize for adult-use, PLNHF would do very well in that market in my view. Finally, it is developing a dispensary near the Wisconsin border in Waukegan, Illinois.

Review of 2022

Last year was a tough year in the cannabis market, with pricing pressure due to the illicit markets ramping up in some states and the maturation of legal producers too. Additionally, consumers, who had been very active during the early part of the pandemic, not only reduced their consumption but also paid more attention to price. The Nevada and California markets, where Planet 13 operated exclusively, were both challenged.

Revenue for the company shrank 12.5% to $104.6 million. Gross margin fell from 55.2% to 45.9%. Operating expenses expanded 31%, but removing a $32.8 million impairment loss, they fell 13.4%, in line with falling sales. The company reported an adjusted EBITDA of $3.5 million, down from $16.9 million in the prior year. One positive in my view as what the company generated $3.8 million from its operations, an improvement from the use of cash in 2021 of $380K.

Looking a bit deeper, as I shared a month ago, most of the business is in Nevada, which fell 25% in 2022. The California business accounted for just 17% of overall revenue.

Outlook

There are just two analysts following the company, and they had no 2024 estimates ahead of the Q4 report in March. Now one does.

For 2023, the analysts project revenue will increase 10% to $115 million as adjusted EBITDA advances to $9 million. This is lower than ahead of the report, at $15 million, or even right after the report, at $10 million. A single analyst forecasts that 2024 revenue will increase 32% to $151 million with adjusted EBITDA of $20 million.

I think that the company could do better in 2023 for revenue as Florida ramps up and as Nevada and California improve. I also think that the 2024 revenue estimate is probably about right. At the same time, this analyst's forecast for adjusted EBITDA seems a little too low. My own estimate is that the company can do a 15% margin on revenue of $150 million, which works out to $22.5 million. This would be slightly higher than the 2021 margin of 14.1%. I think that the operations in Florida will be very high margin and will help the company's overall margin. While 15% is higher for the company compared to its history, it's still very low for the industry.

Valuation

When I wrote up the company in December, I shared a year-end target of $1.85. This was based on achieving 12X enterprise value to adjusted EBITDA. I no longer think that the 12X ratio is realistic. Additionally, the projected adjusted EBITDA is lower than I had expected at that time. Ahead of the Q4 report in March, I had a target for year-end of $1.23, basing it upon achieving 8X my projected adjusted EBITDA in 2024 of $22.5 million. This remains my target and offers 76% upside.

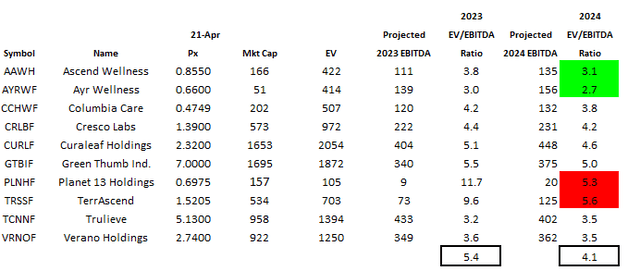

Compared to the top 9 MSOs by revenue, the stock doesn't look that great at its current price relatively:

Alan Brochstein, using Sentieo

I am not concerned with the relatively high valuation for many reasons. First, the average of 4.1X projected adjusted EBITDA is very low, so a small premium is not a problem. Second, the company is debt-free, and all of the rest of the companies have debt. Third, I think the adjusted EBITDA could be a little higher than what a single analyst projects for Planet 13. Finally, the company is much smaller than its peers and has ultimately more growth potential. Its adjusted EBITDA margin is the lowest.

Finally, Planet 13 trades at only 1.3X tangible book value. This is very low compared to the other MSOs, many of which have negative tangible book values. I really like some of the Canadian LPs, which have no debt and trade below tangible book value. This past week, I wrote about how Cronos Group (CRON) is dirt cheap, and I feel even better about Organigram, which is my largest position in my Beat the Global Cannabis Stock Index model portfolio.

Conclusion

I am very bearish on stocks in general now, with a large short position in my trading account and an effective short in my IRA through the use of leveraged inverse ETFs, and I think the weakness in stocks overall won't help the cannabis industry, which is really struggling. So, it's not easy for me to be bullish on a cannabis stock right now, especially one that trades above tangible book value and doesn't stand out from its peers on a valuation-basis.

I am writing positively on Planet 13 at this time because I think that it can rally as the year plays out. I don't have a reason to load up now, but I do like it a lot. I think that the few analysts that cover it are not optimistic enough about the revenue and earnings this year and next. I also really like the balance sheet, which is unique among American cannabis operator companies showing net cash.

I have shared a target that is much higher than the current price and think that Planet 13 could do even better. One risk is that AdvisorShares Pure US Cannabis ETF (MSOS), which owns 7.67 million shares, 1.7% of its portfolio, could sell the position if it continues to get redemptions. I have written about its extreme lack of diversification, and the ETF currently holds 86% in just six stocks. Planet 13 is the tenth largest position and one of the very few that is up in 2023.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

420 Investor launched in 2013, just ahead of Colorado legalizing for adult-use. We are moving to Seeking Alpha and will let our followers know when that occurs. Historically, we have provided great coverage of the sector with model portfolios, videos and written material to help investors learn about cannabis stocks.

This article was written by

Alan Brochstein, CFA, was one of the first investment professionals to focus exclusively on the cannabis industry. He has run 420 Investor, a subscription-based due diligence platform for investors interested in the publicly-traded cannabis stocks that he is moving to Seeking Alpha, since 2013, and he is also the managing partner of New Cannabis Ventures, a leading provider of relevant financial information in the cannabis industry since 2015. Alan is based in Houston. He and his wife have two adult children.

Before focusing exclusively on the cannabis industry in early 2014, Alan had worked in the securities industry since 1986, primarily with the responsibility for managing investments in institutional environments until he founded AB Analytical Services in 2007 in order to provide independent research and consulting to registered investment advisors. In addition to advising several different hedge funds and investment managers, including Friedberg Investment Management, where he participated as a member of its investment management committee, Alan was also a senior analyst for the independent research firm Management CV. In 2008, he began providing a first-of-its-kind subscription-based service for individual investors, Invest By Model, which offered two different portfolios that investors could replicate in their own accounts. Alan also offered The Analytical Trader at Marketfy, where he used fundamental and technical analysis in a disciplined process to offer specific trade ideas geared towards swing traders.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.