Enphase Energy: GARP At Buying Level

Summary

- Enphase Energy is a leader in efficient and data-driven inverters in the solar industry.

- The solar industry is growing fast, and Enphase’s serviceable addressable market is expected to reach $23 billion by 2025, bringing its market share to 22%.

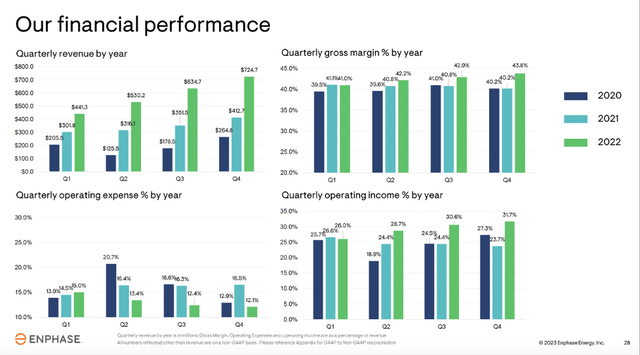

- In Q4 2022, revenues grew 76% year-on-year, and the operating profit margin increased from 24% to 32%.

- The introduction of the new IQ8 family of micro-inverters, IQ load controller, EV Charger, Fuel Cell, Grid Services, and Software contributed to the increased revenues compared to 2021.

- ENPH stock appears attractively valued based on the PE ratio and PS ratio, provided growth continues.

Sundry Photography

Introduction

Earlier in December 2022, I wrote an article about Enphase Energy (NASDAQ:ENPH), which is well positioned in the solar megatrend. Its sales have increased an average of 48% over the past 4 years, growing rapidly and gaining market share.

It is one of the main leaders in the PV inverter and battery industry thanks to its innovative inverters that can greatly increase the efficiency of solar panels. Each panel can operate independently and users can monitor data from each panel. This enables proactive maintenance that increases uptime and energy production.

A leading energy technology company in the world. (Enphase Energy's investor presentation)

I was a big supporter of Enphase Energy in my previous article. However, I thought the stock was rather expensive in this high interest rate environment with a price to FCF ratio of 77. Now, the stock has lost about half of its value in just 4 months, making its valuation favorable.

Its Serviceable Addressable Market Is Expanding Rapidly

Through 2029, analysts predict that the global solar market will expand at a CAGR of 7%. Enphase's serviceable addressable market is massive because it caters to large-scale energy consumers such as utilities, businesses, and institutions but also many consumers. According to Enphase, the serviceable addressable market will reach $23 billion by 2025, bringing Enphase's market share to 22%.

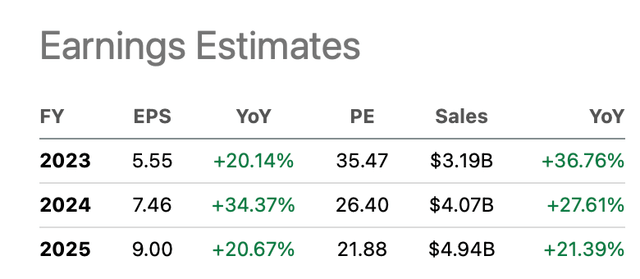

Analysts have raised their revenue expectations since my December article. Back then, analysts predicted Enphase's revenues would reach $4.7 billion by 2025. Now, they are forecasting revenues of up to $5 billion. Due to its infinite energy potential and low environmental impact, solar power is a cornerstone of the clean energy transition. Governments are offering incentives to encourage consumers and businesses to switch to solar energy. This is driving strong growth in the overall addressable solar market. Enphase Energy is strongly positioned in a growing market.

Enphase Energy has an international presence in North America, Europe, Asia and Australia. Mainly North America is Enphase's dominant market, about 76% of sales are generated here. In the fourth quarter, sales increased 15% in North America and 21% year-on-year in Europe. Only one customer accounted for about 37% of annual sales, which does pose a risk for Enphase. Enphase does not sell directly to consumers, but to solar distributors who combine their products with other products such as solar panel products and racking systems and the like. They also sell directly to large installers, OEM, and strategic partners. These OEM customers are solar module manufacturers who integrate Enphase's microinverters into their solar module products.

The new Enphase Energy Systems with IQ8 microinverters shipped in the fourth quarter of 2021 to customers in North America and last quarter also to customers in France and the Netherlands. Government incentives will support consumers to invest in solar panels. For the United States, the ITC offers a 30% tax credit from 2022 to 2032, up from 26% previously. France and the Netherlands also have government incentives. France has no tax rebate on the installation of solar panels but does have a government subsidy when consumers also feed energy back into the grid. The Netherlands levies 0% VAT on solar panels installation starting in 2023, giving consumers a 21% discount. They can also take advantage of the energy savings loan; the interest on this loan may be tax deductible. These savings provide encouragement for consumers to invest in solar panels and are a strong growth catalyst for Enphase Energy.

Strong Results, High Margins

Enphase Energy provides reliable inverters, hardware and software solutions to PV users worldwide. It has built a solid reputation for quality and reliability and offers users insight into its solar panel and maintenance schedules.

Enphase Energy is growing strongly in an expanding market, its revenue has grown at a CAGR of 48% over the past 4 years.

In the fourth quarter of 2022, revenues increased 76% year-on-year and the operating profit margin increased from 24% to 32%. The introduction of the new IQ8 family of microinverters, IQ load controller, EV Charger, Fuel Cell, Grid Services and Software contributed strongly to the increased revenue compared to 2021. Enphase expanded its product portfolio and increased its potential per home from $9,000 to $12,000 per home. Many analysts are positive about the outlook and expect earnings per share to rise 20+% per year and revenue to rise 25+% per year. Enphase is now highly profitable and many industry analysts are optimistic about its prospects.

Enphase's financial performance (Enphase Investor Presentation)

Valuation Now At Buying Level

Although I was of the opinion in December that the stock is expensively valued, I think differently now. We can see from the rising operating margin that Enphase Energy is still in the growth phase, so I place less value on valuing ENPH stock based solely on earnings.

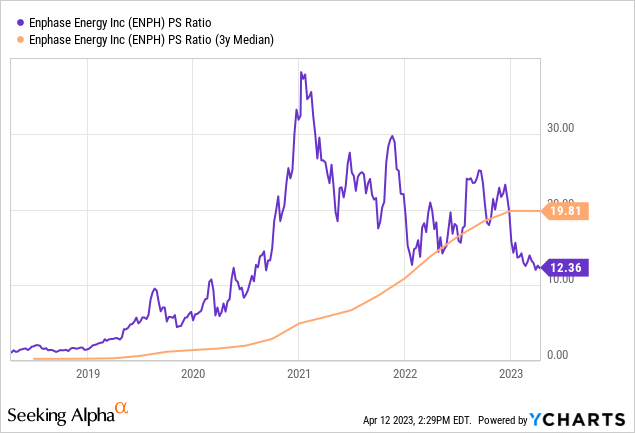

Another way to value the stock is to look at the average price to sales ratio and multiply it by the expected near-term revenue. The price to sales ratio now stands at 12, a sharp discount compared to the past 2 years. In fact, the PS ratio peaked at nearly 40x in early 2021. The average PS ratio is 19.8, quite expensive in my opinion. Still, Enphase is achieving strong gross margins and analysts expect strong revenue growth of up to 25+% per year for the next few years. For fiscal 2025, they expect sales of $5 billion. Take a fair PS ratio of 10x times and we arrive at a market value of $50 billion for fiscal 2025. With the current market capitalization of $27 billion, a solid share price gain is expected (CAGR of 23%). Based on the PS ratio, Enphase appears attractively valued.

Investors may be skeptical if they look at YCharts below and see that the PS ratio was significantly lower in 2019. But gross margins were also not as high as they are today (30% gross margin vs. 43% today). Now Enphase is quite profitable so a higher PS ratio makes sense.

About 30 analysts have strong expectations for the coming years and expect earnings per share to grow 20+% annually. The non-GAAP PE ratio is expected to be 21.9 in fiscal 2025, representing an earnings yield of 4.5%. Its earnings per share are expected to continue to grow solidly. I think the forward PE ratio of 21.8 is very favorable with earnings growth of 8+%. In fact, Enphase's earnings are expected to grow 21% by 2025. The stock also seems very attractively valued based on the PE ratio, provided growth continues.

Enphase's earnings estimates (Enphase ticker page on Seeking Alpha)

Conclusion

Enphase Energy is a leader in efficient and data-driven inverters in the solar industry. The solar industry is growing fast and Enphase’ serviceable addressable market is expected to reach $23 billion by 2025, bringing its market share to 22%. Its revenues have grown at a CAGR of 48% over the past 4 years. In Q4 2022, revenues grew 76% year-on-year and the operating profit margin increased from 24% to 32%.

The introduction of the new IQ8 family of micro-inverters, IQ load controller, EV Charger, Fuel Cell, Grid Services and Software contributed to the increased revenues compared to 2021. Enphase is now highly profitable and many industry analysts are optimistic about its prospects.

Enphase Energy is now at a buy level, with the PS ratio now at 12, a sharp discount from the past 2 years. Analysts expect strong revenue growth of up to 25+% per year over the next few years. The 2025 forward PE ratio of 21.8 compares favorably with earnings growth of 25+% per year. ENPH stock appears attractively valued based on the PE ratio and PS ratio, provided growth continues.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ENPH over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.