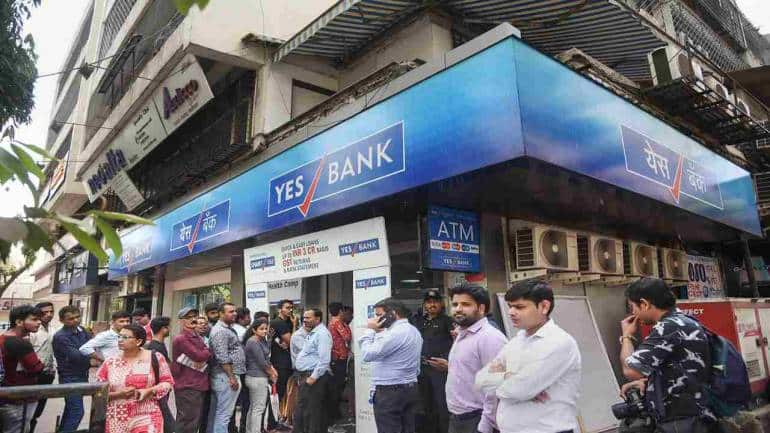

Yes Bank | CMP: Rs 15.70 | Shares ended over 3 percent lower as the company on Saturday reported a near 45% drop in net profit year-on-year for the January-March quarter as provisions for bad loans increased. Net profit fell to RS 202 crores ($24.63 million) for the reporting quarter from Rs 367 crores in the same period a year earlier. Analysts had expected profit to drop to Rs 288 crores, according to Refinitiv data.

PRO Only Highlights

- Quarterly performance largely backed by improved realisations

- Medium-term triggers China plus and protectionist measures for tyre industry

- Valuations not inexpensive; but improved medium-term outlook

- Quarterly performance largely backed by improved realisations

- Medium-term triggers China plus and protectionist measures for tyre industry

- Valuations not inexpensive; but improved medium-term outlook

Highlights Uninspiring numbers weighed down by provision Incremental credit cost to decline, thanks to recovery New NPA formation an area to watch out for Growth picking up but liability warrants focus Core earnings improvement key – NIM expansion and cost reduction critical ROA expansion unimpressive in the context of valuation Yes Bank (CMP: Rs 16.20, Market Cap: Rs 46,582 crore) has reported yet another uninspiring quarter. While core performance showed marginal improvement with a sequential uptick both in loan growth and interest margin, the reported PPOP...