TopBuild Corp. Is A Value Buy Despite Near-Term Challenges

Summary

- BLD’s stock is trading at a 31.5% discount to its last 5-year average P/E.

- The discount is due to concerns regarding the residential end market.

- Long-term industry fundamental and inorganic growth opportunities are good. Hence TopBuild stock is a buy at current valuations.

Editor's note: Seeking Alpha is proud to welcome BI Insights as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

ferrantraite/E+ via Getty Images

Investment Thesis

Even though TopBuild Corp. (NYSE:BLD) should face near-term headwinds from the Residential end market weakness, I believe the company’s stock is poised to do well. The street is expecting BLD to report a 7.68% YoY decline in EPS this year. However, I believe the stock has already priced in this weakness, as the stock is trading at a 31.5% discount to its last 5-year average forward P/E. The company has quite compelling long-term growth prospects, with strong industry fundamentals and the capability to grow inorganically. Hence, I am bullish on the stock.

Revenue analysis and outlook

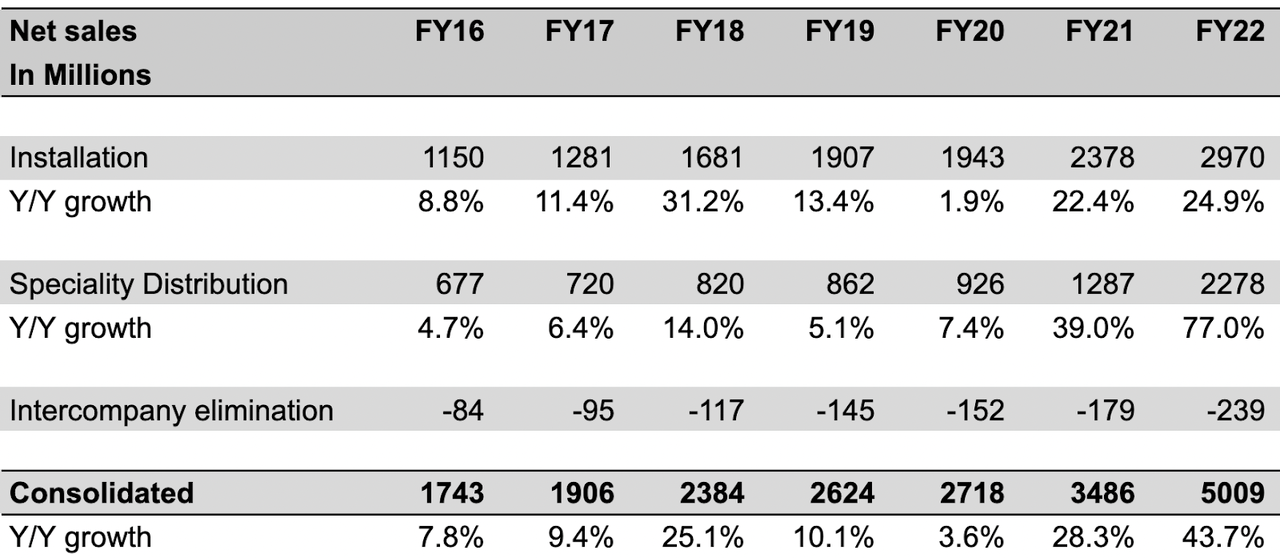

TopBuild experienced a significant increase in its revenue, growing at a CAGR of 15.9% after the pandemic. This growth was mainly driven by strong demand in the Residential end-market and acquisitions. The low mortgage rates, combined with the work-from-home trend, led to a surge in demand for housing over the past few years, which benefited TopBuild's revenue. Consequently, the company observed a 12.7% and 18.7% YoY growth in same-store revenue in FY21 and FY22, respectively. Furthermore, the Distribution International (DI) acquisition, along with other acquisitions, contributed $424 million in FY21 and $868 million in FY22 to the company's revenue.

BLD's historical revenue growth (Company data, BI Insights.)

Most of TopBuild's revenue is derived from the Residential end market, where it serves multifamily builders, custom builders, and national home builders. Given the slowdown in the residential market, one would assume that BLD's results would be impacted. However, BLD reported a robust 14.2% YoY same-store sales growth in 4Q22. BLD's strong growth is attributable to the timing of usage of its products. BLD sells products like insulation, gutter, and related items that are typically installed at a later stage in the construction process. Therefore, the demand for BLD's products tends to lag behind the demand for residential housing. As the swift rise in mortgage rates has led to a significant drop in residential starts, I believe the company should witness its lagging impact on the revenue from mid-FY23 onwards.

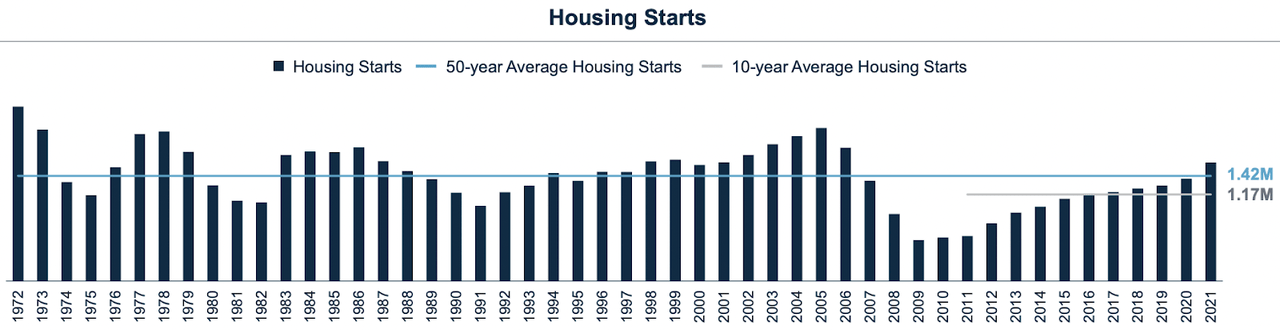

Although the residential end market should pose a headwind in the near term, long-term underlying fundamentals for this end market are strong. The home starts for the last decade (from 2011-2021) averaged around 1.17 million starts per year, which was lower than the last 50-year average of 1.42 million home starts. I believe the housing underbuild during the last decade should catch up in the coming years. This serves as a good tailwind for the residential end market in coming years, benefiting BLD’s revenue.

Historical Single family home start (Investor day presentation)

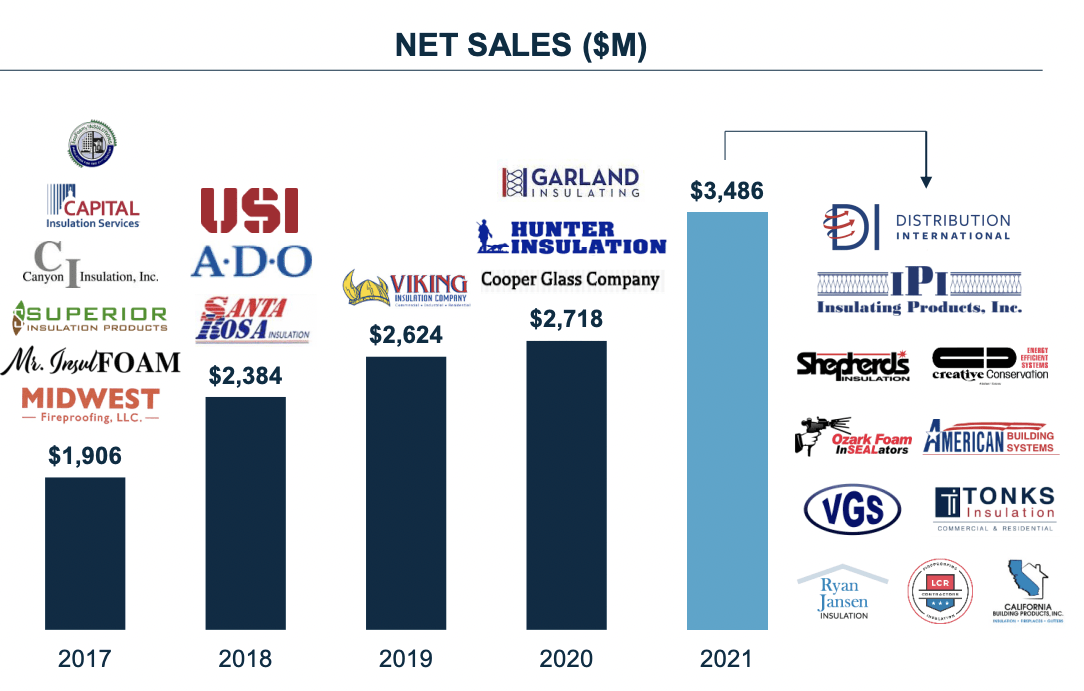

In addition to the organic growth drivers, the company has a good headroom to grow inorganically as well. BLD operates in a highly fragmented distribution and installation industry, and M&As had been a central pillar of BLD’s growth strategy. Since 2018, the company has completed 24 acquisitions, which added a total of $1.6 billion to the revenue in FY22. I believe the company should continue to pursue such acquisitions in the future too as the company has a healthy balance sheet with a low debt level which stands at 1.3x net debt to EBITDA as of FY22.

BLD's historical inorganic growth performance (Company presentation)

Margin analysis and outlook

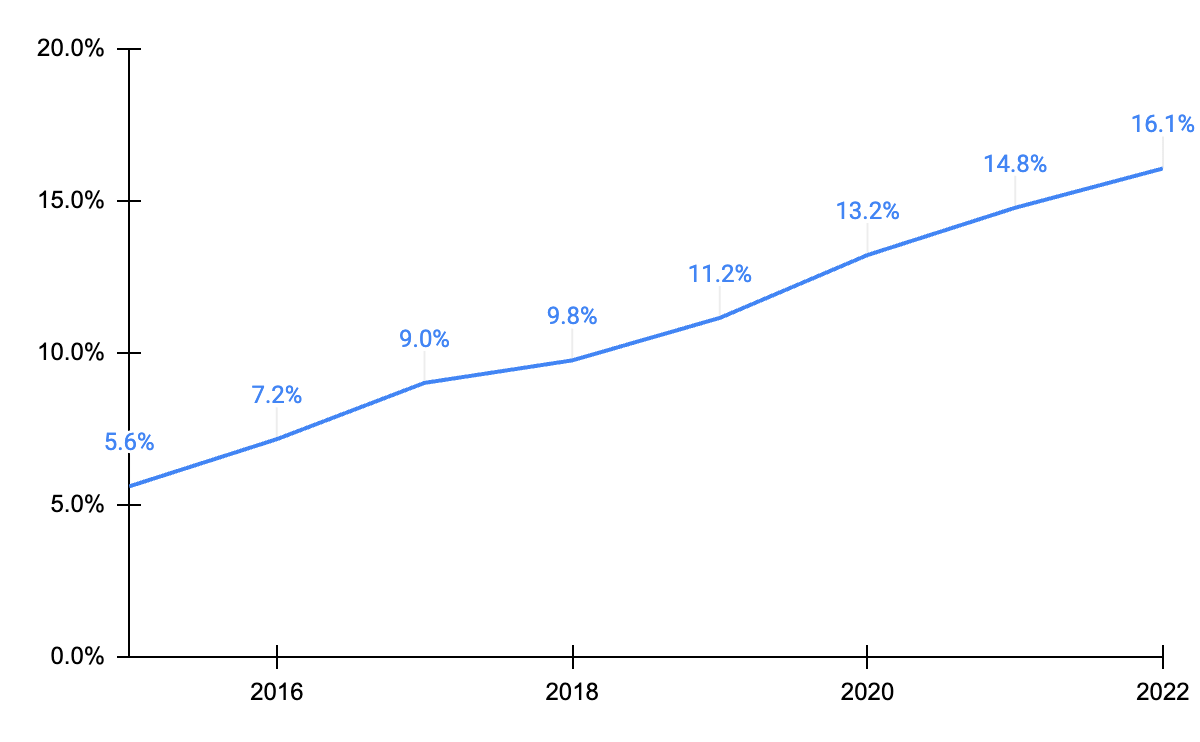

Post spin-off from Masco (MAS) in 2015, BLD margins had been consistently improving every year, growing from 5.6% in FY15 to 16.1% in FY22. The significant improvement in margins was due to operational improvement, supply chain optimization, and volume leverage.

BLD's historical EBIT margin (Source: Company data, BI Insights.)

Although the company has an impressive track record in margin expansion, I believe the company should witness margin normalization in FY23, led by near-term residential market weakness and increased labor costs. As explained earlier in this article, BLD is expected to witness weaker revenue performance from mid-FY23. The weaker revenue performance should result in volume deleverage, which should impact the margins for the period. Moreover, labor cost inflation and management’s decision to retain the workforce rather than downsize should also impact margins. As labor conditions are tight these days, BLD’s management is planning to retain its workforce in the upcoming downturn, which should lead to higher labor costs. On the other hand, the company should start to lap in $35-40 million of synergies from the DI acquisition starting this year, which should partially offset the margin headwinds mentioned above.

Although the company can witness weak margin performance in the near term, I believe the company should continue to improve its margin in the long term as the management targets an incremental EBITDA margin of 22-26% which is well above the FY22 EBITDA margin of 18.8%. Moreover, the company’s strategy to grow inorganically should also benefit the company’s margin, as the company is quick to realize synergy from acquisitions thanks to its simple-to-implement ERP architecture.

Valuation

BLD stock is currently trading at 12.63x the consensus EPS estimate of $15.77 which is 29% lower than its last 5-year average of 17.79x. While I understand that BLD is a cyclical stock and would naturally be trading at a discount before a downturn, I believe the discount is large enough and gives a good margin of safety. Moreover, fundamental industry tailwinds comfort me and I believe the upcoming downturn should be shallow for BLD.

Upon comparison to the sector median, it appears that the company is undervalued. The sector median forward P/E ratio is currently at 13.87x, which is approximately 9% higher than the 12.63x at which BLD is trading. Additionally, BLD's stock appears to be undervalued in comparison to its peer, Installed Building Products (IBP). IBP is currently trading at 13.81x the consensus estimate of $8.06 which is a discount of 23% to its 5-year average of 17.93x.

To sum up, BLD seems to be undervalued or slightly less than fairly valued at worse and provides ample margin of safety.

Risk

My thesis is built over a shallow downturn in the Residential end market, based on the fundamental tailwind that the industry is facing. More persistent than expected inflation can make the Federal Reserve hawkish longer than expected, which can lead to a residential market downturn much more severe. This could lead to underperformance in BLD's stock. Investors should carefully note development around the stickiness of inflation and the Fed's stance.

Conclusion

While TopBuild should face near-term headwinds from the Residential end-market weakness, I believe its stock has already priced in this weakness. The stock is undervalued to its historical averages as well as comparatively undervalued to its peer IBP and sector median. Moreover, supportive industry fundamentals should benefit the company once macroeconomic conditions stabilize. Hence, I am bullish on the stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.