The RealReal Is Facing A Challenging Transition Period Ahead

Summary

- The RealReal, Inc. went public in June 2019 at a price of $20.00 per share, while the stock is now barely above $1.00.

- The firm operates a premium online apparel marketplace and retail location network.

- The RealReal has recently hired a new CEO and the company appears to be shifting its focus to consignments, a higher margin activity.

- Operating losses and cash burn remain heavy, so I'm Neutral on The RealReal, Inc. until we see material and sustained improvement in those metrics.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

SolStock/E+ via Getty Images

A Quick Take On The RealReal

The RealReal, Inc. (NASDAQ:REAL) went public in June 2019, pricing its shares at $20.00 each and raising $300 million in gross proceeds.

The firm has created a website that acts as a marketplace for users wishing to buy and sell clothing and accessories with a focus on luxury and designer fashion items.

REAL has just hired a new CEO and appears to be changing its focus to higher-margin consignment activity.

I’m Neutral [Hold] on REAL until we can ascertain a clear direction and the firm starts making real progress toward operating breakeven.

The RealReal Overview

San Francisco, California-based The RealReal, Inc. was founded in 2011 to develop a second-hand online marketplace where people list their authenticated luxury goods.

Management is headed by new Chief Executive Officer John Koryl, who was previously president of Digital at Canadian Tire Corporation and president at Neiman Marcus Stores and Online.

The RealReal has developed an online luxury consignment technology and service where people send their luxury goods to be inspected and authenticated, photographed by the company’s photographers and finally, after its price has been adjusted based on previous transaction history and real-time market demand, listed on the firm’s online marketplace.

The company’s main revenue sources are orders processed through its website, mobile app as well as various retail locations.

The RealReal’s Market & Competition

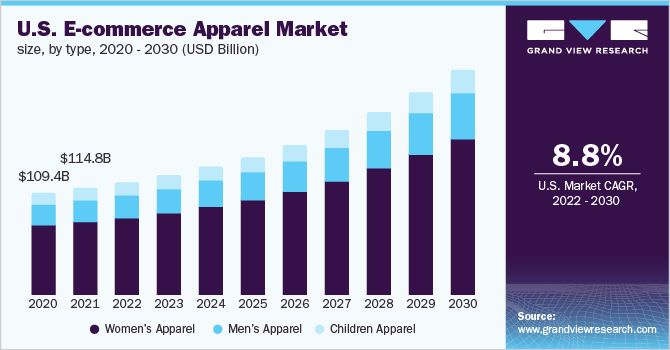

According to a 2022 market research report by Grand View Research, online apparel sales was an estimated $553.1 billion in 2021 and is forecast to reach $1.16 trillion by 2030.

This growth, if achieved, would represent a CAGR of 8.6% from 2022 to 2030.

Industry growth is predicated on an increasing number of working women, changing fashion trends and continued product innovation by manufacturers and designers.

Additional factors driving market growth are rising globalization, growing internet and smartphone penetration, and a projected rise in disposable income.

The chart below shows the historical and projected future growth rate of the U.S. E-commerce apparel market from 2020 to 2030:

U.S. E-commerce Apparel Market (Grand View Research)

Major competitive or other industry participants include:

eBay

Mercari

JD.com

Poshmark

Shopify

Rakuten Group

ThredUp

Amazon

Kohl's

Walmart.

The RealReal’s Recent Financial Trends

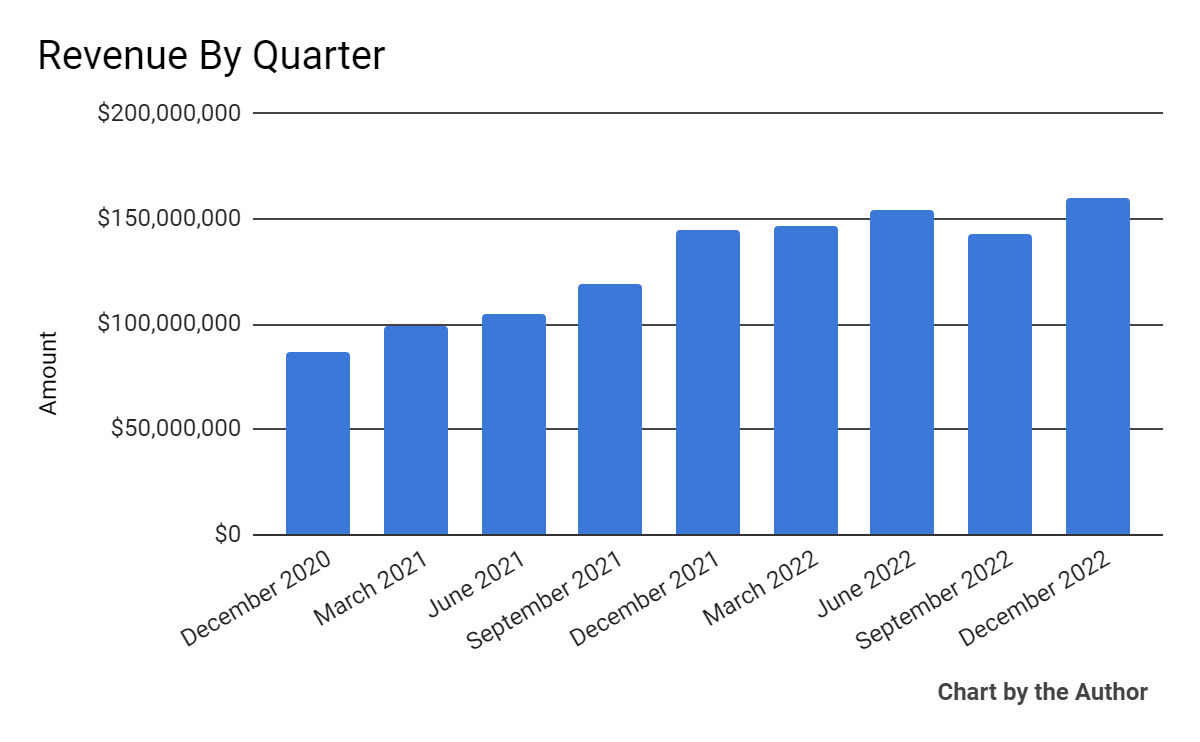

Total revenue by quarter has grown per the following chart:

Total Revenue (Seeking Alpha)

Gross profit margin by quarter has fluctuated as follows:

Gross Profit Margin (Seeking Alpha)

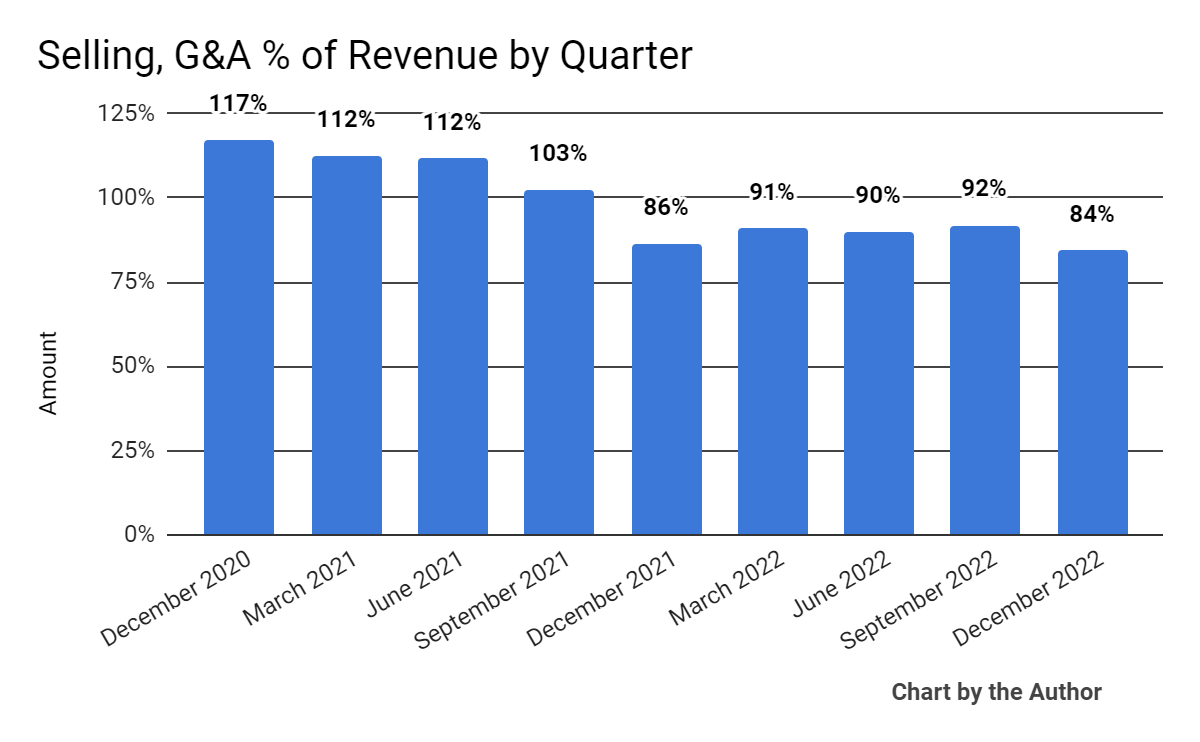

Selling, G&A expenses as a percentage of total revenue by quarter have fallen in recent quarters:

Selling, G&A % Of Revenue (Seeking Alpha)

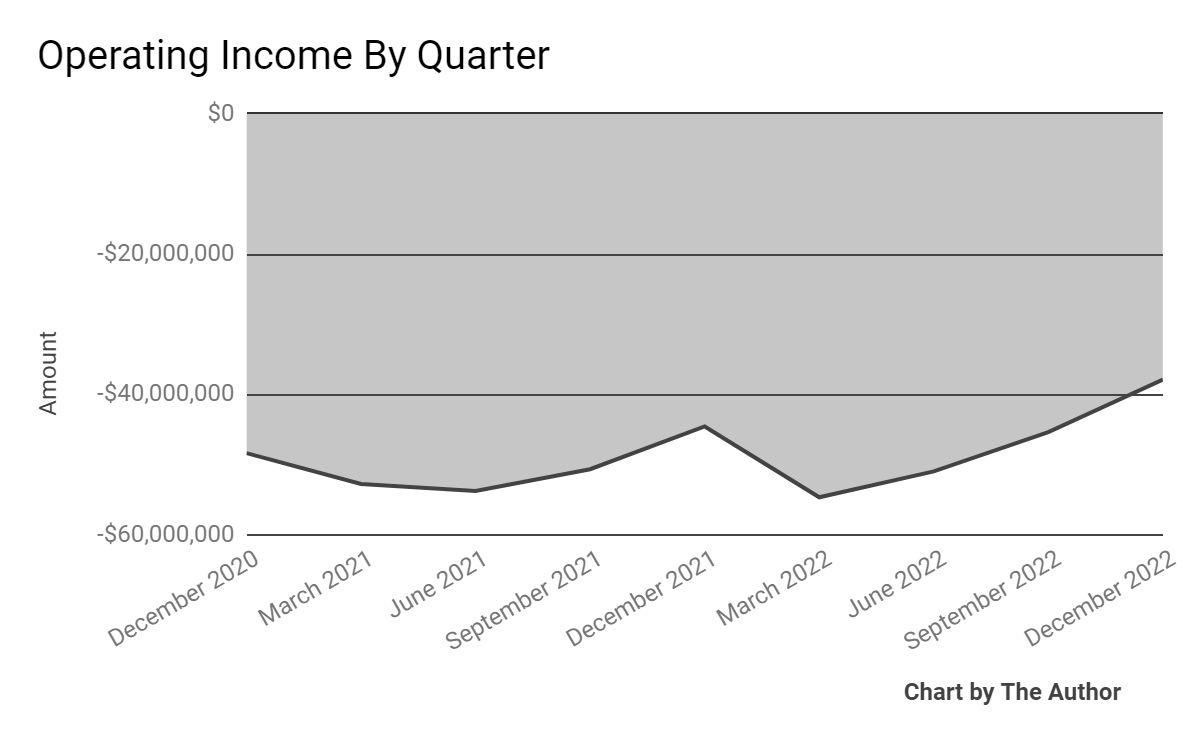

Operating income by quarter has remained heavily negative, with no meaningful or durable progress toward breakeven:

Operating Income (Seeking Alpha)

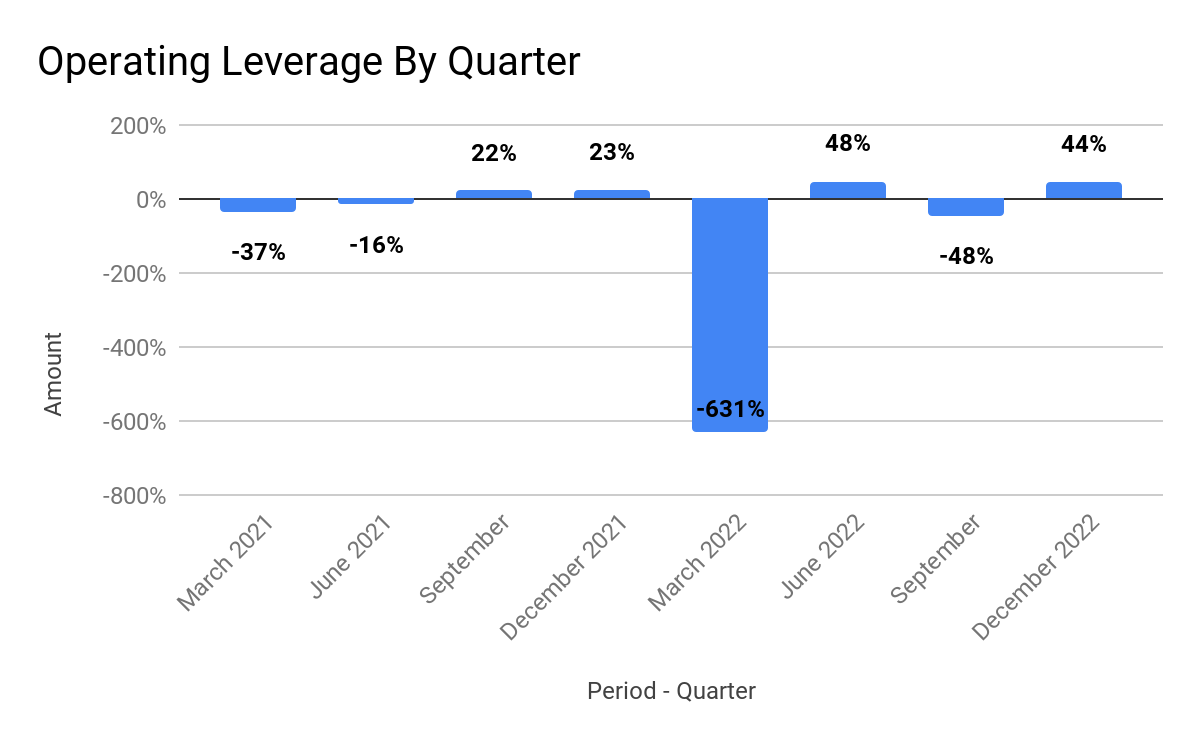

Operating leverage has frequently been negative, improving intermittently in recent quarters:

Operating Leverage (Seeking Alpha)

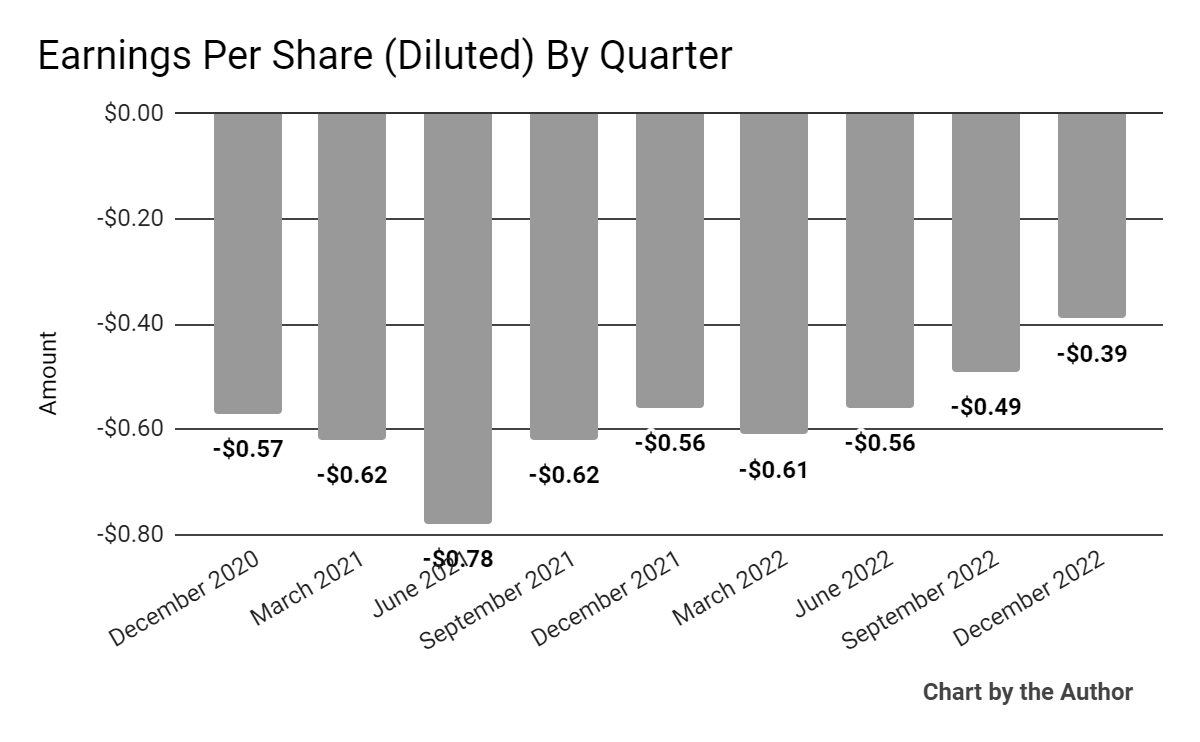

Earnings per share (Diluted) have also remained substantially negative:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP.)

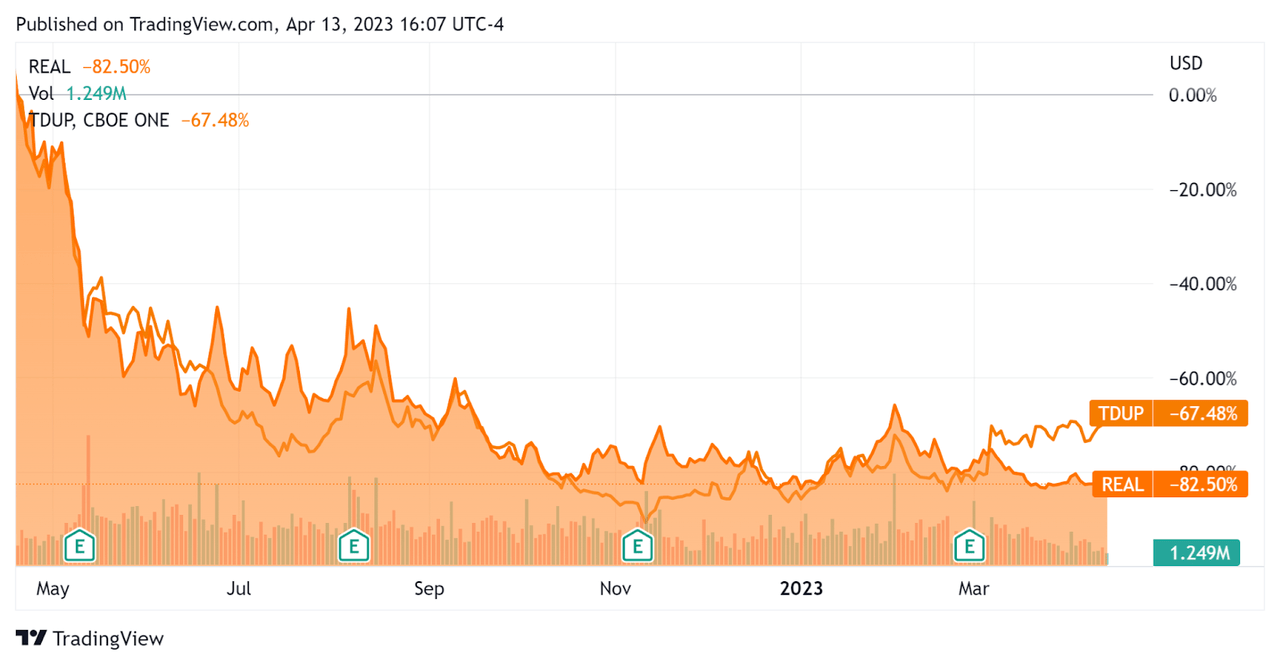

In the past 12 months, REAL’s stock price has fallen 82.5% vs. that of ThredUp, Inc.’s (TDUP) drop of 67.5%, as the chart indicates below:

52-Week Stock Price Comparison (Seeking Alpha)

Management didn’t disclose any company retention rate metrics.

For the balance sheet, the firm finished the quarter with cash and equivalents of $293.8 million and $450 million in long-term debt.

Over the trailing twelve months, free cash used was ($114.5 million), of which capital expenditures accounted for $22.9 million. The company paid a hefty $46.1 million in stock-based compensation in the last four quarters.

Valuation And Other Metrics For The RealReal

Below is a table of relevant capitalization and valuation figures for the company:

Measure [TTM] | Amount |

Enterprise Value / Sales | 0.7 |

Enterprise Value / EBITDA | NM |

Price / Sales | 0.2 |

Revenue Growth Rate | 29.0% |

Net Income Margin | -32.6% |

GAAP EBITDA % | -26.5% |

Market Capitalization | $110,170,000 |

Enterprise Value | $412,110,000 |

Operating Cash Flow | -$91,560,000 |

Earnings Per Share (Fully Diluted) | -$2.05 |

(Source - Seeking Alpha.)

As a reference, a relevant partial public comparable would be ThredUp; shown below is a comparison of their primary valuation metrics:

Metric [TTM] | ThredUp | The RealReal | Variance |

Enterprise Value / Sales | 0.8 | 0.7 | -16.0% |

Enterprise Value / EBITDA | NM | NM | --% |

Revenue Growth Rate | 14.5% | 29.0% | 99.9% |

Net Income Margin | -32.0% | -32.6% | 1.7% |

Operating Cash Flow | -$52,110,000 | -$91,560,000 | 75.7% |

(Source - Seeking Alpha.)

Future Prospects For The RealReal

In its last earnings call (Source - Seeking Alpha), covering Q4 2022’s results, management highlighted its changing focus on higher-value items, optimizing its take rate in the process.

The firm also recently reduced its headcount by 7% and closed a total of six retail locations in order to reduce costs and cut underperforming locations.

Leadership has also attempted to further optimize the site’s dynamic pricing system, "to drive higher initial prices."

Looking ahead, management only provided guidance for Q1, as its new CEO just started. It expects $140 million in revenue, which, if achieved, would represent a revenue drop of 4.6% year-over-year.

Management has been focused on shrinking the direct-to-consumer business and increasing its consignment segment, resulting in higher gross margins.

The company's financial position is moderate, with ample cash and liquidity but significant recent use of cash in operations. The firm has around 2.5 years of runway based on existing cash and trailing twelve-month free cash use.

Regarding valuation, compared to ThredUp, a lower-end consignment site, REAL is valued at a similar EV/Revenue multiple.

The primary risk to the company’s outlook is a macroeconomic slowdown or reduced consumer credit availability as banks reduce their lending activity in the wake of the March banking failures of SVB Financial Group (OTC:SIVBQ), Signature (OTC:SBNY), and Credit Suisse Group (CS).

A potential upside catalyst to The RealReal, Inc. stock could include continued progress in its consignment business, improving margins in the process.

However, the company appears to be in a transition phase with a new CEO, so the jury will be out for some time ahead.

Until we can ascertain a clear and positive direction for The RealReal, Inc. and management makes serious progress toward operating breakeven, I’m Neutral [Hold] on REAL.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.