The Nifty50 managed to defend the 17,600 level on April 18 despite selling pressure in the equity markets for the second consecutive session, which experts feel can act as a support in coming sessions.

The BSE Sensex fell 184 points to close at 59,727, while the Nifty50 declined 47 points to 17,660 and formed a bearish candlestick pattern on the daily charts. The index has also held its downward-sloping resistance trendline for yet another session, which can be a positive sign.

"The Nifty took support at 17,610 and closed above the previous day's low, which is positive for April 19," Kunal Shah, Senior Technical & Derivatives Analyst at LKP Securities said.

The broader trend still remains positive. One should keep a buy-on-dip approach as long as the index sustains above the 17,600 level, he advised.

However, the broader markets maintained an upward journey with the Nifty Midcap 100 index rising 0.8 percent, continuing the uptrend for the seventh consecutive session. The Nifty Smallcap 100 index gained a third of a percent, sustaining upmove for the 11th straight day.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot charts indicate that the Nifty may get support at 17,619, followed by 17,582 and 17,523. If the index advances, 17,739 is the initial key resistance level to watch out for, followed by 17,776 and 17,835.

The Bank Nifty closed with 2.6 points gains at 42,265 amid volatility and formed a bearish candlestick pattern on the daily charts, but overall, traded within the range of the previous session.

The index is stuck in a broad range between 42,000 and 42,500. "The index as long as it sustains above 42,000 will remain in a buy-on-dip mode and if breached will lead to a further correction towards the 41,500 level," Kunal Shah, Senior Technical & Derivatives Analyst at LKP Securities said.

As per the pivot point calculator, the Bank Nifty may take support at 42,146, followed by 42,055 and 41,907. Key resistance levels are expected to be 42,441, along with 42,532 and 42,680.

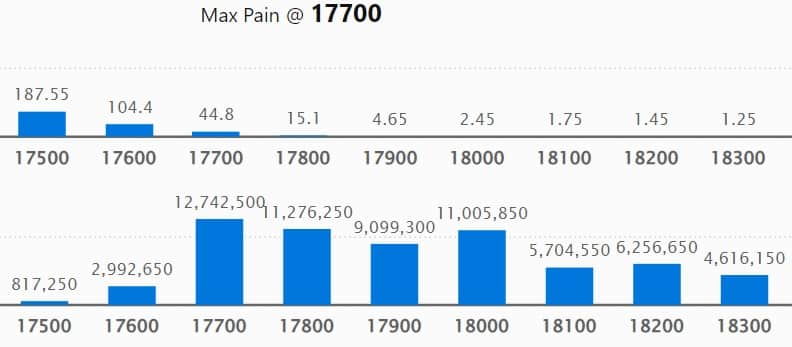

On the weekly options front, the maximum Call open interest (OI) was at 17,700 strike, with 1.27 crore contracts, which is expected to be a crucial level for the Nifty in the coming sessions.

This was followed by 17,800 strike, comprising 1.12 crore contracts, and 18,000 strike, with more than 1.1 crore contracts.

Call writing was seen at 17,700 strike, which added 42.18 lakh contracts, followed by 17,900 strike, which accumulated 30.57 lakh contracts, and 17,800 strike which added 27.85 lakh contracts.

Call unwinding was at 18,400 strike, which shed 11.05 lakh contracts, followed by 18,300 strike which shed 6.52 lakh contracts, and 18,700 strike, which shed 5.82 lakh contracts.

The maximum Put open interest was at 17,500 strike with 61.17 lakh contracts, which is expected to act as support in the coming sessions.

This was followed by the 17,700 strike, comprising 58.44 lakh contracts, and the 17,600 strike where there were 57.37 lakh contracts.

Put writing was seen at 17,400 strike, which added 19.45 lakh contracts, followed by 17,500 strike, which added 16.91 lakh contracts, and 17,200 strike, which added 5.33 lakh contracts.

We have seen Put unwinding at 17,700 strike, which shed 15.68 lakh contracts, followed by 17,800 strike, which shed 12.97 lakh contracts, and 17,300 strike, which shed 4.74 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. The highest delivery was seen in HDFC AMC, Crompton Greaves Consumer Electricals, Honeywell Automation, Cummins India, and Tata Consumer Products, among others.

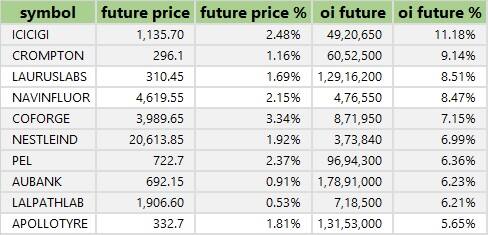

An increase in open interest (OI) and price typically indicates a build-up of long positions. Based on the OI percentage, 56 stocks, including ICICI Lombard General Insurance Company, Crompton Greaves Consumer Electricals, Laurus Labs, Navin Fluorine International, and Coforge, saw long build-ups.

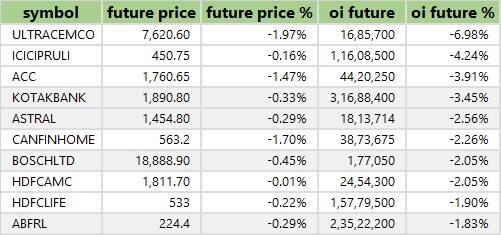

A decline in OI and price generally indicates a long unwinding. Based on the OI percentage, 34 stocks, including UltraTech Cement, ICICI Prudential Life Insurance, ACC, Kotak Mahindra Bank, and Astral, saw a long unwinding.

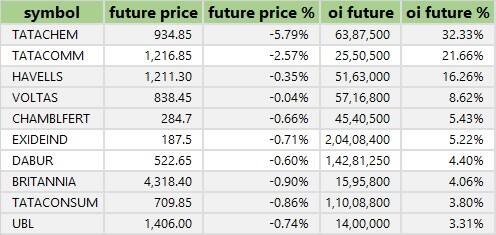

48 stocks see a short build-up

An increase in OI along with a price decrease indicates a build-up of short positions. Based on the OI percentage, 48 stocks, including Tata Chemicals, Tata Communications, Havells India, Voltas, and Chambal Fertilizers, saw a short buildup.

A decrease in OI along with a price increase is an indication of short-covering. Based on the OI percentage, 52 stocks were on the short-covering list. These included Indraprastha Gas, Lupin, State Bank of India, RBL Bank, and HCL Technologies.

Avalon Technologies: Goldman Sachs bought shares worth Rs 32.63 crore in Avalon Technologies on its listing day. Goldman Sachs Investments (Mauritius) I purchased 4.45 lakh shares in the company via open market transactions at an average price of Rs 408.13 per share, and Goldman Sachs Funds - Goldman Sachs India Equity Portfolio acquired 3.5 lakh shares at an average price of Rs 412.91 per share.

(For more bulk deals, click here)

ICICI Securities, Mastek, Tata Communications, Alok Industries, Artson Engineering, Citadel Realty and Developers, G G Engineering, Gujarat Hotels, and Stampede Capital will be in focus ahead of quarterly earnings on April 19.

Stocks in the news

ICICI Lombard General Insurance Company: The firm has recorded a massive 40 percent year-on-year growth in profit at Rs 437 crore for the quarter ended March FY23. Net premium earned for the quarter grew by 12.3 percent to Rs 3,726 crore and total income increased by 13.3 percent to Rs 5,256 crore compared to the year-ago period. The combined ratio was at 104.2 percent in Q4FY23, against 103.2 percent in Q4FY22. The insurance company announced a final dividend of Rs 5.5 per share.

Tata Coffee: The Tata Group company reported a nearly 20 percent year-on-year increase in consolidated profit at Rs 48.8 crore for the March FY23 quarter supported by higher other income and lower tax cost. Consolidated revenue for the quarter grew by 10.2 percent to Rs 723 crore compared to the same period last year. However, EBITDA fell 4.8 percent YoY to Rs 105.72 crore with the margin falling 230 bps for the quarter.

Bank of India: The public sector lender said the board of directors has approved the raising of capital up to Rs 6,500 crore for FY24, comprising Rs 4,500 crore via the issue of fresh equity capital in the form of FPO/QIP/Rights issue/preferential issue and/or Basel III compliant additional Tier-1 (AT-1) bonds, and Rs 2,000 crore via Basel III compliant Tier-2 bonds.

State Bank of India: The country's largest lender said its Executive Committee of the Central Board has approved the long-term fund raising in single and multiple tranches up to $2 billion, through a public offer or private placement of senior unsecured notes in US dollar or any other convertible currency during FY24.

Zydus Lifesciences: The pharma company has received final approval from the United States Food and Drug Administration (USFDA) to manufacture and market Estradiol Transdermal system in the US. Estradiol transdermal system is indicated for the prevention of postmenopausal osteoporosis. The drug will be manufactured at the group’s formulation manufacturing facility at Moraiya near Ahmedabad.

Pidilite Industries: The company has entered into an agreement with US-based Basic Adhesives LLC for the purchase of its certain assets comprising technology, design, trademark, copyright, domain name and trade dress. The company will pay the consideration in tranches over a period of time.

Prestige Estates Projects: Subsidiary Prestige Exora Business Parks acquired 51 percent shares in Dashanya Tech Parkz. The acquisition cost for a 51 percent stake is Rs 66.07 crore.

Fund Flow

Foreign institutional investors (FII) sold shares worth Rs 810.60 crore, whereas domestic institutional investors (DII) bought shares worth Rs 401.66 crore on April 18, National Stock Exchange's provisional data showed.

Stocks under F&O ban on NSE

The National Stock Exchange has retained Balrampur Chini Mills and Delta Corp on its F&O ban list for April 19. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.