LyondellBasell: 4.9% Dividend Yield - Material Sector Dividend Payer Standout

Summary

- Earnings per share yield continue to be attractive at 11.86% when 7% or lower is satisfactory.

- The current P/E of 8.43x earnings is somewhat lower than the normal 5-year of 8.66x to make it near fair value, which will be discussed and a purchase recommendation made.

- Technical analysis using FAST Graphs along with price targets from Morningstar, Value Line, CFRA, and Yahoo Finance are included.

- It has 12 years of a rising dividend, paid an extra high special payment in 2022, and looks to be able to pay a safe future dividend.

- This idea was discussed in more depth with members of my private investing community, Macro Trading Factory. Learn More »

Marina Vol

LYB

LyondellBasell NV (NYSE:LYB) is a quality BBB S&P credit rated international material sector specialty chemicals company headquartered in Houston TX. It deals in ethylene plastics, olefins, polypropylene, and related products. It is in the process of converting a Houston oil refinery to plastic recycling.

The chart below shows the current price on April 15, 2023, which gives it a dividend yield of 4.91%. The 52-week Low and High are shown.

| Stock | Company | Current | Yearly | Est | 52-Week | 52-Week |

| Ticker | Name | Price $ | Div$ | Div Yield | Low | High |

| LYB | LyondellBasell | 96.85 | 4.76 | 4.91% | $71.46 | $117.22 |

Price

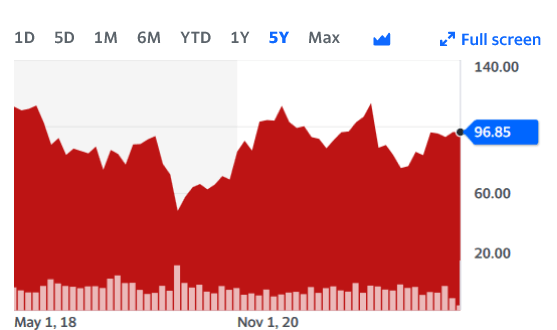

My first purchases of LyondellBasell were in 2020 from a high of $91.51 down to $39.90 in just that year. That was a real roller coaster ride and it happened to also be lows for many other stocks that year. The Yahoo Finance 5-year price graph below shows the steep decline the stock price took in early March 2020.

5-year Price Movement LYB (Yahoo Finance April 14, 2023)

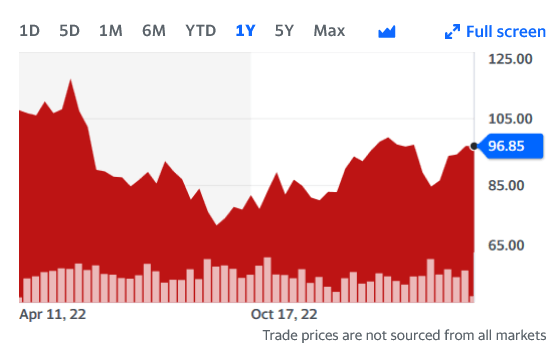

The current price of $96.85 is tickling a recent high, but it has done a full circuit of bottoming too at a price in the low 70s just last September, shown below in the 1-year chart from Yahoo Finance. That was another low month for many stocks.

1-Year Price Movement LYB (Yahoo Finance)

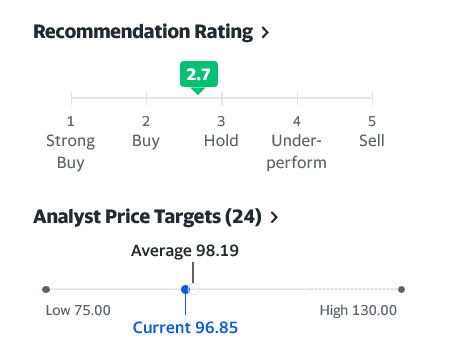

Below is the Yahoo Finance analyst buy recommendation of 2.7 which is just above hold. 24 analysts have the price target running from $75 to a high of $130. The current price is shown in blue and is just below, but near, the average of $98.19.

Analyst Price LYB Buy Suggestions (Yahoo Finance)

Below is the complete list of analyst-suggested price targets using the following abbreviations:

M* = Morningstar.

FV = Fair Value.

BUY 5* = M* cheap buy it now price.

VL = Value Line with the Mid Pt being 15 months out or 2024.

CFRA = TD Ameritrade broker analyst $ price.

Yahoo | $ | BUY 5* | VL | CFRA |

Fin $ | M* FV | M* | Mid Pt | 12 mo |

98.19 | 124 | 86.8 | 76 | 100 |

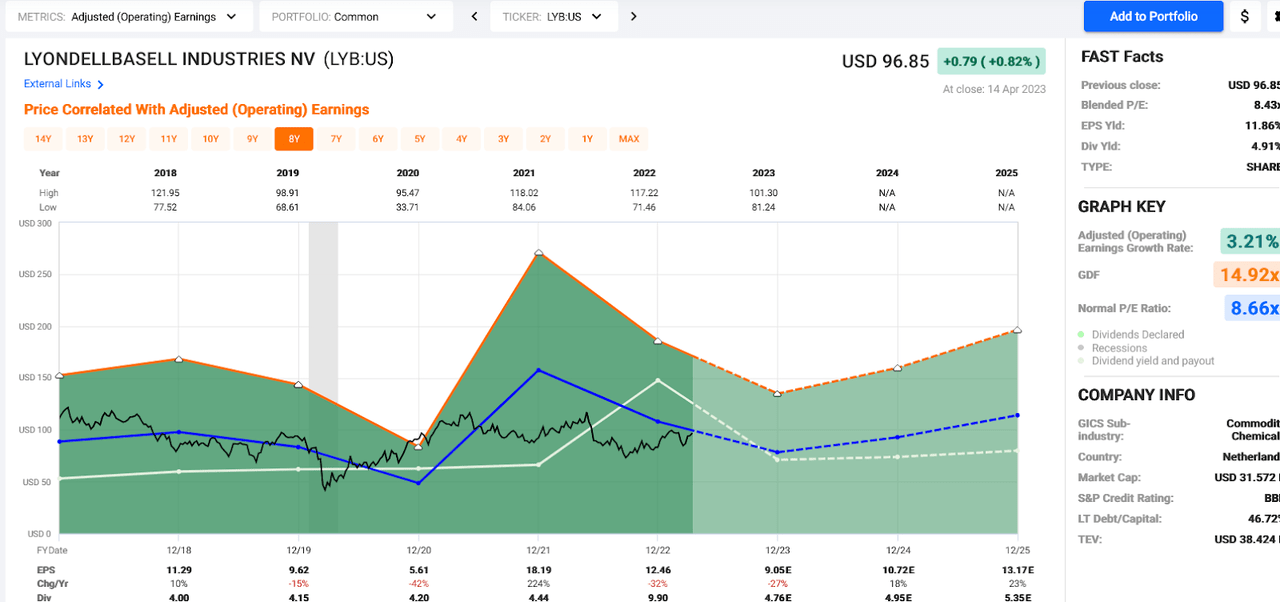

FAST Graphs

The following colors/lines on the "FG" chart represent the following:

Black line = price.

White line = dividend.

Orange line = Graham average of usually 15 P/E "price/earnings" for most stocks.

Blue line = Normal P/E.

Dashed or dotted lines are estimates only.

Green Area represents earnings.

Statistics by year are noted for high and low prices at the top of the chart in black and for earnings and dividends at the bottom of it. The % shown is for the change from year to year for earnings with an E after any number representing an estimate.

LyondellBasell Technical Analysis (FAST Graphs Chart April 14, 2023)

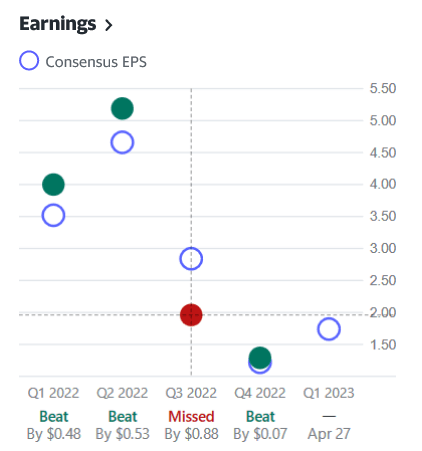

With the black price line near the blue normal P/E line of 8.66x earnings, it would seem the price is attempting to rise back up. I know the next earnings report is due soon or on April 28th. Below is the Yahoo Finance chart showing earnings reports for 2022 and Q4 just beat estimates.

Earnings Beats or Misses for LYB 2022 (Yahoo Finance April 14, 2023)

They actually have estimated earnings for Q1 to be higher, which will be interesting, as that is where FG differs in the chart above. The FG chart shows earnings will probably be lower and the price at that earnings level should also go with it; down. (8.66 x $9.05 = $78.37). I am seeing the Value Line suggestion of $76 or so perhaps happening, but then the remainder of the year seems to be headed upward. So much depends on how this is received and if management can color the future bright with expected earnings rising again in 2024 to $10.72 = price of ~ $92. The price is a puzzle as demand is somewhat weakening with recession worries and costs rising; so, I believe anything can happen and will.

Folks love the dividend and the chart does show a raise should occur as discussed next.

Dividend

The large bump shown in FG in the white line was the extra special $5.20 June payment on top of the regular dividend, as listed in the chart below from my broker TD Ameritrade.

Past Dividends

Ex-dividend date | Amount | Record date | Pay date |

March 3, 2023 | $1.19 | March 6, 2023 | March 13, 2023 |

November 25, 2022 | $1.19 | November 28, 2022 | December 5, 2022 |

August 26, 2022 | $1.19 | August 29, 2022 | September 6, 2022 |

June 3, 2022 | $1.19 | June 6, 2022 | June 13, 2022 |

June 3, 2022 | $5.20 | June 6, 2022 | June 13, 2022 |

The dividend raise should be announced with that earnings report coming April 28th. FG has it going from $4.76 to $ $4.95 and they tend to be quite accurate. That 19c raise which, if given, would = 4% and indeed to me would be quite acceptable and appreciated.

The next earnings report could be very eye-opening in many regards for price and dividend and I await it eagerly.

Summary/Conclusion

LyondellBasell NV is a solid quality BBB credit rated company with a now attractive dividend yield, solid balance sheet, but entering a weakening economy with somewhat lower product demand. A trading alert was issued at the Macro Trading Factory service to decrease position size with anticipation of the coming earnings report and what might cause a drop in price. The dividend payments last year were amazing, so it hurts to decrease size, but I do anticipate adding it back again as the economy improves, which I do believe will happen, but patience might be needed. The current dividend yield and anticipated continued dividend raises, even if smaller, still give it a nice holding place in the RIG portfolio; which is my recommendation. If not owned, I suggest watching for a lower price, as it has proven to be quite cyclical in that regard.

Happy Investing to All!

Macro Trading Factory is a macro-driven service, run by a team of experienced investment managers.

The service offers two portfolios: “Funds Macro Portfolio” & “Rose's Income Garden”; both aim to outperform the SPY on a risk-adjusted basis, in a relaxed manner.

Suitable for those who either have little time/knowledge/desire to manage a portfolio on their own, and/or wish to get exposed to the market in a simple, though more risk-oriented (less volatile), way.

Each of our portfolios, spanning across all sectors, offers you a hassle-free, easy to understand and execute, solution.

Macro Trading Factory for an Upward Trajectory!

This article was written by

I am a Promoting and Contributing author for Macro Trading Factory run by The Macro Teller / The Fortune Teller. The following list shows the # of stocks in each sector along with the % portfolio value and % income coming from the largest holding. All stocks listings and statistics are presented at The Macro Trading Factory service alphabetically with sector, credit ratings, current and forward dividend information, yield, x-dates, pay dates, charts and more. I also check chat daily for questions and present in real time my smaller trades in the chat. All bigger portfolio changes, major sells and buys get a larger Trading Alert and article. Smaller buys or changes to an existing position will get an alert only.

Goals:

- Quality, low debt companies with great credit ratings and selling at a fair or better price and with a safe and rising dividend.

- To keep defensive stocks/sectors at 50% Portfolio Income.

- Also needed is continued patience watching and waiting for it to happen. Doing nothing when others panic makes for success!

Update: Feb 4, 2023.

How to join Macro Trading Factory: explained here: https://seekingalpha.com/author/the-macro-teller/research.

Sectors and holdings are as suggested by Bloomberg. Some positions are large and some small ; The service has listings for all 79.

Consumer Staples (11 stocks): PM

Healthcare (9) : MRK

Communications- tele (5): BCE - Canada

Utility (8): DUK

Consumer Discretionary (2): HD

Energy (6): ENB

Tech/ "fin-tech" : (4): AVGO

Industrial- Defensive (2): LMT

Industrial (7): SBLK

Material (3) : LYB

Financial: (13): (9) BDCs/ ARCC, (1) bank, (1) ETF Fund , (1) BDC preferred and (1) mREIT

-Fixed Bond (1): STWD

REAL ESTATE (Healthcare REITs): (3) : OHI

REAL ESTATE Misc (5): SPG

Cash is ~15.6%

Happy Investing to ALL !!! Rose :))

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LYB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Rose the owner of Rose's Income Garden "RIG" owns all 80 stocks in it.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.