ASML Holding: A Buy For Your Dividend Growth Portfolio (Rating Upgrade)

Summary

- ASML Holding is a leading manufacturer of equipment for the semiconductors industry with a monopoly on EUV machines.

- Shares of ASML are trading for a premium, yet I believe that the premium is justified.

- While there is little margin of safety when it comes to ASML, the current opportunities are enough to justify a BUY rating.

Sundry Photography

Introduction

As an investor focused on dividend growth, I constantly search for fresh prospects to invest in income-generating assets. Whenever I encounter attractively valued existing positions, I frequently add to them. Furthermore, I capitalize on market volatility by opening new positions to broaden my portfolio and enhance my dividend income with reduced capital.

The information technology sector is attractive following its weakness in 2022. I believe that ASML Holding (NASDAQ:ASML) is interesting in particular. The decline in the IT sector has decreased the valuation of different companies. Some blue-chip companies have become more attractive to investors. I rated ASML in August. Since then, shares have outperformed the market. It is time for me to revisit the company.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company's fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it's a good investment.

Seeking Alpha's company overview shows that:

ASML Holding develops, produces, markets, sells, and services advanced semiconductor equipment systems consisting of lithography, metrology, and inspection systems for memory and logic chipmakers. The company provides extreme ultraviolet and deep ultraviolet lithography systems comprising immersion and dry lithography solutions to manufacture various semiconductor nodes and technologies. It also offers metrology and inspection systems, including YieldStar optical metrology solutions to assess the quality of patterns on the wafers and HMI e-beam solutions to locate and analyze individual chip defects. In addition, the company provides computational lithography and lithography process and control software solutions.

Fundamentals

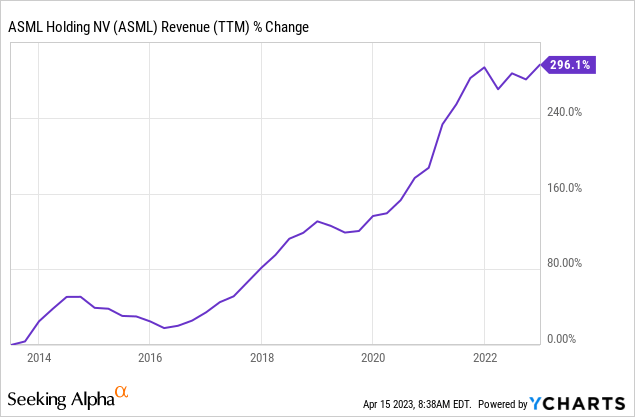

Revenues of ASML have been up by almost 300% over the last decade. It means that sales have quadrupled as the demand for semiconductors increases. As our life becomes more digital and we use more smart devices, the semiconductor demand grows. As a leading manufacturer of equipment used to create these chips, ASML has capitalized on it. In the future, as seen on Seeking Alpha, the analyst consensus expects ASML Holding to keep growing sales at an annual rate of ~18.5% in the medium term.

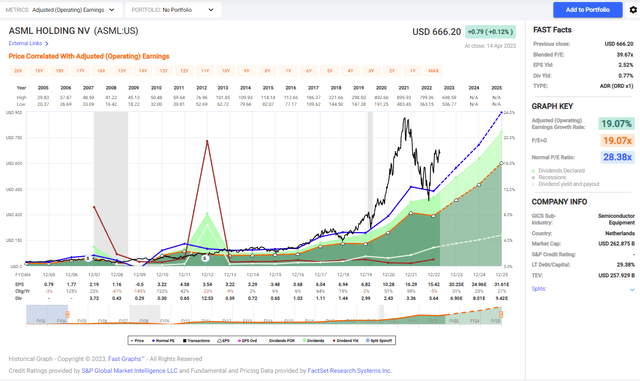

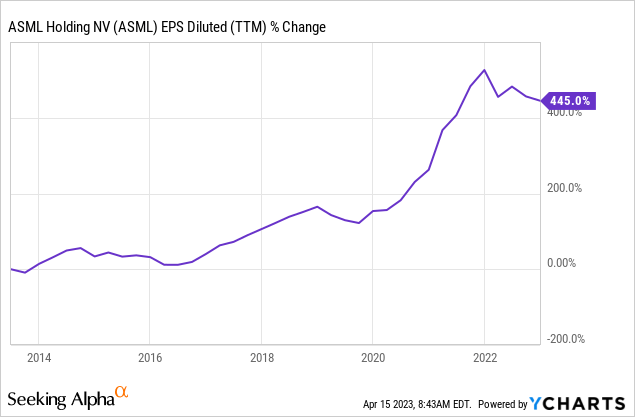

The EPS (earnings per share) has grown even faster. Over the last decade, the EPS has been up 445%, which means it has more than quintupled as the demand for semiconductors grows. In addition to sales growth, the company has lowered costs, improved efficiency, and bought back its shares to support EPS growth. In the future, as seen on Seeking Alpha, the analyst consensus expects ASML Holding to keep growing EPS at an annual rate of ~28.5% in the medium term.

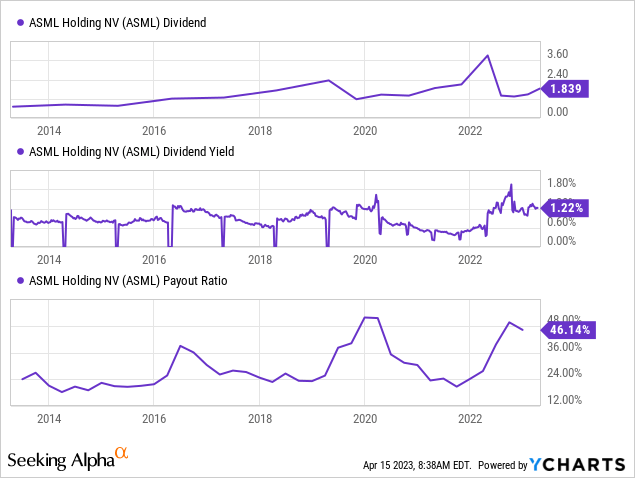

The dividend of ASML has grown annually over the last 13 years. Investors should take into account the fact that the dividend is paid in Euros. Therefore, it might fluctuate and even decrease in USD. So far, there has been no dividend decline due to currency fluctuations, as the dividend growth rate exceeds the changes in the currency markets. Over the last decade, the annual dividend growth rate has been 22%. Over the last five years, it was even faster at 33%.

The dividend seems safe, with a payout ratio of 46%. The graph below shows that the dividend payout ratio is cyclical, yet the company maintains it below 50%. As expected by the analysts, the robust growth rate of the EPS will push down the payout ratio. This robust growth rate means that there is plenty of room for dividend growth while lowering the payout ratio. While the current yield is 1.2%, investors can enjoy an income that outpaces the inflation rate significantly.

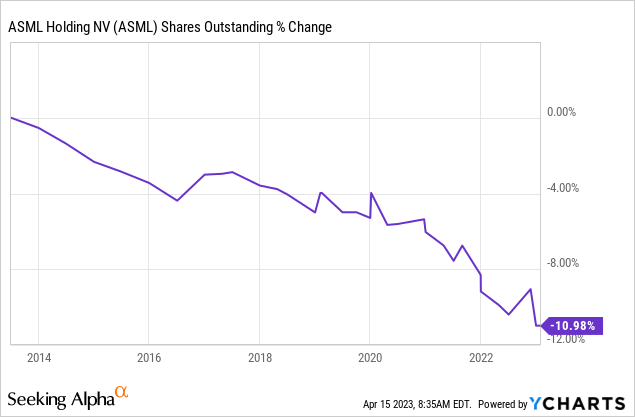

In addition to dividends, ASML also returns capital to its shareholders via buybacks. These share purchase plans are the majority of its capital return policy. The company prefers buybacks as they are more discretionary than dividends, and while dividend reduction suffers from a bad reputation, buyback reductions are more understood by investors. Over the last decade, the company has decreased the number of shares by 11%, supporting EPS growth. As the valuation today is more attractive, buybacks are more efficient.

Valuation

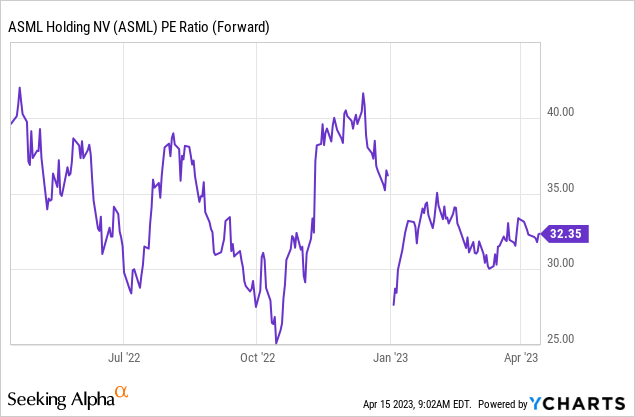

The company's P/E (price to earnings) ratio stands at 32 when using the forecasted EPS for 2023. While this is not a low valuation, it is lower than what we have seen with ASML over the last twelve months, as the graph below shows. The company offers robust growth with great expectations for the medium term. Therefore, investors are giving it a premium. In August, when I looked at the company, shares traded for 37 times forward earnings.

The graph below from FAST Graphs suggests that the shares are trading for a fair valuation when considering the expectations. Since 2005, the average P/E ratio was 28.4, lower than the current P/E ratio. However, the average annual growth rate was 19%. The current exceptions for the medium term are an average growth rate of 28, and therefore, I believe that the current premium is justified.

Opportunities

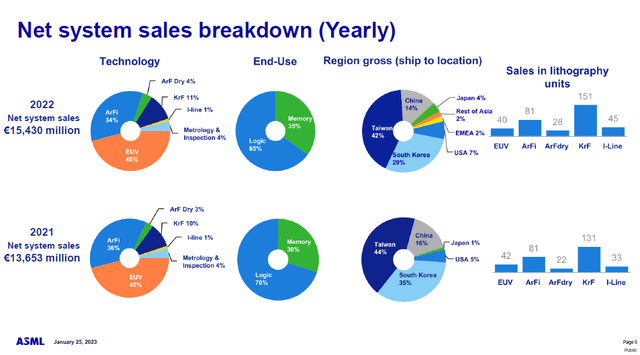

ASML enjoys significant diversification across the board. It has diversified clients from across the globe, with Taiwan and South Korea leading the pack. It supplies equipment to create logic and memory to provide a variety of chipmakers. It also sells various products that can be used for different uses, with most of its sales being EUV equipment, which the company is the only one capable of making.

Moreover, the company enjoys the trends in technology that require significant amounts of chips. These tech advancements are crucial, and they all support ASML's growth. The 5G deployment requires almost ten times more antennas, and the IoT (Internet of Things) revolution will mean that there will be more connected devices to the 5G network. The AI (artificial intelligence) revolution will mean that there will be a higher demand for processing power. While Nvidia (NVDA) is poised to capitalize on it, ASML will sell the equipment to its manufacturer, TSMC (TSM).

As the markets of artificial intelligence, 5G connectivity, augmented reality, and the Internet of Things expand, consumers worldwide are using ever-more powerful and sophisticated devices that are increasingly interconnected.

These developments drive demand for microchips, which in turn drive demand for the chipmaking systems that produce smaller, faster, cheaper, more powerful, and energy-efficient microchips. We can only meet this demand by consistently and continuously advancing our technology.

(ASML Website)

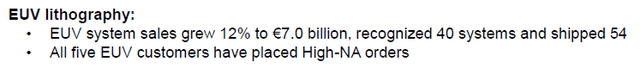

ASML has a monopoly when it comes to manufacturing EUV machines. This technology is applied when manufacturing the most advanced microchips. ASML has five customers using these machines and is the only company that can produce them. Therefore, as the demand for sophisticated semiconductors grows, higher demand for EUV machines will increase by 12% in 2022.

Risks

Exposure to Taiwan is a long-term risk for ASML. China has been eyeing Taiwan for a very long time. It has been conducting military drills next to the island, violating its airspace. While the prospect of a war in the Pacific seems unlikely, it is still a risk for ASML as almost 50% of its sales come from Taiwan. A possible war between Taiwan and China will put a significant portion f its sales at risk.

ASML faces the risk of competition outside the EUV space. Firms like Lam Research (LRCX) and KLA (KLAC) offer products and services for the semiconductor industry, like ASML. While ASML dominates the EUV market, Lam Research and KLA offer, for example, products and services related to metrology, critical components in the semiconductor manufacturing process. The competition in these areas is intense, and all companies compete for higher market share.

Another risk is the current business environment combined with the current valuation of ASML. Shares of ASML trade for a premium. The premium is justified, yet it will only be justified if the company's sales and EPS outlook remain solid. A recession may lower expenditures on microchips as consumers cut spending, and with little margin of safety, shares of ASML may decline.

Summary

Back in August, I rated the shares of ASML as a HOLD due to its very high valuation that left investors a tiny margin of safety. Since then, shares have increased more than 30%, and the risks have not materialized. What also happened is that EPS has grown at a faster pace making the shares cheaper than they were back in August. Therefore, I believe the shares are a BUY at the current valuation.

ASML Holding has solid fundamentals, a valuation closer to its average, and plenty of growth prospects. The shares are attractive despite the risks surrounding a possible recession and market weakness. The tension between China and Taiwan is still a long-term challenge, but I don't think they are enough to avoid the company. Therefore, I raise my rating to BUY.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ASML, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.