The market closed its rangebound session on a flat note on April 21, with the Nifty50 firmly holding its 17,600 mark that coincided with 200-day moving average, while stock-specific action continued amid the ongoing earnings season.

The BSE Sensex was up 23 points at at 59,655, while the Nifty50 fell 0.40 points to 17,624, continuing consolidation for a third consecutive session and forming small bodied bearish candlestick pattern on the daily charts with upper and lower shadows.

"Technically, this market action signals a formation of high wave type candle pattern. But, having moved with in rangebound action over the last few sessions, the predictive value of this high wave pattern could be less," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

Nifty is sustaining above the support of previous upside broken trend line at 17600 levels in the last few sessions, but was not able to show any sustainable upside bounce from the said support. This is not a good sign and this indicates possible downside breakout of the support, he feels.

Hence, "the short term trend of Nifty remains weak and there is a possibility of some more weakness in the coming week. A decisive break below 17,600-17,550 levels could open sharp decline for the market. Immediate resistance is at 17,700 levels," the market expert said.

However, the broader markets underperformed frontliners as the Nifty Midcap 100 and Smallcap 100 indices fell 0.4 percent and 0.3 percent, respectively, on weak breadth. About three shares declined for every two advancing shares on the NSE.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

Pivot charts indicate that the Nifty may get support at 17,572, followed by 17,546 and 17,504. If the index advances, 17,655 is the initial key resistance level to watch out for, followed by 17,681 and 17,723.

The Bank Nifty lost all its previous day's gains and closed with 151.5 points losses at 42,118. The index has formed bearish candlestick pattern with upper and lower shadows on the daily scale.

Overall, the index witnessed a volatile trading session and closed around the critical support zone of 42,000. The index is consolidating in a broad range between 42,000-42,500 and a break on either side will have trending moves, said Kunal Shah, Senior Technical & Derivatives Analyst at LKP Securities.

He feels if the index fails to hold the support of 42,000 on a closing basis, it will witness further downside toward the 41,500 level.

As per the pivot point calculator, the Bank Nifty may take support at 41,994, followed by 41,895 and 41,734. Key resistance levels are expected to be 42,314, along with 42,414 and 42,574.

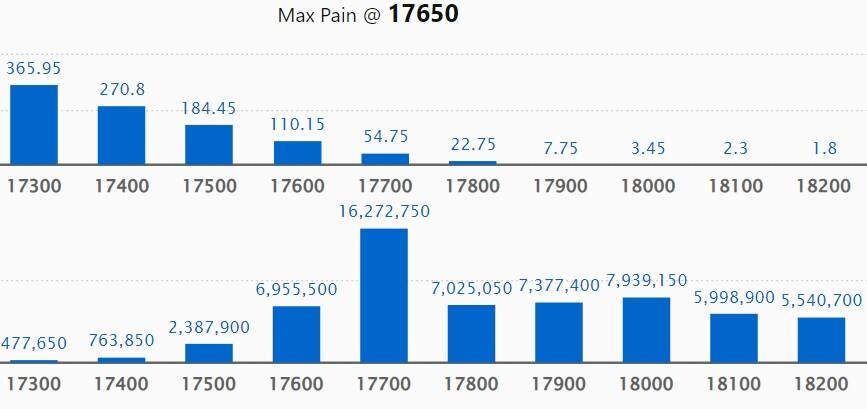

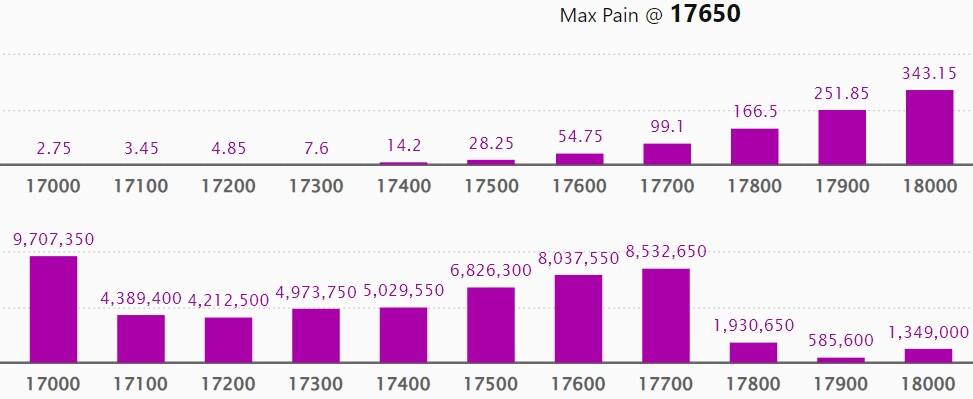

On the monthly options front, the maximum Call open interest (OI) was at 17,700 strike, with 1.62 crore contracts, which is expected to be a crucial level for the Nifty in the coming sessions.

This was followed by 18,000 strike, comprising 1.25 crore contracts, and 18,000 strike, with more than 79.38 lakh contracts.

Call writing was seen at 17,700 strike, which added 60.27 lakh contracts, followed by 17,900 strike, which accumulated 29.58 lakh contracts, and 18,100 strike which added 22.06 lakh contracts.

Call unwinding was at 16,500 strike, which shed 2,650 contracts, followed by 16,300 strike which shed 1,750 contracts, and 16,700 strike, which shed 1,700 contracts.

The maximum Put open interest was at 17,000 strike with 97.07 lakh contracts, which is expected to act as a crucial level in the coming sessions.

This was followed by the 17,700 strike, comprising 85.32 lakh contracts, and the 17,600 strike where there were 80.37 lakh contracts.

Put writing was seen at 17,600 strike, which added 24.57 lakh contracts, followed by 17,000 strike, which added 23.51 lakh contracts, and 17,300 strike, which added 16.49 lakh contracts.

We have seen Put unwinding at 16,900 strike, which shed 4.73 lakh contracts, followed by 17,800 strike, which shed 1.67 lakh contracts, and 16,700 strike, which shed 1.06 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. The highest delivery was seen in Bharti Airtel, Cipla, Hindustan Unilever, Atul, and Infosys, among others.

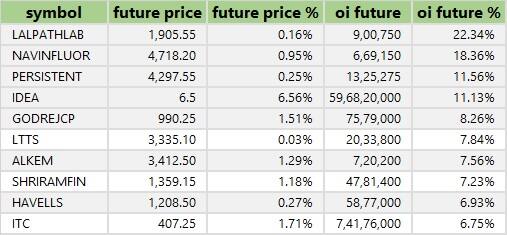

An increase in open interest (OI) and price typically indicates a build-up of long positions. Based on the OI percentage, 54 stocks, including Dr Lal PathLabs, Navin Fluorine International, Persistent Systems, Vodafone Idea, and Godrej Consumer Products, saw long build-ups.

A decline in OI and price generally indicates a long unwinding. Based on the OI percentage, 39 stocks, including NMDC, Bosch, Syngene International, Honeywell Automation, and ACC, saw a long unwinding.

71 stocks see a short build-up

An increase in OI along with a price decrease indicates a build-up of short positions. Based on the OI percentage, 71 stocks, including PVR, Max Financial Services, Tech Mahindra, RBL Bank, and City Union Bank, saw a short buildup.

A decrease in OI along with a price increase is an indication of short-covering. Based on the OI percentage, 27 stocks were on the short-covering list. These included Coromandel International, HCL Technologies, Bata India, Tata Consultancy Services, and Tata Chemicals.

(For more bulk deals, click here)

IndusInd Bank, Century Textiles & Industries, Bank of Maharashtra, Persistent Systems, Mahindra Logistics, IIFL Securities, NELCO, Tamilnad Mercantile Bank, Trident Texofab, and Tata Teleservices (Maharashtra) will be in focus ahead of quarterly earnings on April 24.

Stocks in the news

Reliance Industries: The country's largest company by market capitalisation recorded 19.1 percent year-on-year growth in consolidated profit at Rs 19,299 crore for Q4FY23, with EBITDA growing 21.8 percent on-year to Rs 41,389 crore. Gross revenue rose 2.8 percent YoY to Rs 2.39 lakh crore with continuing growth momentum in consumer businesses.

ICICI Bank: The country's second-largest private sector lender clocked a massive 30 percent on-year growth in standalone profit at Rs 9,122 crore for January-March quarter FY23, despite 51.5 percent increase in provisions & contingencies, driven by net interest income and operating profit. Net interest income for the quarter at Rs 17,667 crore surged by 40.2 percent year-on-year, with net interest margin expansion of 90 bps YoY and 25 bps QoQ at 4.90 percent.

Yes Bank: The private sector lender said its standalone profit in January-March 2023 fell 45 percent YoY to Rs 202 crore, dented by 128 percent increase in provisions and contingencies. However, net interest income grew 15.7 percent to Rs 2,105 crore with net interest margin expansion of 30 bps at 2.8 percent for the quarter.

Tejas Networks: The telecom and networking products maker narrowed its consolidated loss for the March FY23 quarter to Rs 11.5 crore, from a loss of Rs 49.6 crore in same period last year as consolidated revenue surged 13.6 percent YoY to Rs 299.3 crore and EBITDA loss dropped to Rs 8.19 crore from Rs 88.11 crore in the same period.

HDFC Asset Management Company: HDFC AMC received final approval from SEBI for change in control of the company due to change in co-sponsor of HDFC Mutual Fund from HDFC to HDFC Bank, after the merger of HDFC and HDFC Bank. The respective approvals from SEBI in terms of the AIF regulations and the PMS regulations are awaited.

Gujarat Industries Power: The company's board approved the procurement of imported coal for 500 MW Surat Lignite Power Plant (SLPP). The approval has also given for deliberation of EPC contract for pooling sub-station -2 (PSS-2) of solar / wind / hybrid RE Park of 2375 MW capacity at Khavda, Great Rann of Kutch, Gujarat.

Kotak Mahindra Bank: Shareholders approved the appointment of Uday Kotak as a Non-executive, Non-independent Director of the private sector lender. Ninety nine percent of shareholders voted in favour of resolution to appoint Kotak as a Non-Executive Director. Uday Kotak’s current term as MD & CEO of Kotak Mahindra Bank is set to end in December 2023.

Fund Flow

Foreign institutional investors (FII) sold shares worth Rs 2,116.76 crore, whereas domestic institutional investors (DII) bought shares worth Rs 1,632.66 crore on April 21, National Stock Exchange's provisional data showed.

Stocks under F&O ban on NSE

The National Stock Exchange has not added any stock to its F&O ban list for April 24. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.