Arcos Dorados: Taking Market Share In LatAm

Summary

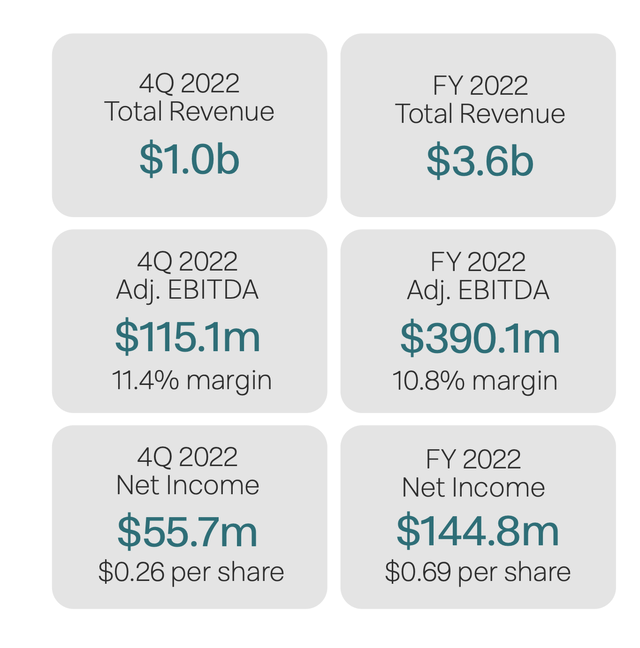

- Arcos Dorados had a strong year in 2022, but its stock has been stuck in neutral, trading at half the valuation of its U.S. peers.

- Another solid performance should help boost the stock, and it's early same-store sales performance shows that it's off to a good start in 2023.

- ARCO stock is in the high-risk/reward category but has upside to $12.

Joe Raedle/Getty Images News

Another strong year operationally should propel the stock of Arcos Dorados (NYSE:ARCO) higher.

Company Profile

ARCO is the largest franchisor of McDonald’s (MCD) restaurants in Latin America. It has the exclusive rights to own and operate MCD restaurants as well as grant sub-franchises in 20 Latin American countries.

ARCO has master franchise agreements (MFAs) with MCD where the two companies agree on restaurant openings and a reinvestment plan for a three-year period. ARCO paid MCD an effective royalty rate of about 5.6% of sales in 2022. That will rise to 6.0% of sales in 2023 and 2024.

ARCO owns the bulk of its restaurants, but it does sub-franchise out some. It generally collects a 5% franchise fee and rent fees on these locations.

ARCO reports its results based on three geographic segments. Brazil is its largest market by far and thus its own segment. Its North Latin America Division (NOLAD) includes Mexico, Costa Rica, Panama, Puerto Rico, Martinique, Guadeloupe, French Guiana, St. Croix, and St. Thomas. Its Southern Latin American Division (SLAD) consists of Argentina, Chile, Peru, Colombia, Ecuador, Uruguay, Venezuela, Trinidad and Tobago, Aruba, and Curacao.

Opportunities and Risks

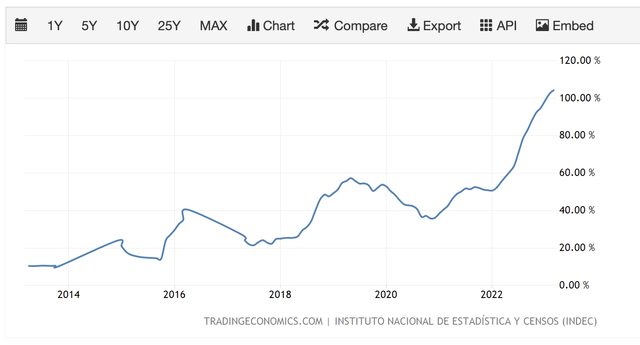

When looking at ARCO, one thing you’ll notice throughout its history is explosive same-store sales, much different than you’d see at most U.S. restaurants. A big part of that, though, is rampant inflation in South America, particularly in Argentina, as well as currency deflation.

Argentina Inflation (Trading Economics) Brazilian Real to US Dollar (Xe)

These are two battles the company is always dealing with, as ultimately, its bottom-line results in U.S. dollars are what matters. Lately, ARCO has been delivering, putting up strong results in 2022. Last year marked a new EBITDA record for the company, as well as its best-ever EBITDA margin for a full year. And Q4 was the highest adjusted EBITDA it has ever posted in a single quarter.

In Q4, ARCO has been able to drive same-store sales well above inflation levels throughout its geographies. In NOLAD, Q4 SSS grew 3.1x the blended rate of inflation in the region, while SLAD grew at 1.6x the blended inflation in that region. Its largest market, Brazil, meanwhile, saw comp sales soar 3.6x the rate of blended inflation.

2023 has also been off to a good start with SSS in January and February growing at a combined 1.9x the rate of inflation across the company. This is an important metric that ARCO will need to do well with, but it will face tough comps, and it likely got some boost from marketing campaigns around last year’s World Cup, which saw Argentina crowned the winner.

For his part, CEO Marcelo Rabach was confident the strong SSS trends would continue, saying on the company’s Q4 call:

“Comparable sales growth in the first 2 months of this year of 2023 remained very strong. They grew almost 2x blended inflation for the company. And it's important to notice that the growth remains strong across all 3 divisions as it was the case in 2022. So based on our aggressive marketing plans and these recent trends, we are confident that we can deliver another year of comparable sales growth, well above inflation in our markets, which will then generate the expected operational leverage. …

"We remain focused on driving top line with sustainable volume growth. That's what we have done in 2022 and the plan to continue in 2023. We already started with a very healthy sales trend, as we mentioned in the first 2 months in all channels, and we are committed to deliver U.S. dollar absolute EBITDA growth as we have done in 2022 as well with a healthy margin profile and, of course, maintaining a disciplined cost and expense control."

Delivery has been a big boost to ARCO. This has obviously been a global trend for a while, but one in which ARCO is still fully taking advantage of. On its Q4 call, COO Luis Raganato said:

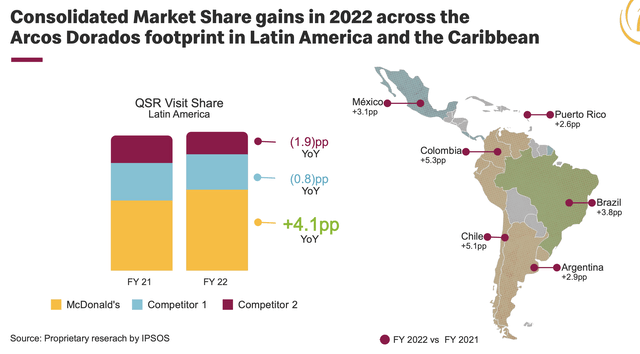

“Sales in delivery have more than tripled since 2019. Even as on-premise sales channels normalized in 2022, delivery growth remained incredibly strong. In fact, we had the highest ever delivery sales total in the fourth quarter, which was up an impressive 52% versus the prior year quarter. While most of the QSR industry has seen delivery sales remain relatively flat, the McDonald's brand has captured nearly all the growth in the sales channel, which led to significant market share gains relative to our main competitors in the region.”

The company has also taken a page out of the old U.S. MCD playbook with drive-thrus. ARCO made investments to speed up the process and increase accuracy, which has been paying off in increased sales. Between delivery and drive-thrus, it appears the company is gaining share across its markets.

Latin America also remains a bit of an underdeveloped region for MCD locations, and thus expansion is another growth driver for ARCO. The company opened 66 new locations in 2022, with 40 of them in Brazil. It will look to open 75-80 new restaurants this year, while modernizing at least 250 locations to its EOTF (Experience of The Future) format. This is a global MCD format that includes adding technology like self-ordering kiosks and wireless chargers, as well as improved back-end infrastructure. These improvements typically give an uplift to sales.

Operating in Latin America obviously adds additional risks. I have already mentioned the inflation and currency battles the company deals with on a regular basis. Unlike MCD, ARCO is also much more a restaurant owner, not a franchisor, which carries more of a burden with food and labor inflation. In addition, in Latin American McDonald’s usually isn’t the cheap food option like it is in the U.S. Local alternatives are generally cheaper, so it can be more exposed to any economic softness.

ARCO also carries about $455 million in net debt. Based on current estimates, its leverage is fairly modest. On another positive note, in March, Fitch upgraded its debt rating to BB+ with a stable outlook, and the company doesn't plan to increase its debt as it adds more locations.

Valuation

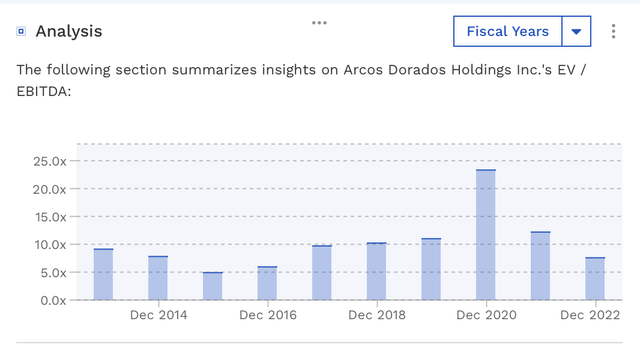

ARCO stock trades at 7x the 2023 EBITDA consensus of $415.5 million and 6.4x the 2024 EBITDA consensus of $454.9 million.

From a P/E perspective, it trades at 10.9x 2023 EPS estimate of 71 cents. Meanwhile, it's valued at about a 9.3x 2024 EPS estimate of 83 cents.

The company is projected to see revenue growth of 8% this year and 6% next year.

The stock’s multiple is below where it has been over the past 5 years, but above where it traded in 2015 and 2016. It trades at a large discount to its U.S. counterparts, which generally are getting twice the multiple.

ARCO Historical Valuation (FinBox)

Conclusion

Despite ARCO’s strong 2022, the stock hasn’t done much over the past year, or the past 5 years for that matter. The stock carries risk, but given the valuation discrepancy versus its U.S. peers, the stock should perform well if the company can turn in another solid year of growth. It has some growth drivers, now it just needs to execute and outpace inflationary and currency impacts.

I see upside to around $12, which would be an under an 8.5x multiple on the 2024 EBITDA consensus. Of course, the stock goes into the high risk/reward bucket.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.