Markets

The market almost reversed some of the previous week's gains and snapped a three-week winning streak following lower-than-expected corporate earnings with a cautious outlook by IT biggies, and fear of corporate earnings downgrade.

The rising possibility of a 25 bps hike by the Federal Reserve in the next policy meeting & fear of recession in the US, and RBI's persistent concern over inflation also made the market participants nervous.

For the week ended April 21, the BSE Sensex shed 1.28 percent or 776 points to 59,655, and the Nifty50 plummeted 1.14 percent or 204 points to 17,624, whereas the Nifty Midcap 100 and Smallcap 100 indices outperformed the benchmarks, rising seven-tenth of a percent and a third of a percent respectively.

Technology stocks led the major fall during the week, followed by the selling pressure in select infra and metal stocks, whereas the buying in FMCG, oil & gas, pharma and select banks stocks limited losses.

In the coming week, the market on Monday will first react to Reliance Industries and ICICI Bank quarterly numbers announced over the weekend, while overall, the tug-of-war between bulls and bears is expected to continue given the expiry of monthly futures & options contracts, experts said.

The stock-specific action will be continued due to the ongoing corporate earnings season. The participants will also closely track the global economic data points, especially US, ahead of the FOMC meeting next month, experts said.

"The focus would remain on earnings for cues in the coming week, in absence of any major event. Besides, the scheduled monthly

expiry of the April month derivatives contract will keep the participants busy," Ajit Mishra of Religare Broking said.

Also, Arvinder Singh Nanda, Senior Vice President at Master Capital Services said India's fiscal deficit, and US & Eurozone GDP Q1 estimates are the key events that will drive the markets next week.

Here are 10 key factors that will keep traders busy next week:

We will see a pick up in the corporate earnings season next week with nearly 200 companies announcing numbers including prominent names like IndusInd Bank, Bajaj Auto, HDFC Asset Management Company, Nestle India, Tata Consumer Products, Bajaj Finance, Maruti Suzuki India, Axis Bank, Bajaj Finserv, Hindustan Unilever, Tech Mahindra, Wipro, UltraTech Cement, and Kotak Mahindra Bank.

Among others, ACC, Persistent Systems, Tata Teleservices (Maharashtra), AU Small Finance Bank, Mahindra CIE Automotive, Mahindra Lifespace Developers, HDFC Life Insurance Company, Indus Towers, KPIT Technologies, L&T Technology Services, Poonawalla Fincorp, SBI Life Insurance Company, Syngene International, Voltas, Aditya Birla Sun Life AMC, Coforge, Indian Hotels, LTIMindtree, CSB Bank, L&T Finance Holdings, M&M Financial Services, SBI Cards and Payment Services, IDBI Bank, IDFC First Bank, and RBL Bank will also release their quarterly earnings scorecard next week.

The management commentary about future growth will be a key thing to watch.

2) Domestic Economic Data Points

On the domestic front, apart from earnings, we will have fiscal deficit numbers for March as well as the financial year 2022-23 next week on April 28. In the April-February FY23, the fiscal deficit came in at Rs 14.54 lakh crore (accounted for 82.8 percent of the government's target for FY23 against 82.7 percent in the previous year), widening from Rs 13.17 lakh crore in the same period previous fiscal. The government estimated FY23 fiscal deficit at 6.4 percent of the GDP.

The infrastructure output for March, and foreign exchange reserves for the week ended April 21 will also be released on the same day.

3) Global Economic Data Points

Investors globally will look at US GDP growth rate estimates for the first quarter of the current calendar year. Experts largely expect the US growth rate for the January-March period to drop, from the 2.6 percent growth recorded in October-December of 2022 as the consistent rate hikes in the last year by the Federal Reserve may be impacting the growth.

The US 10-year treasury bond yield climbed to 3.58 percent from 3.40 percent in the last couple of weeks amid prospects of further rate hikes by the Fed along the global inflation concerns, while the US dollar index hovered in the range of 101-102 levels last week.

Apart from that, participants will also keep an eye on Europe Q1CY23 GDP growth estimates, US jobs data and the Bank of Japan's interest rate decision (which is likely to keep rates unchanged).

Here are key global economic data points to watch out for next week:

4) Oil Prices

The movement in crude oil prices will also be important to watch as we saw the first weekly decline since the banking crisis in mid-March. International benchmark Brent crude futures fell over 5 percent in the passing week to close at $81.66 a barrel, after a more than 18 percent rally in the previous four consecutive weeks. The demand outlook fears especially after recent US economic data and Federal Reserve Beige Book survey weighed on the sentiment though we have encouraging Chinese GDP figures.

"Apart from disappointing US data releases, Federal Reserve Beige Book survey too stated the US economy stalled in recent weeks, with hiring and inflation slowing and access to credit narrowing," Ravindra Rao, Head of Commodities at Kotak Securities said.

He further said as of now, economically sensitive commodities are struggling for direction as participants assess the latest inflation data and await more data before the major central bank meetings in the first two weeks of May.

On the fundamental front, he feels oil prices may remain soft on easing supply concerns as Iraq is likely to restart the export of crude oil from the Kurdistan region by the end of this week.

5) FII Flow

After nearly three weeks of consistent inflow, the foreign institutional investors turned net sellers last week. In fact, the outflow also caused selling pressure in Indian equity markets as they seem to be worried due to rising recession fears in the US and possible earnings downgrade and may be looking cautious ahead of the FOMC meeting in May.

FIIs have net sold more than Rs 4,600 crore worth of shares during the week, resulting in a reduction in net inflow for FY23 to a little over Rs 300 crore. Hence, further outflow may bring more downside in the market, experts said.

On the other hand, domestic institutional investors tried hard to compensate for the FII outflow last week, by buying over Rs 3,000 crore worth of shares. Net for the current financial year, they also bought over Rs 300 crore shares.

6) IPO

The primary market will be back in action next week with Mankind Pharma hitting Dalal Street with its more than Rs 4,300 crore public issue.

The offer will open for subscription on April 25 and the closing date would be April 27, while the anchor book will be done on April 24, a day before the issue opening.

The company has fixed its IPO price band at Rs 1,026-1,080 per share. The IPO comprises only an offer for sale and there is a fresh issue portion, so the response by investors to the issue will be closely watched considering the valuations which most experts feel are a bit expensive compared to listed peers.

7) Technical View

The Nifty50 has seen the formation of a Bearish Engulfing pattern on the weekly scale, which is a negative sign, though it has consistently held on to 17,600 mark on a closing basis in the last three sessions. This level also coincides with 200-day simple moving average (17,605 on daily charts), while overall, the index has consistently taken support at a downward sloping resistance trendline adjoining record highs of December and swing high of February, which is between 17,500-17,600.

Hence, the aforementioned levels are going to act as support next week, followed by 17,400-17,200 which will be a crucial support area for the Nifty50, whereas 17,700-17,750 will remain the critical resistance zone for the index in the coming days, experts said.

"It is a healthy correction so far and Nifty should hold the 17,400-17,500 zone to the stage next leg of recovery else consolidation would set in again," Ajit Mishra of Religare Broking said.

On the higher side, he feels the 17,850-18,100+ zone would act as a strong hurdle.

8) F&O Cues

The Option data indicated that the Nifty50 may see a trading range of 17,400-17,800 levels in the coming days and decisively breaking of the said range on either side can give direction to the market in short term, experts said.

On the Call side, we have seen maximum Call open interest at 17,700 strike, followed by 18,500 strike, with writing at 17,700 strike then 17,900 strike, whereas the maximum Put open interest was at 17,000 strike, followed by 17,700-17,600 strikes, with Put writing at 17,600 strike, then 17,000 strike.

"Total cumulative Call open interest was recorded at 12.35 crore, while Put open interest stands at 10.12 crore. After combining both derivative and technical pictures in one frame, it doesn’t portray a rosy picture for the market in the short term," Arvinder Singh Nanda said.

9) India VIX

India VIX, which measures the expected volatility in the market, fell 2.33 percent for the week to 11.63 levels, the lowest level since December 2019 on the weekly basis.

Overall, the volatility remained at lower levels and below the 12 mark for the third consecutive week. Also, it remained below the long upward-sloping support trendline adjoining multiple touchpoints from the lows of September 2021, for the third week in a row.

Having a low VIX generally indicates a sign of market stability and investor confidence.

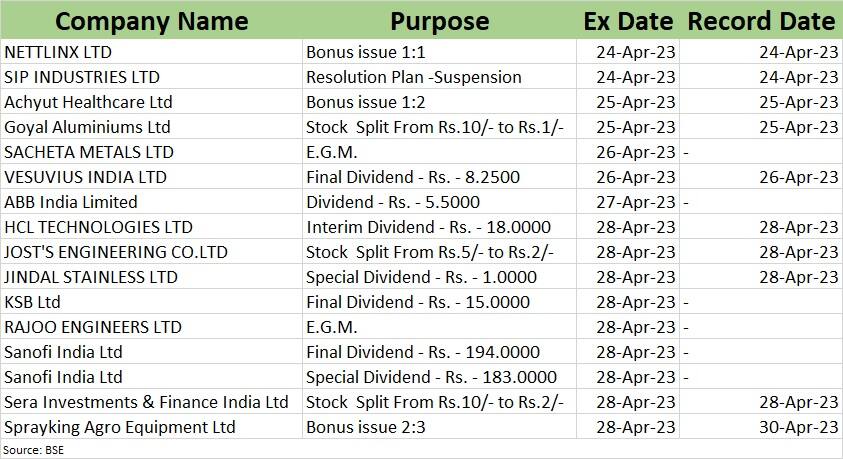

10) Corporate Action

Here are key corporate actions taking place in the coming week:

ABB India, HCL Technologies, Jindal Stainless, KSB, Sanofi India, and Vesuvius India will turn ex-dividend next week.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.