W. P. Carey: Get Recession Insurance With This 5.8% Yielding REIT (Technical Analysis)

Summary

- W. P. Carey is highly unlikely to slash its dividend pay-out during a recession.

- The trust’s business is internationally diversified and offers protection against a U.S. recession.

- A downturn in the real estate economy would likely benefit W. P. Carey’s acquisition strategy.

Sviatlana Zyhmantovich

In recent months, passive income investors have had to digest a lot of negative and concerning news, including growing concerns about slowing economic growth, concerns about the state of the commercial real estate sector amid higher interest rates and higher vacancy levels, and a potentially cascading crisis in the U.S. banking system.

In short, it is more important than ever to overweight high-quality, internationally-diversified, and defensively-positioned real estate investment trusts like W. P. Carey Inc. (NYSE:WPC), and fortunately, W. P. Carey has recently experienced a significant drop and is now cheap based on funds from operations.

As a result, W. P. Carey is one REIT that I am currently aggressively overweighting because of the trust's combination of strong dividend coverage, inflation protection, and recession protection.

Furthermore, the stock is about to be oversold, indicating that passive income investors may be in for a good investment.

W. P. Carey Could Be A Winner In The Next Recession

In times of volatility, it is critical to overweight defensively oriented REITs with strong dividend coverage and the ability to maintain dividend payments even in times of slowing economic growth and high inflation.

W. P. Carey protects investors from inflation by generating approximately 55% of the trust's rent from inflation-protected leases that tie rate increases to the consumer price index. W. P. Carey also has a well-covered dividend and a 77% pay-out ratio. So, even if the trust's AFFO grows more slowly in the future, the dividend should be quite safe.

Furthermore, during previous recessions, the trust was an aggressive buyer of real estate, regularly purchasing properties for more than $1 billion per year. As a result, I believe W. P. Carey is a defensive real estate investment for passive income investors, and the REIT could go on the offensive during the next recession.

In 2022, W. P. Carey invested $1.3 billion in new real estate, acquiring 13.9 million square feet of new properties. During a downturn, I expect W.P Carey to increase its acquisition strategy and purchase more cash-flow-producing real estate.

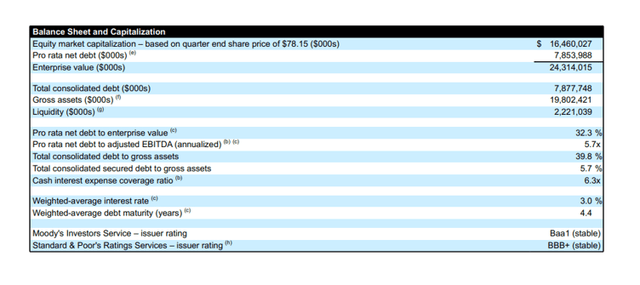

However, the trust's true recession value lies in its diversification and strong balance sheet. At the end of last year, W. P. Carey had $2.2 billion in liquidity, and the trust could easily stem billions in partially debt-financed acquisitions. A recession may thus be a catalyst for W. P. Carey's growth rather than an event that results in a contraction of its adjusted funds from operations.

International Exposure Limits Downside Risks In Case Of A U.S. Recession

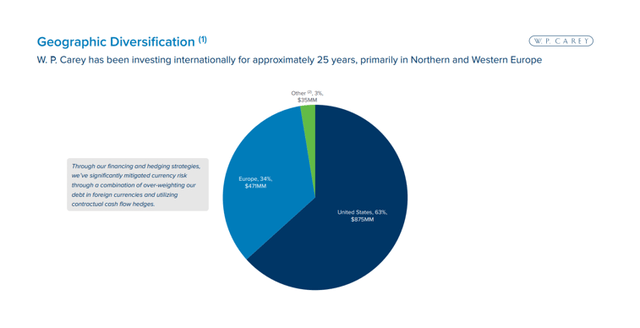

As I've mentioned in previous articles, diversification is critical to protecting investor capital, especially during more difficult and unpredictable economic times. As a result, I believe the trust's international focus is an added benefit of investing in W. P. Carey.

While the trust has a primary focus in the United States, W. P. Carey is internationally diversified, generating approximately 34% of its annual base rent from markets other than the United States.

Geographic Diversification (W. P. Carey)

W. P. Carey: Technical Analysis

W. P. Carey's stock price has seen a significant correction in the last month, which is worthy of recognition and, of course, exploitation. According to the Relative Strength Indicator, which is currently at 35.40, the stock is about to be oversold. An RSI value less than 30 usually indicates negative/bearish sentiment toward the underlying security and can be interpreted as a contrarian indicator.

Given the high degree of dividend coverage provided by the trust, I believe W. P. Carey does not deserve such a steep valuation haircut, owing primarily to new uncertainty surrounding recent bank failures.

Relative Strength Index (Stockcharts.com)

WPC’s Valuation Now Implies A Very High Margin Of Safety

The top reason to buy W. P. Carey on the dip relates to the trust’s improved margin of safety. The REIT is guiding for $5.30 to $5.40 per diluted share in adjusted funds from operations in 2023 which I think could grow to $5.60 to $5.70 per share in 2024.

Given a market price of the trust’s stock of presently $73.69, the AFFO multiple has contracted from 15.0x when I last covered the trust to 13.0x, and this is primarily due to the unrelated troubles emerging in the U.S. bank system.

Other commercial real estate investment trusts also have seen considerable valuation haircuts including Kimco Realty Corporation (KIM) and Realty Income Corporation (O). Kimco Realty trades at 12.4x FFO and Realty Income at 15.6x FFO. I recommend all three trusts as their stock prices consolidate as all of them cover their pay-outs with funds from operations and offer very safe dividends.

Why W. P. Carey Might See A Lower/Higher Valuation

A slowdown in the commercial real estate market could have a short-term negative impact on W. P. Carey's AFFO performance. As I previously stated, I believe W. P. Carey, with its strong balance sheet and large cash position, could emerge as an aggressive net buyer of properties during a recession.

In my opinion, a dividend cut is unlikely because the trust's dividend is well-covered by adjusted funds from operations. If the market recovers and inflation falls, the trust's AFFO could be valued higher.

My Conclusion

I like W. P. Carey stock for a couple of reasons, especially now that the stock is down: the trust has consistently good dividend coverage, provides inflation protection, and carries recession insurance because W. P. Carey has the resources to double down on real estate acquisitions when they are cyclically cheap.

Because W. P. Carey is close to being oversold according to the Relative Strength Index, I believe the trust's high quality 5.4% dividend is worth considering on the dip.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WPC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.