PHD And VVR: Two 12% Yielders Raising Dividends, At Discounts

Summary

- PHD has raised its payouts six times in the past year. VVR has raised it three times, plus a special dividend.

- They both yield over 12%, and pay monthly.

- They're also selling at 8% to 12% discounts.

- We're currently running a sale for our private investing group, Hidden Dividend Stocks Plus, where members get access to portfolios, market alerts, real-time chat, and more. Learn More »

JamesBrey

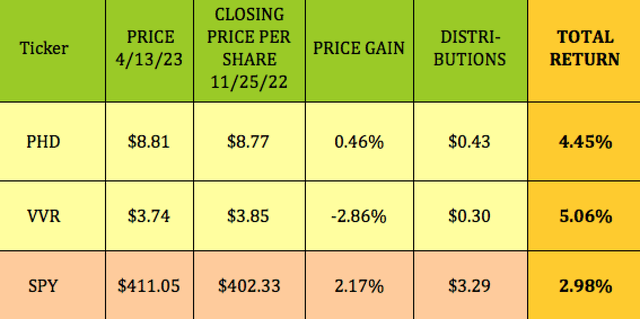

Looking for a way to benefit from rising rates? Pioneer Floating Rate Fund (NYSE:PHD) and Invesco Senior Income Trust (VVR) are two closed-end funds which we first covered in late November 2022.

Since then, they've both had better total returns than the S&P 500 - VVR has the best return, at ~5%, while PHD returned 4.45%, vs. ~3% for the S&P:

Hidden Dividend Stocks Plus

Fund Profiles:

Pioneer Floating Rate Fund is a CEF which seeks a high level of current income by investing primarily in floating-rate loans. It also seeks capital preservation as a secondary objective to the extent consistent with its primary goal.

Invesco Senior Income Trust is a CEF whose investment objective is to provide a high level of current income, consistent with preservation of capital. The fund achieves its objective via investing primarily in floating or variable senior loans of issuers which operate in a variety of industries and geographic regions.

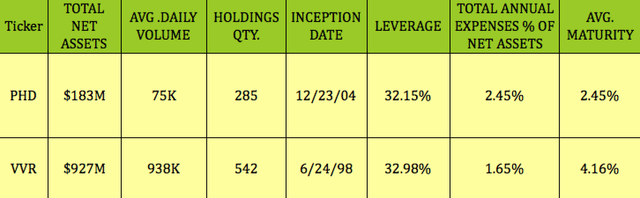

PHD is much smaller than VVR, with $183M in assets, vs. $927M for VVR, which also has much higher average daily volume of 938K, vs. just 75K for PHD.VVR holds 542 positions, vs. 285 for PHD.

Both funds use 30%-plus leverage, with VVR using slightly more than PHD. PHD's Expense ratio is 2.45%, vs. 1.65% for VVR. PHD has a shorter average maturity of 2.45%, vs. 4.16% for VVR. VVR has been around six years longer, IPO'ing in 1998, while PHD debuted in 2004:

Hidden Dividend Stocks Plus

Dividends:

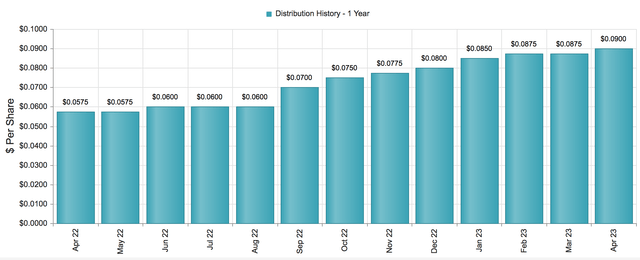

PHD has raised its monthly distributions six times over the past year - going from $.0575 to $.09:

PHD site

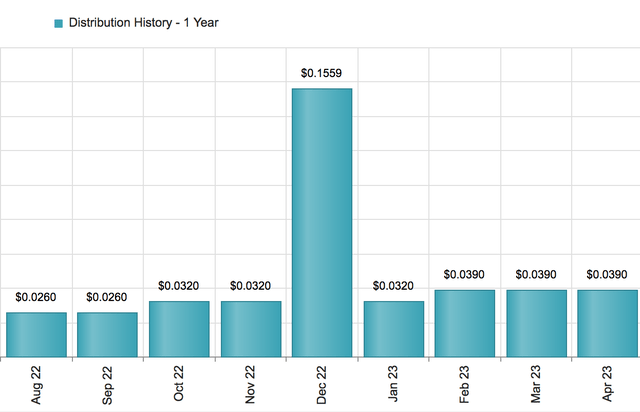

VVR has raised its payout three times since September '22, and also paid a special dividend in December '22:

VVR site

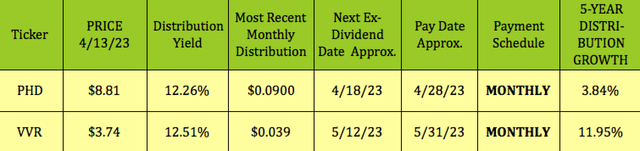

At their 4/13/23 intraday prices, PHD yielded 12.26%, while VVR yielded 12.51%. PHD declared a 4/18/23 ex-dividend date, with a 4/28/23 payout date, while VVR's next monthly ex-dividend date should be ~5/12/23, with a ~5/31/23 payout date:

Hidden Dividend Stocks Plus

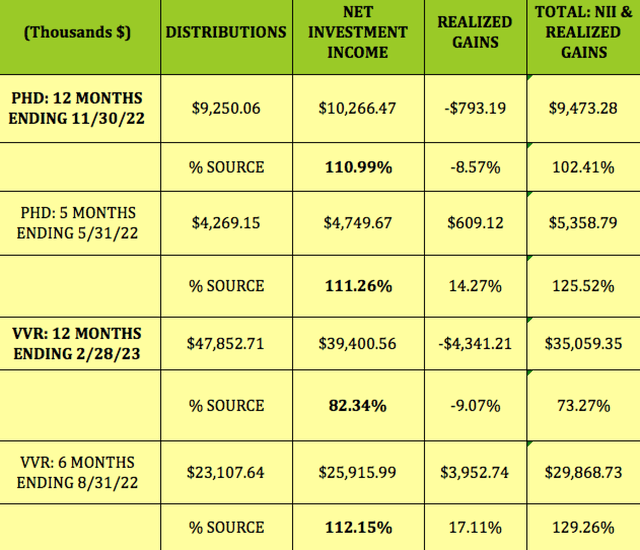

PHD covered its by 102.41% for the 12 months ending 11/30/22, with the coverage coming from Net Investment Income, NII. Its NII coverage was 111%, similar to its coverage for the five months ending 5/31/22.

VVR had a shortfall for the 12 months ending 2/28/23, with NII only covering 82.34% of its distributions. Realized gains were -$4.34M.

VVR's NII coverage for the six-month period ending 8/31/22 was 112.15%, while the last six months ending 2/28/23, NII was only ~$13.5M, vs. ~$24.7M in distributions:

Hidden Dividend Stocks Plus

Holdings:

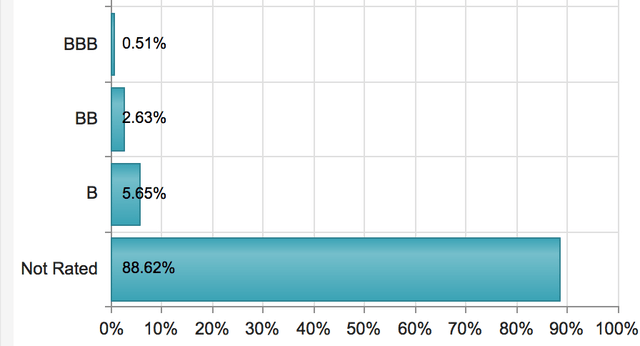

PHD holds 88.6% in unrated securities, with 5.65% in B-rated and 2.63% in BB-rated holdings:

PHD site

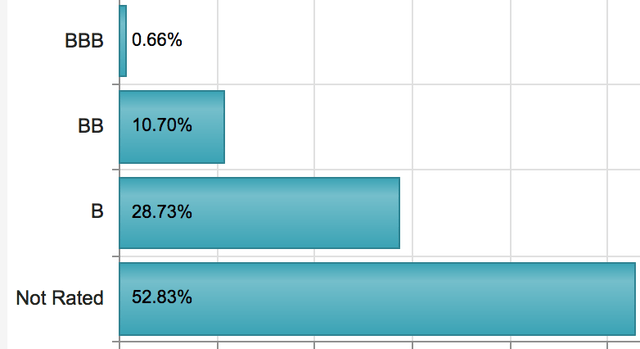

VVR holds 10.7% in BB-rated, 28.73%, and 52.83% in unrated holdings:

VVR site

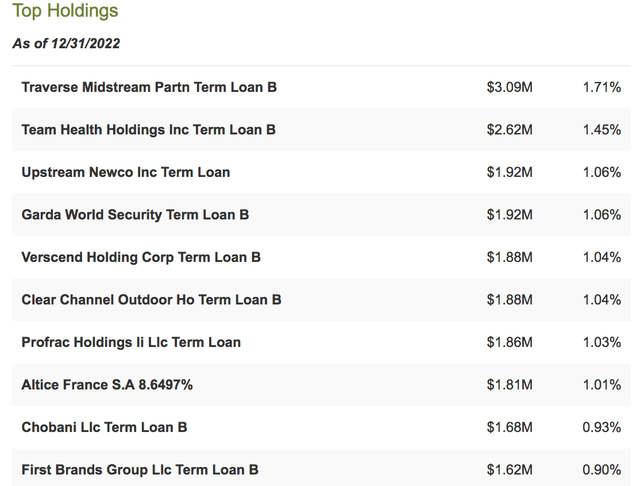

PHD's top 10 holdings comprise 10.17% of its portfolio, comprised of term loans.

PHD site

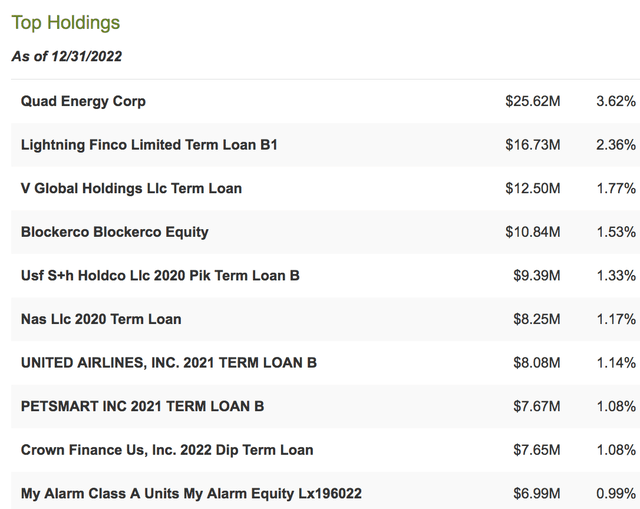

VVR's top-10 holdings comprised ~16% of its portfolio, and included debt from such well-known names as PetSmart and United Airlines, as of 12/31/22. Its top five sectors were services, 14.73%, gaming/leisure, at 8.94%, aerospace, at 8.6%, healthcare, at 7.48%, and technology, at 6.60%.

VVR site

Performance:

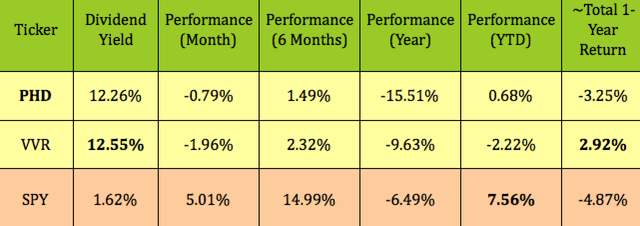

Both funds have lagged the S&P in price performance over the past month, six-month, one-year, and year to date periods. However, VVR has the best ~total one-year return, at 2.92%, vs. negative returns for PHD and the S&P.

Hidden Dividend Stocks Plus

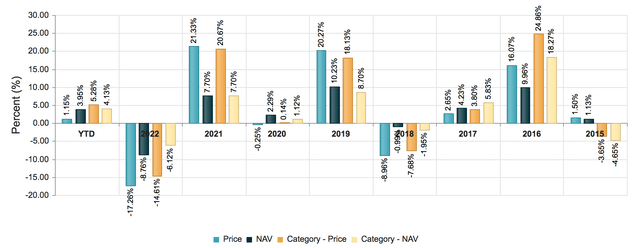

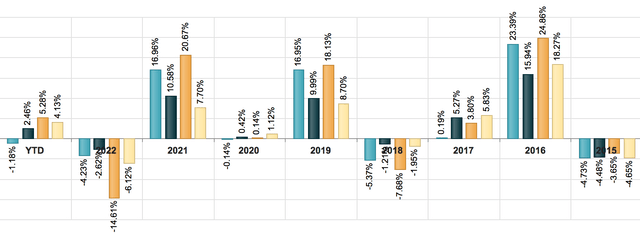

PHD outperformed the Morningstar US CEF Senior Loans category in 2015, 2019, and 2021:

PHD site

VVR outperformed the Morningstar US CEF Senior Loans category in 2018-2019 and 2022, while outperforming on a NAV basis in 2021:

VVR site

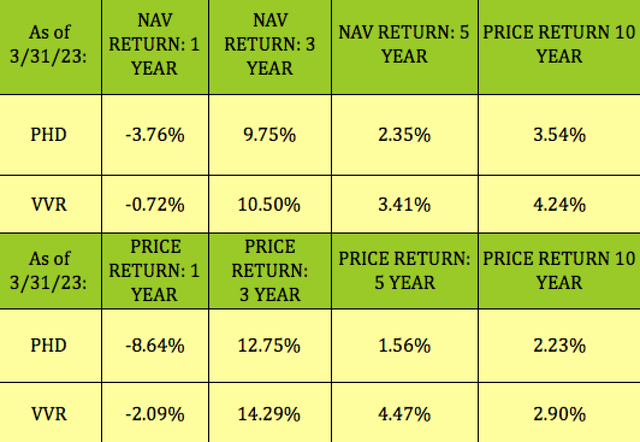

VVR has the edge over PHD in NAV and Price returns over the past one-, three-, five-, and 10-year periods, as of 3/31/23:

Hidden Dividend Stocks Plus

Valuations:

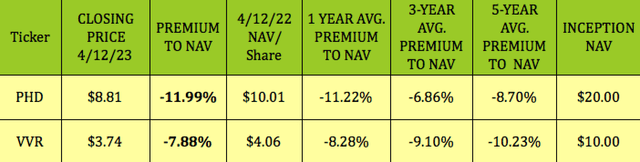

Buying CEFs a discount to NAV that are deeper than their historical averages can be a useful strategy, due to mean reversion.

PHD's ~-12% premium to NAV is a bit deeper than its 1-year -11.22% premium, and much deeper than its -6.86% 3-year, and -8.7% 5-year premiums.

As VVR has had better NAV returns than PHD, it's not surprising that its -7.88% premium is not as deep as its one-, three-, and five-year average premiums to NAV:

Hidden Dividend Stocks Plus

Parting Thoughts:

If the Fed continues its rate hikes at least in 2023, these floating rate funds could be a good place to stash some cash for the near term.

We favor PHD based upon its current deeper discount and distribution coverage. However, keep an eye on VVR - if there's a market pullback, you may be able to buy it at a deeper than historic discount.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Our Marketplace service, Hidden Dividend Stocks Plus, focuses on undercovered, undervalued income vehicles, and special high yield situations.

We scour the US and world markets to find solid income opportunities with dividend yields ranging from 5% to 10%-plus, backed by strong earnings.

We publish exclusive articles each week with investing ideas for the HDS+ site that you won't see anywhere else.

We offer a range of income vehicles, many of which are still selling below their Net Asset and redemption values in 2023.

This article was written by

Robert Hauver, MBA, was VP of Finance for an industry-leading corporation for 18 years, and publishes SA articles under the name DoubleDividendStocks. TipRanks rates DoubleDividendStocks in the Top 25 of all financial bloggers, and Seeking Alpha rates us in the Top 5 of several categories, including Dividend Ideas, Basic Materials, and Utilities.

"Hidden Dividend Stocks Plus", a Seeking Alpha Marketplace service, which focuses on undercovered and undervalued income vehicles. HDS+ scours the world's markets to find solid income opportunities with dividend yields ranging from 5% to 10%-plus, backed by strong earnings.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in PHD over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: This article was written for informational purposes only, and is not intended as personal investment advice. Please practice due diligence before investing in any investment vehicle mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.