The boost to Tata Consumer Products' revenue will come from India foods business, which is expected to grow 30 percent YoY

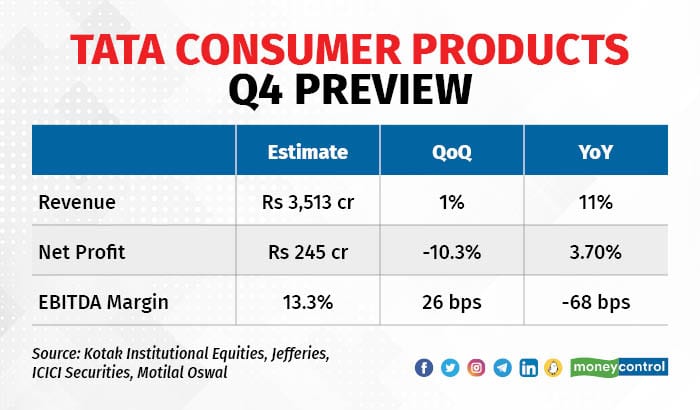

Tata Consumer Products, set to report its numbers on April 25, will likely see its topline grow by 11 percent year-on-year, according to experts. An average of estimates of brokerages polled by Moneycontrol suggests revenue will rise to Rs 3,513 crore.

Net profit is expected to rise a modest 3.7 percent YoY to Rs 245 crore.

The boost to revenue will come from its India foods business, which is expected to grow 30 percent YoY led by price hike in the salt portfolio. Kotak Institutional Equities has pegged 5 percent volume growth in the foods business.

The tea portfolio is also expected to perform better than previous quarters. “1 percent on-year growth seen in domestic tea sales versus 9 percent decline in Q3, with 3 percent growth in volumes versus 5 percent decline in Q3,” as per analysts at KIE.

For NourishCo, the brokerage expects Rs 150 crore in revenue for the quarter, implying FY23 revenue of Rs 600 crore.

Meanwhile, the company’s international business continues to languish. Analysts expect the international beverages segment to be muted due to the inflationary environment. International tea revenue could decline 2.3 percent year-on-year, which is an improvement compared to last quarter's 5 percent fall.

ICICI Direct estimates 123 basis point gross margin contraction due to high tea procurement prices in international markets. Jefferies expects international business margins to improve sequentially but remain low YoY.

The company was in focus last quarter for ceasing talks of Bisleri acquisition. Moneycontrol had earlier reported that Bisleri would have failed to boost Tata Consumer’s profitability due to high local competition, counterfeits and low pricing power.

Thus, with the announcement of Q4 earnings, the Street will be eyeing any updates on the acquisitions front and new product launches. Management commentary on volumes and tea prices will be key monitorables.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.