Preferreds Weekly Review: Issuers Are Providing Guidance On LIBOR Transition

Summary

- We take a look at the action in preferreds and baby bonds through the first week of April and highlight some of the key themes we are watching.

- Preferreds were roughly flat on the week as lower Treasury yields were offset by wider credit spreads.

- Issuers have started to provide (identical) guidance on the LIBOR transition for their Fix/Float preferreds.

- Looking for a helping hand in the market? Members of Systematic Income get exclusive ideas and guidance to navigate any climate. Learn More »

Darren415

This article was first released to Systematic Income subscribers and free trials on Apr. 10.

Welcome to another installment of our Preferreds Market Weekly Review, where we discuss preferred stock and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the first week of April.

Be sure to check out our other weekly updates covering the business development company ("BDC") as well as the closed-end fund ("CEF") markets for perspectives across the broader income space.

Market Action

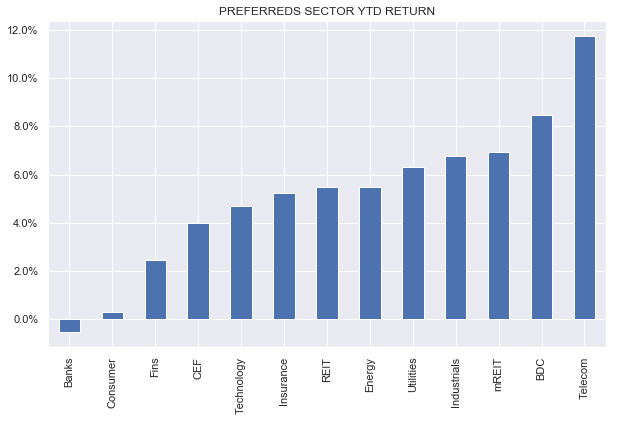

Preferreds were roughly flat on the week as wider credit spreads offset lower Treasury yields. Year-to-date, banks and Financials have underperformed though absolute performance is not particularly terrible as the Banks sector is roughly flat for the year.

Systematic Income

Market Themes

It seems like it would never happen but the date LIBOR goes away is finally approaching. After 30-June, 3-month LIBOR - the most relevant tenor for Fix/Float preferreds - will no longer be updated.

Various issuers have already started to put out press releases saying that their LIBOR-based floating-rate instruments will switch over to Term SOFR after the 30-June date. This includes JPMorgan, Citibank, Bank of America and others.

Preferreds, even those issued many years ago, have so-called LIBOR fallback language in case the rate ceases to exist. As we discussed in a previous weekly, the fallback waterfall for most preferreds looks like this:

- Use the usual LIBOR figure published on Reuters

- If it's not there call up 4 banks in London

- If no one is picking up the phone call up 3 US banks

- If no one is picking up the phone there either use whatever was the previous rate

We can summarize this process even quicker by saying that if the LIBOR rate is not published in its usual place then do a "dealer poll" and if that fails use the previous rate. Dealer poll language is very common in securities documentation and is a typical backstop in case of a dispute or lack of clarity about the pricing of a given market instrument or variable.

This sounds like a pretty good fallback but the problem is it might as well not be there at all. This is because the likelihood that a bank will stick its neck out and quote LIBOR when LIBOR no longer exists is nil. People have gone to jail for quoting "wrong" LIBOR so the chance that a trader at a bank with no upside (banks don't get paid for participating in dealer polls) and full career risk downside will decide to chance it and provide a quote for LIBOR is a joke.

So we can further summarize the fallback language as "if LIBOR is not published, use the previous rate". This highlights how investors can get stuck with a coupon on a preferred that does not reflect reality.

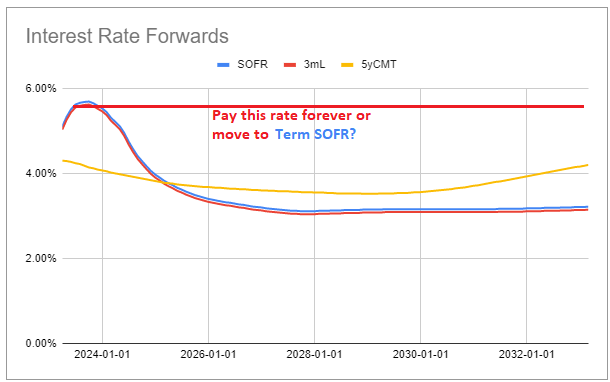

The chart below shows 3-month LIBOR forwards (red sloping line). The 30-June date is roughly when LIBOR is expected to peak. If preferreds use the standard fallback mechanism they would have to pay this rate forever (or until redemption). This will obviously fail to capture the economics of LIBOR floating-rate preferreds as short-term rates are expected to move significantly lower. This would leave the issuers paying a rate that is well above the rate they should pay if LIBOR never went away. This provides an added incentive for issuers to address this issue for their preferreds.

Systematic Income Preferreds Tool

The solution to this problem was created jointly by Congress (via the "LIBOR Act") and the Fed (via the "LIBOR Rule"). In short, issuers cannot be sued for going beyond the prospectus and switching to a rate not mentioned there. That rate will be Term SOFR. However, because SOFR is a fundamentally different kind of loan rate (reflecting secured lending) from LIBOR (which, in theory at least, reflects unsecured lending) it is lower than LIBOR. To address this the Fed came up with adjustments to SOFR to make it economically similar to LIBOR. For the 3-month tenor that adjustment is 0.26161%.

At the moment the 3-month differential is around 0.295%, meaning investors will "lose" around 0.033% in the transition. Theoretically, it may have been better to set the spread individually for each preferred immediately before the first floating-rate period however that may have been too complicated and could incentivize issuers to try to push markets around to get a favorable rate for their preferreds at the time of the switch.

Overall, the confirmation of the transition is good to see and we don't expect any surprises on this front.

Market Commentary

Bank preferreds have stabilized since the initial drawdown in March. In fact, 39 Bank preferreds (or close to 30% of the sector) are up in total return terms since the start of March on the back of falling Treasury yields and the fact that many Bank preferreds tend to be very long-duration, due to their low coupons and fixed-rate profile.

First Republic Bank suspended preferred dividends. Our view on preferred dividends has been that, first, banks wouldn't cut preferreds just to stick it to investors or to save a bit of cash - they would only do it when in dire straits. FRC fits the dire straits pattern well with the stock down 90% this year. Second, banks can't last indefinitely with preferred dividends suspended. This remains to be seen but we would expect FRC to be taken over (with preferreds very likely written down) or to bounce back and the dividends to be reinstated. In short, the issue should resolve itself one way or another soon. Remaining in non-dividend payment limbo is not a viable strategy for a bank given the terrible signal this sends of its underlying strength.

Western Alliance, one of the regional banks under the gun, reported that there was an 11% deposit outflow in Q1. This number is roughly where deposits were at the end of 2021 and the broader view is that this amount of outflows is manageable. Total insured deposits rose to 68% which suggests that the pace of outflows should decelerate, all else equal. Moreover, deposit outflows appear to have stabilized across the industry.

This dynamic is, in part, due to something we highlighted in the wake of the crisis - that, unlike in the GFC, there is a self-stabilizing aspect to this banking crisis. The worse the situation looks, the more likely rates are to come down and, therefore, the less bad the issue of unrealized losses will be for the banks (as lower rates cause the value of Treasuries and Agencies to rise). For instance, since the first week of March 5Y Treasury yields are lower by around 1% or about a quarter of its starting level. This drop in rates has significantly reduced the overhang of unrealized losses on bank balance sheets.

Stance and Takeaways

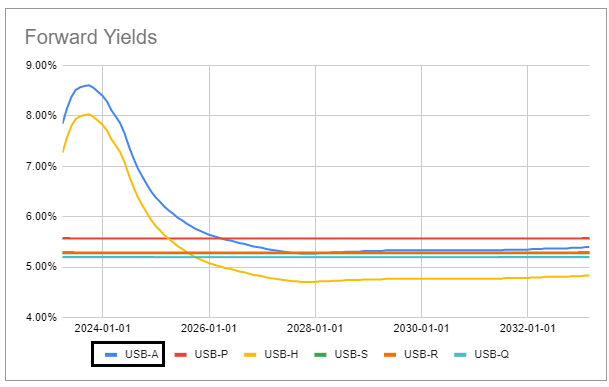

In the Banks sector we continue to like preferreds of the larger issuers which stand to benefit from the deposit reshuffling in the sector. Specifically, we continue to hold U.S. Bancorp Series A (USB.PA) which looks most attractive in the USB suite.

Systematic Income Preferreds Tool

We also like the Wells Fargo Series Q (WFC.PQ) whose yield is expected to rise to the highest in the suite at a high single-digit level on the first call date in September unless redeemed. A redemption would equate to a roughly 5% immediate gain.

Systematic Income Preferreds Tool

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis - sign up for a 2-week free trial!

This article was written by

At Systematic Income our aim is to build robust Income Portfolios with mid-to-high single digit yields and provide investors with unique Interactive Tools to cut through the wealth of different investment options across BDCs, CEFs, ETFs, mutual funds, preferred stocks and more. Join us on our Marketplace service Systematic Income.

Our background is in research and trading at several bulge-bracket global investment banks along with technical savvy which helps to round out our service.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of USB.PA, WFC.PQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.