Broadcom: A Dividend Growth Dream

Summary

- Broadcom has a heavy customer concentration with Apple.

- However, if the VMware acquisition is approved, that would cut revenues from that source in half.

- Broadcom’s focus on networking means it is more resilient during tough macroeconomic climates.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

peshkov/iStock via Getty Images

This article was co-produced with Chuck Walston.

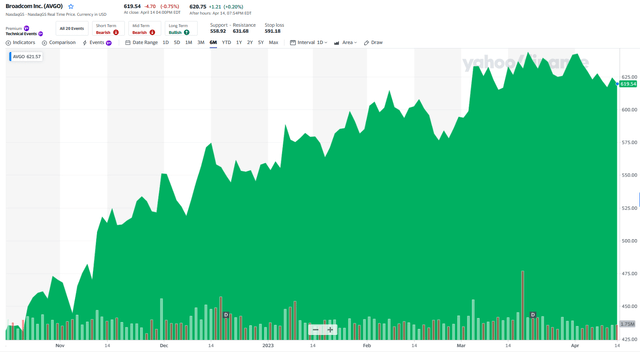

Shortly after joining the iREIT/Dividend Kings team, Chuck Walston authored an article highlighting Broadcom (NASDAQ:AVGO) as his third Strong Buy pick of 2022. Since that piece debuted, shares of AVGO are up over 44%.

Chuck's latest article on Broadcom appeared in December with a downgrade of the stock to a Buy rating.

Since then, AVGO provided Q4/FY22 results in mid-January, and they were worth “writing home to ma about.” Revenue surged 21%, EBITDA increased 27%, and FCF grew by 22% last fiscal year.

Despite those tough comps, analysts forecast 7% growth in revenue and adjusted EBITDA in 2023.

Of course, analysts’ estimates do not take into account Broadcom's planned acquisition of VMware (VMW). Assuming the VMware deal is approved, it represents a ray of sunshine on the horizon; however, a storm may be brewing in AVGO’s relationship with Apple (AAPL).

A Glance At Results

For those unfamiliar with Broadcom, simply perusing one quarter’s results can be an eye-opener. AVGO provided Q1 2023 earnings at the beginning of March. The firm beat on the top and bottom lines with revenue up 16% and non-GAAP EPS up 23%.

Here is an example of how the company can shock and awe: with $8.915 billion in revenue for the quarter, $3.9 billion of that was free cash flow, representing a margin of 44% of revenue.

The operating margin for semiconductors was 58%, and the software operating margin was 72%.

Of the company’s peers: ASML Holding (ASML), Texas Instruments (TXN), Advanced Micro Devices (AMD), Intel (INTC), Applied Materials (AMAT), Analog Devices (ADI), and Lam Research (LRCX), AVGO generates net margins that are on average nearly 50% higher.

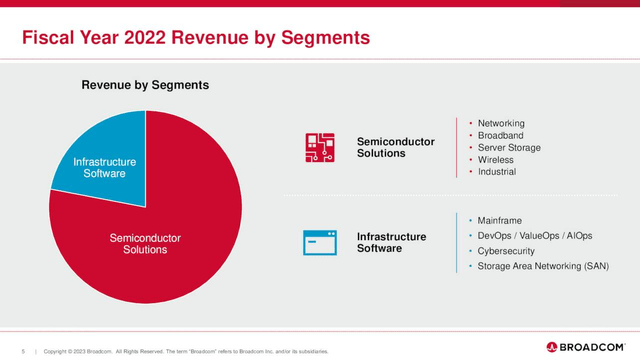

Semiconductor solutions, constituting 78% of the company’s revenue in FY2022, grew 21% year-over-year and 1% from the prior quarter.

The biggest negative in the results was that the infrastructure software segment recorded a 1% sales decline.

Those that follow AVGO are aware that CEO Hock Tan will consistently demur when asked to provide guidance beyond the next quarter.

Tan guided for year-over-year revenue growth of about 8% for Q2 2023. The forecast anticipates high-single-digit percentage growth in semiconductors and low to mid-single-digit percentage growth in software.

Tan also noted that the company is booked for fiscal 2023 and that lead times and visibility on semiconductors remains largely at 50 weeks.

Here it is important to note that Broadcom scrubs the company’s backlog. AVGO estimates customer demand and will not intentionally ship products to companies that would result in inventory exceeding a given quarter’s demand. Nor does it allow companies to cancel orders.

The strong results caught the market’s attention: AVGO shares are up over 4% since earnings debuted. However, the focus for many investors was Tan’s following commentary:

So as you know, such AI networks are already been deployed at certain hyperscalers through our Jericho 2 switches and Ramon Fabric. In fact, in 2022, we estimated our Ethernet switch shipments deployed in AI was over $200 million.

With the expected exponential demand from our hyperscale customers, we forecast that this could grow to well over $800 million in 2023. We anticipate this trend will continue to accelerate and mindful that we need even more higher performance networks in the future.

We have been investing in a new generation of this lossless low latency Ethernet fabric designed specifically to handle such data and compute-intensive AI workloads. Of course, additionally, the exciting growth prospects for generative AI are driving our compute offload accelerated business at hyperscalers.

As we have indicated to you last quarter, this business achieved over $2 billion in revenue in 2022. We are on track to exceed $3 billion in revenue in our fiscal 2023. In Q2, looking forward, short-term, we expect these tailwinds to drive our networking revenue to grow about another 20% year-over-year.

This revelation prompted Bank of America analyst Vivek Arya to state that, "Trading at just 13-14x PE, [Broadcom] provides perhaps the most compellingly valued exposure to the fast-growing generative AI market."

He was joined by Bernstein analyst Stacy Rasgon who characterized AVGO as an "AI story at a smartphone price."

AVGO: The Difference That Makes A Difference

An application-specific integrated circuit chip (ASIC) is a microchip designed for a hyper-specific task. ASICs are generally dramatically smaller, have lesser power requirements and are more performant.

Although engineering costs for ASICs can be prohibitive, manufacturing costs are generally lower when they are produced at a high scale. This creates a best of both world’s scenario for Broadcom, as it is unlikely that rivals will attempt to offer a competing product considering the initial costs involved.

AVGO’s ASICs target hyperscale cloud projects related to machine learning and AI.

With an ASIC market share of 35%, Broadcom is the market leader. In part due to AI related demand, ASIC revenue is expected to increase by 50% to $3 billion in 2023.

Broadcom’s main competitor in ASICs is Marvell Technology (MRVL).

The VMware Acquisition

Last May, AVGO announced a deal to acquire VMware. At a cost of $61 billion, the acquisition will be funded with 50% cash and 50% stock. Broadcom will assume $8 billion in net debt and add an additional $32 billion in debt to fund the transaction.

If the deal is approved, it is expected to be immediately accretive. By bringing VMware under Broadcom’s banner, management guides for $8.5 billion in annualized EBITDA within three years of the acquisition. The addition of VMware will also result in nearly half of annual revenues being generated by software.

Another positive would be that it would reduce the share of total income derived from Apple.

As I was penning these words, news hit that the European Commission sent AVGO a "statement of objections," citing concerns that the acquisition would lead to restricted competition if VMware is acquired by Broadcom.

Tan has stated that he expects regulatory approval this fiscal year, and Broadcom has gained regulatory approval from Brazil, South Africa, Canada, Germany, France, Austria, Denmark, Italy and New Zealand.

A Potential Hurricane of A Headwind

High inflation, soaring interest rates and an ever-present threat of a recession on the horizon has dampened demand for a variety of consumer-related devices. The result is that the semiconductor industry is experiencing a downturn.

Broadcom has dodged that trend, largely because chips dedicated to consumer-related products represent a fraction of the company’s business.

Broadcom and Apple reached an agreement in 2020 whereby AVGO would supply RF components and modules to Apple for three and a half years. Broadcom derived 15% of the company’s revenue in 2000 from Apple. Fast forward to FY 2022, and Apple accounted for 20% of AVGO’s total revenue.

However, rumors abound that Apple plans to develop a WiFi/Bluetooth chip to replace the chips Broadcom provides for its devices.

Both the ability and the impetus for Apple to design chips to replace Broadcom’s is far from a foregone conclusion. For one, AVGO has a competitive edge that may not be eclipsed. Broadcom also provides a variety of components for Apple, so it is unlikely that Apple will opt to replace every product line.

Additionally, although the bulk of Broadcom’s products are fabricated by Taiwan Semiconductor Manufacturing (TSM), AVGO does operate several small chip fab plants. Buried In the company’s last 10-K is an enlightening statement:

“We use our internal fabrication facilities for products utilizing our innovative and proprietary processes, such as our FBAR filters for wireless communications and our vertical-cavity surface emitting laser and side emitting lasers-based on GaAs and InP lasers for fiber optic communications, while outsourcing commodity processes such as standard CMOS. By doing so, we can protect our IP and accelerate time to market for our products.’"

In summation, Apple taking Broadcom out of its supply chain is a gargantuan task.

And last but not least, when CEO Tan fielded a related question during the last earnings report he stated that,

"Our strategic engagement continues very much the same as it has for the last multiple years, and we see that to continue in a fairly predictable, stable manner."

Debt, Dividend, And Valuation

AVGO ended Q1 with $12.6 billion in cash and $39.3 billion in debt of which $1.1 billion is short-term. The weighted average coupon rate and years to maturity of the firm’s fixed debt is 3.61% and 10.2 years, respectively.

As previously noted, if the VMware deal is approved, Broadcom will add $40 billion in total debt.

The company’s debt is rated BBB-/Positive by S&P.

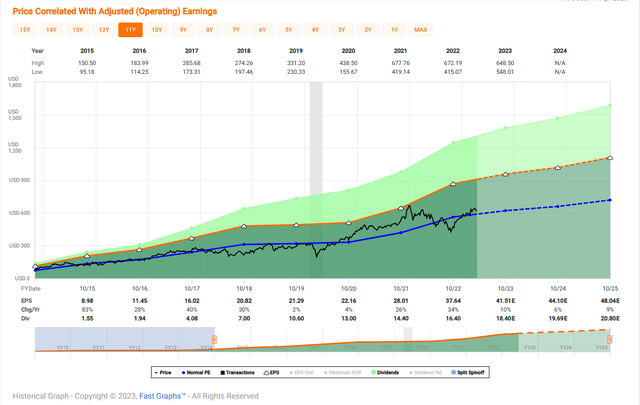

AVGO’s current yield is 2.96%. The payout ratio is a hair under 44%, and the 5-year dividend growth rate is 25.72%. Management’s target is to return half of previous year’s FCF to shareholders via the dividend.

In Q1, the company bought back $1.2 billion in common stock, and $11.8 billion was remaining under the share repurchase authorization.

AVGO currently trades for $616.70 per share. The average 12-month price target of the 17 analysts following the company is $674.17.

The average price target of the 7 analysts that rated the stock following the last earnings report is $690.00.

The forward P/E for AVGO is 18.32x, far below the stock’s average P/E ratio over the last 5 years of 32.84x.

The stock’s 5-year PEG ratio is 1.06x, roughly in line with the 5-year average for that metric.

Is Broadcom A Buy, Sell, Or Hold?

A large percentage of Broadcom's business is derived from large commercial projects, including on-premise and public cloud data centers. To a much lesser degree than most, AVGO’s revenues are not tied to consumer related products. Therein lies the difference between AVGO and the many semiconductor stocks that are lagging the market.

Now consider that a recent study by Gartner forecasts worldwide public cloud services to grow 20.7% to total $591.8 billion in 2023.

While the possibility that Apple could transition to its own semiconductors is a concern, to some extent, that is built into the current share valuation.

Meanwhile, if the VMware acquisition is approved, customer concentration with Apple will be roughly halved, and AVGO will gain a solid source of recurring revenue.

Furthermore, the essential nature of many of Broadcom's products makes it recession resistant.

I rate AVGO stock as a Buy.

Get My New Book For Free!

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, and we recently added Prop Tech SPACs to the lineup. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.

This article was written by

Brad Thomas is the CEO of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 100,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) iREIT on Alpha (Seeking Alpha), and (2) The Dividend Kings (Seeking Alpha), and (3) Wide Moat Research. He is also the editor of The Forbes Real Estate Investor.

Thomas has also been featured in Barron's, Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox.

He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, and 2022 (based on page views) and has over 108,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley) and is writing a new book, REITs For Dummies.

Thomas received a Bachelor of Science degree in Business/Economics from Presbyterian College and he is married with 5 wonderful kids. He has over 30 years of real estate investing experience and is one of the most prolific writers on Seeking Alpha. To learn more about Brad visit HERE.Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.