If The Banking Crisis Is Over, Rates Will Go Much Higher

Summary

- Earnings season has started and so far, the banks have delivered better-than-feared results.

- This has caused the market to start repricing the path of monetary policy.

- Rate cuts are being removed from the equation.

- Looking for a helping hand in the market? Members of Reading The Markets get exclusive ideas and guidance to navigate any climate. Learn More »

wildpixel

With signs of the banking crisis easing this past week, the market has started to reprice its bets on rate cuts. Bank earnings will play a big part in this, too, because they are coming better than feared, as deposits stabilize, there will be no reason for rate cuts in 2023.

JPMorgan (JPM) reported blowout numbers, and if a banking crisis is ongoing, it seems hard to find. Not only were JPMorgan's results strong, but so were Citigroup's (C) and Wells Fargo's (WFC). It could be that the banking crisis is now behind us, and it could even suggest that the expectation for financial conditions to tighten further may not materialize due to it.

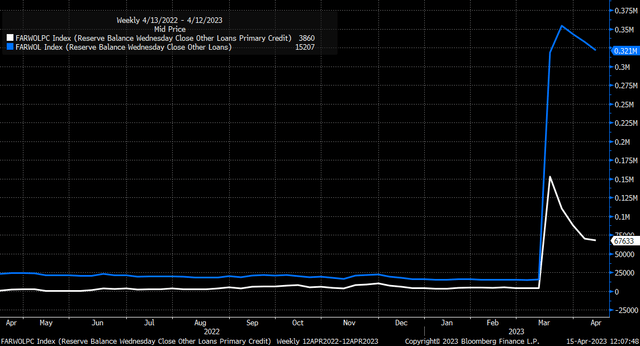

At least based on the Fed balance sheet this week, usage of the Fed's discount window continues to subside, dropping to $67 billion from around $154 billion on March 15. Meanwhile, total loans by the Fed dropped to about $321 billion from a peak of $354 billion on March 22.

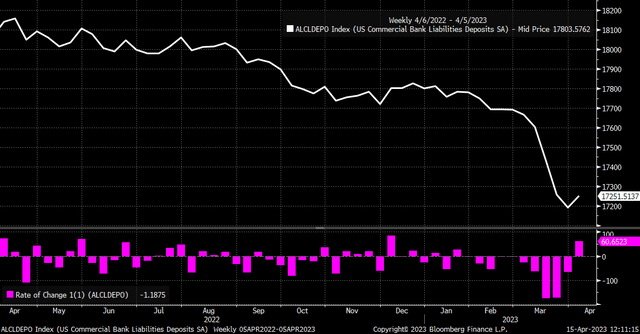

Furthermore, during this past week, there was a significant inflow of over $60 billion into bank deposits, marking its most substantial increase since the end of 2022. While one week's data may not be enough to confirm a trend or guarantee that inflows will persist, it is undoubtedly a step in the right direction.

Moreover, loans and leases experienced an increase this past week, marking the first time since the middle of March. Meanwhile, the Chicago Fed's adjusted national financial condition index indicated signs of easing this past week.

If there is a banking crisis, some of the pressures observed in previous weeks appear to be easing. If these conditions continue to improve, the market will likely adjust its expectations for the projected path of monetary policy. In light of the results reported by some of the large banks, the markets seemed to reconsider some of their prior assumptions regarding the path of monetary policy.

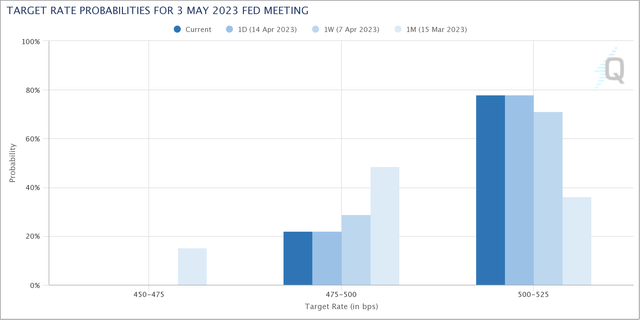

The likelihood of a 25 basis points rate increase for the May meeting also increased this past week to around 80%, up from 71% last week. The more signs of easing in the financial sector, the more probable it becomes that the Fed will continue raising rates.

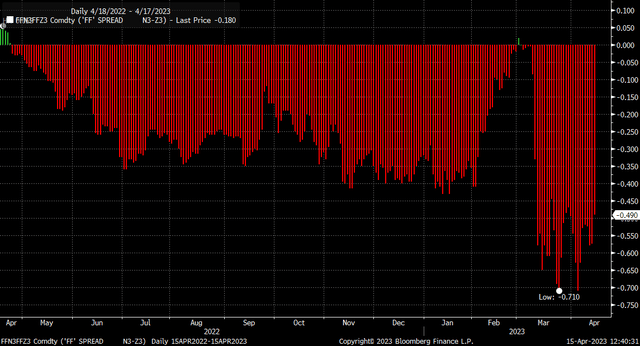

This week, Fed Funds Futures increased from 4.48% to 4.57%, while the peak terminal rate increased to 5.06% in July. At the same time, the spread between the July 2023 contracts and the December 2023 contract has narrowed to just -49 basis points, an increase from its low of -71 basis points on March 24.

As the data indicates that the banking crisis is resolving and financial conditions are easing, the spread is more likely to contract further as the market moves to remove rate cuts from its forecast for 2023. Removing rate cuts will increase interest rates along the Treasury curve, leading to higher real yields.

The equity market's upward movement has been mainly due to the expectation that the Fed would cease raising rates because the stress from the bank sector would result in financial conditions tightening, doing some of the Fed's work. However, if this assumption proves to be incorrect, and the banking crisis continues to ease, it is likely to force the Fed back into action until there are clear indications that not only are the sticky components of inflation easing but that the labor market is cooling.

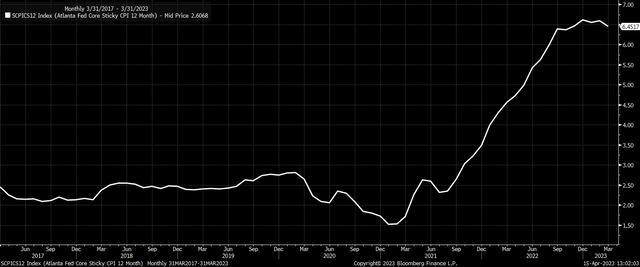

Up to this point, sticky inflation remains high, as indicated by the Atlanta Fed's 12-month Sticky CPI, which remains at 6.45% in March, down from its December peak of 6.61%.

So not only will future economic data help shape expectations for monetary policy but earnings season will also. If the banks show signs that they are doing rather well, the impact of the banking crisis are easing, and the borrowings from the Fed and bank deposits stabilize, one would think that rates will go higher as rate cuts are moved from the equation for 2023.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Join Reading The Markets Risk-Free With A Two-Week Trial!

(*The Free Trial offer is not available in the App store)

Find out why Reading The Markets was one of the fastest-growing SA marketplace services in 2022. Try it for free.

The market is more complex than ever, and Reading The Markets is here to help you cut through all the noise and to help you better understand what is driving trading and where the market is likely heading, both short and long-term.

Check out my newsletter if you want to start with something less intensive.

This article was written by

I am Michael Kramer, the founder of Mott Capital Management and creator of Reading The Markets, an SA Marketplace service. I focus on long-only macro themes and trends, look for long-term thematic growth investments, and use options data to find unusual activity.

I use my over 25 years of experience as a buy-side trader, analyst, and portfolio manager, to explain the twists and turns of the stock market and where it may be heading next. Additionally, I use data from top vendors to formulate my analysis, including sell-side analyst estimates and research, newsfeeds, in-depth options data, and gamma levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Charts used with the permission of Bloomberg Finance L.P. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer's views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer's analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer's statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.