Spotify: Profitability Remains Elusive

Summary

- I am more than happy to invest in companies that are yet to make profits as long as there is a clear pathway toward profitability in the future.

- If a company fails to break through to profitability even after passing its best days, that is concerning.

- Spotify has become a major player in the music streaming industry with over 205 million premium subscribers compared to just 18 million in 2015.

- Spotify's international expansion will help maintain growth in the coming years, with India proving to be a bright spot already.

- The sixfold rise in Spotify revenue since 2016 has not led to any profits so far, which needs a little digging.

- I do much more than just articles at Leads From Gurus: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Sergi Alexander

With millions of users worldwide and a reputation for innovative products and services, Spotify Technology S.A. (NYSE:SPOT) has become a major player in the music streaming industry. From just 18 million in 2015, the number of premium Spotify subscribers has swollen to 205 million today, which is a testament to how the company has taken the music-streaming industry by storm, rivaling the likes of Apple Music owned by Apple, Inc. (AAPL) while negating the threats posed by pirated content.

The spectacular growth of the company, which is evident from stellar revenue growth in the last 5 years, has not pushed Spotify into profitability yet, which is one of the main reasons why I have always chosen to wait on the sidelines. I am more than happy to invest in companies that are yet to make profits as long as there is a clear pathway toward profitability in the future. However, if a company fails to break through to profitability even after passing its best days, that is concerning. I am not even remotely suggesting that Spotify's best days are behind the company, but this is a concern that I have had to deal with recently.

For this reason, I decided to take another look at Spotify.

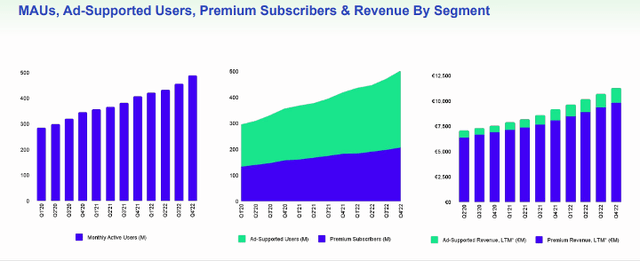

Spotify's Recent Performance

After a strong fourth quarter, music streaming service Spotify has shown impressive growth in both its user base and revenue. The company reported 3.17 billion euros in revenue, beating expectations of 3.16 billion euros. Monthly active users reached a record high of 489 million, up 20% from the previous year, with 33 million new additions during the quarter. Paid subscribers also grew by 14% to 205 million. Despite posting a net loss of 270 million euros, Spotify remains optimistic about its future growth prospects, particularly in the area of podcasting. The company continues to invest in advertising, with ad-supported revenue growing by 14% and accounting for 14% of total revenue in the last quarter.

Exhibit 1: Financial performance snapshot

The Rest of the World segment, including India and Indonesia, has been a significant driver of Spotify's recent growth. Spotify has been able to establish itself as a popular music streaming service in India, thanks to its diverse and personalized offerings, flexible subscription plans, and aggressive marketing campaigns. The company made a strong entrance into India in 2019 by offering more than 40 million songs across various languages, including Hindi, Punjabi, Tamil, Telugu, and Malayalam. To appeal to the Indian market, Spotify also introduced affordable pricing plans, including a free ad-supported tier and various premium options ranging from Rs. 7 per day to Rs. 999 per year. Additionally, the company launched innovative payment methods, such as UPI, Paytm, prepaid cards, and cash on delivery. Spotify has also successfully attracted students in India with its discounted student plan, offering almost 50% off the regular premium price of Rs. 119 per month. According to Gustav Gyllenhammar, VP of Markets and Subscriber Growth for Spotify, the number of subscribers in India doubled in 2021, and the country is now among the top 20 markets for Spotify globally in terms of user-created playlists.

The India Opportunity for Spotify

India has become a strategic and significant market for Spotify as it continues to expand its reach and influence globally. The country's contributions to Spotify's growth can be seen in several ways. First, India offers a rich and diverse pool of content creators across music and podcasts, catering to the different tastes and preferences of users. Spotify has partnered with several local labels and independent artists to provide a wide range of content on its platform. The company has also invested in creating original podcasts that appeal to different segments of listeners.

Second, India is one of the most engaged markets for Spotify, with users spending more time listening to music and podcasts than in other regions. Indians create more playlists than other markets and are avid consumers of podcasts, with one in four users engaging with podcast content during Q4 2022.

Third, India is a testbed for new features and experiments that help Spotify improve its product and service offerings globally. The Indian market is the largest user of personalized playlists based on listening history, new releases, favorite artists, and most listened-to songs which helps the platform test features before rolling them out in other markets.

Commenting on the India opportunity during the Q3 2022 earnings call, CEO Daniel Ek said:

It's still early if you think about the impact India has on the overall Spotify business. However, it is my belief that India will be a massive part of the Spotify business if you fast-forward the next five to 10 years. We're going to be long-term about India; this is not something we're going to try for a quarter or a year, and then, if we don't get the results that we want, we'll stop investing. We will invest for as long as we need to in order to succeed in India.

The music streaming industry in India is one of the fastest-growing segments of the digital media market, with revenue in the music streaming segment projected to reach $291.6 million in 2023 and grow at an annual growth rate of 8.19% from 2023 to 2027. Local services dominate the market, but international players such as Spotify and YouTube Music are gaining traction among Indian listeners. The music streaming industry in India is largely driven by Bollywood and regional film music, which account for about 80% of the country's music revenue, while non-film music genres such as pop, rock, and hip-hop are also gaining popularity among young audiences. According to a Kantar and VTION study, Gaana, the streaming service owned by Times Internet, is the dominant player in India's audio streaming market with a 30% market share. JioSaavn is the second-largest player with a 24% market share, followed by Wynk Music at 15%. Spotify and Google Play Music are tied at 15% market share each, while other services account for the remainder.

Since 2020, Spotify has recorded significant growth in India which is now one of the top 10 engagement markets for the company. More importantly, India is still a young market with a long runway for growth.

India is also a significant market for Spotify's ad business, where the platform is regarded as a premium choice for audio and music streaming. The music-streaming giant relies on advertising for 14% of its revenue worldwide. In contrast to video platforms, Spotify's advertising approach is highly personalized, with video ads only displayed to users actively engaging with the app. This makes it a preferred option for brands targeting India's urban premium market. Advertising rates on Spotify India are approximately twice as high as those of its competitors. When Spotify initially launched in India, OTT platforms were among the first to advertise on the platform. To date, Spotify has worked with approximately 200-250 brands in India and plans to expand its ad sales team fivefold in 2023, with a strong presence in Delhi, Mumbai, and Bangalore. In addition, Spotify will introduce its self-serve academy to provide structured learning for marketing professionals and launch podcast advertising in India this year.

The AI Revolution

The AI DJ feature unveiled by Spotify is a new, interactive guide that uses advanced technology to recommend and play music for users based on their individual music preferences. Powered by OpenAI technology and Sonantic's dynamic AI voice platform, the AI DJ feature provides commentary on tracks and artists, making it feel like a real human DJ is curating the music.

The AI DJ feature is a groundbreaking development for the music industry as it provides users with a personalized listening experience that is constantly evolving based on their feedback. The feature uses machine learning algorithms to scan the latest music releases and old favorites, delivering a unique lineup of music that updates regularly. Users can skip or like songs to improve the AI DJ's recommendations, making it an interactive tool that adapts to individual tastes over time.

The AI DJ is also an innovative way to discover new music and artists. Providing insightful facts about songs, genres, and culture, creates a deeper connection between fans and creators. The feature combines the expertise of Spotify's music editors with cutting-edge AI technology to offer an immersive and personalized music experience. The AI DJ feature is currently available in beta for Premium users in the U.S. and Canada and will come to more markets soon.

Profitability Is A Long Way Away

Spotify, despite stellar growth in revenue, is yet to become profitable. As long-term-oriented investors, we need to invest in companies that are likely to earn economic profits that far exceed the cost of capital in the long run, and I am not convinced that this will be the case with Spotify.

Content is key for Spotify but the company has to acquire content from third parties, which leaves room for potential disruptors to change the music streaming industry dynamics in the future. Spotify spends substantial amounts on content acquisition, and these costs will keep profit margins thin in the foreseeable future in any case. On the other hand, Spotify's main competitors such as Apple, Inc., Amazon.com, Inc. (AMZN), and Alphabet Inc. (GOOG) can afford to book losses with their streaming businesses as these companies are in it not to make money but to expand their horizons to acquire more customers who would end up paying for other products and services. Spotify, as a pure-play streaming company, is at the other extreme where profitability needs to stem from the music streaming business itself, which is easier said than done.

A Spotify bull may counterargue that the company will reach profitability as it scales further. Although I do not want to rule out this probability, I believe Spotify has scaled tremendously to attract 205 million paying subscribers already, which does not leave room to grow exponentially in the short term anymore. Spotify will continue to grow with the help of international markets and innovative products but growth will be slow and steady from here.

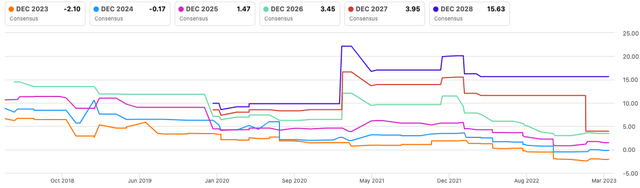

Earnings Revisions Are Not Trending Favorably

At Leads From Gurus, our investment strategy is centered around earnings revision trends, earnings surprises, and stock price movements associated with earnings revisions. Apart from a brief period during the post-Covid recovery, Spotify stock has not lived up to investor expectations in the last 5 years. The company has a poor track record of positive earnings surprises, and to make matters worse, EPS estimates have trended downward for some time now (my focus is on current fiscal year estimates). This is a red flag that pushes Spotify out of our investment universe.

Exhibit 2: EPS revisions

I have waited on the sidelines to invest in Spotify for some time now, and there are no regrets given that SPOT has declined 7% in the last 5 years. I will continue to wait on the sidelines today until the emergence of a catalyst that could push the company into profitability.

Takeaway

Spotify, the well-established leader in the music streaming industry, still has a long way to grow but it will be slow and steady growth as the company expands into international markets. As investors, we want rising revenue to lead to higher profits, and this is where Spotify has failed so far. The sixfold rise in revenue since 2016 has not led to any profits, and I believe Spotify will continue to find it difficult to earn profits in the foreseeable future. Because long-term stock prices mirror earnings growth, it is difficult for me to create room for SPOT in my portfolio today.

Unlock Alpha Returns with Our Comprehensive Investment Suite

Leads From Gurus offers a wide range of tools and resources to help you achieve superior investment returns. Our team of expert analysts uncovers undercovered and thinly followed stocks to supercharge your investment returns.

- Benefit from our top investing guru insights and strategies, combined with our unique approach to generate alpha returns.

- Access our model portfolios and receive actionable ideas to build a successful portfolio.

- Join our community of like-minded investors and exchange ideas to maximize your investment potential.

Don't miss out on our launch discount - act now to secure your subscription and start supercharging your portfolio!

This article was written by

As the founder of Leads From Gurus, a Marketplace service on Seeking Alpha, I aim to uncover alpha-generating opportunities. I also work with leading financial publications including Refinitiv, ValueWalk, and GuruFocus.

My portfolio is designed to benefit disproportionately from the rise of under-covered small-cap stocks, which I identify through a rigorous due diligence and research process. I believe that the best investment opportunities can often be found in hidden gems that are overlooked by many investors and analysts. My investment approach is focused on long-term macro trends and themes, and I use my top-down analysis to identify individual opportunities within these themes.

I take a disciplined and consistent approach to investing, and I am a strong believer that patience and conviction are key to long-term success in the stock market. I build and maintain valuation models for all stocks in my portfolios to estimate the intrinsic value of these companies in a fair, conservative way to avoid value traps in this volatile market.

I am a CFA level 3 candidate and an Associate Member of the Chartered Institute for Securities and Investment (CISI, UK). During my free time, I enjoy reading and staying up-to-date with the latest financial news and trends. Please click the "Follow" button to stay updated on my latest articles and insights.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.