Carlyle Group: Shares Remain A Value Amid Rising Asset Prices In 2023

Summary

- Stocks and bonds are boasting strong returns so far on the year.

- With a single-digit forward earnings multiple and decent fee revenues, I see shares of CG as a value play with a decent yield.

- The chart, meanwhile, is not as sanguine, and I highlight key price levels to monitor.

pixelfit/E+ via Getty Images

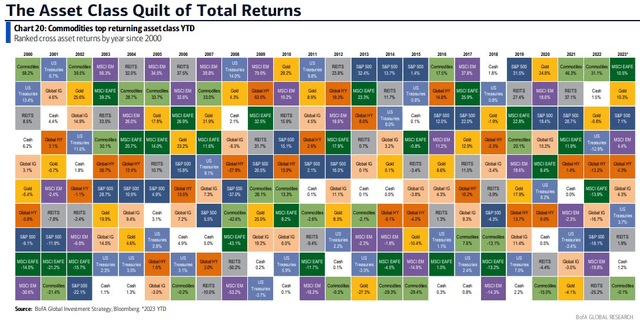

It has been a great year so far for investors. Does it feel that way? It might not. But each Friday, I like to review the year-to-date quilt of asset returns. Through April 13, only commodities are lower in 2023 - and that decline is a meager 0.1%. Global equities are strong, while fixed-income investors are recouping a chunk of 2022's losses.

That bodes well for asset managers, and I continue to see shares of The Carlyle Group as a buy on valuation, but the technicals still have work to do.

Strong Returns Across Assets YTD

According to Bank of America Global Research, Carlyle (NASDAQ:CG) is one of the largest alternative asset managers in the world and its business spans three segments - global private equity, global credit, and global investment solutions. Carlyle has offices worldwide and specializes in direct and fund of fund investments.

The Washington D.C.-based $11.1 billion market cap Asset Management and Custody Banks industry company within the Financials sector trades at a low 9.2 trailing 12-month GAAP price-to-earnings ratio and pays a high 4.2% dividend yield, according to The Wall Street Journal.

Back in early February, Carlyle topped earnings estimates due to robust fee-related margins. But the stock fell modestly after the report due to a dip in fundraising and higher expenses. These will be key metrics to look out for in its upcoming Q1 report due out in early May. There was also a modest top-line beat while total assets under management rose 24% year-on-year. Fees were up by 38%. With rebounding asset prices in 2023, there may be tailwinds for the money manager, though dealmaking activity is weak amid a tightening credit market.

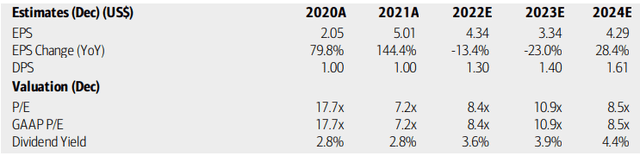

On valuation, analysts at BofA see earnings falling sharply this year before rebounding back near 2022 levels by next year. Dividends, meanwhile, are seen as rising from $1.30 today to $1.61 in 2024. While income-driven investors will like that yield trend, the valuation is particularly compelling in my view.

Consider that the current forward operating P/E is under 9, and if we assume $4 of normalized earnings with a 5-year average earnings multiple of 12.5 applied, we are talking about a $50 stock. Even more appealing is that CG's price-to-book ratio of 1.79 is a whopping 51% below the long-term average. But is now the time to buy? Or can you pick up the stock cheaper soon? Let's look at upcoming events and the technical situation.

Carlyle: Earnings, Dividend, Valuation Forecasts

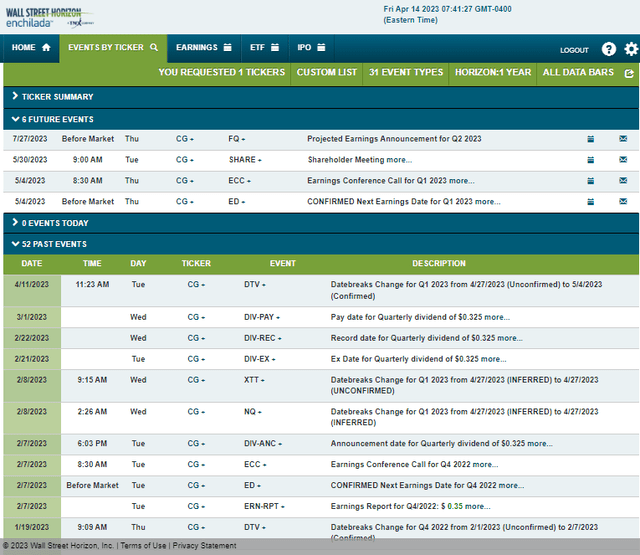

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q1 2023 earnings date of Thursday, May 4, BMO with a conference call immediately after the numbers cross the wires. You can listen live here. The firm also hosts its annual shareholder meeting on Tuesday, May 30.

Corporate Event Risk Calendar

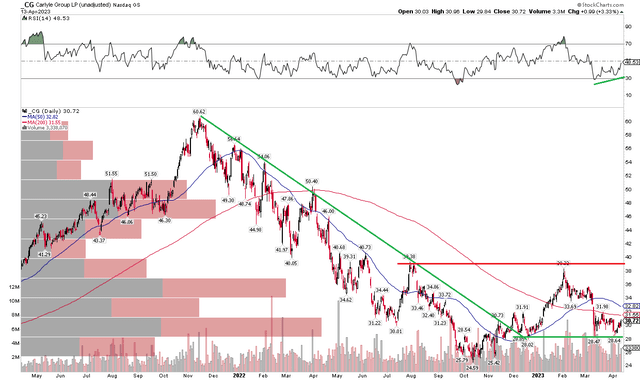

The Technical Take

CG continues to have its fits and starts. The stock was on the rise sharply from October last year through early February, following its Q4 earnings report. With a more than 50% surge from under $25 to near $40, shares found resistance that I highlighted back in January. A steep pullback into the high $20s - holding the late December low - then took place. Now, with a flat 200-day moving average and the stock trading under both its 200dma and the 50-day moving average, there are negative trend indicators.

I see near-term resistance just below $34 - notice the gap down in March under its February range lows. Longer-term, a rally above the $38 to $40 zone would help support the bearish to bullish reversal that began with a halt of the downtrend off the late 2021 peak. A move above $40 would portend a bullish measured move price objective to near $55 based on the current $25 to $40 range.

CG: Shares Back Off From $40 Resistance, Support Near $28

The Bottom Line

I continue to like CG on valuation. I reiterate my buy rating but acknowledge that the technicals and momentum are not all that strong yet.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.