- Devices

- 4 min read

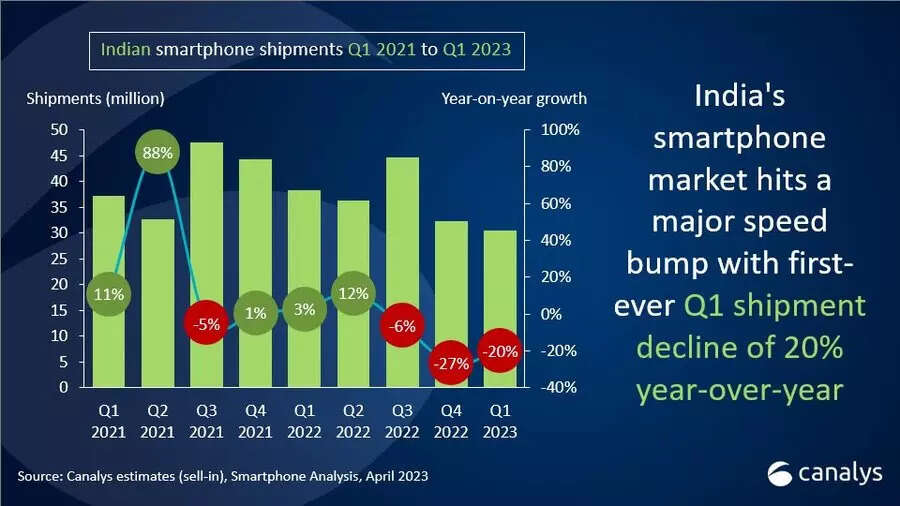

India smartphone shipments slump continues as sales plummet 20℅ in Q1

While Samsung continued to remain on the top spot in the first quarter with a market share of 21% and shipments of 6.3 million units, its Chinese rival Oppo shot to the second position with 5.5 million shipments giving it an 18℅ share of the market overtaking compatriots Vivo and Xiaomi.

While Samsung continued to remain on the top spot in the first quarter with a market share of 21% and shipments of 6.3 million units, its Chinese rival Oppo shot to the second position with 5.5 million shipments giving it an 18℅ share of the market overtaking compatriots Vivo and Xiaomi.

Vivo narrowly missing out to Oppo, became the third largest seller in the Indian smartphone market with 5.4 million units with same 18% market share as Oppo. Xiaomi, however, slipped to the fourth place accounting for a 16% share with 5 million shipments according to the research firm’s data.

Another Chinese vendor Realme maintained fifth place with 2.9 million shipments as the online channel remained muted.

“The market is still witnessing uneven demand woes and channels remain vulnerable to stock build-up,” said Canalys.

“The Indian market faces early-year struggles but vendors keep fueling the market as they remain bullish on long-term prospects,” said Sanyam Chaurasia, Analyst at Canalys.

Indian smartphone shipments and annual growth

Canalys Smartphone Market Pulse: Q1 2023Vendor Q1 2023 shipments (million) Q1 2023

market

shareQ1 2022

shipments (million)Q1 2022

market shareAnnual

growthSamsung 6.3 21% 7.1 19% -11% OPPO 5.5 18% 4.6 12% 18% vivo 5.4 18% 5.7 15% -4% Xiaomi 5.0 16% 8.0 21% -38% realme 2.9 9% 6.0 16% -52% Others 5.5 18% 6.8 18% -19% Total 30.6 100% 38.2 100% -20% Note: Xiaomi estimates include sub-brand POCO and OPPO includes OnePlus. Percentages may not add up to 100% due to rounding.

Source: Canalys Smartphone Analysis (sell-in shipments), April 2023

The gloom scenario in smartphone market comes in even as top global brand Apple is in the midst of opening it's first ever offline stores in India, indicating it's anticipation of strong demand revival

“Just as the economic indicators toward the end of Q4 2022 clearly suggested that demand would remain sluggish in the short term, it was witnessed so in Q1 2023. Despite this challenge, investments from major brands are pouring in as they align with the government's vision and changing consumer behavior,” Chaurasia added.

According to the analyst, brands are focusing on optimising retail, manufacturing, local sourcing, and research & development (R&D) to secure their long-term position in the market.

Canalys data showed the shipments of all brands, except Oppo, fell in Q1. Realme’s shipments declined the sharpest at 51% year-over-year in Q1, followed by Xiaomi with a fall of 38%, and Samsung with a decline of 11% during the same period.

Canalys said efficient channel management, quick model placement in offline space among others could be the deciding factors to get out of the current slump.

“Q1 2023 showcased that brands must balance channel contributions to keep business operations stable and maintain share,” said Chaurasia.

“Vendors with efficient channel management have proven to be more resilient to market volatility. Post-pandemic, vendors who have nurtured mainline retail channels, have demonstrated stability even during market downturns. Increasing contributions from high-price-band models have encouraged vendors to focus on strengthening