Broadwind, Inc.: Intriguing Growth But The Valuation Is Too High

Summary

- Broadwind, Inc. has been able to report some stellar revenues in the last earnings call but had unfortunately a negative bottom line.

- The industry it's operating in is growing at a rapid pace and Broadwind should be able to capture some of that momentum.

- But the company has been diluting shares and the bottom line is inconsistent which makes me rate it a hold instead of a buy for now.

tianyu wu

Investment Summary

Broadwind, Inc. (NASDAQ:BWEN) is a leading manufacturer of wind turbine components and industrial weldments. The company has a variety of products and services, including gears and gearboxes, towers, and welded fabrications, as well as maintenance, repair, and refurbishment services for wind turbines.

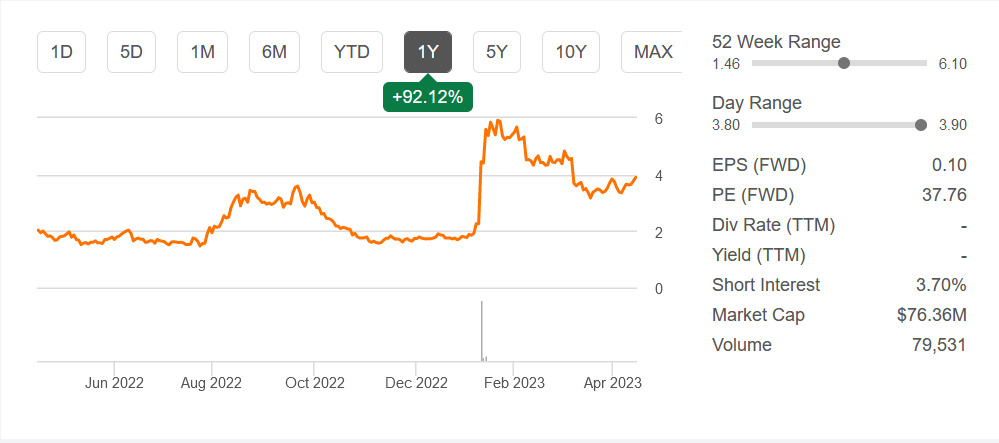

Stock Price (Seeking Alpha)

The last earnings report really highlighted the potential of the company and its ability to quickly grow and perform despite ever more challenging economic environments. With a 54% increase in revenues, it helped the share price jump drastically which unfortunately means the current price is a bit too high. I think the valuation is too rich and it exposes a portfolio to too many risks as valuation compression very well might happen. Because of this, I will rate the company hold for now.

Market Overview

The global electric equipment market has a bright future where there is the possibility of a lot of growth happening. According to a report by researchandmarkets, the industry is estimated to experience a 10.2% CAGR between 2022 and 2026 indicating a higher demand for the products and the possibility of companies like BWEN capitalizing greatly.

Market Outlook (ResearchandMarkets)

The optimism was felt in the earnings report as well for the industry as a whole. The CEO Eric Blashford said the following “Our backlog sits at a near-record high entering the first quarter 2023”. I think this is great for investors to say because it also highlights the demand the industry is seeing. Which is directly reflected in the revenue increases that Broadwind saw. I think that the market trends will continue and that most companies will be able to also keep up good margins as inventories shouldn't be stacking up and creating a liability instead.

Quarterly Result

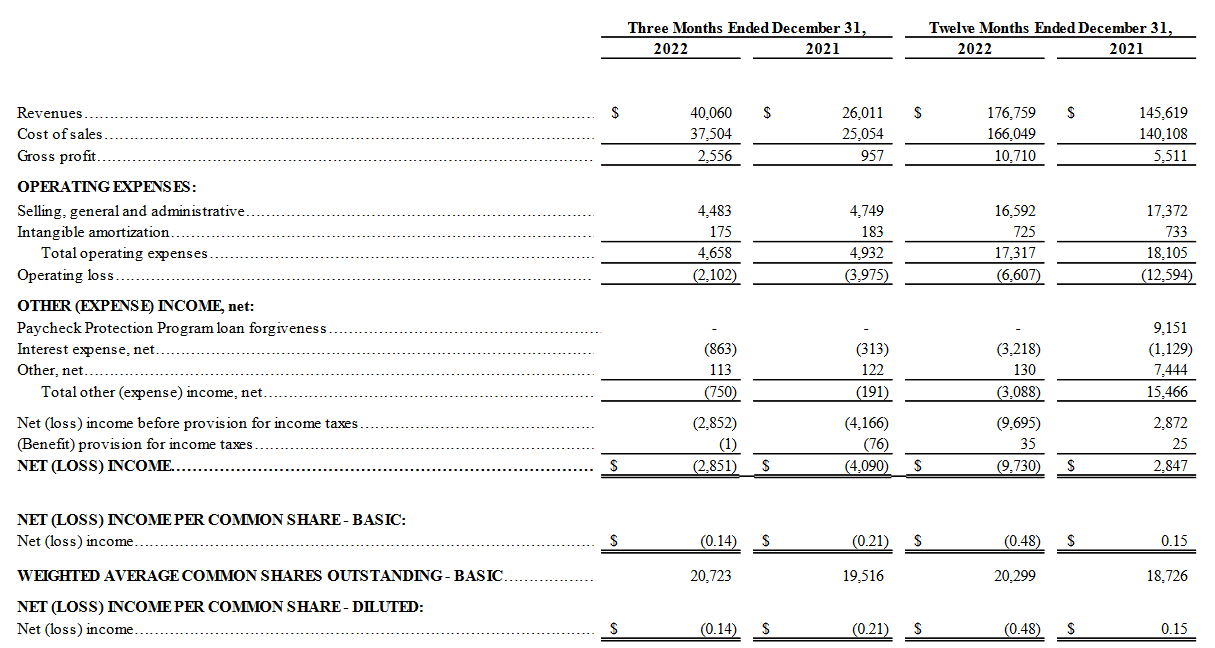

Broadwind, Inc. has recently published its earnings report for the year ending December 31, 2022. According to the report, the company's revenues showed a significant increase, reaching $176.8 million, compared to the $145.6 million reported in the previous year. However, the company still faced an operating loss for the year, albeit a slight improvement from the previous year's loss, amounting to $6.6 million. I think that the report highlighted some underlying issues of being a small company in a fast-growing industry. Often the cost of sales is very high as the company hasn't been able to establish its framework which it can then leverage further and better. I think the biggest risk is disappointing margins in the coming reports. But we will have to wait to see how it fleshes out.

Income Statement (Earnings Report)

The company's net loss per common share was $0.48, compared to net income per common share of $0.15 in the previous year. While I think the company's revenues increased impressively, the operating expenses continued to remain high which makes me worried about the coming few quarters and whether the valuation right now is going to tank as Broadwind isn't able to keep up the same margins and they slip even further down into the negatives.

Risks

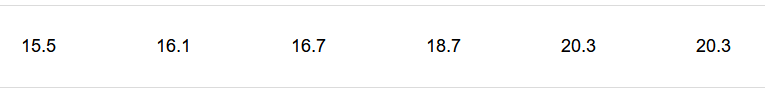

With Broadwind, Inc. I think some of the major risks is the share dilution happening. I am actually quite bullish on the revenue growth for the company and I can see them growing faster than the industry or at the very least at the same pace. But the margins haven't been consistent and this makes me worried about the future performance. Inconsistent and negative net incomes make it hard to not dilute shares to raise capital.

Shares Outstanding (Seeking Alpha)

Looking at the balance sheet the company seems to have made significant steps towards trying to get into a healthier state. The cash the company holds increased drastically from $852 thousand to above $12 million. What makes me believe the company will continue diluting shares is also because of the not fast enough decrease in operating expenses. The company might be increasing revenues YoY but the margins aren't increasing fast enough. Operating expenses were $17 million in 2022, resulting in a net loss of $6.6 million. With the current cash position that's only 2 years of operations left if these numbers continue. That might be the biggest reason I believe share dilution will be continuing.

Pair that with a high forward valuation too and I think there is too much risk right now in buying shares in the company. I am confident they will be able to continue their fast growth but buying at the right prices is also very important.

Valuation & Wrap Up

Looking at the valuation of the company I have already mentioned frequently throughout the article that I think it's too high and overvalued right now. Trading at around 37x forward earnings presents a lot of risks to investors.

Compared to some peers like Power Solutions International, Inc. (OTCPK:PSIX) which has a much lower valuation of around 15 forward earnings but also a positive bottom line. This company also offers exposure to the same market trends as Broadwind and I think that for the investor who doesn't like to have too much risk in their portfolio, then PSIX might look a lot more appealing.

All in all, I think Broadwind will continue to grow very fast-paced fueled by the demands the industry as a whole is seeing. But I also want a fair price to pay, and right now it's not there. This all leads me to rate the company hold for now. Until there is a lower valuation I don't see a strong enough buy case. If I see a forward p/e around 18 and the company has managed to consistently keep a positive bottom line then I might shift my views here.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.