Becton, Dickinson and Company: This Serial-Acquirer Is A Buy

Summary

- The medical devices industry has grown steadily for many decades, driven by people living longer and increased adoption of technologically advanced healthcare devices.

- Given the predictability of the revenues, this industry lends itself well to industry consolidators who can deploy excess free cash flow into additional revenue streams.

- Many of the devices sold by companies like Becton, Dickinson are frequently repurchased by hospitals and patients. They are not subject to the same patent cliffs facing pharmaceutical companies.

andresr/E+ via Getty Images

Introduction

Healthcare is one of the largest industries in the US, it's also notoriously expensive. The problem is complex, with many players, Doctors, Hospital Owners, High Medical School Tuition, Insurance, and Pharmaceutical companies all taking a part in driving up costs.

One often overlooked, but very important, sub-segment of healthcare is the medical devices that doctors and nurses use on a daily basis to perform surgeries, administer medication, and take care of their patients.

One of the largest of these companies is Becton, Dickinson and Co. (NYSE:BDX) which develops, manufactures, and sells medical supplies, devices, laboratory equipment, and diagnostic products worldwide. They provide a variety of products for both medical institutions and the public, including IV and catheter systems, diabetes products, blood collection and diagnostic systems, and various surgical products.

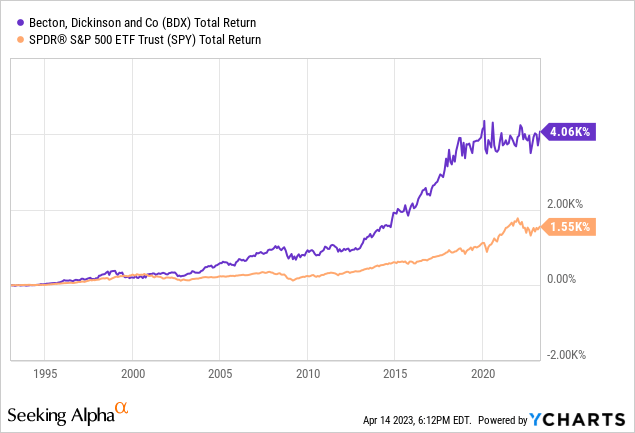

As it turns out, the medical supplies business is indeed a very lucrative niche and one that Beckton Dickinson has clearly thrived in...

But as great as those returns are, the past is the past, and as investors we need to focus on the future.

Within this article, I'll:

- Provide an overview of the business and industry

- Analyze their financial performance versus peers

- Compare its relative valuation versus peers

Overview

Let's start with a brief overview of the industry. The medical supplies industry includes all sorts of companies that make and distribute products used in healthcare, like medical devices, diagnostic tests, and equipment. The industry has grown steadily for many decades driven by people living longer and increased adoption of technologically advanced healthcare devices.

Another major factor helping to advance the industry's rapid growth is the increasing prevalence of chronic diseases, such as diabetes and cardiovascular disease, which often require constant monitoring. Advances in technology have led to the development of new and innovative medical devices and diagnostic tests to help those that suffer from these conditions, DexCom (DXCM), or Abbott's (ABT) Freestyle are prime examples.

And while the industry continues to grow there are still some risks, especially regulatory challenges which should be a concern for companies operating in the industry.

In the world of healthcare, the regulatory environment feels like it is always changing, new regulations and standards are introduced on a regular basis. Such rapid change can make compliance costly and time-consuming for all those involved. While this is a risk for companies in this industry it may also be an opportunity for the most well-adept companies to take share from those who are less nimble.

Predictable Revenues

Unlike the pharmaceutical business, which I view as something more akin to mining for gold, or movie production, the medical supplies/devices industry boasts a predictable recurring revenue model. Many of the devices sold by companies like Becton, Dickinson are frequently repurchased by hospitals and patients. They are also not subject to the same risky patent cliffs that face pharma companies whereby competitors can launch clones after a set time period.

Given the predictability of the revenues, this industry lends itself well to industry consolidators who can deploy excess free cash flow into additional revenue streams. This is something that sets Becton, Dickinson apart, they are serial acquirers of medical device businesses.

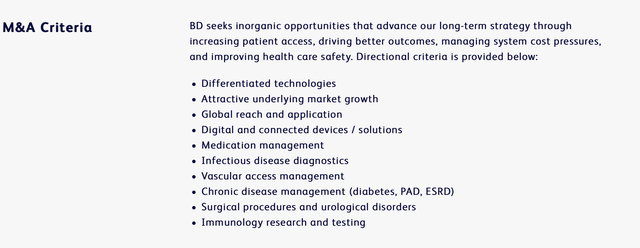

BDX outlines the criteria they look for on their website:

While I am no medical expert, it doesn't take one to understand what they are looking for...

Differentiated technologies = monopoly/near-monopoly.

Attractive underlying market growth = secular growth potential.

If executable, that's often a winning combination. A number of my largest investments are also in the business of acquiring niche businesses with monopolistic pricing power and it's worked out extremely well for them over time, just like BDX. If you're interested in reading more check out my article on Constellation Software (OTCPK:CNSWF).

| Year | # of Disclosed Acquisitions performed by Becton, Dickinson |

| 2021 | 6 |

| 2020 | 4 |

| 2019 | 2 |

| 2018 | 2 |

| 2017 | 3 |

Source: BDX Investor Relations

Financials

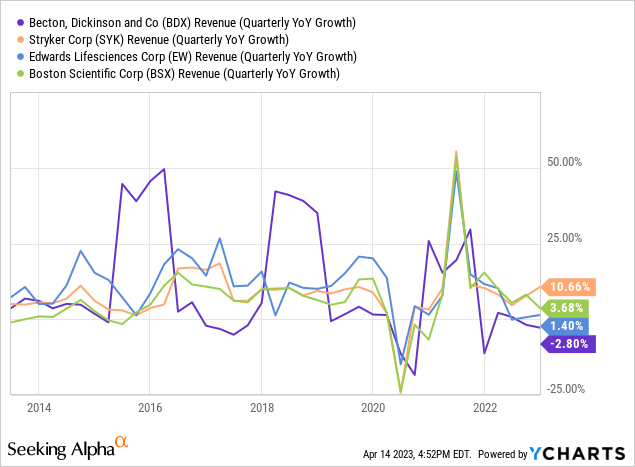

Now that we've discussed the industry and what makes Becton, Dickinson unique let's see how its financial performance has fared versus some of its peers: Stryker (SYK), Edwards Lifesciences (EW), and Boston Scientific (BSX).

Revenue Growth

As you can see in the chart above revenue growth at these companies has, surprisingly, been highly variable, especially in the case of Becton, Dickinson which has oscillated from strong growth (during years when they acquire large businesses) to flat growth.

The chart above is a strong illustration of how important M&A is to Becton, Dickinson's strategy, more on this later.

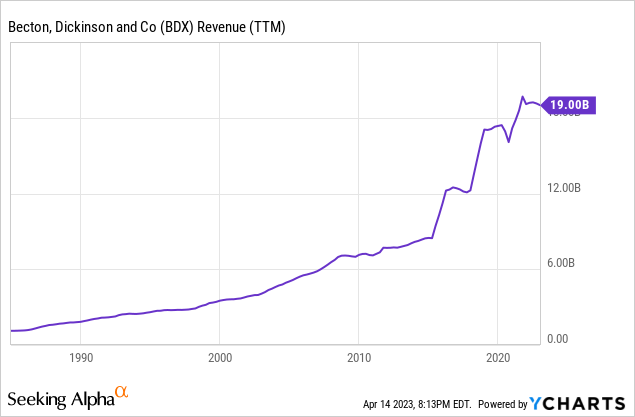

Things look a little bit smoother when you zoom out and look at revenue growth as a whole but it does go to show the reliance that Becton has on M&A to drive its growth.

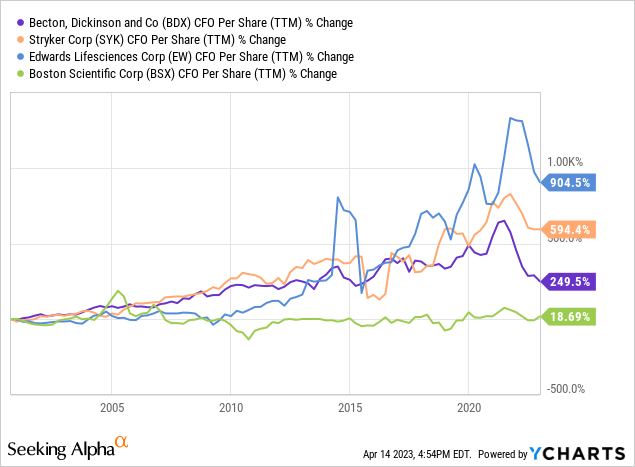

Operating Cash Flow Per Share

Looking at the operating cash flow growth of these businesses, we can see that they've all performed relatively well, perhaps with one notable exception of Boston Scientific. Most of these companies have seen a rapid contraction from where they were in 2021 and early 2022 but are still up overall.

Despite the sharp drop-off over the past year, these growth rates are nothing to scoff at, 249%, 594%, and 905% are all exceptional growth rates by any metric. That said, Becton, Dickinson is clearly growing slower than Stryker or Edwards.

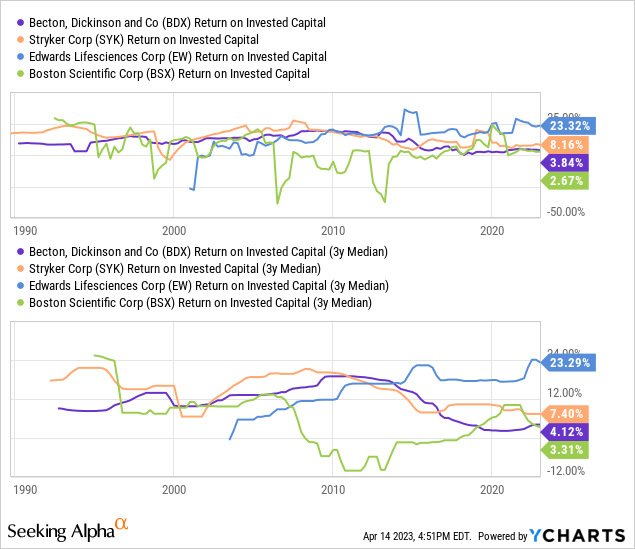

Return on Invested Capital

Since Becton, Dickinson is what I call a "serial acquirer" of businesses I believe it's important to track metrics like ROIC so investors can keep an eye on how efficient management is when it acquires new businesses.

Unfortunately, it appears that since the mid-2010s things have taken a turn for the worse at Becton, Dickinson when it comes to deploying capital. Historically they were earning returns in the high single digits to low double digits, now they are deploying capital earning returns in the low single digits. This is happening at the same competitors like Edwards are improving their return on invested capital.

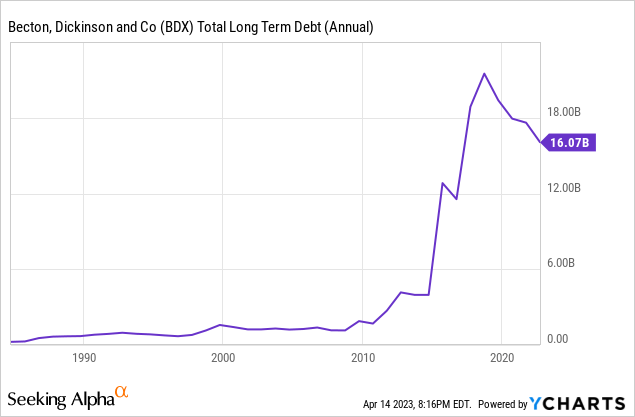

One caveat to this concerning chart is the impact private equity may be having on the space. Becton usually funds its M&A with cash on hand combined with debt. As many private equity funds are heavily levered, this is a disadvantage during periods of low rates but an advantage during times of rising rates (such as now). I will be paying close attention to see how their returns on invested capital progress in the years to come to see if they can turn the ship around.

It should also be noted that Becton levered up during the last decade of ultra-low rates, since rates are much higher now I believe it'll be important for them to keep debt in check if they are to succeed in the long term.

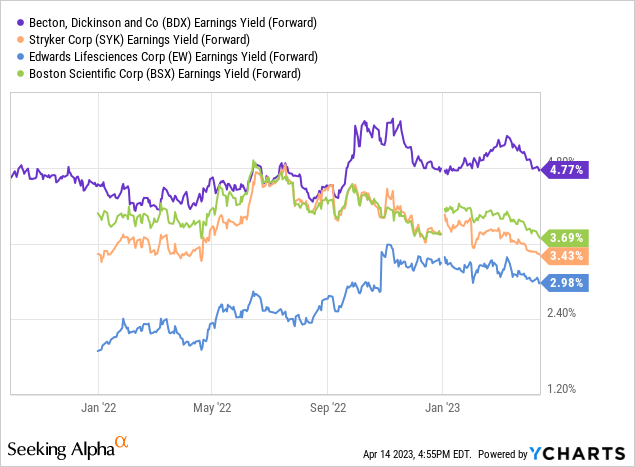

Valuation and Conclusion

Compared to its peers, based on forward earnings, Becton, Dickinson is the cheapest of the bunch. Compared to Boston Scientific's 3.69% earnings yield, Becton, Dickinson's 4.77% looks like a steal, especially considering that Becton has stronger cash flow growth and (somewhat) superior returns on capital.

The medical devices industry is growing steadily and Becton, Dickinson has thrived in this niche, providing a variety of products for medical institutions and the public. The predictability of the recurring revenue model in the medical supplies/devices industry lends itself well to industry consolidators who can deploy excess free cash flow into additional revenue streams, and Becton, Dickinson has been a serial acquirer of these businesses.

In conclusion, despite slower growth compared to some of its peers, and declining returns on capital, I believe Becton, Dickinson is a Buy due to its valuation.

Thank You

To those of you who read my article, thank you! I hope you all have enjoyed a great April thus far, here's to some beautiful spring weather! Please let me know if you'd like to discuss anything mentioned in the article below. All the best!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CNSWF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please note that this article is for informational purposes only and should not be construed as investment advice. It is important to do your own research and consult with a financial advisor before making any investment decisions.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.