Trending Topics

Govt’s benefits to banks hinge on credit-deposit ratio

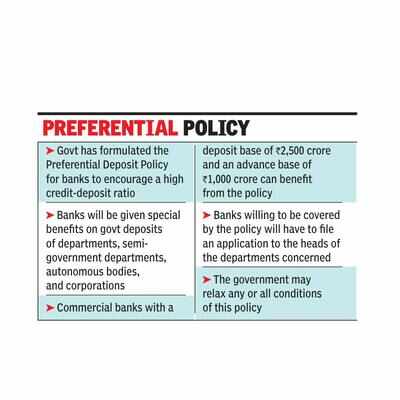

Panaji: The state government has formulated the Preferential Deposit Policy for Banks, 2023, to encourage banks to maintain a high credit-deposit (CD) ratio. Pranab Bhat, undersecretary, finance, said that any bank with branches in Goa which figures in the Top 5 in the state in terms of the highest CD ratio will be granted benefits under the policy.

The policy was formulated on Thursday.

Bhat said that such banks shall be given special treatment when it comes to the deposits of the government departments, autonomous bodies, and corporations, as well as the deposits of semi-government departments. The eligible banks shall be allowed to match the highest interest rate quoted for deposits by any bank, provided the quoted rate is within 0.5% of the highest quoted rate of non-eligible banks.

“If more than one eligible bank falls within the range, the bank with the highest CD ratio shall be preferred,” Bhat said.

A Scheduled Commercial Bank in Goa with a deposit base of Rs 2,500 crore and an advance base of Rs 1,000 crore can benefit from the policy.

Banks willing to be covered by the policy will have to file an application to the heads of the departments concerned after the quotes for interest rates have been opened. The banks will also need to secure the confirmation from the State Level Bankers’ Committee that they figure in the Top 5 in the state as far as the CD ratio is concerned.

Bhat said that the government may relax any or all conditions of this policy. “If any question arises regarding the interpretation of any clause, word, or expression of this policy, the decision shall lie with the government, which shall be final and binding on all concerned,” he said.

All issues relating to the eligibility, definitions, and operationalisation, or issues not envisaged at the time of the formulation of the policy will be resolved by the government of Goa.

The policy was formulated on Thursday.

Bhat said that such banks shall be given special treatment when it comes to the deposits of the government departments, autonomous bodies, and corporations, as well as the deposits of semi-government departments. The eligible banks shall be allowed to match the highest interest rate quoted for deposits by any bank, provided the quoted rate is within 0.5% of the highest quoted rate of non-eligible banks.

“If more than one eligible bank falls within the range, the bank with the highest CD ratio shall be preferred,” Bhat said.

A Scheduled Commercial Bank in Goa with a deposit base of Rs 2,500 crore and an advance base of Rs 1,000 crore can benefit from the policy.

Banks willing to be covered by the policy will have to file an application to the heads of the departments concerned after the quotes for interest rates have been opened. The banks will also need to secure the confirmation from the State Level Bankers’ Committee that they figure in the Top 5 in the state as far as the CD ratio is concerned.

Bhat said that the government may relax any or all conditions of this policy. “If any question arises regarding the interpretation of any clause, word, or expression of this policy, the decision shall lie with the government, which shall be final and binding on all concerned,” he said.

All issues relating to the eligibility, definitions, and operationalisation, or issues not envisaged at the time of the formulation of the policy will be resolved by the government of Goa.

Start a Conversation

FOLLOW US ON SOCIAL MEDIA

FacebookTwitterInstagramKOO APPYOUTUBE