Ardmore Shipping Is Riding Some Powerful Tailwinds

Summary

- ASC is riding some powerful market trends at the moment as spot rates have soared this year.

- Company management smartly shifted to the spot market at just the right time.

- Investors can ride this powerful wave for now.

Tony Cane-Honeysett/iStock via Getty Images

Ardmore Shipping (NYSE:ASC) is riding some powerful waves that should help it generate outsized earnings in the near to medium term.

Company Profile

ASC owns a fleet of mid-sized refined products and chemical tankers. As of mid-March, it operated a fleet of 29 vessels. It owns 22 vessels and operates two vessels under commercial management agreements and five under time charter-in contracts.

Of the vessels it owns, 21 are built with an eco-design to improve fuel efficiency, while the other ship was upgraded to an eco-mod design in 2014. Its newbuild ships are built in South Korea and Japan.

ASC says its customers include oil majors, national oil companies, oil and chemical traders, chemical companies, and pooling service providers. It has no employment arrangements with third-party or related-party commercial managers. It gets technical management services through its 50% joint venture AASML. Otherwise, it has no related-party transactions.

Opportunities and Risks

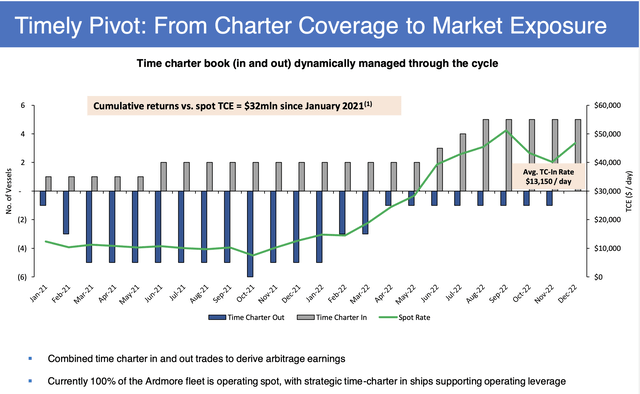

All of ASC’s vessels currently operate on the spot market, thus spot transport prices for refined products and chemicals are one of the biggest drivers of ASC’s business. However, this hasn’t always been the case, and the company will navigate between spot exposure and time charters.

The company smartly moved its exposure to the spot market coming out of the pandemic, which helped it generate a nice amount of additional revenue. While this was a great move, it also shows the importance of management making the right decisions. That adds both opportunity and risk to the business.

Discussing this move at its analyst day, COO Gernot Ruppelt said:

“Allow me to explain what we are looking at here. The green line is the spot market. The bars in blue are the number of ships we had on time chartered out. The bars in gray are the number of ships we have time chartered in. As you can see here, looking at the green line, markets were low in 2021. The work was still affected by restricted mobility due to the COVID pandemic. Then markets started to recover last winter and continue to accelerate as of last spring. 2021, when markets were weak, as you can see here, bars in blue, we had a very meaningful amount of TC cover. Starting last winter, we started to take redelivery of those ships, and we put them back in the spot market. At the same time, we extended and expanded our time charter-in position, so we increased our market exposure. Our average TCN rate at the moment is just above $13,000 a day, and we calculated that over a 2-year period, TC versus spot created about $30 million in value.

“Now, of course, we did not predict the Russian invasion of Ukraine. But as the world was recovering from the pandemic and the global need for mobility was on the upswing, we felt there was more upside to the market, and certainly more than what the going time charter rates were pricing in at that time, set us to pivot from a more defensive position to more market exposure. We will now look at some spot voyages in a bit more detail to give you a better sense of how our business works and how we trade our ships.”

Now the global economy and geopolitical events can all influence market rates. China re-opening should lead to greater demand, which should support prices. At the same time, the Ukraine-Russia conflict and subsequent Russian oil price cap is also playing a huge role on rates and routes.

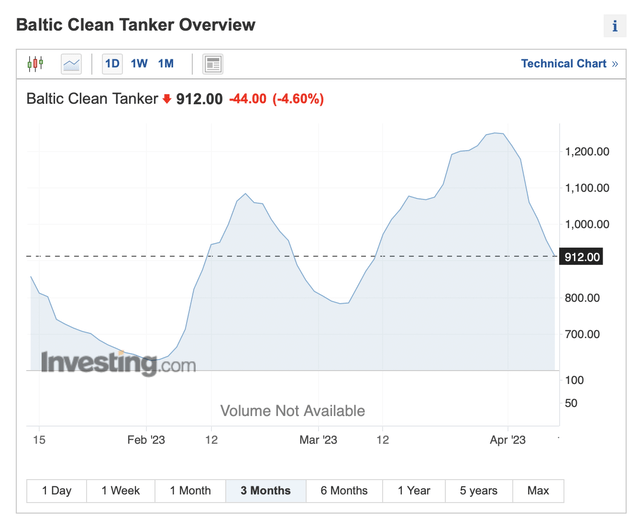

The length of routes have tripled in many cases, as Russia finds new outlets for refined products to places like Brazil and the U.S. ships to Europe. The Clean Tanker index, which measure freight costs for shipping refined products, meanwhile, at one point doubled since the price caps went into effect in early February. The index has since given back some of its gains this month. With its vessels getting spot rates on the open market, ASC should be a big beneficiary of this dynamic in the short run.

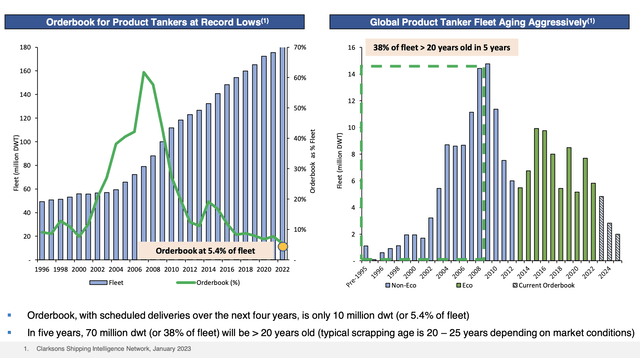

In addition to economic and geopolitical factors, the supply of ships also plays a big role in market rates, especially over the long term. Shipping intelligence firm Clarkson estimates that 38% of the products fleet with be over 20 years old within 5 years. Ships typically get scrapped between 20-25 years, although will be in service longer when the market is strong. Meanwhile, the current order book is at record lows. That’s a good dynamic for a company like ASC, which should keep rates at nice levels for a while.

Company Presentation (Clarkson)

With outsized earnings in the near term and a solid medium-term backdrop, ASC should be able to continue to reduce debt, pay a nice dividend, and invest in its fleet. ASC reduced its debt by more than half in 2022, taking it down to $160.8 million at the end of the year. It also reintroduced a dividend, paying out a 45-cent quarterly dividend, good for a 12% yield. In the current environment, the dividend is well covered (1.6x) and ASC should be able to sustain it for the next couple of years based on current analyst projections. However, while management has said it is sustainable through the shipping cycle, I would look at the dividend more as a bonus, as it will likely depend on market conditions and spot rates in my view.

In the current market, the company also has the ability to invest in projects that improve its fleet, such as adding variable speed drives to reduce a vessel's electrical load and corresponding fuel consumption.

Longer term, ASC is also looking for non-fossil fuel transport to be a growth driver in the future. In 2022, 28% of its business included the transportation of non-fossil fuel cargo. That can include things like vegetable oils, and the company plans to take a proactive approach working with customers in energy transition projects.

Valuation

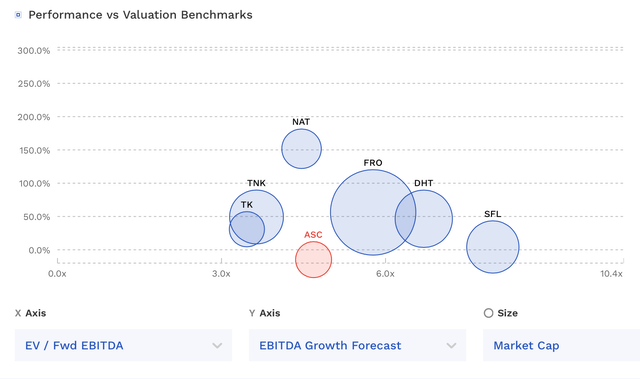

ASC trades at 4.5x the 2023 EBITDA of $170.6 million and 6x the 2024 EBITDA consensus of $128.6 million.

ASC stock trades towards the middle of other marine shipping companies.

ASC Valuation Vs Marine Shipping Peers (FinBox)

Conclusion

ASC is riding some powerful market trends at the moment. Company management smartly shifted to the spot market at just the right time, which should lead to some robust numbers in the near term. Even with the potential global economic slowdown, the combination of the impact Russian oil price caps and China re-opening should benefit shipping rates for quite a while.

Taking into consideration a more normalized environment, ASC is probably trading at a fair valuation. In shipping, outsized rate don’t usually last too long, as more ships get ordered and the supply-demand dynamics swing the other way. However, in this case, there is no indication of a lot of new orders, which is a positive longer out.

While I think ASC is fairly valued, I think the combination of the current market and its nice dividend make it a “Buy” in the short to medium term. However, this isn’t a stock to tuck away and forget, as the market will eventually shift.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.