EPR Properties: A Strong Play Despite Uncertainty

Summary

- The stock has been under pressure ever since COVID-19.

- EPR Properties has high exposure to the theater business, accounting for over 40% of its annual sales.

- The bankruptcy of Regal, and potentially AMC, will likely weigh down EPR shares negatively this year.

- I have decided to move EPR Properties to a hold recommendation. While the company's current characteristics remain appealing, investors may want to wait for more updates before making a decision.

FuzzMartin

EPR Properties (NYSE:EPR) is a real estate investment trust (REIT) based in the United States that specializes in owning, acquiring, and managing properties in the experiential and infrastructure sectors. And although I am a fan of EPR due to its highly profitable business, high and well-covered dividend yield, and strong management team, I have decided to move the REIT to a hold recommendation. While the company still possesses attractive qualities, there is currently a great deal of uncertainty surrounding its future prospects.

Overview of EPR's Portfolio and Debt Situation

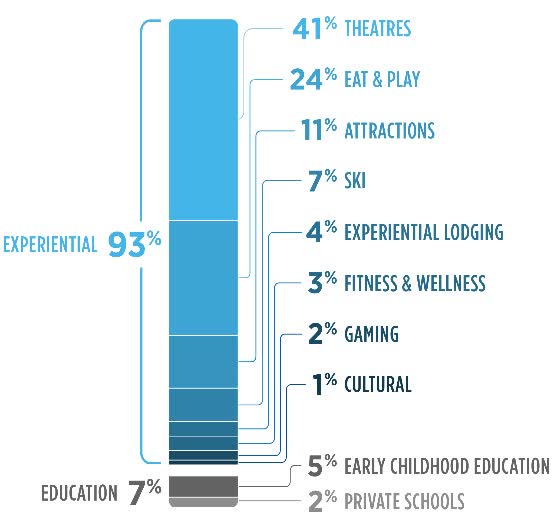

EPR has a well-diversified portfolio that includes experiential and infrastructure properties across various industries, including entertainment, recreation, education, and infrastructure. The company's properties range from theatres, ski parks, waterparks to private schools. EPR generates over 41% of its revenue from theatres, which had brought uncertainty to the company, as we will discuss shortly.

Diversified, Experiential Property Types (EPR Properties)

Revenue and net income have been consistently increasing year over year, excluding 2021 due to the pandemic, the company has managed to recover the revenue lost during the pandemic, exceeding the total revenue earned in 2019. Additionally, the company has reported an impressive 97% stable occupancy rate.

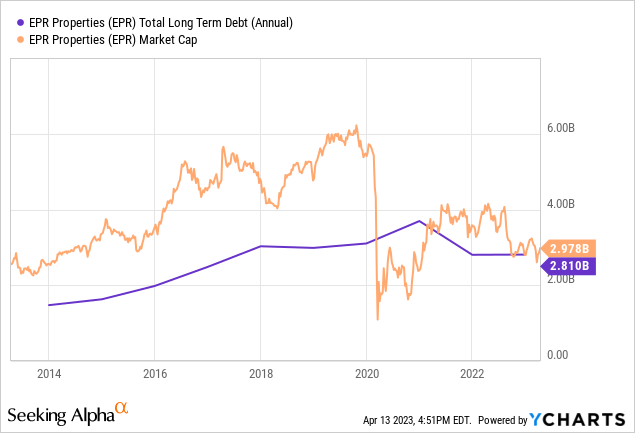

REITs aim to increase shareholder value by acquiring properties and growing cash earnings per share and dividends per share, which can lead to significant debt. EPR is no exception as the company has a total debt of $2.8 billion, which is a substantial amount for a REIT with a market cap of less than $3 billion. Although the total debt has remained stable, the EPR market cap has fallen by over 50% since the pandemic started, making the debt-to-capitalization ratio concerning.

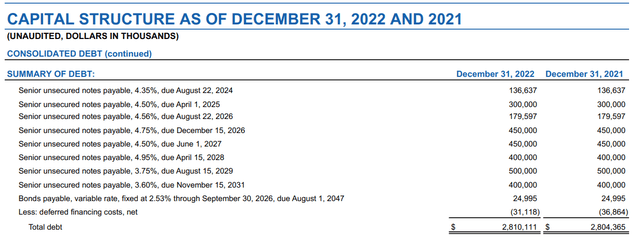

Furthermore, EPR has $137 million in unsecured debt maturing next year and another $300 million in 2025, with a 4.35% and 4.5% yield, respectively. In the current interest rate environment, it may be challenging to refinance this at favourable terms, particularly given the state of the theatre industry. To reduce the rate, EPR will have to provide collateral or accept higher rates, which will impact its net income.

Capital Structure as of December 31, 2022 (EPR Properties)

Additionally, under EPR's debt covenants, the company's debt-to-asset ratio cannot exceed 60%, which is currently just under 50%. Therefore, although EPR talks about its untapped $1 billion credit line, accessing it all at once could be challenging.

EPR's Dividend Yield and Payout Ratio Analysis

EPR's current dividend yield stands at 8.4%. The company cut its dividend in the second quarter of 2020 due to COVID-19 but reinstated it in July 2021. Currently, the company pays $0.275 per share on a monthly basis, making it an attractive choice for income-oriented investors.

For REITs, the dividend payout ratio is calculated using Adjusted Funds from Operations (FFO). This metric helps to normalize a REIT's earnings by adjusting for non-cash charges and one-time expenses that don't fully reflect its underlying earnings. By using this measure, investors can get a better understanding of the recurring cash flow a REIT generates and can use it to make dividend payments.

Using this metric, the adjusted funds from operations payout ratio based on the fourth quarter of 2022 figures was 65%. This low payout ratio suggests that the dividend is secure, as it provides a significant margin of safety in the event of adversity.

Conservative investors should still tread with caution. While EPR's dividend payout ratio looks stable, the company is still exposed to risks due to the pandemic's ongoing uncertainty. Theatres, which make up a significant portion of EPR's portfolio, continue to face challenges due to the pandemic's restrictions and changing consumer behaviour.

A Lot of Unanswered Questions in the Theatre Business

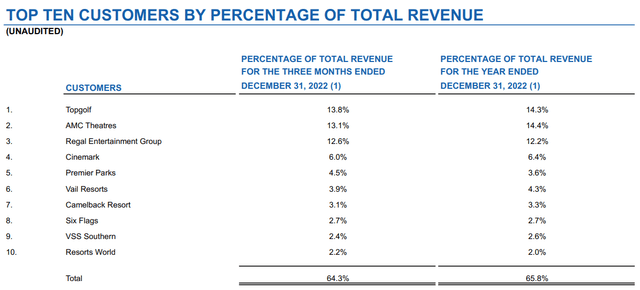

As I mentioned EPR generates over 41% of its revenue from theatres and regardless of where the industry heads in the future, EPR has a major concentration problem. The top 3 tenants account for more than 40% of its total revenue. Unfortunately for EPR, two of its major tenants are experiencing financial troubles.

Top Ten Customer by % of Total Revenue (EPR Properties)

While landlords usually don't need to worry about tenants' revenue as long as they pay the rent, concentration issues can be problematic. In the case of EPR, having two major customers in financial distress changes the picture.

AMC Entertainment (AMC) and Regal make up about 27% of EPR's total rent.

There are rumours that AMC could file for bankruptcy. AMC has previously avoided bankruptcy with the help of meme investors. A gamma squeeze occurred when short sellers were forced to buy AMC stock because its price had soared after the cash infusion. AMC saw an opportunity to avoid bankruptcy by raising funds through the issuance of stock. The business had financially improved. However, with the headwind in the sector, there are fresh rumours of impending bankruptcy in 2023.

This one isn’t a rumour but confirmed, poor performance over the past two years has resulted in Regal filing for protection under Chapter 11 in September 2022. This caused the stock price to fall by almost 20% as investors panicked. Regal's parent company, Cineworld, is in the middle of bankruptcy proceedings. So far, the situation has unfolded favourably. Regal has paid all of its rent to EPR through at least February, and although some of the leases were under renegotiation, Regal has decided not to move forward for now.

However, some big unanswered questions remain. Cineworld has said that it has been in talks with its key stakeholders -- mainly creditors and landlords -- to develop a reorganization plan.

The good news is that lease obligations are high in the capital structure, meaning that Regal will have to keep paying its rent at locations it plans to keep open. So far, that is all of its EPR-owned properties. But leases could end up being modified, or theatres could end up closing. The theatre operator recently announced an agreement to restructure its debt, but as of mid-February, Cineworld had already amended 150 Regal leases and was actively negotiating with other large landlords.

In addition, Regal still owes EPR $87.3 million from pandemic-era rent deferrals, and the future of this is uncertain. Plus, box office revenue, in general, isn't strong right now -- 2022 box office revenue was 35% below comparable pre-pandemic levels, and it had been on a steady decline for years at that point.

EPR has said for a while that it aims to gradually reduce its exposure to theatre properties and add to its portfolios of other types of experiential real estate. But this isn't exactly the best environment in which to attempt to sell theatre real estate.

What I’ll Be Watching

EPR's valuation looks extremely attractive, it has a very high dividend yield that is well-covered by its cash flow. Also, EPR's management team has done a good job of navigating the pandemic and recovering the revenue lost due to the pandemic.

Furthermore, while borrowing money at favourable terms has become less of an option, EPR is generating about $150 million in cash flow annually, on top of its dividend, so it can fund some growth without any further capital raising. Most REITs don't have that luxury, at least not to this extent.

Obviously, the outcome of the Regal bankruptcy proceedings is at the top of the list as far as near-term issues are concerned. I will also be keeping a close eye on theatrical releases versus streaming, and other movie theatre industry trends as well as how AMC's situation unfolds.

While they're impossible to predict, I will also be watching interest rates. As I’ve said, EPR's business is affected by it in several ways. And I will be paying close attention to the commercial real estate market in general.

Although EPR possesses attractive characteristics, there is a great deal of uncertainty surrounding its future and risk, which leads me to rate EPR stock as a hold until further updates develop.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.