'Snatching Defeat' Stock Market (And Sentiment Results)...

Summary

- It didn’t take long for the Fed to mess things up (once again) and snatch defeat from the jaws of victory.

- Why was Alibaba down on Wednesday?

- Auto-supplier update.

Wipada Wipawin/iStock via Getty Images

Snatching Defeat From The Jaws of Victory

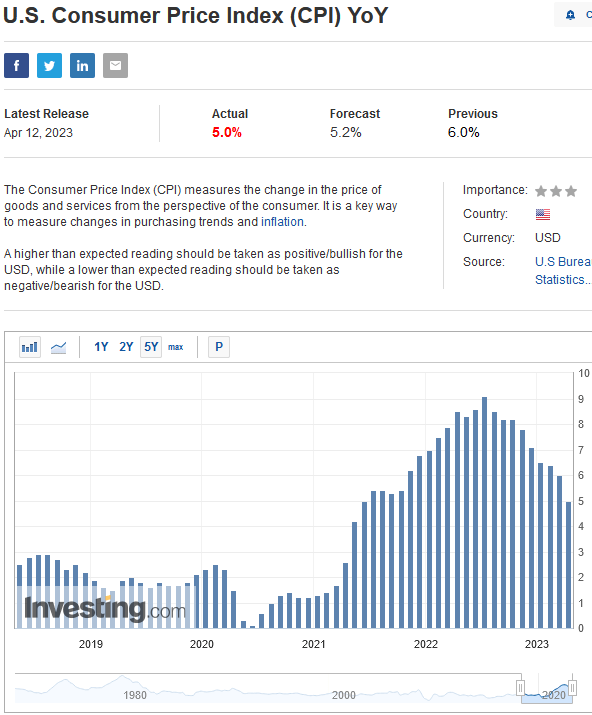

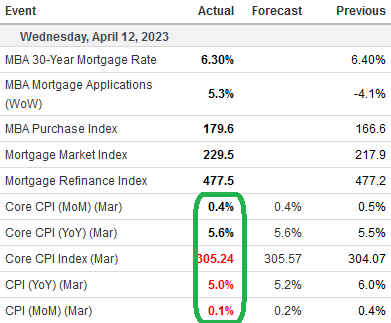

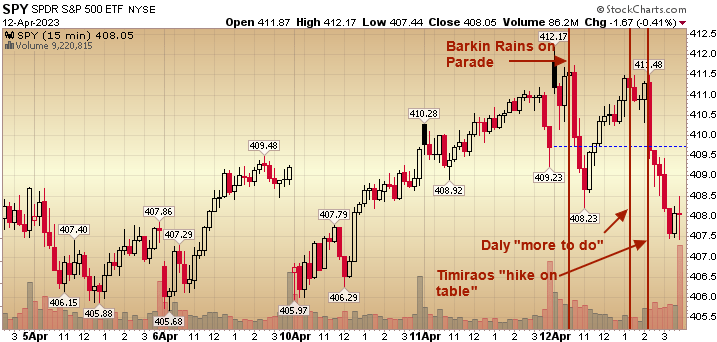

On Wednesday, the market started up nicely on the back of the better than expected CPI prints:

Investing.com Investing.com Investing.com

It didn't take long for the Fed to mess things up (once again) and snatch defeat from the jaws of victory:

Stockcharts.com

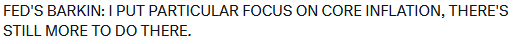

At ~10AM Richmond Fed President came out with this beauty:

Financial Juice

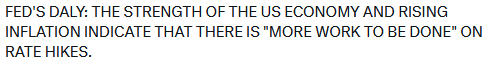

At ~1pm San Francisco Fed President Daly (yes, the overseer of SVB) had this backward looking insight:

Financial Juice

I guess we didn't cause enough portfolio impairment for the banks yet. So far only one has failed in her region. If they push hard enough they can kick First Republic and Pacific West Bancorp off the cliff. Her region will lead the pack for failure. You would think she might be the cautious one moving forward, but I guess "breaking things" is an afterthought. Bureaucrats blame management and taxpayers pick up the tab either through bailouts (direct tax on the middle and upper class) or inflation (indirect tax on the poor).

Finally, at 2:30pm we got the "Fed whisperer" (Powell Mouthpiece - Nick Timiraos) drop this bomb in the Wall Street Journal at 2:30pm:

WSJ

Buffett was out in the morning on CNBC suggesting more banks will fail, but the depositors will be protected. Note, he has not invested in any of the "cheap" regional banks of yet.

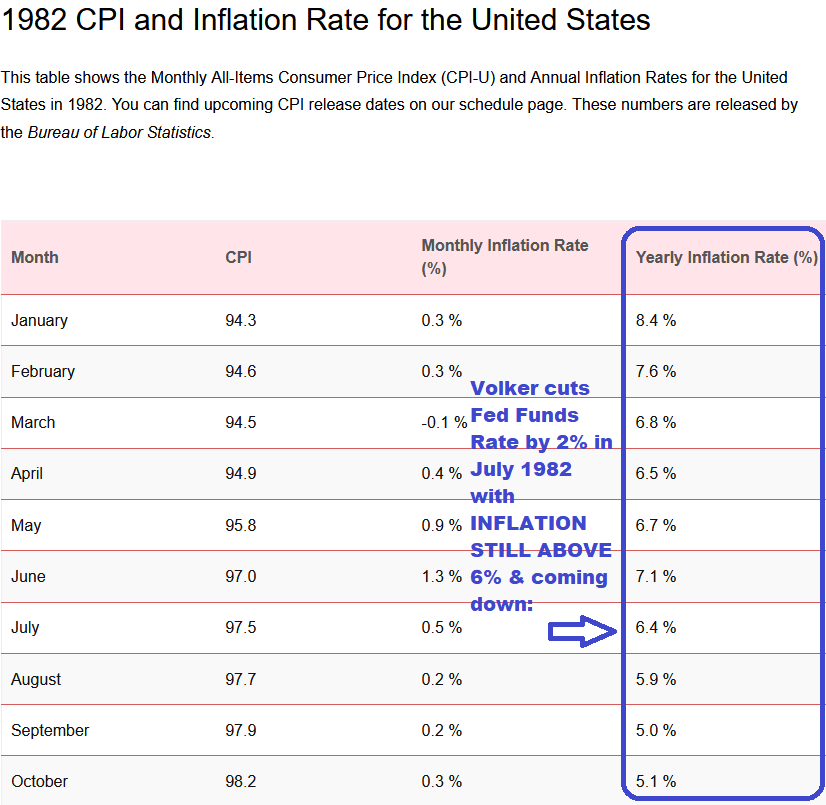

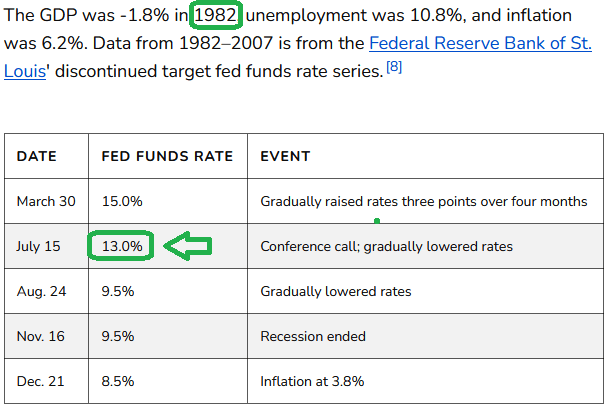

The thing that is so perplexing about Chairman Powell is that while he has repeatedly stated that he aspires to be like Paul Volker ("Keep at It"), it is apparent to me that he does not understand the history. In 1982, while inflation was STILL ABOVE 6%, Volker cut the Fed Funds Rate by 2% in July 1982:

cpiinflationcalculator.com thebalancemoney.com

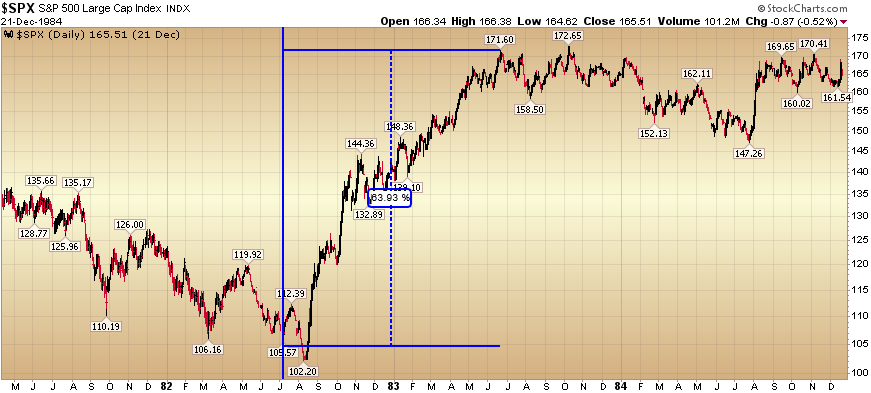

Here's what happened next:

stockcharts.com

A 64% rally for the S&P 500 over the next 12 months…

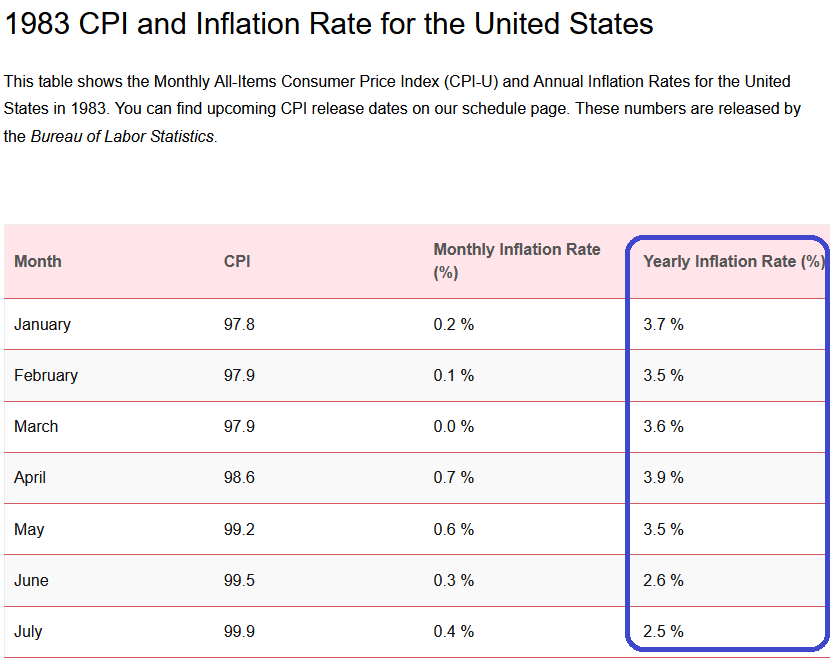

Ahh, but what about inflation you ask? Surely it must have exploded higher with "animal spirits" back in the markets? Try again, inflation collapsed to 2.5% due to the LAGGED EFFECT of the tightening. Volker knew this would happen because he studied, understood, and respected history…

cpiinflationcalculator.com

So far it is not clear that Powell understands this concept. I am rooting for him to prove me wrong and pause in time just like his hero did in 1982. He has a chance to be another hero, but he's cutting it very close to the point of no return. Things are already breaking and the Fed is tone deaf…

Why Was Alibaba Down On Wednesday?

This was the most common question of the day. Here's the answer:

There were 2 reasons the stock was down:

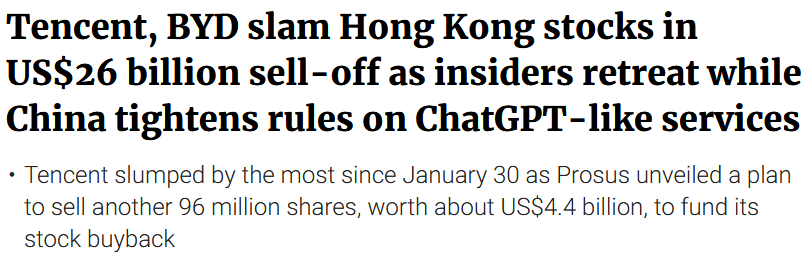

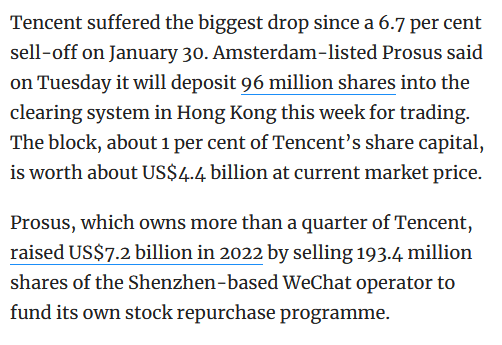

1. The entire group, led by Tencent (down the most) was down for this reason:

SCMP.com SCMP.com

2. SoftBank needs more liquidity from their series of failed investments. More cutting their flowers and watering their weeds. They've been selling for about 6 months in the hole, so not real news. Looks like their last tranche. No other liquidity for them as most of their portfolio is in VC and cashflow negative tech. They have no choice.

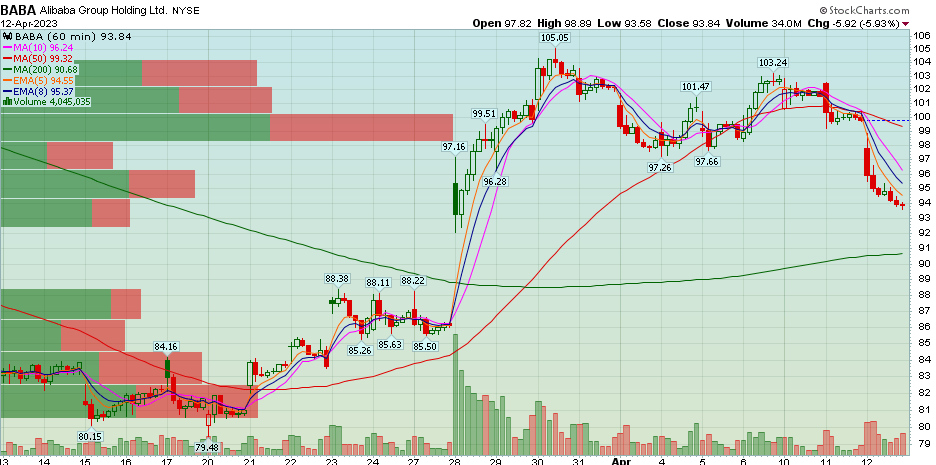

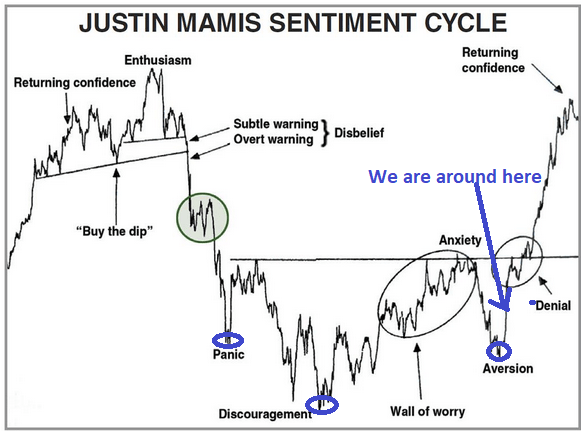

As a reminder from 2 weeks ago article, we are in "aversion" headed UP to "denial." Could we fill the gap at $86 again first? Possible, not probable.

stockcharts.com

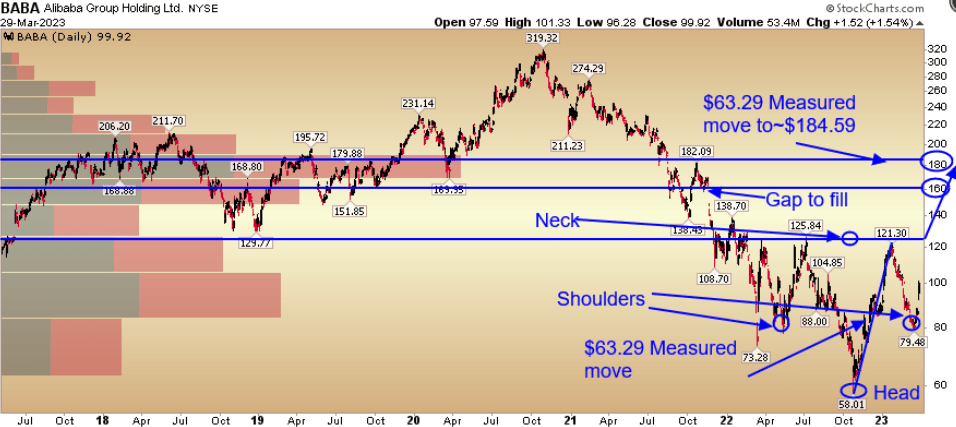

Since we've covered the fundamentals many times over, here are our first technical targets, which are miles away from our final targets. $160 is on the basis of filling a gap, $180 is on the basis of a "measured move" from the "inverse head and shoulders."

stockcharts.com

I would pay attention to the short term overhead supply between $160-180. This is where everyone will think the move is over because it will stall and pull back for months before making the long term move back to fair value.

While technical analysis is a tool, it is not the answer. It is simply a guide to understand where you might be in the process. We find sentiment and positioning slightly more useful. In this case, the technicals are lining up perfectly with a standard emotional process cycle (by Justin Mamis). We have covered this chart many times in the past:

Justin Mamis

Recency Bias

There are a ton of charts out that show us why a recession is upon us and therefore the stock market must crash. In most instances they point to the last 20 years and show that because it happened in 2000 and 2008 it must always happen. When you step back and look at a longer timeline, the facts simply don't bear it out.

Argument 1: ISM Manufacturing PMI hasn't been this low since 2008 and 2000. We're going to crash! It was a lot lower in 1982 and we rallied 64% the next 12 months. Why? The Fed cut rates. Most people are saying if the Fed cuts we will crash because the Fed is too far behind the curve. Again recency bias from 2008 and 2000.

BofA

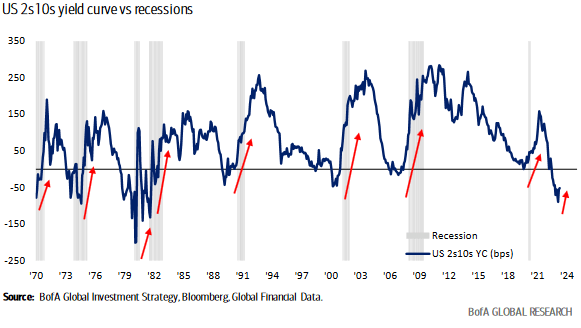

Argument 2: The Stock Market must crash because the yield curve is inverted. See 1982 once again:

BofA

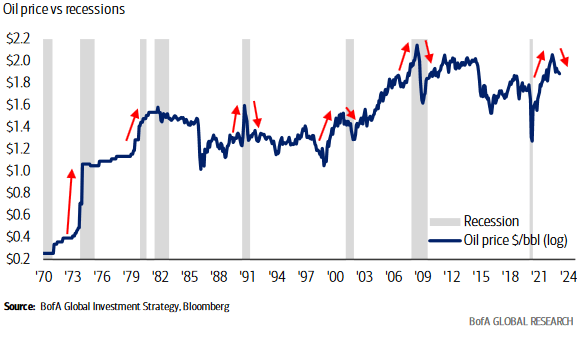

Argument 3: Oil prices not rallying despite supply cut = recession. See 1982:

BofA

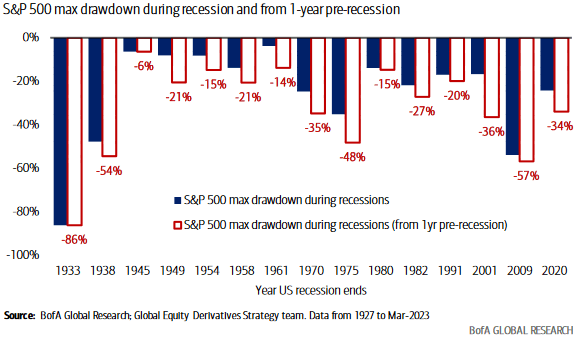

Argument 4: Market drawdown will be lower than October lows once the recession comes. The drawdown of 27% (S&P 500) last year was bigger than the early 90's recession and the same as the 1982 drawdown.

BofA

Auto-Supplier Update

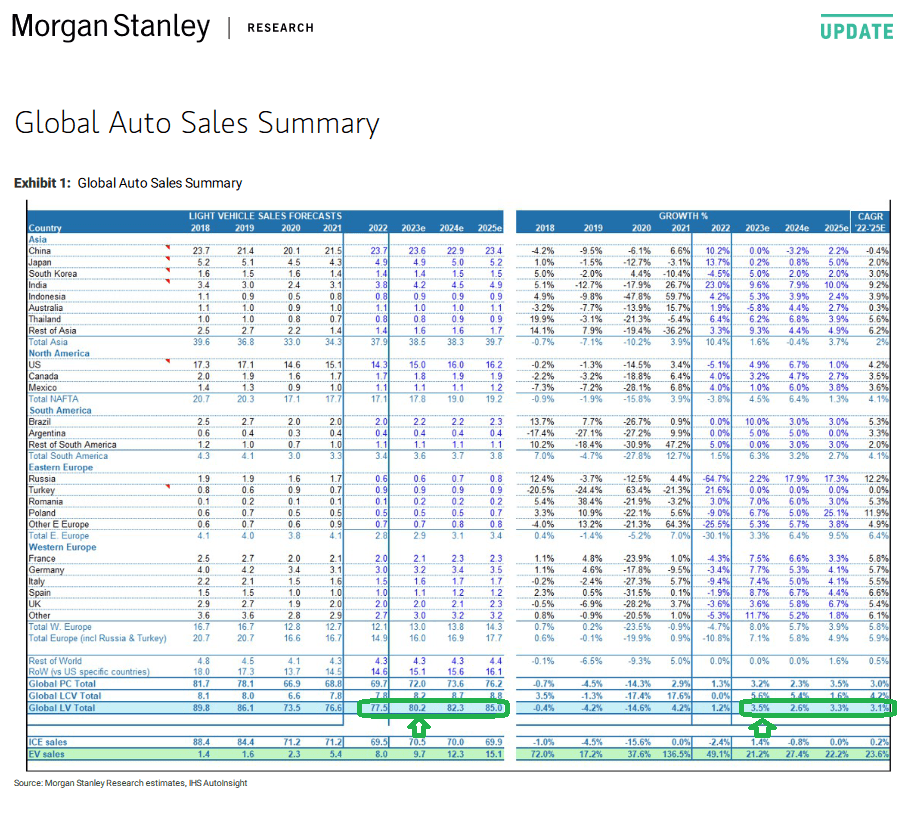

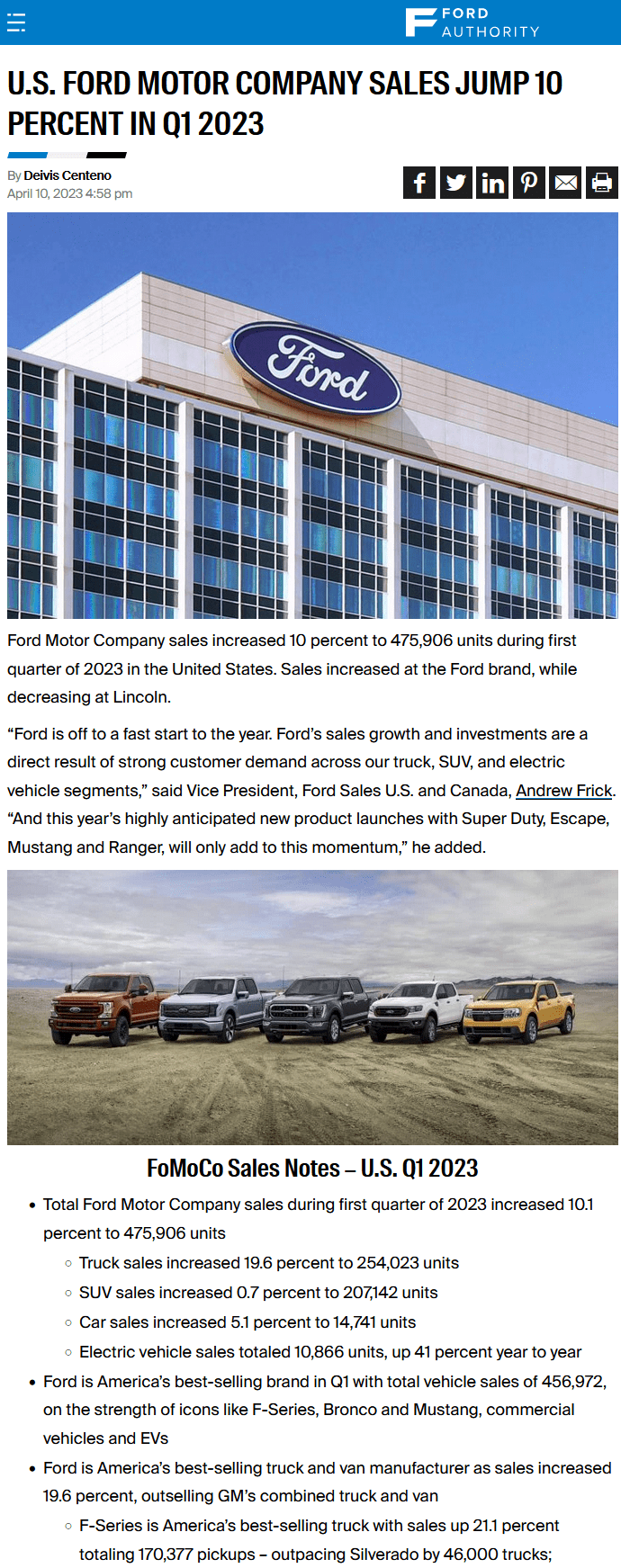

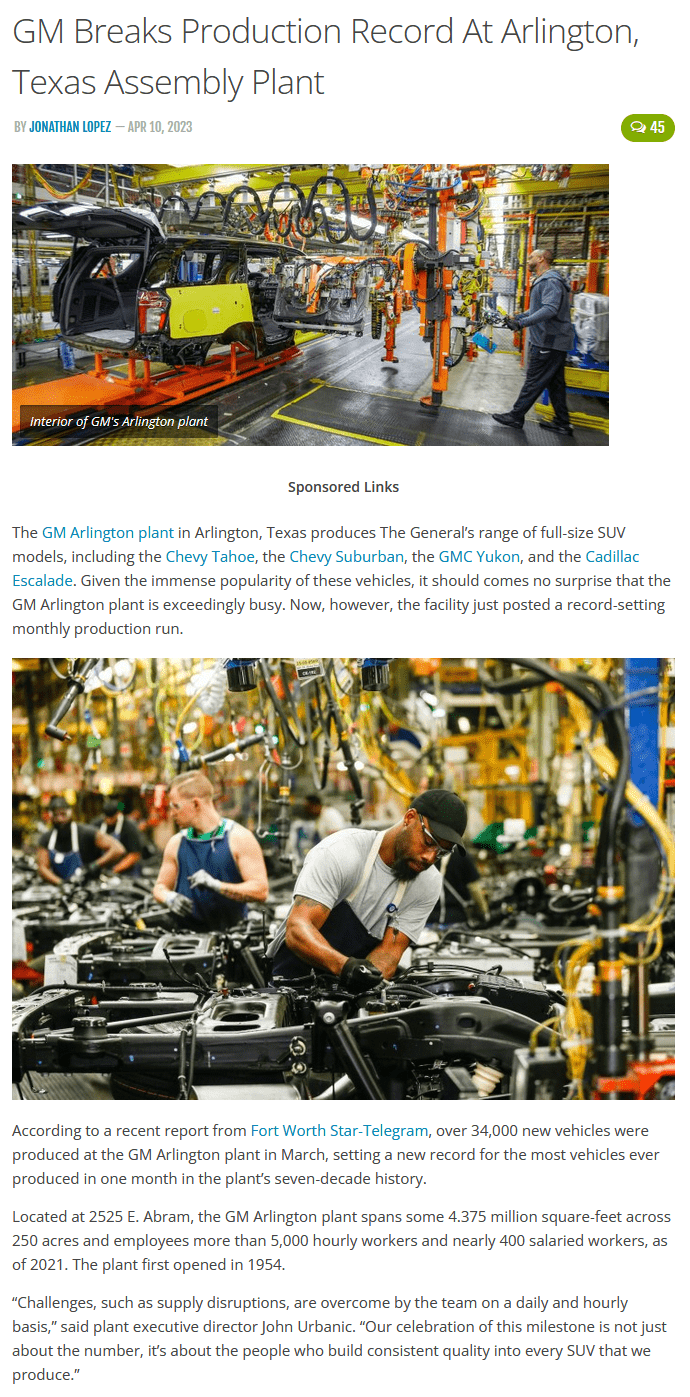

One of our top positions is auto-supplier - Cooper-Standard (CPS). We made our case for the stock on the podcast|videocast in May as well as on Fox Business - "The Claman Countdown" June 7, 2022 with Liz Claman and executed across accounts at ~$5.50 (it is now up ~137% as of yesterday's close). See the original clip below:

Cooper-Standard thesis remains intact as new auto sales continue to exceed expectations.

Morgan Stanley Ford Authority CNBC GM Authority

Now onto the shorter term view for the General Market:

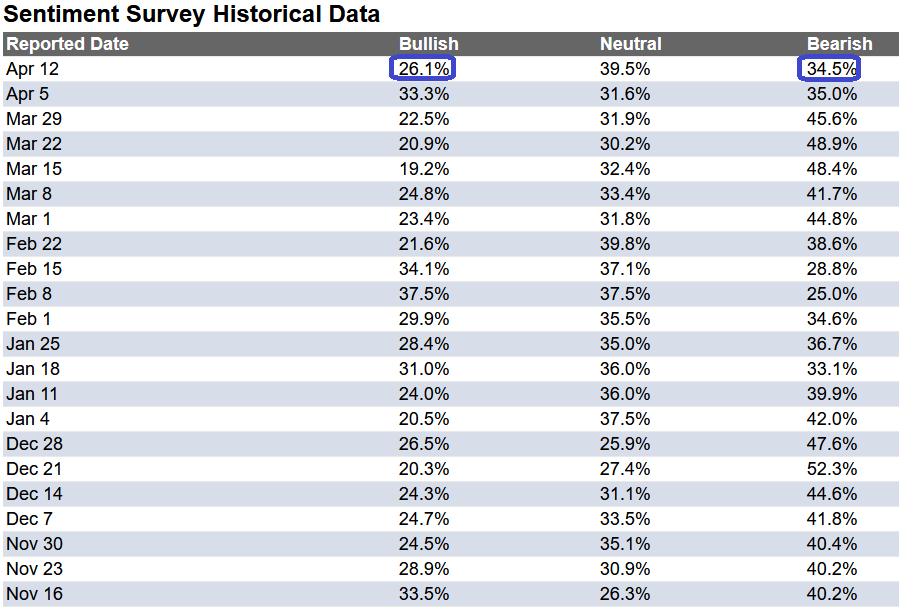

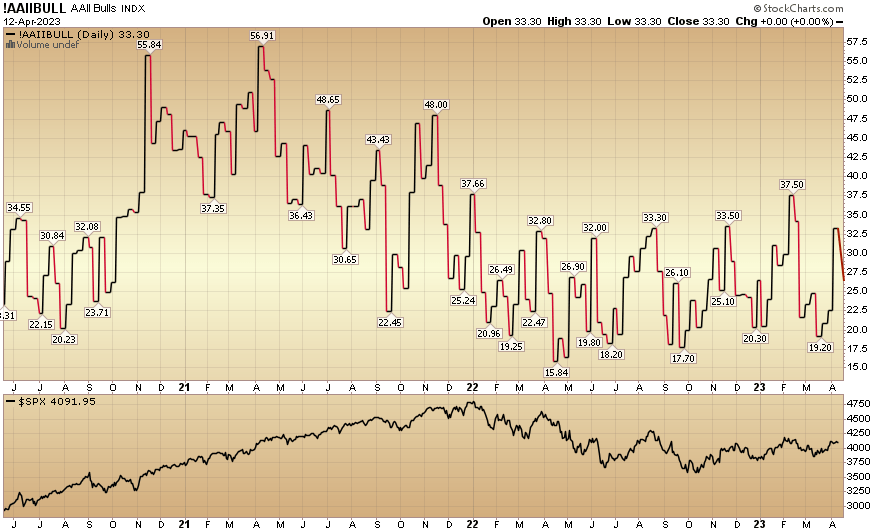

In this week's AAII Sentiment Survey result, Bullish Percent dropped to 26.1% from 33.3% the previous week. Bearish Percent flat-lined to 34.5% from 35%. Retail investor fear is back.

AAII.com stockcharts.com

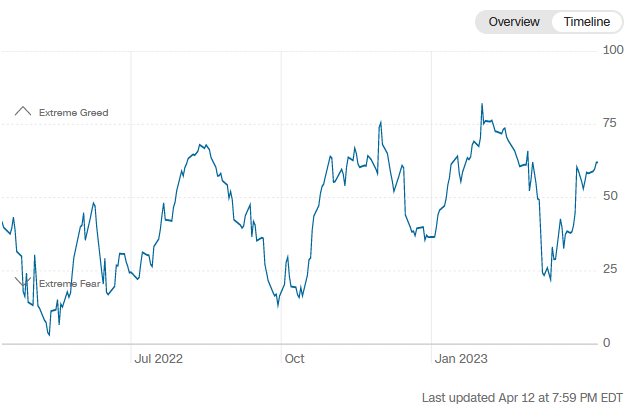

The CNN "Fear and Greed" rose from 53 last week to 62 this week. Sentiment is improving.

CNN CNN

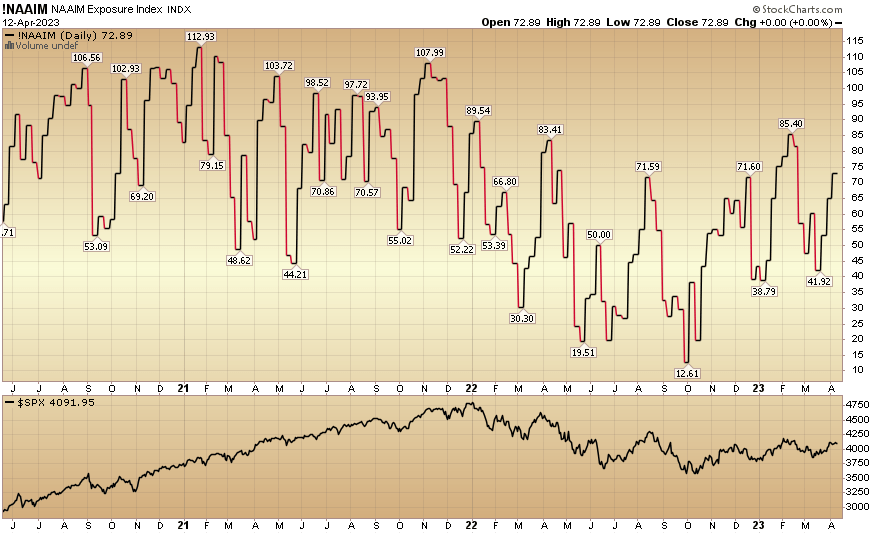

And finally, the NAAIM (National Association of Active Investment Managers Index) rose to 72.89% this week from 65.15% equity exposure last week.

stockcharts.com

*Opinion, not advice. See "terms" at hedgefundtips.com.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA CPS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.