The market snapped a three-day fall and closed the weekly F&O expiry session with moderate gains on April 20. Select banking & financial services, and auto stocks supported the market, however, the gains were limited due to selling pressure in pharma, select FMCG and technology stocks.

The BSE Sensex rose 65 points to 59,632, while the Nifty50 continued to hold the 17,600 mark, climbing 6 points to 17,625 and forming a Doji kind of pattern on the daily charts, indicating indecisiveness among buyers and sellers about the future trend.

“Nifty remained sideways during the day as the headline index failed to witness any kind of directional move. On the lower end, 17,580 is placed as a crucial support; any decisive fall below 17,580 may take the index towards 17,500-17,400,” Rupak De, Senior Technical Analyst at LKP Securities said.

On the higher end, he feels 17,700 continues to remain a strong resistance, a decisive move above 17,700 may reinstate the bullishness in the market.

However, the broader markets closed flat with a positive bias and the breadth was slightly tilted in favour of bulls.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot charts indicate that the Nifty may get support at 17,593, followed by 17,569 and 17,531. If the index advances, 17,669 is the initial key resistance level to watch out for, followed by 17,693 and 17,731.

The Bank Nifty gained 116 points to close at 42,270, slightly outperforming broader markets and benchmark indices. The index has formed small bodied bullish candlestick pattern with long upper and lower shadows on the daily scale.

The fight between the bulls and the bears continued in the index and the broad range of 42,000-42,500 still remains intact. A break on either side will decide the clear momentum for the index, Kunal Shah, Senior Technical & Derivatives Analyst at LKP Securities said.

He feels the undertone within the range remains bullish as long as it holds the level of 42,000 on the downside. The support if breached will lead to a sharp correction toward the 41,500 level, he said.

As per the pivot point calculator, the Bank Nifty may take support at 42,149, followed by 42,086 and 41,983. Key resistance levels are expected to be 42,355, along with 42,419 and 42,521.

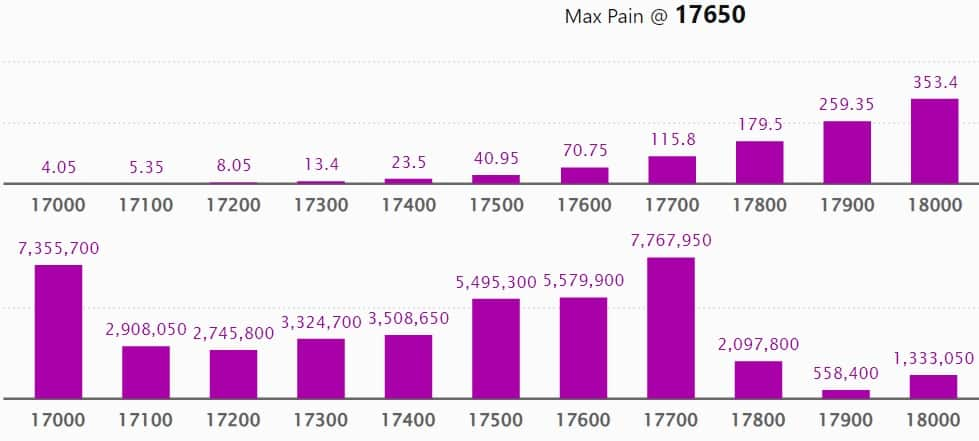

On the monthly options front, the maximum Call open interest (OI) was at 18,500 strike, with 1.23 crore contracts, which is expected to be a crucial level for the Nifty in the coming sessions.

This was followed by 17,700 strike, comprising 1.02 crore contracts, and 18,000 strike, with more than 63.06 lakh contracts.

Call writing was seen at 18,500 strike, which added 98 lakh contracts, followed by 17,700 strike, which accumulated 51.63 lakh contracts, and 18,200 strike which added 21.72 lakh contracts.

Call unwinding was at 16,000 strike, which shed 61,150 contracts, followed by 17,300 strike which shed 12,450 contracts, and 17,200 strike, which shed 2,700 contracts.

The maximum Put open interest was at 17,700 strike with 77.67 lakh contracts, which is expected to act as a crucial level in the coming sessions.

This was followed by the 17,000 strike, comprising 73.55 lakh contracts, and the 17,600 strike where there were 55.79 lakh contracts.

Put writing was seen at 17,700 strike, which added 41.61 lakh contracts, followed by 16,500 strike, which added 15.53 lakh contracts, and 17,600 strike, which added 14.49 lakh contracts.

We have seen Put unwinding at 19,000 strike, which shed 42,600 contracts, followed by 18,000 strike, which shed 19,950 contracts, and 18,500 strike, which shed 7,200 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. The highest delivery was seen in Cipla, Ipca Laboratories, Marico, Maruti Suzuki, and HDFC, among others.

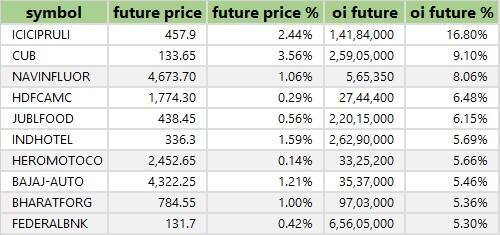

An increase in open interest (OI) and price typically indicates a build-up of long positions. Based on the OI percentage, 70 stocks, including ICICI Prudential Life Insurance, City Union Bank, Navin Fluorine International, HDFC AMC, and Jubilant Foodworks, saw long build-ups.

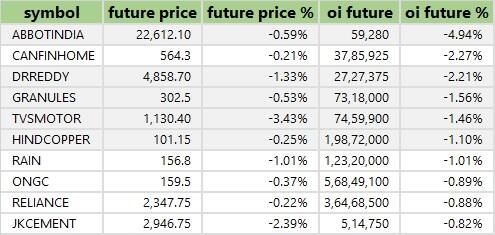

A decline in OI and price generally indicates a long unwinding. Based on the OI percentage, 15 stocks, including Abbott India, Can Fin Homes, Dr Reddy's Laboratories, Granules India, and TVS Motor Company, saw a long unwinding.

67 stocks see a short build-up

An increase in OI along with a price decrease indicates a build-up of short positions. Based on the OI percentage, 67 stocks, including Coforge, Shree Cements, Ramco Cement, Metropolis Healthcare, and Chambal Fertilizers, saw a short buildup.

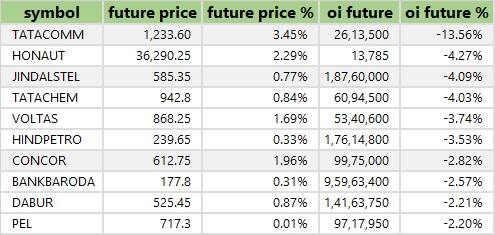

A decrease in OI along with a price increase is an indication of short-covering. Based on the OI percentage, 36 stocks were on the short-covering list. These included Tata Communications, Honeywell Automation, Jindal Steel & Power, Tata Chemicals, and Voltas.

PNB Housing Finance: Nippon India Mutual Fund has bought 5 lakh equity shares or around 0.3 percent stake in the housing finance company via open market transactions at an average price of Rs 133 per share. Goldman Sachs Investments Mauritius I Limited was the seller in this deal.

(For more bulk deals, click here)

Results on April 20 and April 21

Reliance Industries (RIL) is going to be in focus ahead of its quarterly and full-year earnings on April 21. Aditya Birla Money, Hindustan Zinc, Tejas Networks, Bheema Cements, Metalyst Forgings, Rajratan Global Wire, and Wendt (India) will also release their quarterly earnings scorecard on the same day.

ICICI Bank will be in action ahead of its quarterly and full-year numbers on April 22. Along with that, Yes Bank, Macrotech Developers, CE Info Systems, Star Housing Finance, and Nath Bio-Genes (India) will also be announcing their numbers on the same day.

Stocks in the news

HCL Technologies: The IT services company reported lower-than-expected earnings for Q4FY23 with profit falling 2.8 percent QoQ to Rs 3,983 crore and revenue declining 0.4 percent to Rs 26,606 crore. On the operating front, EBIT fell 7.5 percent sequentially to Rs 4,836 crore with its margin down by 140 bps to 18.2 percent for the quarter. Revenue in dollar terms declined 0.3 percent and topline in constant currency terms was down 1.2 percent QoQ, but its attrition rate dropped sequentially to 19.5 percent from 21.7 percent.

Cyient: The engineering and technology solutions company has recorded a 4.6 percent sequential growth in consolidated profit at Rs 163.2 crore for the quarter ended March FY23 on strong topline and operating numbers. Revenue for the quarter at Rs 1,751.4 crore grew by 8.2 percent and dollar revenue at $213 million increased by 8.1 percent, with constant currency revenue growth at 6.6 percent QoQ.

Sterling & Wilson Renewable Energy: The company posted a net loss of Rs 417.45 crore for the quarter ended March FY23, widening from a loss of Rs 126.3 crore in the same period last year, as consolidated revenue plunged 91.7 percent YoY to Rs 88.4 crore and EBITDA loss increased to Rs 352.12 crore from Rs 124.24 crore in the same period.

Siemens: The company as part of a consortium along with Rail Vikas Nigam, has received two separate orders from Gujarat Metro Rail Corporation (GMRCL). Siemens's share in orders is Rs 678 crore. The orders are for Surat Metro Phase 1 and Ahmedabad Metro Phase 2.

Suven Pharmaceuticals: The Competition Commission of India (CCI) has approved the acquisition of up to 76.10 percent of the voting share capital of Suven Pharmaceuticals by Berhyanda. Berhyanda is ultimately managed by Advent International Corporation.

Finolex Cables: The electrical and telecommunication cables manufacturer would set up a plant at the Urse facility in Pune to produce optical fibre preforms as well as expand on its fibre draw capacity. The plant with an initial capacity of 100 tons of preforms, is being set up at a cost of Rs 290 crore and would be funded entirely out of internal accruals.

Life Insurance Corporation of India: The premium of the life insurance company in March FY23 dropped 32 percent compared to the year-ago month, but the premium for FY23 grew by 17 percent over the previous year. The retail annual premium equivalent growth stood at 10 percent YoY in March, reports CNBC-TV18.

Fund Flow

Foreign institutional investors (FII) sold shares worth Rs 1,169.32 crore, whereas domestic institutional investors (DII) bought shares worth Rs 832.72 crore on April 20, National Stock Exchange's provisional data showed.

Stocks under F&O ban on NSE

The National Stock Exchange has not added any stock to its F&O ban list for April 21. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.