DIV: Out Of Favor Amid The Tech-Led Rally

Summary

- The high-dividend factor has lagged so far in 2023.

- With growth stocks soaring in recent months, low-quality high-yielders have sagged.

- With a solid valuation, the technicals lean bearish.

courtneyk

The high-dividend factor has been highly problematic for yield-hungry investors in 2023. In fact, few smart beta strategies have worked since mega-cap growth has reigned supreme this year. If you’ve been underweight tech, you have likely underperformed within your domestic allocation.

Still, with the Fed perhaps cutting interest rates later this year, high-payout equities could once again return to favor. For now, though, I am a hold on DIV.

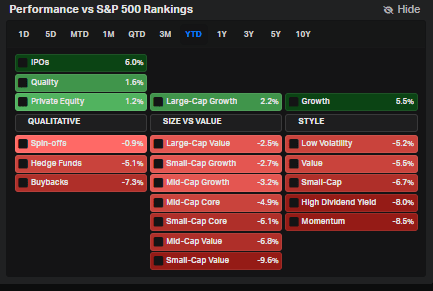

2023 Factor Returns: Dividends Soft

Koyfin Charts

According to the issuer, the Global X SuperDividend U.S. ETF (NYSEARCA:DIV) offers investors access to 50 of the highest dividend-paying equities in the United States, potentially increasing a portfolio’s yield. Distributions are paid monthly and have been for more than 10 years. Here's how DIV works: The ETF’s index screens for stocks that exhibit low volatility relative to the S&P 500 while also finding stocks that have the beefiest yields.

DIV is a decent-sized fund with more than $630 million in assets under management and it sports an expense ratio that is moderate at 0.45% - that’s higher than other broader dividend-focused index funds, but still not too steep considering DIV pays a 7.2% trailing 12-month yield – much higher than bigger index dividend funds.

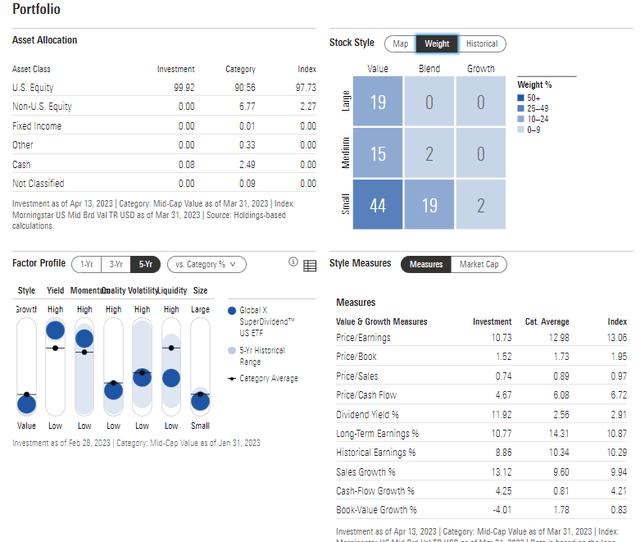

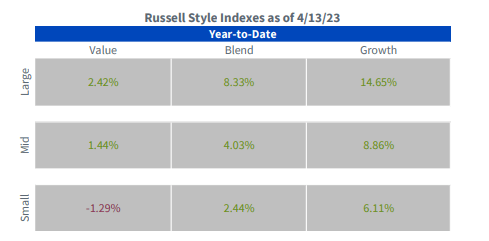

DIV will always hold 50 positions and it currently has a 0.12% 30-day median bid/ask spread. So, it is wise to use limit orders during periods of light liquidity in the market. Digging into the portfolio, data from Morningstar show that owning the ETF means taking an active bet on small caps and the value style. Notice in the Style Box below, that 44% of the allocation is positioned into small-cap value. That has been a weak spot in the market this year, sharply underperforming large-cap growth (image below).

With high factor exposure to value and yield, when tech and discretionary produce alpha, expect DIV to be weak. Also, the fund is of low quality, so the balance sheets of the fund’s holdings are not all that strong. The upside is that DIV has a low forward P/E barely above 10 while Global X notes that the forward price-to-book ratio is 1.65. Also, DIV has proven itself to be a low-volatility fund with a 0.82 beta against the SPX.

DIV: Focused On Small-Cap Value, Low Valuation

Small-Cap Value: Red YTD

WisdomTree

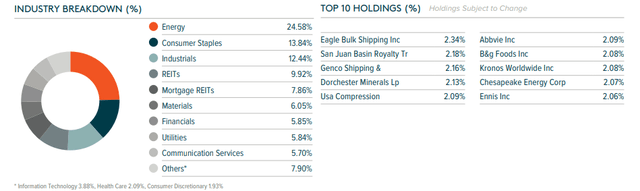

DIV: High On Energy, No Tech

Sector-wise, another active wage is placed in the Energy sector. While Energy is less than 5% of the S&P 500, the resource-rich niche is nearly a quarter of DIV while defensive Consumer Staples is another overweight. There is no exposure to the Information Technology sector nor Consumer Discretionary.

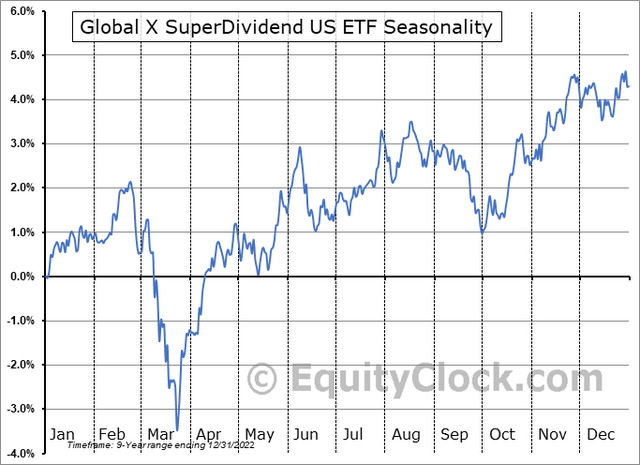

Seasonally, DIV tends to rise steadily from mid-April through year-end in the fund’s 9-year history, according to data from Equity Clock. The February and March timeframe is, on average, volatile, but the balance of the year has been a steadier ride.

DIV Seasonality: Steady Rise Starting in Q2

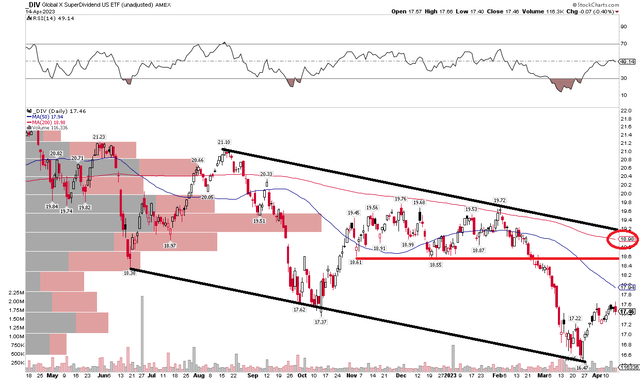

The Technical Take

I concede that technicals on a high-yield play like DIV are not quite as important since investors are focused on the income return, not so much on the price performance. Still, people remember what they paid for any ETF, so monitoring the charts is still an important part of the analysis. In this case, the fund has been in a protracted downtrend over the last year-plus.

I see support at a downtrend line, currently near $16 while resistance is found just above the falling 200-day moving average under $20. Overall, I would be a buyer on a dip to the $15 to $16 range but would avoid the fund at current levels.

DIV: A Pronounced Downtrend, Falling 200-dma

The Bottom Line

I like the valuation of DIV but the momentum is on the side of the bears. So, there are mixed signals. I am a hold on the fund right now but would go long about 10% lower from Friday’s close.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.