UGA: The Gasoline ETF For The Peak Driving Season

Summary

- Use of the U.S. Strategic Petroleum Reserve supports higher gasoline prices: The administration did not replace barrels before the latest rally.

- The war in Ukraine, China’s economy, and U.S. energy policy favor higher gasoline prices.

- NYMEX futures provide the best path toward gasoline investing and speculation.

- UGA is the ETF product that tracks NYMEX gasoline futures prices.

- Looking for more investing ideas like this one? Get them exclusively at Hecht Commodity Report. Learn More »

Ladanifer

Gasoline is a highly seasonal commodity that declines during winter and rises during spring and early summer. The weather during winter causes drivers to put fewer clicks on odometers, but they make up for it during spring and summer vacation periods as pleasure driving increases.

The United States remains the leading gasoline-consuming country. Even though the number of EVs on the road has increased, they account for around 1% of the total number of automobiles. While the Biden administration is committed to reducing fossil fuel production and consumption with support for alternative and renewable fuel sources, gasoline is the fuel that powers most cars.

In late April 2023, nearby NYMEX gasoline prices have been trending higher, and higher highs could be on the horizon. The United States Gasoline Fund, LP (NYSEARCA:UGA) tracks the gasoline futures price.

Gasoline found a bottom during the offseason

Gasoline futures reached a record $4.3260 per gallon wholesale all-time high in June 2022 after crude oil prices rose to over the $130 per barrel level in March 2022. Oil stopped short of the 2008 record peak, but gasoline and distillate product prices moved to new all-time highs. In 2008, gasoline prices only rose to $3.6310 per gallon, 69.5 cents below the June 2022 high.

Gasoline's ascent peaked in June 2022 during the heart of the U.S. driving season.

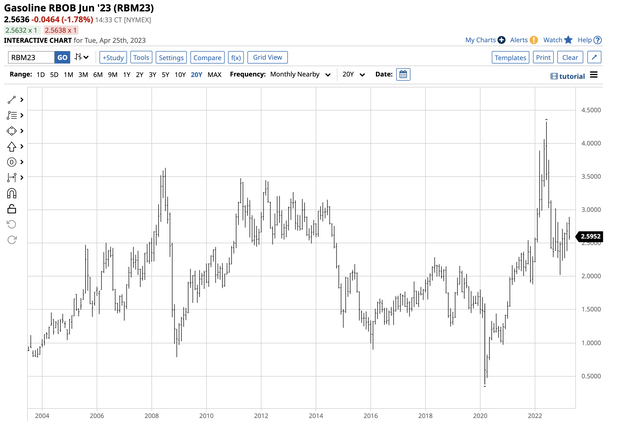

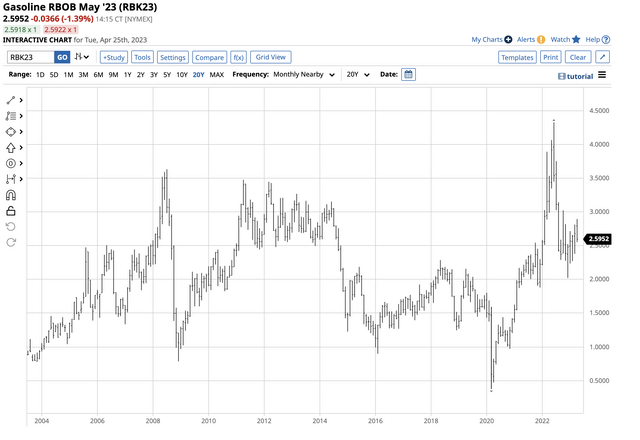

Twenty-Year Chart of NYMEX Gasoline Futures Prices (Barchart)

The twenty-year chart shows gasoline futures ran out of upside steam at the seasonally appropriate time and declined to a $2.0204 low in December 2022 during the height of the offseason.

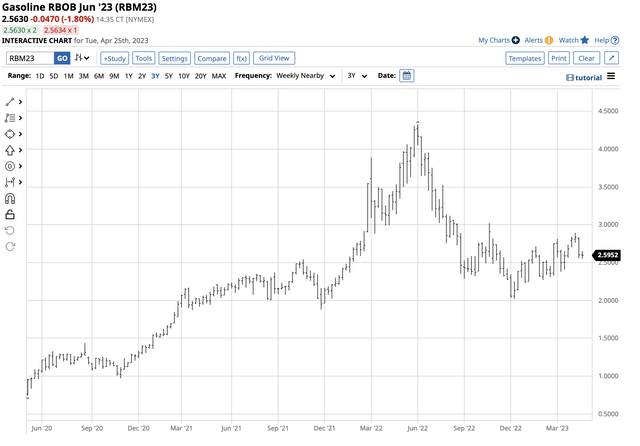

Three-Year Chart of NYMEX Gasoline Futures Prices (Barchart)

The three-year gasoline futures chart illustrated the pattern of higher lows and higher highs since the late 2022 low, with prices above the $2.60 per gallon wholesale level on April 25, 2023, as peak driving demand is on the horizon.

The U.S. SPR supports higher gasoline prices

One factor that weighed on crude oil and oil product prices in 2022 was the Biden administration's release of the energy commodity from the Strategic Petroleum Reserve. In an April 13, 2023, Seeking Alpha article, I highlighted the decline in the U.S. SPR.

The SPR peaked at 726.616 million barrels in December 2010 and steadily edged lower to 593.683 million at the end of 2021. In 2022, the SPR plunged as the administration released unprecedented petroleum from reserves. While the SPR stood at 369.6 million barrels for the week ending on April 7, it edged lower to 368 million the following week.

I had written that the administration stated it would repurchase crude oil at $67-$72 per barrel, and the price fell to a $64.12 per barrel low in March, which was a missed opportunity. However, comments on the piece suggested it was not incompetence but intentional, as not replacing the sold barrels supports the administration's green agenda.

Meanwhile, seasonality and other compelling factors favor a continuation of higher lows and higher highs in the gasoline futures market.

The factors favoring higher gasoline prices

For the short term, seasonality is bullish for gasoline prices as drivers prepare to put more clicks on odometers as the weather favors more time on the road.

The other bullish factors include:

- OPEC+ cut crude oil production on April 2, supporting oil and oil product prices.

- Chinese demand will likely increase as the world's second-leading economy emerges from COVID-19 protocols.

- While EVs on the road increase, gasoline continues to power most U.S. cars.

- U.S. energy policy will likely remain the same under the Biden administration, which inhibits fossil fuel production.

- The war in Ukraine continues to rage, and one of Russia's primary economic weapons against "unfriendly" countries supporting Ukraine is petroleum. Russia remains OPEC's most influential non-member, with production policy a function of negotiations between Riyadh, Saudi Arabia, and Moscow.

- The U.S. dollar index remains under pressure and in a short-term bearish trend since the September 2022 high. A weaker U.S. dollar favors higher commodity prices, and crude oil is no exception.

- Supply-side inflationary pressures favor higher crude oil prices.

While crude oil and oil product prices may not run away on the upside over the coming weeks and months, the short-term trends have stabilized, with seasonality favoring the upside. Fundamentals and technicals remain positive for gasoline entering the peak U.S. demand season.

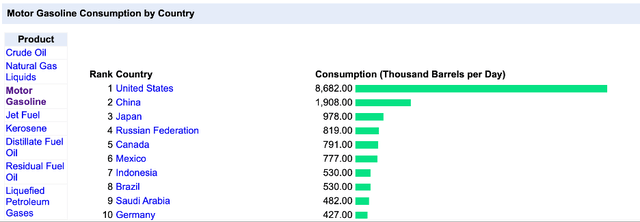

The Leading Gasoline Consuming Countries (indexmundi.com)

As the chart shows, the United States is, by far, the world's leading gasoline-consuming country.

NYMEX futures are the most direct route for a risk position

The most direct avenue for a risk position in gasoline is via the futures and futures options trading on the CME's NYMEX division.

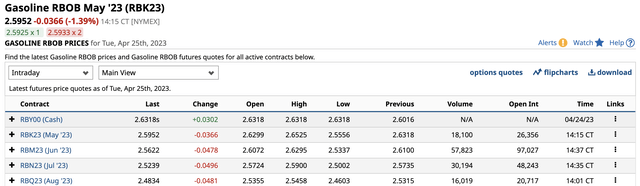

NYMEX Gasoline Futures Forward Curve During the 2023 Peak Driving Season (Barchart)

The gasoline forward curve highlights a small backwardation, with nearby prices at a premium to deferred prices over the driving season. Backwardation is a sign of supply concerns. Moreover, prices remain mostly above the $2.50 per gallon level throughout the 2023 driving season.

Twenty-Year Chart of NYMEX Gasoline Futures (Barchart)

The twenty-year chart shows that nearby gasoline prices at over $2.50 per gallon are at the highest pre-2022 level in April since 2014.

The futures offer a direct route for market participants looking to add gasoline exposure to portfolios. On April 24, the gasoline futures market had around 297,000 contracts of open interest, with an average of over 150,000 contracts changing hands each day. Gasoline is a highly liquid futures market.

UGA is the ETF product

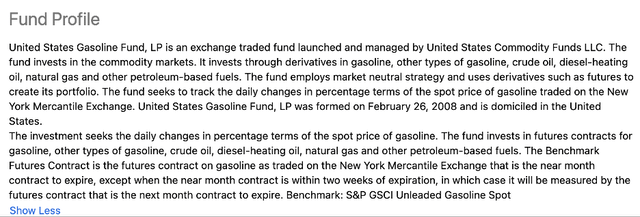

The United States Gasoline Fund LP (UGA) is the ETF product that tracks NYMEX gasoline futures prices. UGS's fund summary states:

Fund Profile for the UGA ETF Product (Seeking Alpha)

At $59.26 per share on April 25, UGA had over $74.35 million in assets under management. UGA trades an average of 21,691 shares daily and charges a 0.96% management fee.

Nearby NYMEX gasoline futures rose from $2.0204 in December 2022 to $2.5908 on April 25, a 28.2% increase.

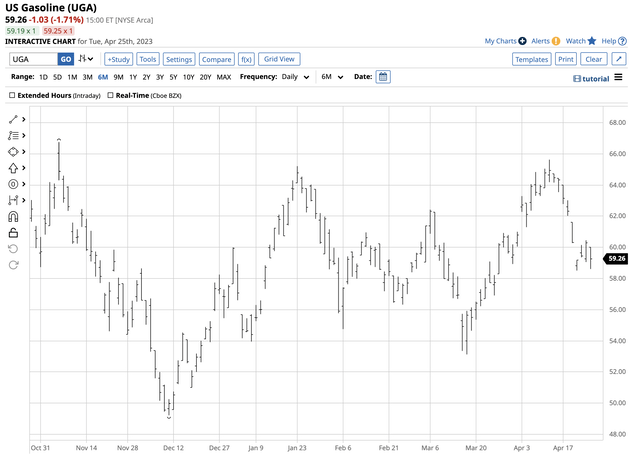

Chart of the Price Action in the UGA ETF Since the December 2022 Low (Barchart)

Over the same period, UGA moved from $49.22 to $59.26 per share or 20.4%. While the ETF underperformed the nearby gasoline futures, it did move significantly higher, following gasoline prices. UGA is an ETF that investors can access through standard stock market accounts.

As oil and gasoline prices have recovered over the past weeks and months, UGA could continue to move higher, reflecting increasing demand during the peak 2023 driving season as drivers could be paying more at the pump as the odometer clicks rise during spring and the peak summer months.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from a top-ranked author in commodities, forex, and precious metals. My weekly report covers the market movements of over 29 different commodities and provides bullish, bearish, and neutral calls; directional trading recommendations, and actionable ideas for traders. I am offering a free trial and discount to new subscribers for a limited time.

This article was written by

Andy spent nearly 35 years on Wall Street, including two decades on the trading desk of Phillip Brothers, which became Salomon Brothers and ultimately part of Citigroup.

Over the past two decades, he has researched, structured and executed some of the largest trades ever made, involving massive quantities of precious metals and bulk commodities.Andy understands the market in a way many traders can’t imagine. He’s booked vessels, armored cars, and trains to transport and store a broad range of commodities. And he’s worked directly with The United Nations and the legendary trading group Phibro.

Today, Andy remains in close contact with sources around the world and his network of traders.

“I have a vast Rolodex of information in my head… so many bull and bear markets. When something happens, I don’t have to think. I just react. History does tend to repeat itself over and over.”

His friends and mentors include highly regarded energy and precious metals traders, supply line specialists and international shipping companies that give him vast insight into the market.

Andy’s writing and analysis are on many market-based websites including CQG. Andy lectures at colleges and Universities. He also contributes to Traders Magazine. He consults for companies involved in producing and consuming commodities. Andy’s first book How to Make Money with Commodities, published by McGraw-Hill was released in 2013 and has received excellent reviews. Andy held a Series 3 and Series 30 license from the National Futures Association and a collaborator and strategist with hedge funds. Andy is the commodity expert for the website about.com and blogs on his own site dynamiccommodities.com. He is a frequent contributor on Stock News- https://stocknews.com/authors/?author=andrew-hecht

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.